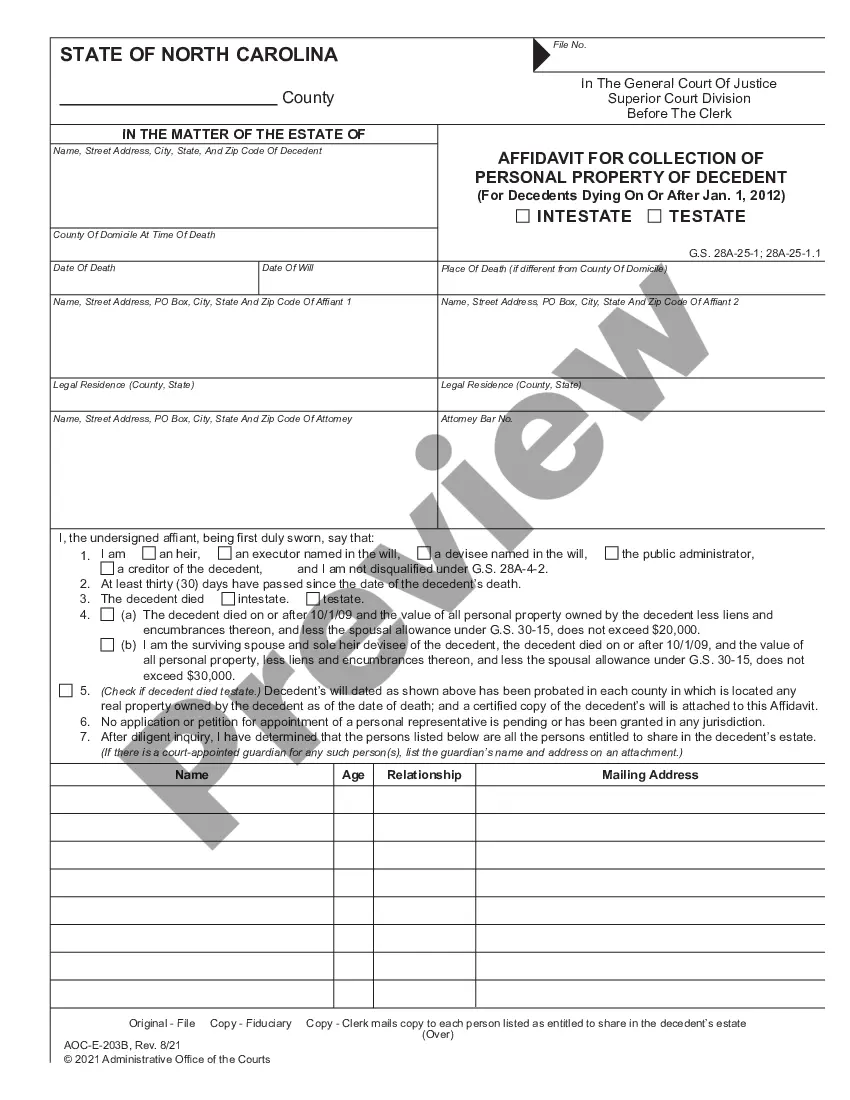

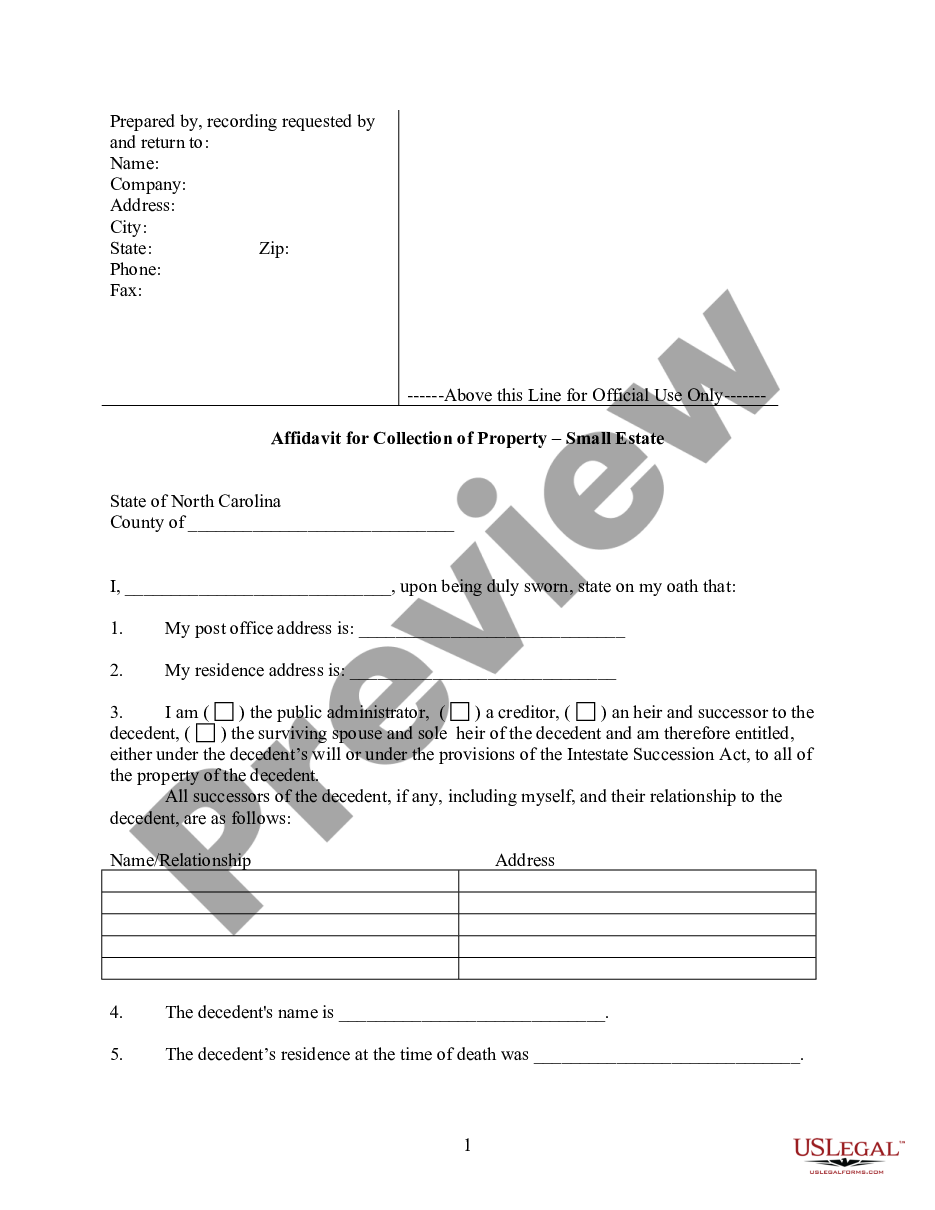

This is a pamphlet on small estate procedure from the North Carolina Administrative Office of the Courts covering the topics of executor, administrator, collector by affidavit and summary administration.

Title: Wake North Carolina Estate Procedure Pamphlet — Comprehensive Instructions for Probate Process and Estate Administration Keywords: Wake County, North Carolina, estate, procedure pamphlet, instructions, probate process, estate administration Description: The Wake North Carolina Estate Procedure Pamphlet is a comprehensive guide designed to provide detailed instructions on navigating the probate process and estate administration in Wake County, North Carolina. This pamphlet aims to assist individuals who have been appointed as personal representatives or executors of an estate, as well as beneficiaries, in understanding the necessary steps involved in settling an estate. The Wake North Carolina Estate Procedure Pamphlet — Instructions covers various aspects of the estate administration process, offering a step-by-step outline to ensure a smooth progression. This valuable resource describes the legal procedures, responsibilities, and timelines associated with probate, helping individuals carry out their duties with confidence and efficiency. Within the pamphlet, different types of instructions and specific guidance are provided for various estate scenarios, including: 1. Estate Administration Checklist: A detailed checklist offers an overview of all the essential tasks to be completed during the process, such as gathering necessary documents, notifying beneficiaries, filing necessary forms, and inventorying assets. 2. Probate Filings and Deadlines: Instructions outline the required paperwork and forms that must be filed with the Wake County Probate Court, including the Application for Letters Testamentary or Letters of Administration. Additionally, important deadlines for filing these forms are highlighted to avoid any delays or complications. 3. Asset Inventory and Valuation: This section provides guidance on conducting a thorough inventory of the deceased person's assets, including real estate, bank accounts, investments, personal property, and more. It offers insights into obtaining professional appraisals, if necessary, to ascertain accurate asset valuations. 4. Debts, Creditors, and Taxes: Instructions explain the process of notifying and settling outstanding debts and creditors on behalf of the deceased person. Further guidance is shared on fulfilling tax obligations, including filing the final income tax return and estate tax returns if applicable. 5. Estate Distribution and Final Accounting: This portion covers the distribution of assets to beneficiaries, preparation of a final accounting statement, and obtaining acknowledgement and releases from beneficiaries. The Wake North Carolina Estate Procedure Pamphlet — Instructions serves as an invaluable resource, ensuring that individuals involved in the probate process and estate administration in Wake County, North Carolina, have a comprehensive understanding of their obligations. By following the provided instructions and adhering to the prescribed timelines, personal representatives and beneficiaries can navigate the complex estate procedures with greater ease and efficiency.Title: Wake North Carolina Estate Procedure Pamphlet — Comprehensive Instructions for Probate Process and Estate Administration Keywords: Wake County, North Carolina, estate, procedure pamphlet, instructions, probate process, estate administration Description: The Wake North Carolina Estate Procedure Pamphlet is a comprehensive guide designed to provide detailed instructions on navigating the probate process and estate administration in Wake County, North Carolina. This pamphlet aims to assist individuals who have been appointed as personal representatives or executors of an estate, as well as beneficiaries, in understanding the necessary steps involved in settling an estate. The Wake North Carolina Estate Procedure Pamphlet — Instructions covers various aspects of the estate administration process, offering a step-by-step outline to ensure a smooth progression. This valuable resource describes the legal procedures, responsibilities, and timelines associated with probate, helping individuals carry out their duties with confidence and efficiency. Within the pamphlet, different types of instructions and specific guidance are provided for various estate scenarios, including: 1. Estate Administration Checklist: A detailed checklist offers an overview of all the essential tasks to be completed during the process, such as gathering necessary documents, notifying beneficiaries, filing necessary forms, and inventorying assets. 2. Probate Filings and Deadlines: Instructions outline the required paperwork and forms that must be filed with the Wake County Probate Court, including the Application for Letters Testamentary or Letters of Administration. Additionally, important deadlines for filing these forms are highlighted to avoid any delays or complications. 3. Asset Inventory and Valuation: This section provides guidance on conducting a thorough inventory of the deceased person's assets, including real estate, bank accounts, investments, personal property, and more. It offers insights into obtaining professional appraisals, if necessary, to ascertain accurate asset valuations. 4. Debts, Creditors, and Taxes: Instructions explain the process of notifying and settling outstanding debts and creditors on behalf of the deceased person. Further guidance is shared on fulfilling tax obligations, including filing the final income tax return and estate tax returns if applicable. 5. Estate Distribution and Final Accounting: This portion covers the distribution of assets to beneficiaries, preparation of a final accounting statement, and obtaining acknowledgement and releases from beneficiaries. The Wake North Carolina Estate Procedure Pamphlet — Instructions serves as an invaluable resource, ensuring that individuals involved in the probate process and estate administration in Wake County, North Carolina, have a comprehensive understanding of their obligations. By following the provided instructions and adhering to the prescribed timelines, personal representatives and beneficiaries can navigate the complex estate procedures with greater ease and efficiency.