High Point North Carolina Living Trust for Husband and Wife with No Children

Description

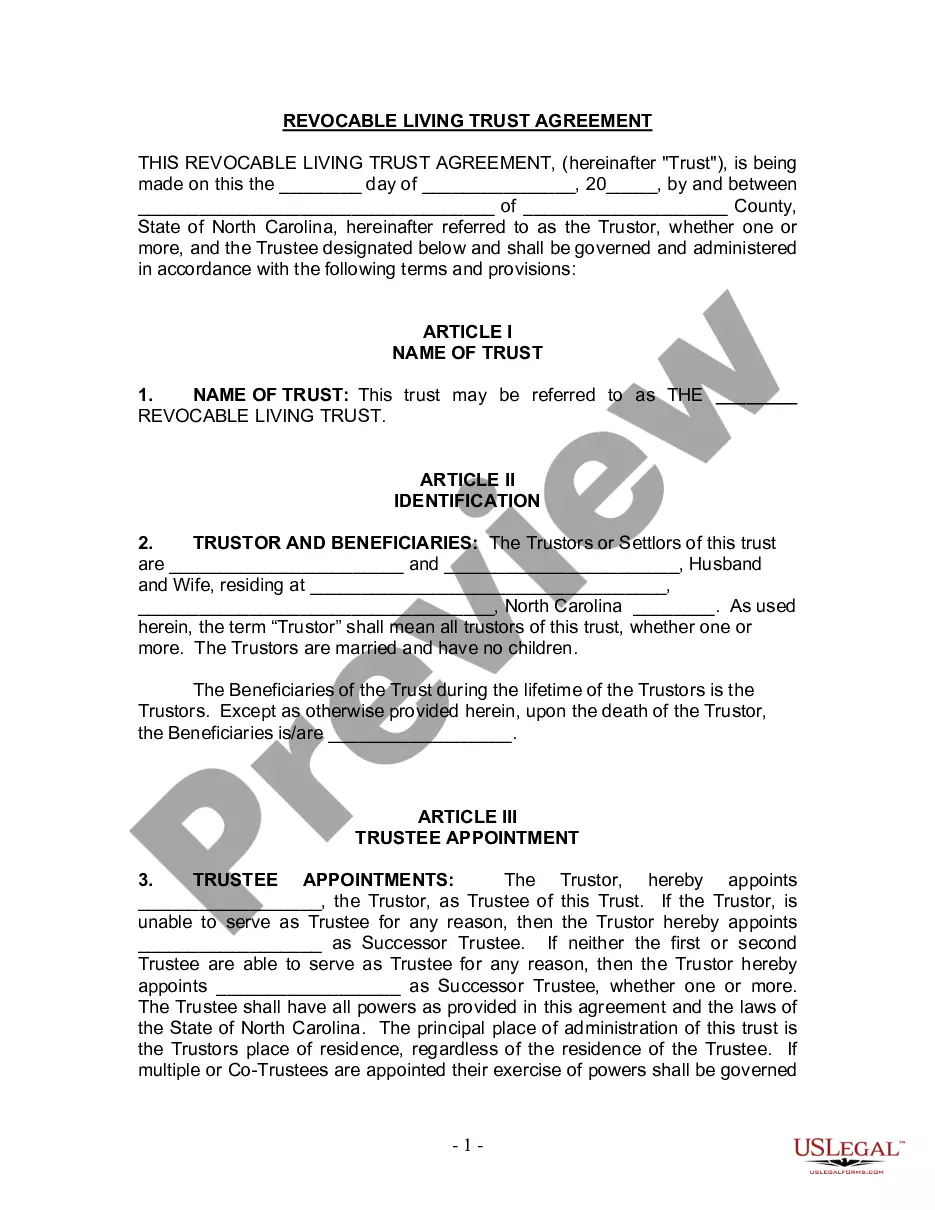

How to fill out North Carolina Living Trust For Husband And Wife With No Children?

Finding authentic templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All the files are systematically organized by usage area and jurisdiction, making it as simple as ABC to find the High Point North Carolina Living Trust for Husband and Wife with No Children.

Submit your credit card information or use your PayPal account to complete the service payment. Download the High Point North Carolina Living Trust for Husband and Wife with No Children. Store the template on your device for completion and access it in the My documents section of your profile whenever you wish to retrieve it. Maintaining organized paperwork that complies with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates readily available for any needs!

- Examine the Preview mode and document description.

- Ensure you have selected the correct one that aligns with your needs and completely adheres to your local jurisdiction standards.

- Search for an alternate template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the accurate one. If it meets your satisfaction, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

For couples, a joint revocable living trust is usually the most advantageous option. This type of trust, particularly a High Point North Carolina Living Trust for Husband and Wife with No Children, enables both partners to have a say in asset management and distribution. It provides greater privacy than a will and allows for seamless transitions in case one partner passes away. Plus, it can simplify estate planning and provide tax benefits down the line.

The best living trust for a married couple often involves a revocable living trust that allows for joint management and shared benefits. A High Point North Carolina Living Trust for Husband and Wife with No Children can be customized to meet your specific needs, ensuring that both partners have equal authority over assets. This arrangement promotes peace of mind, knowing that both partners' interests are protected. It's a proactive way to manage your estate and provide for the future.

A revocable living trust is often considered the best choice for married couples, especially for those creating a High Point North Carolina Living Trust for Husband and Wife with No Children. This type of trust allows couples to maintain control over their assets while also providing easy management in case of incapacity. Additionally, it simplifies the transfer of assets upon death, avoiding the probate process. You can tailor it to fit your unique situation.

The 5 year rule for trusts is essential for understanding how your assets are managed within a High Point North Carolina Living Trust for Husband and Wife with No Children. This rule typically states that if you transfer assets into a trust within five years of applying for government benefits, those assets may affect eligibility for benefits. It is crucial for you to plan your trust carefully to avoid any unintended consequences. Using a reputable platform like uslegalforms, you can easily create a trust that aligns with this rule, ensuring your family's future is secure.

While a trust can offer many benefits, there are some disadvantages to consider when opting for a High Point North Carolina Living Trust for Husband and Wife with No Children. Trusts can involve setup and maintenance costs, which may be more than other estate planning options. Additionally, a trust does not completely eliminate estate taxes or protect assets from creditors. You can weigh these factors with the assistance of experts like uslegalforms to determine if a trust aligns with your financial goals.

Whether a husband and wife should create separate living trusts depends on their specific circumstances. A High Point North Carolina Living Trust for Husband and Wife with No Children can provide unified management of assets, simplifying the process for both partners. However, if there are distinct financial situations or concerns about individual properties, separate trusts might offer better control and protection. It’s important to consult with a professional to evaluate what best meets your needs.

Yes, you can create your own living trust in North Carolina, including a High Point North Carolina Living Trust for Husband and Wife with No Children. The process can be straightforward if you have a clear understanding of your goals and the laws involved. However, using a tool like uslegalforms can provide you with valuable guidance and templates, ensuring that you meet all legal requirements and protect your interests effectively.

One significant mistake parents often make when establishing a trust fund is failing to clearly define their intentions and wishes. When setting up a High Point North Carolina Living Trust for Husband and Wife with No Children, it is crucial to outline how you want the trust administered and who will act as the trustee. If these details are vague or not communicated effectively, it can lead to confusion and disputes among beneficiaries. Utilizing resources like uslegalforms can help you navigate this process smoothly.