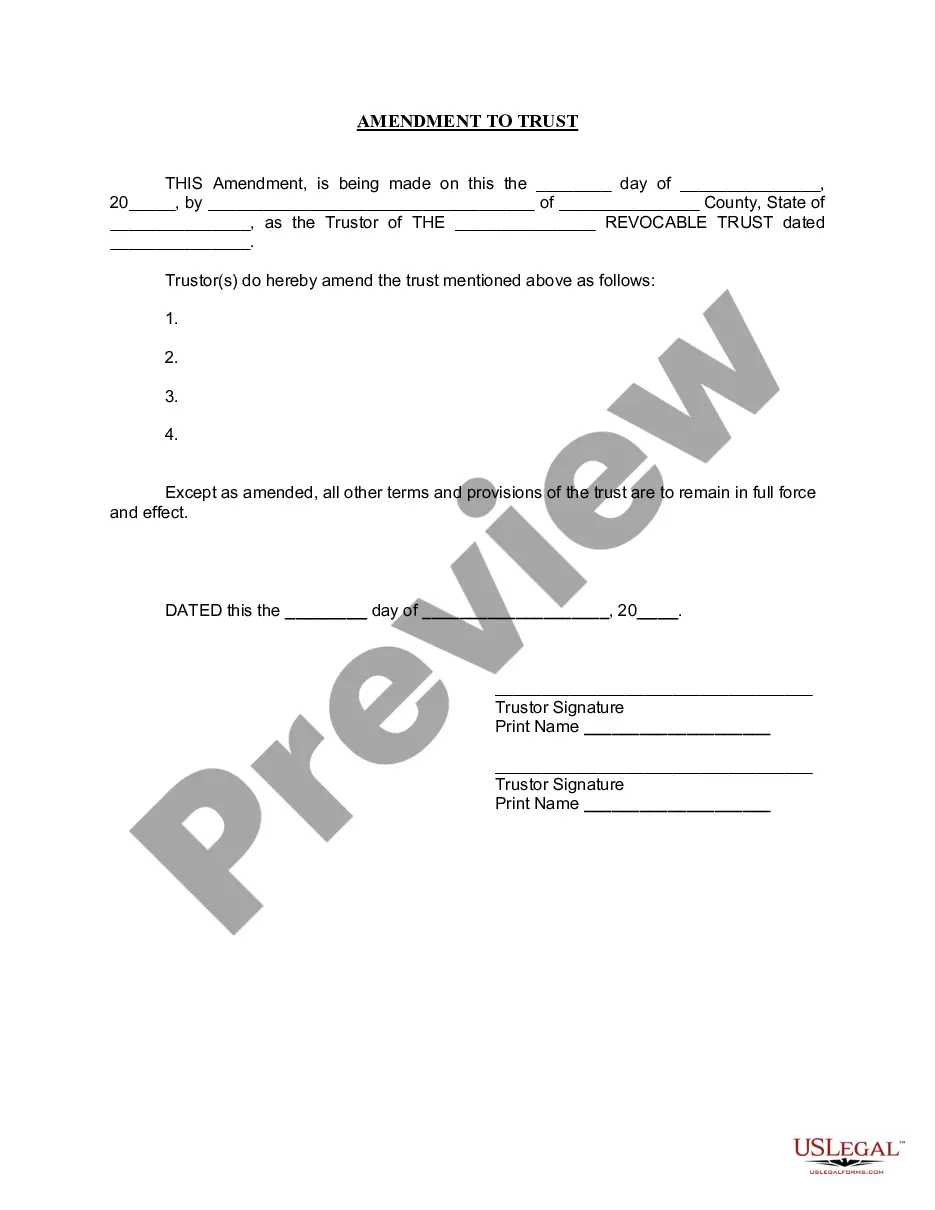

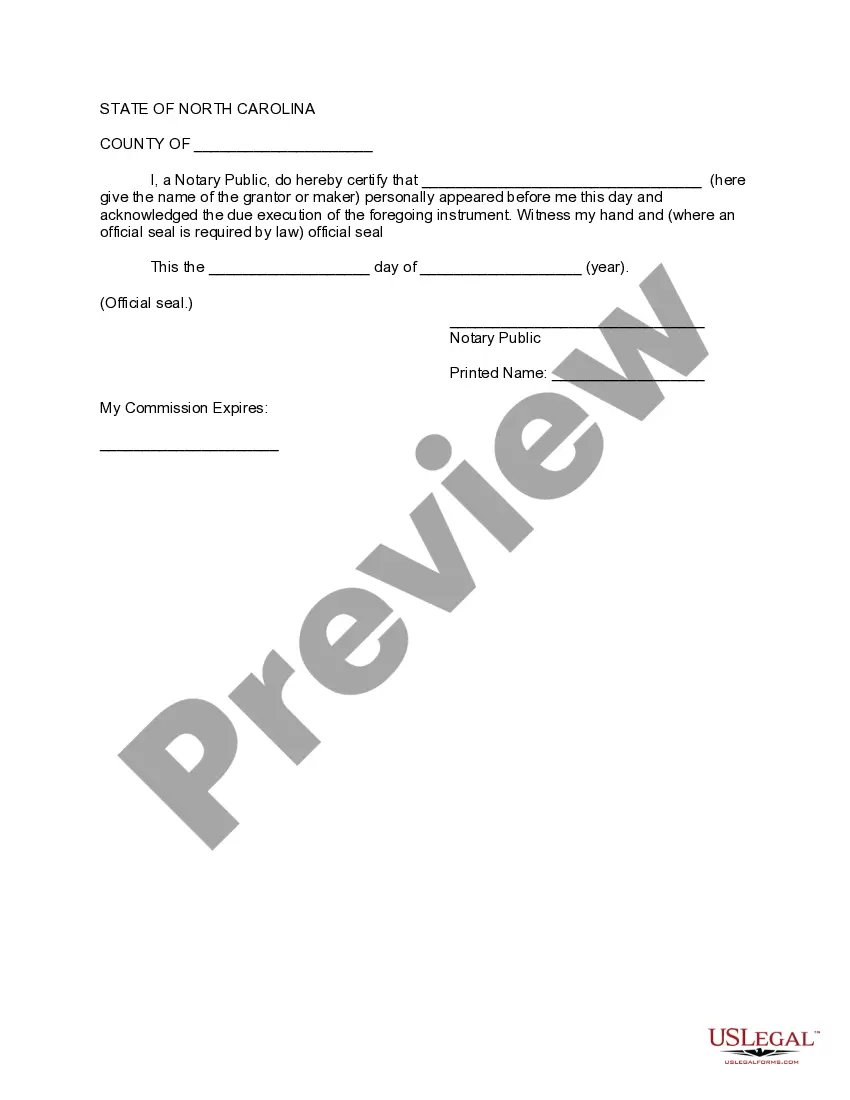

The Wilmington North Carolina Amendment to Living Trust is a legal document that allows individuals to modify the terms and provisions of their existing living trust in Wilmington, North Carolina. This amendment is specifically designed to reflect any changes in the granter's circumstances, intentions, or wishes regarding the distribution of assets and management of their estate after their demise. In Wilmington, North Carolina, there are primarily two types of amendments to a living trust: 1. Revocable Amendment to Living Trust: A revocable amendment to a living trust in Wilmington, North Carolina entails modifications that can be made during the granter's lifetime. It offers flexibility to alter key provisions such as beneficiaries, trustee designations, and asset distribution percentages. This type of amendment allows individuals to update the trust according to their changing financial situation, family dynamics, or personal preferences. 2. Irrevocable Amendment to Living Trust: An irrevocable amendment to a living trust in Wilmington, North Carolina involves making changes that are more permanent and cannot be modified without the agreement of all parties involved. Once the trust has been amended irrevocably, the granter relinquishes control over the assets and any amendments must be executed with utmost care and consideration due to their irreversible nature. The Wilmington North Carolina Amendment to Living Trust includes several key features and benefits: 1. Flexibility: The amendment provides an opportunity to adapt the trust during the granter's lifetime to ensure it aligns with their current wishes, allowing for adjustments to beneficiaries, trustees, or asset distribution. 2. Efficient Administration: By keeping the trust updated through amendments, the granter can facilitate a seamless transfer of assets to the designated beneficiaries without the need for lengthy and expensive probate proceedings. 3. Privacy Protection: A trust amendment allows for the avoidance of the public scrutiny associated with probate, as the amended living trust remains a private document, typically shared only with relevant parties. 4. Asset Protection: By maintaining an updated living trust, the granter can incorporate asset protection measures, ensuring their estate's safeguarding against potential creditors or legal disputes. 5. Estate Tax Planning: A properly amended living trust can assist the granter in utilizing estate tax planning strategies and maximizing potential tax benefits available under Wilmington, North Carolina laws. In summary, the Wilmington North Carolina Amendment to Living Trust serves as a crucial document for individuals seeking to modify the terms and provisions of their existing living trust in Wilmington, North Carolina. Whether through a revocable or irrevocable amendment, this legal tool provides the necessary flexibility and control to reflect changes in the granter's intentions, wishes, and circumstances. By using this amendment, individuals can ensure their estate plans accurately represent their current desires and provide for the efficient administration and distribution of assets in the future.

Wilmington North Carolina Amendment to Living Trust

Description

How to fill out Wilmington North Carolina Amendment To Living Trust?

Do you need a trustworthy and affordable legal forms supplier to buy the Wilmington North Carolina Amendment to Living Trust? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of separate state and county.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Wilmington North Carolina Amendment to Living Trust conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search in case the form isn’t suitable for your specific scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Wilmington North Carolina Amendment to Living Trust in any provided file format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal paperwork online once and for all.