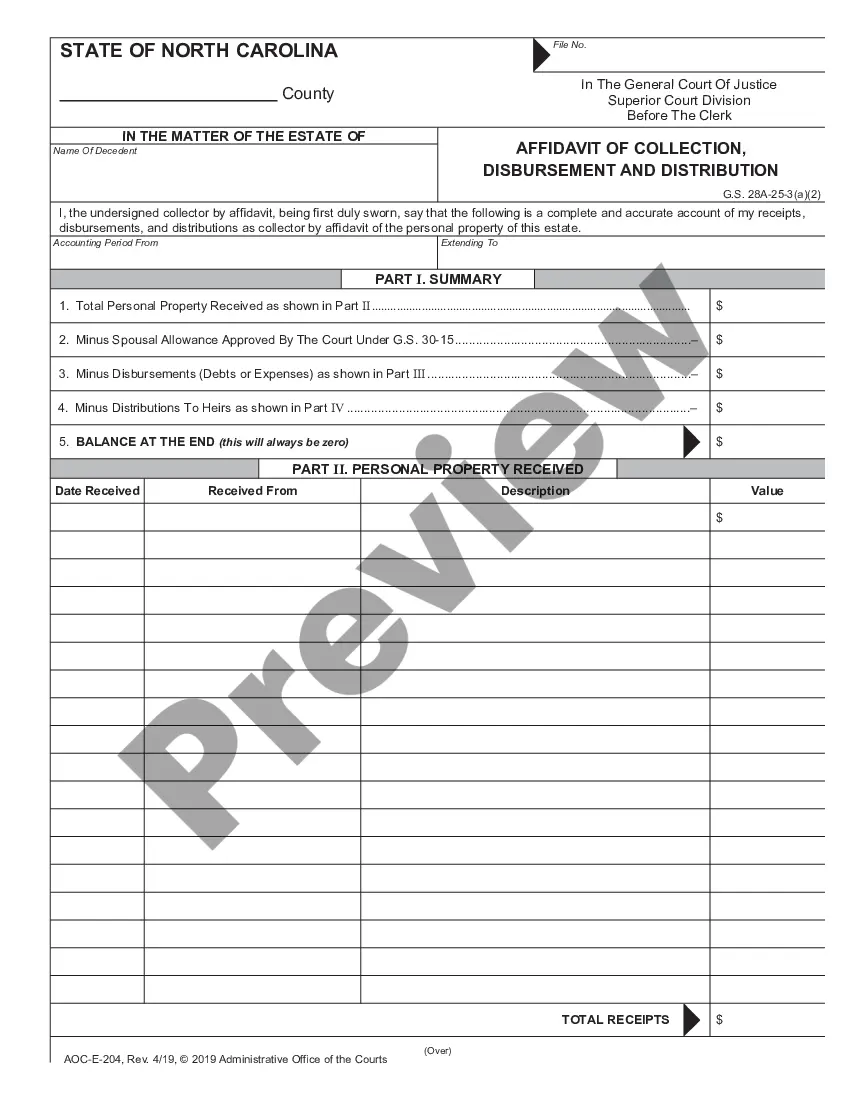

Instructions for Preliminary Inventory for Collection of Personal Property of Decendent: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

The Charlotte North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent is a document that provides guidance and instructions for individuals responsible for the collection and inventory of personal property belonging to a deceased person. It is typically used in the context of probate and estate administration. The purpose of this document is to ensure that all personal property owned by the decedent is properly accounted for and managed during the probate process. It is an essential step in the administration of an estate, as it allows for the identification, valuation, and distribution of the decedent's personal belongings. The instructions outline the steps that need to be followed to complete the preliminary inventory process. They provide information on the required forms, deadlines, and relevant procedures. The document also includes a list of keywords and categories that will help in properly identifying and categorizing the decedent's personal property. Some of the keywords that may be included in the instructions are: 1. Decedent: Refers to the deceased person whose personal property is being inventoried and collected. 2. Personal property: Refers to any movable assets owned by the decedent, such as furniture, jewelry, vehicles, cash, stocks, and personal belongings. 3. Inventory: Refers to the process of listing and describing all personal property items owned by the decedent. 4. Valuation: Refers to the determination of the fair market value of the personal property items for estate tax and distribution purposes. 5. Categorization: Refers to the classification of personal property items based on their type, such as furniture, electronics, collectibles, and artwork. Different types of Charlotte North Carolina Instructions for Preliminary Inventory for Collection of Personal Property of Decedent may exist based on the specific probate laws and regulations in Charlotte, North Carolina. These variations may address specific requirements or details that are unique to the region or county within Charlotte. It is important to consult the relevant legal resources or seek professional assistance, such as an estate attorney or probate specialist, to obtain the specific instructions applicable to your situation and location within Charlotte, North Carolina. Remember that laws and regulations may vary, so it is crucial to ensure compliance with the correct instructions for the specific jurisdiction.