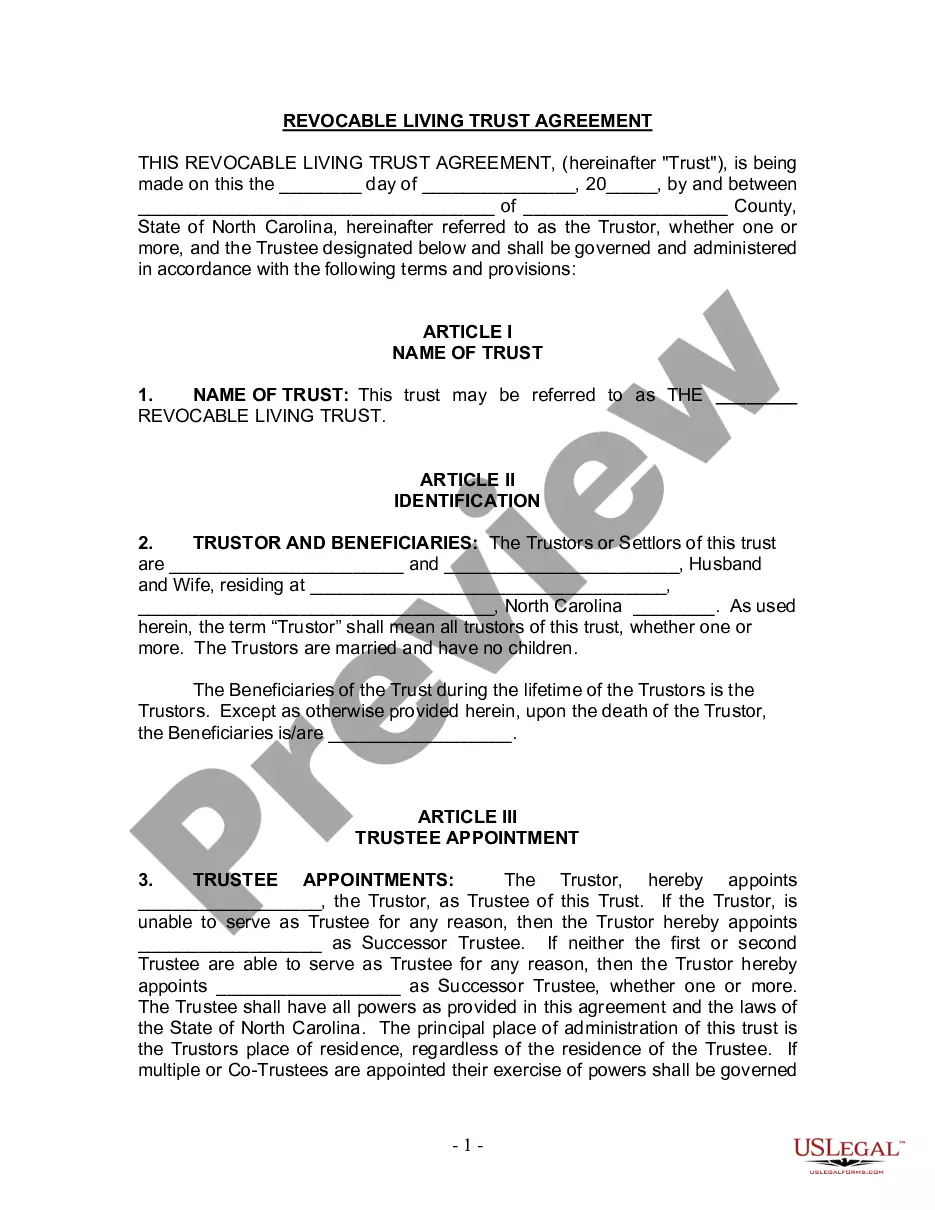

Wake North Carolina Living Trust for Husband and Wife with No Children

Description

How to fill out North Carolina Living Trust For Husband And Wife With No Children?

If you are looking for a legitimate form template, it’s challenging to select a more user-friendly platform than the US Legal Forms site – one of the most extensive collections online.

With this collection, you can obtain numerous form examples for business and personal uses categorized by types and regions, or keywords.

With our advanced search capability, locating the latest Wake North Carolina Living Trust for Husband and Wife with No Children is as simple as 1-2-3.

Receive the form. Choose the format and store it on your device.

Make modifications. Fill in, alter, print, and sign the acquired Wake North Carolina Living Trust for Husband and Wife with No Children.

- If you are already familiar with our platform and possess an account, all you need to obtain the Wake North Carolina Living Trust for Husband and Wife with No Children is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions outlined below.

- Ensure you have located the sample you need. Review its details and use the Preview feature to view its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to find the appropriate document.

- Confirm your choice. Click the Buy now button. Afterward, select the desired pricing plan and enter your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

The main disadvantage of a family trust includes potential misunderstandings among family members about distributions and asset management. A Wake North Carolina Living Trust for Husband and Wife with No Children can provide clear guidelines that mitigate this issue. Clear communication and comprehensive documentation within the trust can help families navigate these challenges while also securing their assets for future generations.

One downside of putting assets in a trust could be the associated costs and time required for setup and management. However, a Wake North Carolina Living Trust for Husband and Wife with No Children can offset these concerns by providing clarity and reducing legal complications later. It is crucial to weigh these factors against the long-term benefits of having assets managed according to your wishes.

Encouraging your parents to consider a trust can be wise, especially a Wake North Carolina Living Trust for Husband and Wife with No Children. This setup may protect their assets, streamline their estate plans, and provide peace of mind knowing their wishes will be honored. Additionally, trusts can help avoid probate, which often simplifies the transfer process for heirs.

Some people view trusts as burdensome due to potential fees and complexity. However, when managed correctly, a Wake North Carolina Living Trust for Husband and Wife with No Children serves as a beneficial tool for estate planning. Misconceptions often arise from poorly drafted or misunderstood trusts. Transparent communication and proper setup can alleviate concern and highlight the advantages.

Yes, a married couple may benefit from placing their house in a trust, especially when utilizing a Wake North Carolina Living Trust for Husband and Wife with No Children. This arrangement provides clear instructions for property transfer upon death, avoids probate, and can protect assets from creditors. Additionally, it simplifies the management of the house during difficult times, ensuring both parties have access to their shared home.

In North Carolina, a trust does not necessarily need to be notarized, as long as it follows proper legal guidelines. However, a Wake North Carolina Living Trust for Husband and Wife with No Children becomes more credible when notarized. Notarization serves as a form of verification, helping to prevent challenges to the trust's authenticity. Using platforms like USLegalForms can clarify these details and simplify the process for you.

Yes, you can write your own trust in North Carolina. However, creating a Wake North Carolina Living Trust for Husband and Wife with No Children involves specific language and legal requirements to ensure its validity. While it may seem straightforward, complications can arise if the trust is not drafted correctly. Utilizing resources like USLegalForms can assist you in crafting a trust that protects your interests effectively.

One significant mistake is failing to update the trust as circumstances change. When setting up a Wake North Carolina Living Trust for Husband and Wife with No Children, it’s essential to reflect any life changes, such as marriage or changes in financial status. Not naming the right beneficiaries in the trust can lead to confusion and potential legal issues down the line. Always seek guidance to ensure your trust meets your family’s needs.

Yes, you can create your own Wake North Carolina Living Trust for Husband and Wife with No Children, but it requires attention to detail. While DIY options are available, using a platform like uslegalforms may simplify the process. A professionally designed template ensures you meet state requirements and protects your interests without confusion.

A downside to a Wake North Carolina Living Trust for Husband and Wife with No Children is the potential upfront costs and the complexity involved in setting it up. Unlike a will, a trust requires the proper transfer of assets, which can be intricate and requires attention. Moreover, it may involve future administrative responsibilities to maintain the trust, which needs careful planning.