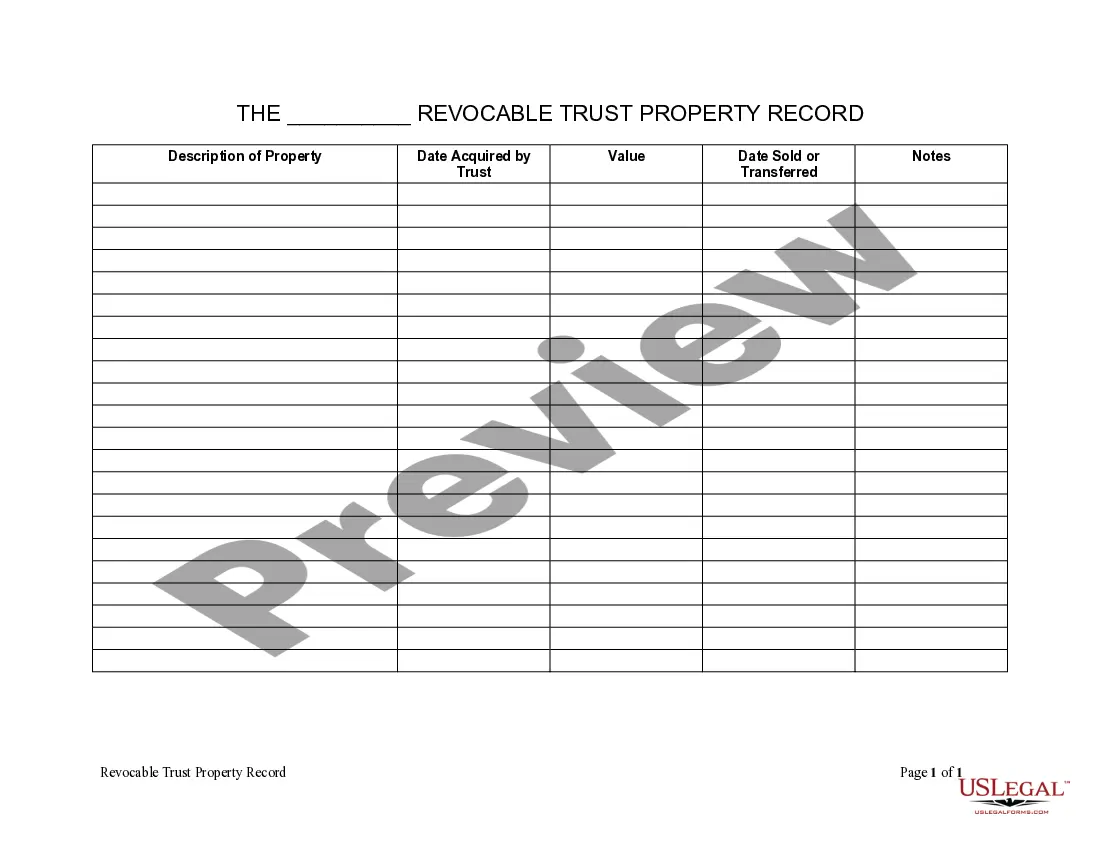

Wilmington North Carolina Living Trust Property Record is a comprehensive and organized documentation system that contains all the necessary information related to properties held under a living trust in Wilmington, North Carolina. As part of estate planning, a living trust allows individuals to transfer their assets, including real estate, into a trust during their lifetime, specifying how they want these assets to be managed and distributed after their passing. The Wilmington North Carolina Living Trust Property Record includes essential details about each property within the trust, ensuring efficient management and seamless transition of assets. The record typically includes the following key information: 1. Property Identification: Each property within the living trust is assigned a unique identification number or address, enabling easy identification and reference. 2. Legal Descriptions: Accurate legal descriptions of each property are recorded, including the physical address, lot size, boundaries, and any relevant legal documents such as deeds or titles. 3. Property Valuation: The living trust property record includes the current market value of each property, which assists in determining the overall net worth of the trust. Regular property appraisals may also be included for reference. 4. Property History: Any significant events related to the property, such as previous owners, changes in ownership, renovations, or repairs, are recorded to provide a comprehensive history of the property. 5. Property Taxes and Assessments: The record also includes information about property tax assessments, payment history, due dates, and any outstanding property taxes or liens. 6. Insurance Documentation: Details of property insurance policies, including coverage, premiums, and expiration dates, are documented to ensure comprehensive protection for the property and trust beneficiaries. 7. Trust Beneficiaries: The Wilmington North Carolina Living Trust Property Record may include a list of beneficiaries entitled to receive proceeds or benefits from the properties within the trust, along with their contact information. Types of Wilmington North Carolina Living Trust Property Record: 1. Residential Properties: This type of property record comprises houses, apartments, condominiums, or any residential dwellings held under the living trust. 2. Commercial Properties: Records related to commercial buildings or office spaces held under the living trust fall under this category, including details about leases, tenants, and rental income. 3. Vacant Land or Lots: If the trust includes undeveloped land or vacant lots, separate record sections may be dedicated to these properties, including zoning information, potential usage, and development plans. 4. Rental Properties: For properties held under the living trust and rented out, additional records may be maintained to track rental income, leases, expenses, and tenant information. It is important to keep the Wilmington North Carolina Living Trust Property Record accurate, up-to-date, and easily accessible to trustees, beneficiaries, or any authorized individuals involved in the management, administration, or planning of the trust.

Wilmington North Carolina Living Trust Property Record

Description

How to fill out Wilmington North Carolina Living Trust Property Record?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Wilmington North Carolina Living Trust Property Record or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Wilmington North Carolina Living Trust Property Record adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Wilmington North Carolina Living Trust Property Record is suitable for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!