Cary, North Carolina Financial Account Transfer to Living Trust Are you a resident of Cary, North Carolina, considering a financial account transfer to a living trust? This comprehensive guide will delve into the details of this process and provide you with relevant information to make informed decisions about your estate planning. We will also explore different types of financial account transfers to living trusts, ensuring you gain a complete understanding of your options. In Cary, North Carolina, a financial account transfer to a living trust refers to the act of transferring ownership of your financial accounts to a trust, which you have established during your lifetime. By doing so, you can enjoy the benefits of a living trust while ensuring the seamless management and distribution of your assets upon incapacitation or passing. What is a Living Trust? A living trust is a legal entity created during your lifetime to hold and distribute your assets. Unlike a will, a living trust becomes effective immediately and eliminates the need for probate court involvement upon your death. It also allows for efficient management of your affairs in case of incapacitation or disability, ensuring your finances are handled as per your wishes. Benefits of a Financial Account Transfer to Living Trust: 1. Avoiding Probate: Probate can be a lengthy and expensive process, during which your financial accounts could be tied up. A living trust bypasses probate, allowing for quicker distribution of assets to your beneficiaries. 2. Privacy: Unlike a will, which becomes public record upon probate, a living trust maintains your privacy as its contents remain confidential. 3. Incapacity Planning: A living trust provides a mechanism to manage your financial affairs if you become unable to do so due to illness, injury, or disability. 4. Flexible Asset Management: You retain complete control over your financial accounts during your lifetime and can make changes or amendments to the living trust as needed. 5. Potential Tax Benefits: A living trust may help with tax planning and may provide benefits for certain financial situations. Consult with a financial advisor or tax professional in Cary, North Carolina, to understand the specific advantages applicable to your circumstances. Different Types of Cary North Carolina Financial Account Transfers to Living Trusts: 1. Revocable Living Trust: The most common type of living trust, which allows you to retain control over your assets during your lifetime, make amendments, and revoke the trust if desired. 2. Irrevocable Living Trust: This type of trust cannot be altered or undone without the consent of the beneficiaries. It provides potential tax benefits but limits your control over the assets. 3. Testamentary Living Trust: Created through a will, this type of trust only becomes effective after your passing and must go through probate. It allows for flexibility while maintaining court oversight during administration. Before proceeding with a financial account transfer to a living trust in Cary, North Carolina, it is crucial to consult with an experienced estate planning attorney who can tailor the process to your specific needs and provide legal guidance. They will ensure that all necessary documentation is properly prepared and executed. In conclusion, a financial account transfer to a living trust in Cary, North Carolina, offers numerous benefits, including the avoidance of probate, efficient asset management, and privacy preservation. By choosing the appropriate living trust type, such as a revocable or irrevocable trust, you can customize your estate planning according to your unique requirements. Seek the assistance of a knowledgeable professional to navigate this process smoothly and ensure your assets are protected for future generations.

Cary North Carolina Financial Account Transfer to Living Trust

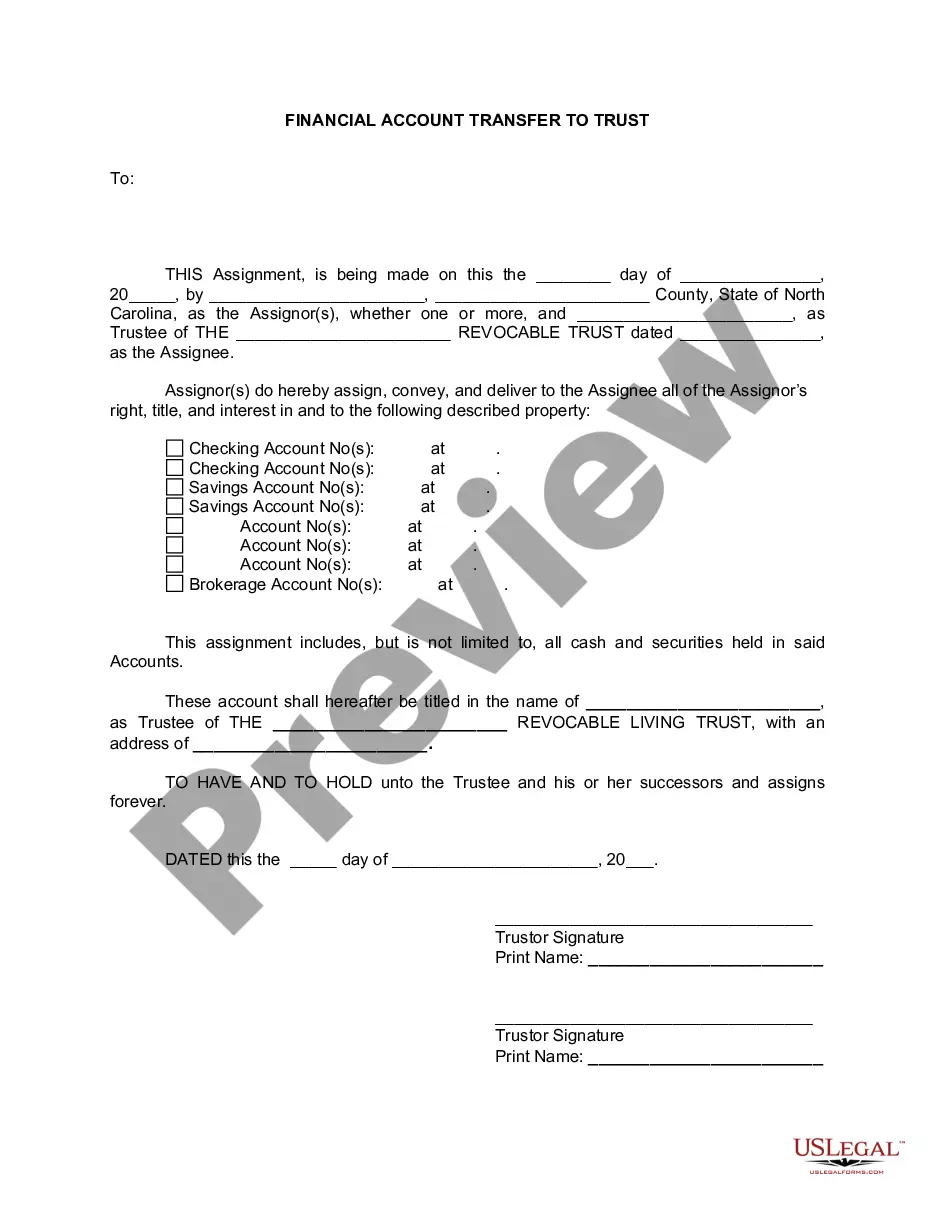

Description

How to fill out Cary North Carolina Financial Account Transfer To Living Trust?

If you are searching for a valid form, it’s extremely hard to find a more convenient place than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can find a huge number of form samples for organization and individual purposes by categories and states, or keywords. Using our advanced search feature, finding the newest Cary North Carolina Financial Account Transfer to Living Trust is as easy as 1-2-3. Additionally, the relevance of each document is verified by a team of professional lawyers that on a regular basis review the templates on our website and revise them according to the latest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Cary North Carolina Financial Account Transfer to Living Trust is to log in to your profile and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have found the sample you need. Check its description and utilize the Preview feature (if available) to check its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to get the appropriate document.

- Confirm your selection. Select the Buy now option. After that, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Indicate the format and save it to your system.

- Make changes. Fill out, edit, print, and sign the obtained Cary North Carolina Financial Account Transfer to Living Trust.

Every template you save in your profile has no expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you need to receive an extra copy for modifying or printing, you may come back and export it once again whenever you want.

Make use of the US Legal Forms professional library to get access to the Cary North Carolina Financial Account Transfer to Living Trust you were seeking and a huge number of other professional and state-specific samples in one place!