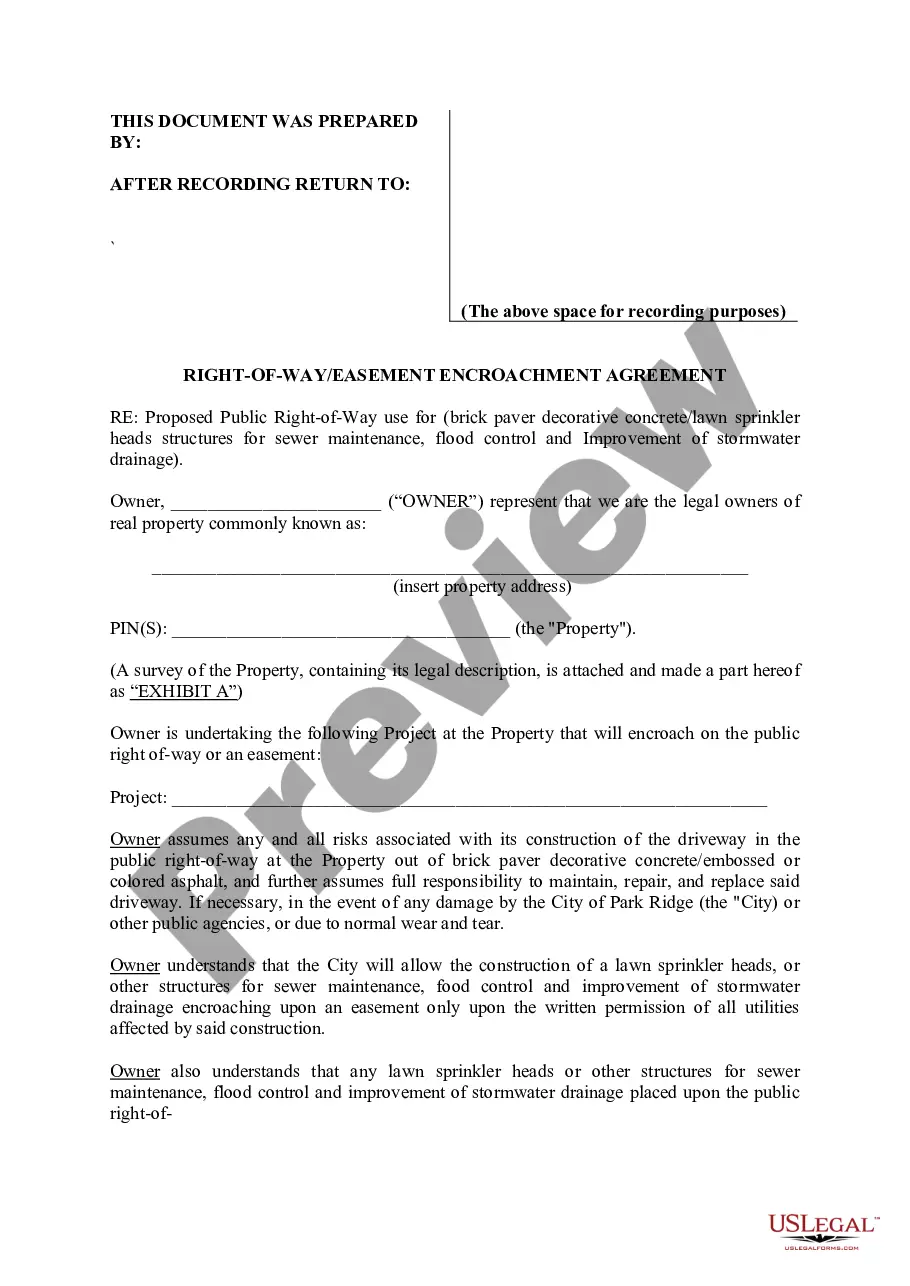

Raleigh North Carolina Living Trust Property Record

Description

How to fill out North Carolina Living Trust Property Record?

Obtaining verified templates tailored to your local regulations can be difficult unless you access the US Legal Forms repository.

It is an online compilation of over 85,000 legal documents for personal and professional purposes, catering to various real-world situations.

All documents are meticulously organized by usage category and jurisdiction, making the search for the Raleigh North Carolina Living Trust Property Record as simple and straightforward as pie.

Click on the Buy Now button and select the subscription plan that you prefer. You will need to create an account to access the library’s resources.

- Examine the Preview mode and document description.

- Ensure you’ve selected the correct template that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you encounter any discrepancies, use the Search tab above to find the appropriate one. If it works for you, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Go to your county's website and search for tax maps or real property records. Go to: . Click on ?Access to Local Geospatial Data in NC?.

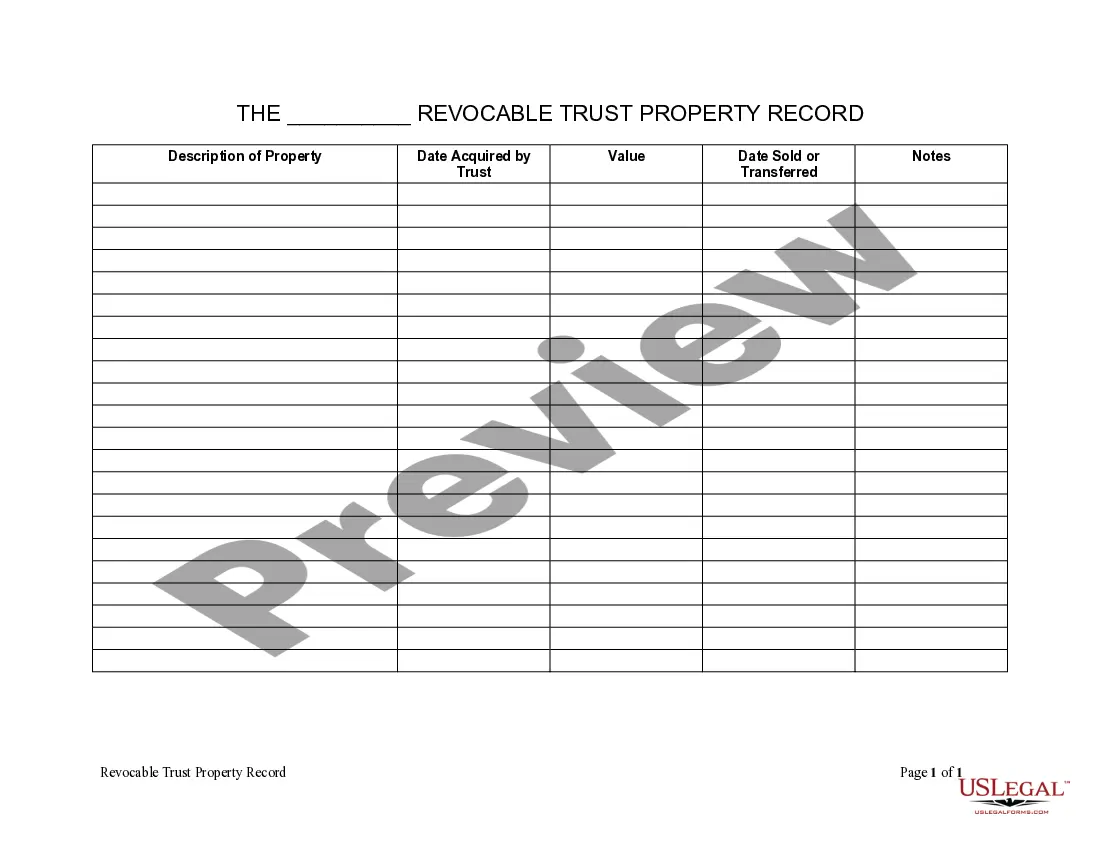

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

Another reason to use a trust is that it creates a veil of privacy for you and your family. Wills become part of the public record when they go through probate. Your trust will never become public record and no one needs to know what assets are in it, who your beneficiaries are, or how assets are being distributed.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

The deed and certificate are generally recorded together in the county's public land records. A certificate of trust reveals limited information such as the date the trust was created, the name of its creator and trustee, and the powers granted to the trustee.

Likewise, North Carolina law provides that all current trust beneficiaries have a right to receive a copy of the trust document, and a right to financial accountings and trust management records at ?reasonable intervals.? It is a good idea for a trustee to be proactive, and responsive, in providing these items to

All real estate records are public records and are available for inspection between the hours of 8 a.m. and 5 p.m. Monday through Friday. The Register of Deeds Office is located in the County and Courts Office Building, 720 East Fourth Street, Charlotte, NC 28202.

Typically, California property records are under the local county recorder's purview. However, the public can find property records at the county clerk's office in some instances. Also, property tax records are typically available at the local tax assessor's office.

Does a Beneficiary Have the Right to See the Trust? The California Probate Law section 16061.7 provides for the beneficiaries right to see the trust. Trustees should furnish beneficiaries and heirs with copies of the trust document.