Inventory For Trust Under Will: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Charlotte North Carolina Inventory for Trust Under Will

Description

How to fill out North Carolina Inventory For Trust Under Will?

Acquiring verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library. It’s an online collection of over 85,000 legal forms catering to both personal and professional requirements, along with various real-world situations.

All the documents are systematically categorized by usage area and jurisdiction, making the search for the Charlotte North Carolina Inventory for Trust Under Will as simple as can be.

For those already familiar with our service and have used it in the past, obtaining the Charlotte North Carolina Inventory for Trust Under Will requires just a few clicks. Simply Log In to your account, select the document, and click Download to save it onto your device. This process will necessitate only a few extra steps for new users.

Maintaining organized paperwork that complies with legal standards is crucial. Take advantage of the US Legal Forms library to always have necessary document templates readily available for any of your needs!

- Review the Preview mode and form description. Ensure you’ve chosen the correct one that satisfies your needs and fully aligns with the requirements of your local jurisdiction.

- Search for an alternative template, if necessary. If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your satisfaction, proceed to the next step.

- Acquire the document. Click on the Buy Now button and select the subscription plan that fits you best. You will need to create an account to gain access to the library’s resources.

- Complete your purchase. Enter your credit card information or use your PayPal account to finalize the subscription payment.

- Download the Charlotte North Carolina Inventory for Trust Under Will. Store the template on your device to continue with its completion and access it later in the My documents section of your profile whenever required.

Form popularity

FAQ

To be valid, the person making the Will (the testator) must, with the intent to sign the Will, sign it personally or direct another person to sign it in the testator's presence.

Probate assets include: Real estate, vehicles, and other titled assets owned solely by the deceased person or as a tenant in common with someone else. Tenants in common don't have survivorship rights.Personal possessions. Household items go through probate, along with clothing, jewelry, and collections.

For small estates, North Carolina has a simplified process which allows you to wrap up the estate without formal probate. This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

Valuing parts of the estate for probate Assets need to be valued at their open market value. This is the price the asset might reasonably fetch if it was sold on the open market at the time of the death. This represents the realistic selling price of an asset, not an insurance value or replacement value.

Technically, you do not need to file your will with the court while you are still living. But, it could be beneficial to your family or your executor to have the will entrusted to a third party where it can easily be produced.

Lack of a Signature and/or Witnesses A will that is unsigned or fails to meet the witness requirements may not be legally enforceable under North Carolina state law. You can contest a will on these grounds.

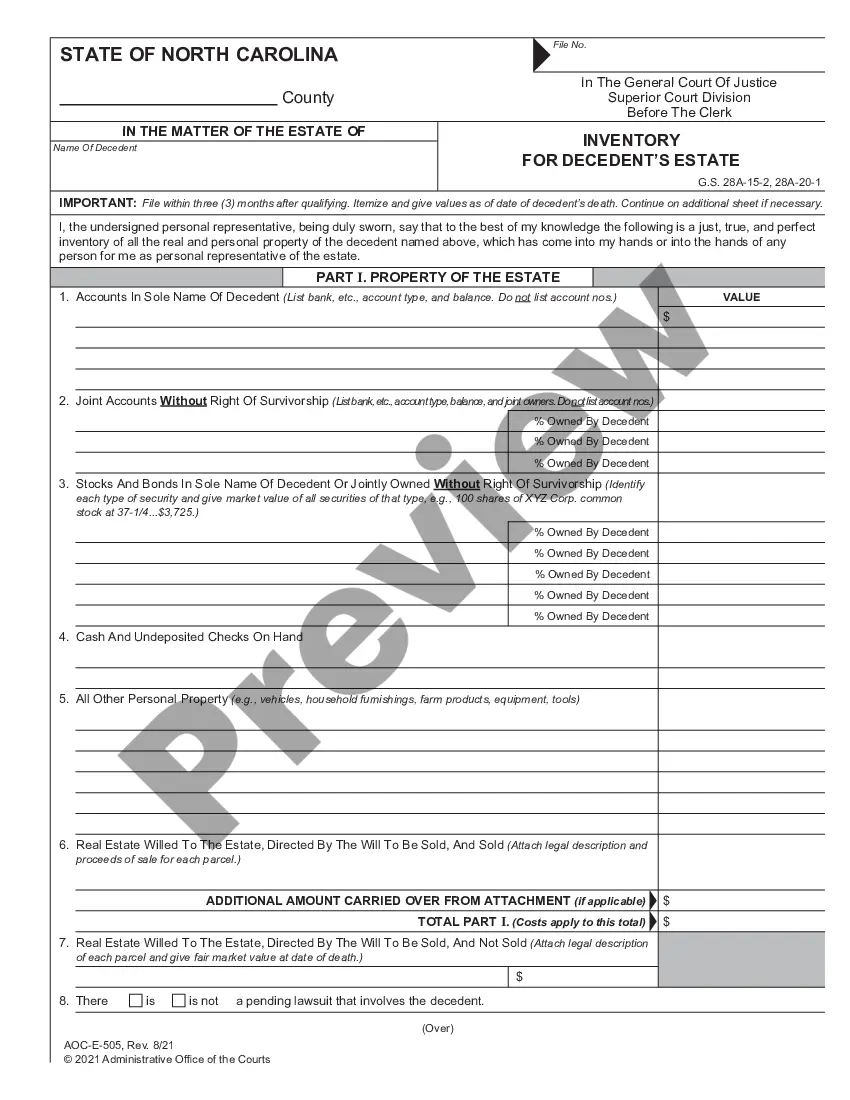

On the 90-day inventory form, you will need to list the following information: The decedent's county of residence. The decedent's name. Any accounts in the sole name of the decedent and their value. Any joint accounts, the percentage the decedent owned, and their value.