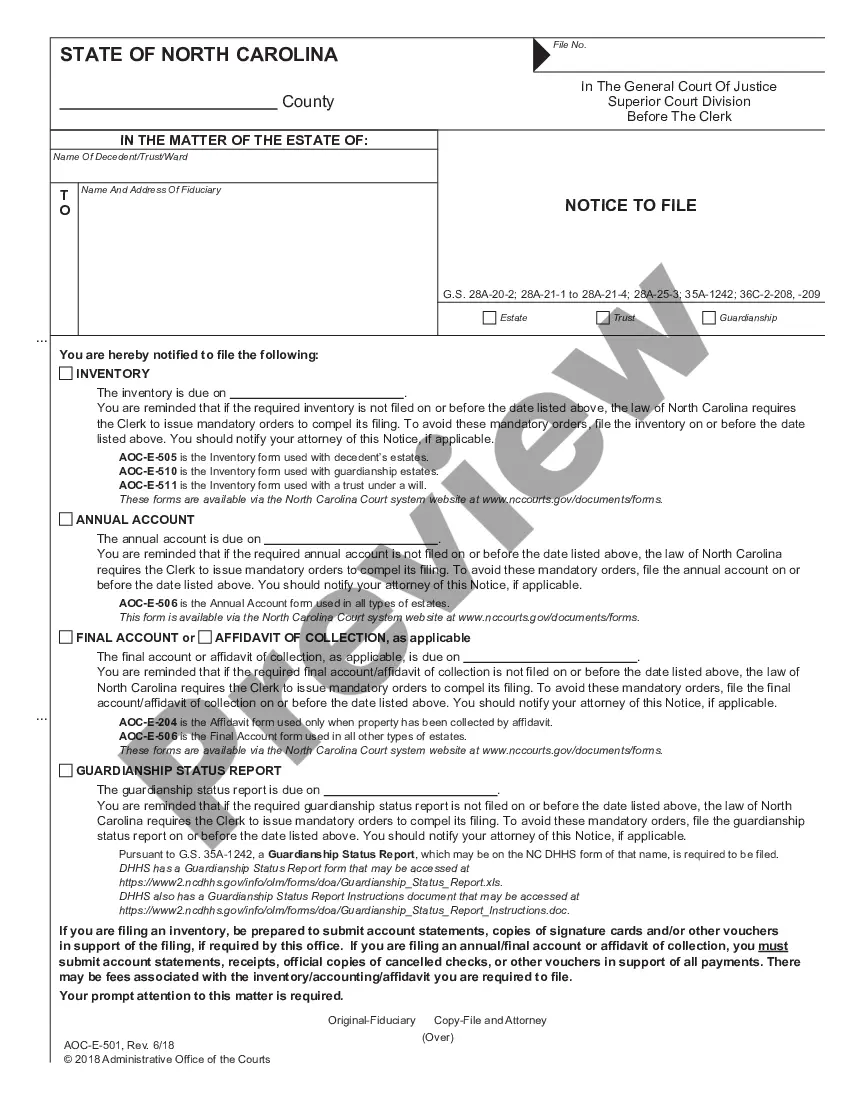

Account, Annual or Final: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Cary North Carolina Account Annual Final

Description

How to fill out North Carolina Account Annual Final?

If you have previously employed our service, Log In to your account and acquire the Cary North Carolina Account Annual Final on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to receive your document.

You have continuous access to all the documents you have purchased: you can find them in your profile under the My documents section whenever you need to reuse them. Make the most of the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Verify that you’ve selected the correct document. Review the description and utilize the Preview feature, if available, to determine if it suits your requirements. If it does not, use the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Cary North Carolina Account Annual Final. Select the file format for your document and download it to your device.

- Finalize your sample. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

To perform a final estate accounting, begin by gathering all relevant financial information, including assets, expenses, and liabilities. Next, you should itemize each asset and liability, detailing their values and the transactions made. In Cary, North Carolina, the Account Annual Final must comply with local laws, which may require specific documentation and reporting. You can streamline this process using platforms like USLegalForms, which provide templates and guidance tailored for final estate accounting.

In North Carolina, the notice to creditors runs for a minimum of 90 days. This period allows creditors to submit claims against the estate. It is important to file your Cary North Carolina Account Annual Final within this time frame to ensure compliance with state laws. By utilizing USLegalForms, you can create the appropriate notices and ensure that you meet all deadlines to protect the estate's interests.

Settling an estate in North Carolina typically takes several months to over a year. The timeline depends on various factors such as the complexity of the estate, the presence of disputes, and the court's schedule. It's essential to follow the Cary North Carolina Account Annual Final process to ensure all legal and tax requirements are met efficiently. Using a reliable platform like USLegalForms can help simplify the necessary paperwork and guide you through each step of the settlement process.

In North Carolina, the specific form for final accounting is often the AOC-E 201, which details the estate's finances. This form must be filled out to illustrate how the estate's assets were managed. Executors also provide a final accounting summary to beneficiaries, clarifying how funds were allocated. The Cary North Carolina Account Annual Final can assist you in accurately completing these necessary forms.

Final accounting of an estate in North Carolina provides a summary of all financial activities associated with the estate prior to its closure. This accounting includes records of receipts, expenses, and distributions made to beneficiaries. It serves as a crucial document that ensures all parties involved understand the financial summary of the estate. Utilizing resources such as the Cary North Carolina Account Annual Final can aid in preparing a thorough final accounting.

The AOC-E 201 form in North Carolina is a legal document used for estate accounting purposes. Specifically, this form aids in documenting the financial status of the estate at the time of closing. Executors must complete this form to ensure compliance with court requirements. When linked with the Cary North Carolina Account Annual Final, it streamlines the overall process of finalizing an estate.

Final accounting to beneficiaries is a detailed report that shows how estate assets were managed and distributed. This report is presented to beneficiaries at the conclusion of the estate's administration. It includes details of all transactions and any expenses incurred during the process. By utilizing the Cary North Carolina Account Annual Final, executors can provide beneficiaries with clear and comprehensive information.

In North Carolina, an executor generally has up to one year to settle an estate, although this period can be extended under certain circumstances. The timeline ensures that all financial matters, including debts and distribution, are carefully handled. Delays may arise, but keeping open communication with beneficiaries can aid in managing their expectations. Understanding the Cary North Carolina Account Annual Final can help you navigate these timelines effectively.

To close an estate in North Carolina, you typically need several forms, including the necessary estate accounting forms. Common documents include the Final Account and any tax forms required by the state. Each estate is unique, so it's vital to gather the right forms to comply with legal requirements. The Cary North Carolina Account Annual Final helps ensure all documentation is complete.

The final account of the estate in North Carolina provides a complete overview of the estate's financial activities. This document outlines all income, expenses, and distributions to beneficiaries. It ensures transparency and accountability during the estate settlement process. Utilizing the Cary North Carolina Account Annual Final simplifies this process, allowing you to understand your responsibilities clearly.