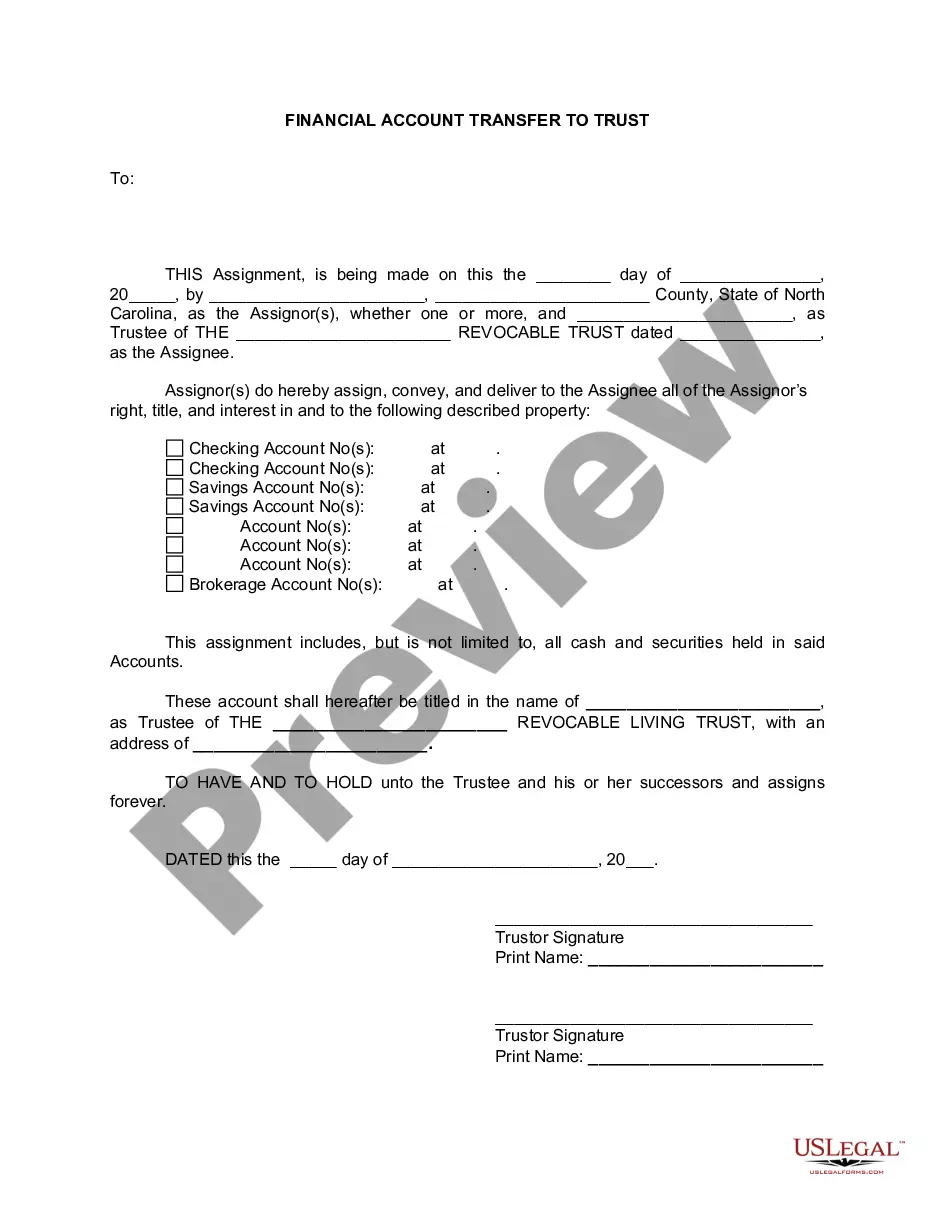

A Charlotte North Carolina Financial Account Transfer to Living Trust is a legal process wherein an individual's financial accounts, such as bank accounts, investment portfolios, and retirement funds, are transferred to their living trust. This transfer occurs in order to ensure seamless management and distribution of these assets upon the individual's incapacitation or death. Living trusts, also known as revocable trusts, are estate planning tools that allow individuals to maintain control over their assets while providing a framework for their efficient administration. By transferring financial accounts to a living trust, individuals can take advantage of various benefits, including avoiding probate, maintaining privacy, minimizing estate taxes, and ensuring a smooth transition of assets to beneficiaries. There are various types of Charlotte North Carolina Financial Account Transfer to Living Trust, including: 1. Bank Account Transfer: This involves transferring personal bank accounts, such as checking and savings accounts, to the living trust. This can be done by contacting the bank and providing the necessary documentation, including the trust agreement. 2. Investment Account Transfer: Individuals can transfer their investment accounts, such as brokerage accounts, stocks, bonds, and mutual funds, into their living trust. This transfer may require completing specific forms provided by the respective financial institution or brokerage firm. 3. Retirement Account Transfer: It is possible to transfer retirement accounts, such as individual retirement accounts (IRAs), 401(k)s, or pensions, to a living trust. However, there are certain rules and restrictions imposed by the Internal Revenue Service (IRS) that need to be followed, including potential tax consequences. 4. Estate Account Transfer: If an individual has an estate account specifically set up for managing their estate's financial matters, this account can also be transferred to the living trust. This account often serves as a centralized hub for managing and distributing assets during the probate process. When pursuing a Charlotte North Carolina Financial Account Transfer to Living Trust, it is essential to seek professional legal advice from an estate planning attorney familiar with the laws and regulations of North Carolina. They can provide guidance tailored to individual circumstances, prepare the necessary legal documents, and ensure a proper and legally binding transfer of financial accounts to the living trust.

Charlotte North Carolina Financial Account Transfer to Living Trust

Description

How to fill out Charlotte North Carolina Financial Account Transfer To Living Trust?

If you are looking for a relevant form, it’s impossible to find a better platform than the US Legal Forms site – probably the most extensive libraries on the internet. With this library, you can get thousands of templates for organization and personal purposes by categories and regions, or key phrases. With the high-quality search option, discovering the most up-to-date Charlotte North Carolina Financial Account Transfer to Living Trust is as elementary as 1-2-3. In addition, the relevance of each file is confirmed by a group of professional lawyers that regularly review the templates on our platform and revise them based on the newest state and county laws.

If you already know about our system and have an account, all you need to receive the Charlotte North Carolina Financial Account Transfer to Living Trust is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the sample you require. Read its explanation and make use of the Preview option (if available) to see its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the appropriate document.

- Confirm your choice. Click the Buy now button. After that, choose your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the form. Pick the format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Charlotte North Carolina Financial Account Transfer to Living Trust.

Every single form you add to your account does not have an expiration date and is yours forever. You can easily access them via the My Forms menu, so if you need to get an additional duplicate for editing or creating a hard copy, you can return and download it once more at any time.

Take advantage of the US Legal Forms extensive library to gain access to the Charlotte North Carolina Financial Account Transfer to Living Trust you were looking for and thousands of other professional and state-specific templates on one website!