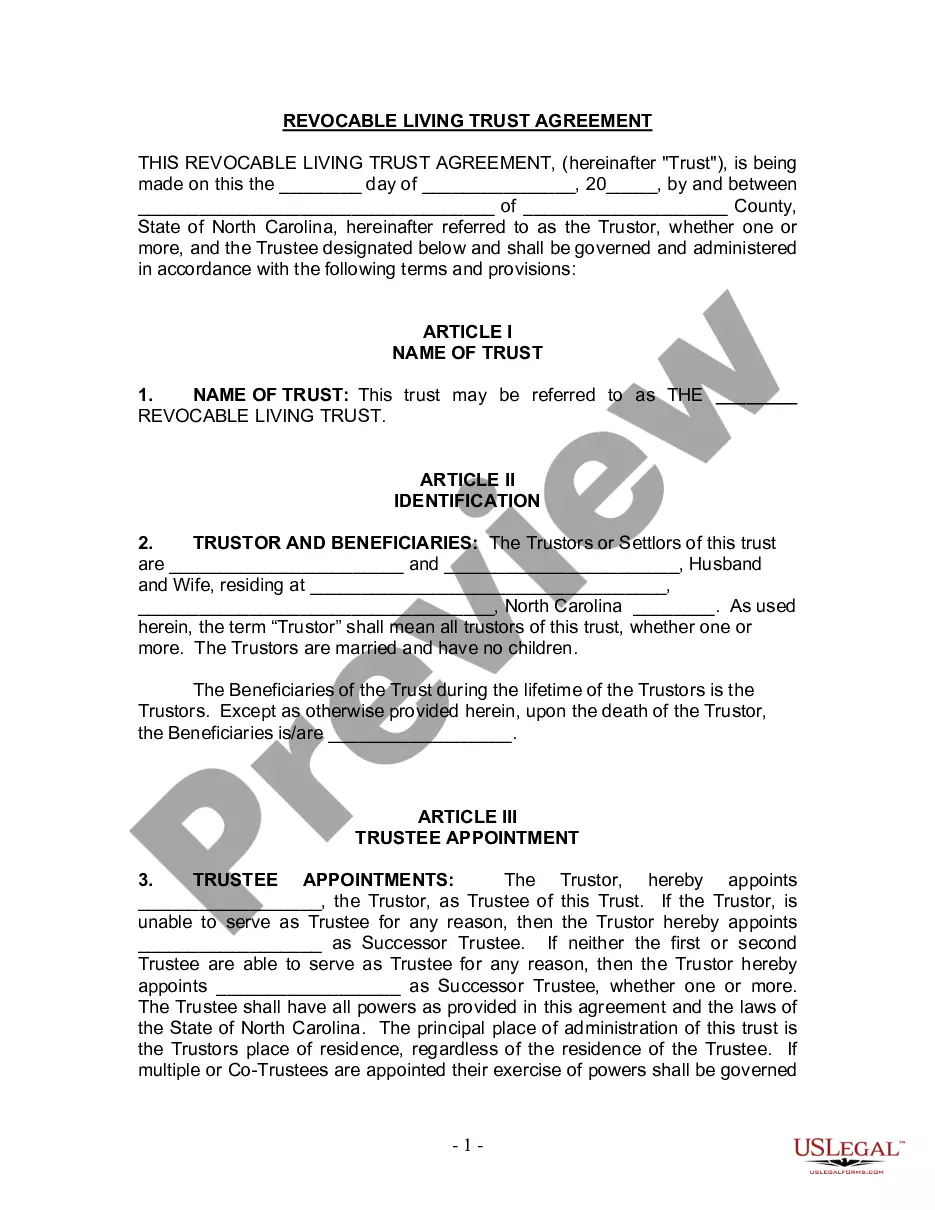

Charlotte North Carolina Living Trust for Husband and Wife with No Children

Description

How to fill out North Carolina Living Trust For Husband And Wife With No Children?

If you are in search of a legitimate document, it’s very difficult to find a superior location than the US Legal Forms website – one of the most extensive collections available online.

With this collection, you can obtain numerous templates for business and personal needs categorized by types and states, or keywords.

Using our excellent search feature, locating the most recent Charlotte North Carolina Living Trust for Husband and Wife with No Children is as simple as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file type and save it to your device.

- Moreover, the accuracy of each document is validated by a team of expert attorneys who frequently assess the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Charlotte North Carolina Living Trust for Husband and Wife with No Children is to Log In to your account and click the Download button.

- If it’s your first time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have located the form you require. Review its details and utilize the Preview option (if available) to scrutinize its contents. If it does not satisfy your needs, use the Search field at the top of the page to find the correct document.

- Confirm your decision. Click on the Buy now button. After that, select your desired pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

A living trust in North Carolina (also known as an inter vivos trust) is set up by the grantor, a person placing assets in trust. When you establish a trust like this, your assets will be owned in the name of the trust, but managed for your benefit while you are alive.

Deciding between a Will and a Trust depends on your circumstances; there are pros and cons of each. For example, a Trust can be used to avoid probate and reduce Estate Taxes, whereas a Will cannot.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000. The exact amount you'll pay for a lawyer will depend on the fees the lawyer charges.

A will distributes assets immediately after probate ends. A trust lets you keep assets in the trust if you wish and pass them on at later dates, such as beneficiaries' significant birthdays. Your revocable living trust protects you should you become mentally incapacitated.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

One advantage for using a trust is that trusts can be used to begin distributing property before death, at death or even sometime afterwards. That isn't helpful or important in all cases, but it provides a level of flexibility that a will simply can't.