A living trust, also known as a revocable trust or inter vivos trust, is a legal document that allows individuals to manage and distribute their assets during their lifetime and after their death. In the case of a husband and wife with no children residing in Cary, North Carolina, a living trust can serve as a crucial estate planning tool to ensure their assets are protected, managed efficiently, and smoothly transferred to their chosen beneficiaries. The primary purpose of a living trust is to avoid probate, a costly and time-consuming legal process that validates a will and distributes assets according to its provisions. By creating a living trust, assets placed within the trust can bypass probate, saving significant time and money for the surviving spouse. Cary North Carolina offers several types of living trusts for husband and wife with no children, including: 1. Joint Living Trust: A joint living trust is a single trust created by both partners or spouses. Both individuals contribute their assets into the trust and have joint control over the trust during their lifetime. In the event of one spouse's death, the surviving spouse retains sole control of the assets, ensuring uninterrupted management and potential tax benefits. 2. Separate Living Trusts: Alternatively, spouses can establish separate living trusts to manage their individual assets while still enjoying the advantages of a living trust. This approach allows each spouse to maintain control over their own assets, but still provides flexibility for transferring assets to the surviving spouse or other beneficiaries. 3. A-B Trust (Marital and Bypass Trust): An A-B Trust, also known as a marital and bypass trust, is a more complex living trust specifically designed to maximize estate tax exemptions. Upon the death of one spouse, the living trust splits into two separate trusts: the Marital Trust (A-Trust) and the Bypass Trust (B-Trust). The Marital Trust provides income and assets to the surviving spouse, while the Bypass Trust preserves the deceased spouse's estate tax exemption by passing assets to other beneficiaries. 4. Testamentary Trust: While not strictly a living trust, a testamentary trust is worth mentioning for the purpose of estate planning. Rather than being created during the couple's lifetime, a testamentary trust is outlined in a will and only becomes effective upon the death of the spouse who established it. This can be a suitable option for couples who want to retain maximum flexibility during their lifetime but ensure specific provisions are carried out once they pass away. Creating a Cary North Carolina living trust for husband and wife with no children requires careful consideration of individual circumstances, goals, and preferences. Seeking professional assistance from an estate planning attorney is highly recommended understanding the legal requirements, tax implications, and draft a trust document that reflects the couple's wishes accurately.

Living Trusts Cary Nc

Description

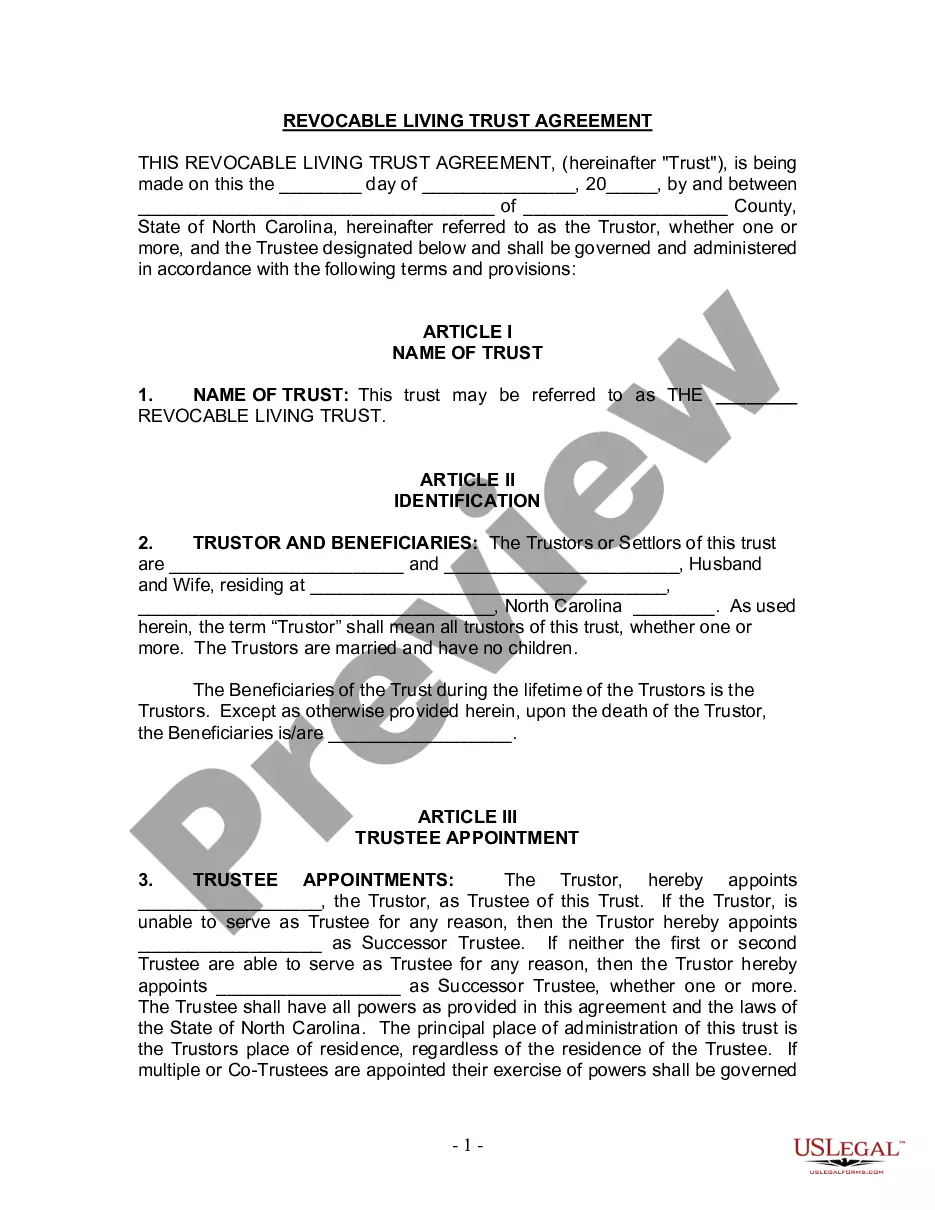

How to fill out Cary North Carolina Living Trust For Husband And Wife With No Children?

If you are looking for a valid form, it’s extremely hard to choose a more convenient service than the US Legal Forms website – one of the most considerable libraries on the internet. Here you can get a large number of templates for organization and individual purposes by types and regions, or keywords. With our advanced search function, getting the newest Cary North Carolina Living Trust for Husband and Wife with No Children is as easy as 1-2-3. In addition, the relevance of every file is verified by a group of expert lawyers that on a regular basis review the templates on our website and update them based on the most recent state and county requirements.

If you already know about our platform and have an account, all you should do to get the Cary North Carolina Living Trust for Husband and Wife with No Children is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the form you want. Read its description and use the Preview function to check its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to get the appropriate document.

- Confirm your choice. Select the Buy now button. After that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and save it on your device.

- Make changes. Fill out, modify, print, and sign the acquired Cary North Carolina Living Trust for Husband and Wife with No Children.

Each form you save in your user profile does not have an expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to receive an additional duplicate for editing or printing, you may come back and download it again at any time.

Make use of the US Legal Forms professional library to get access to the Cary North Carolina Living Trust for Husband and Wife with No Children you were looking for and a large number of other professional and state-specific templates on one platform!