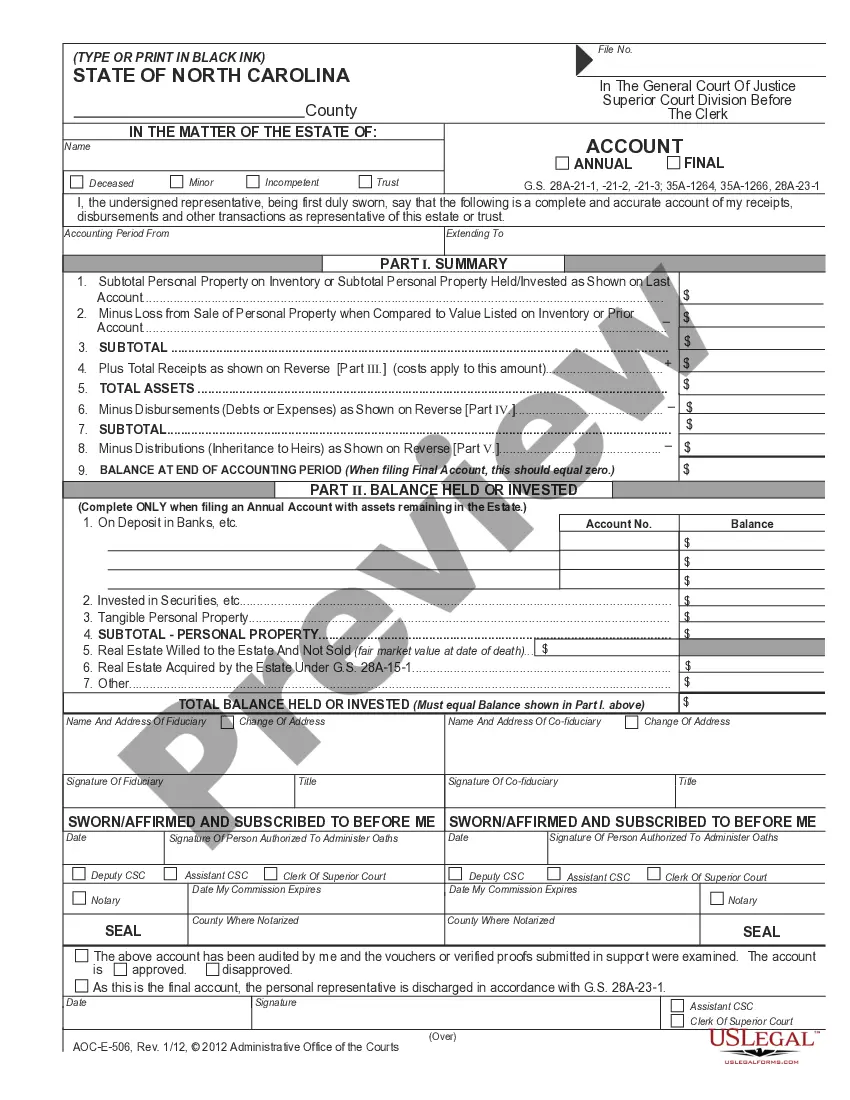

Notice to File Inventory/Annual Account/Final Account: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account

Description

How to fill out North Carolina Notice To File Inventory - Annual Account - Final Account?

Obtaining validated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms for both personal and professional purposes and various real-world situations.

All the documents are appropriately categorized by area of use and jurisdiction, making the search for the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account as straightforward as possible.

Maintaining documents organized and compliant with legal regulations is crucial. Leverage the US Legal Forms library to always have necessary document templates for any requirements readily at your disposal!

- For those already acquainted with our catalog who have used it previously, acquiring the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account only requires a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- This procedure will demand a few additional actions for new users.

- Follow the instructions below to begin with the most comprehensive online form catalog.

- Review the Preview mode and form description. Ensure you’ve chosen the correct one that fulfills your requirements and fully aligns with your local jurisdiction standards.

Form popularity

FAQ

In North Carolina, the requirements for notice to creditors involve notifying all known creditors of the deceased about the probate proceedings. This ensures creditors have an opportunity to assert their claims against the estate. You will need to follow your jurisdiction’s rules regarding how and when to send the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account to meet these obligations. Platforms like USLegalForms can provide templates to ease this process.

The form for final accounting in North Carolina is typically referred to as the 'Final Account' form, which details all financial activities related to the estate. This document must accurately reflect income, expenses, and distributions made to beneficiaries. It is also essential to file the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account alongside this form. For ease and accuracy, consider using USLegalForms to access customized forms tailored to your needs.

Yes, it is possible to settle an estate without undergoing probate in North Carolina, particularly if the estate is small or if all assets are jointly owned. In such cases, heirs may transfer property through an affidavit instead of a formal probate process. However, some assets may still require the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account for tax purposes or creditor notifications. You might want to utilize services like USLegalForms to guide you in these situations.

The final account of the estate in North Carolina is a comprehensive report that summarizes all financial transactions made on behalf of the estate. This includes income, expenses, distributions, and any relevant fees. It serves to provide transparency to the beneficiaries and must be filed with the court, accompanied by the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account. Consulting with platforms like USLegalForms can assist you in preparing this crucial document.

In North Carolina, an estate generally must exceed $15,000 in value to require probate. However, certain assets, like jointly owned property or life insurance proceeds, may not count toward this total. Thus, even if the estate’s value is below this threshold, complex situations might still require a probate process. It is beneficial to understand the specifics, and using resources like USLegalForms can help clarify these requirements.

To file an estate in North Carolina, you must start by submitting a petition for probate to the local clerk of court in your county. You should complete the necessary forms, including the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account, which details the assets of the estate. Be prepared to provide a death certificate and any relevant documents to support your filing. Utilizing platforms like USLegalForms can simplify this process by providing you with the forms you need.

The estate account for the deceased is a dedicated financial account that holds all assets and income related to the estate until its final settlement. This account manages probate costs, taxes, and distributions to heirs, ensuring proper handling of funds. In Fayetteville North Carolina, maintaining this account is crucial to meet the requirements outlined in the Notice to File Inventory, Annual Account, and Final Account. Utilizing platforms like uslegalforms can simplify this process, offering resources and guidance for effective estate management.

In North Carolina, the order of inheritance follows a specific hierarchy defined by state law. Generally, spouses, children, and grandchildren inherit first, followed by parents, siblings, and more distant relatives. This structure ensures that the deceased's wishes are honored while adhering to Fayetteville North Carolina requirements for Notice to File Inventory, Annual Account, and Final Account. Understanding this order can help beneficiaries navigate the complexities of estate distribution.

Final accounts for an estate detail the financial activities that occurred during the administration of the estate. They summarize all income, expenses, distributions to heirs, and any other transactions. In Fayetteville North Carolina, a Notice to File Inventory, Annual Account, or Final Account must be submitted to the court to ensure transparency and compliance with local laws. This process helps assure all beneficiaries that the estate is settled fairly and legally.

In North Carolina, certain properties are exempt from creditors during the estate collection process. These may include personal belongings, certain types of retirement accounts, and specific amounts of home equity. Knowing these exemptions can be vital when dealing with the Fayetteville North Carolina Notice to File Inventory - Annual Account - Final Account, as it protects assets from being used to settle debts. Engaging with resources like US Legal Forms can provide clarity on what qualifies as exempt.