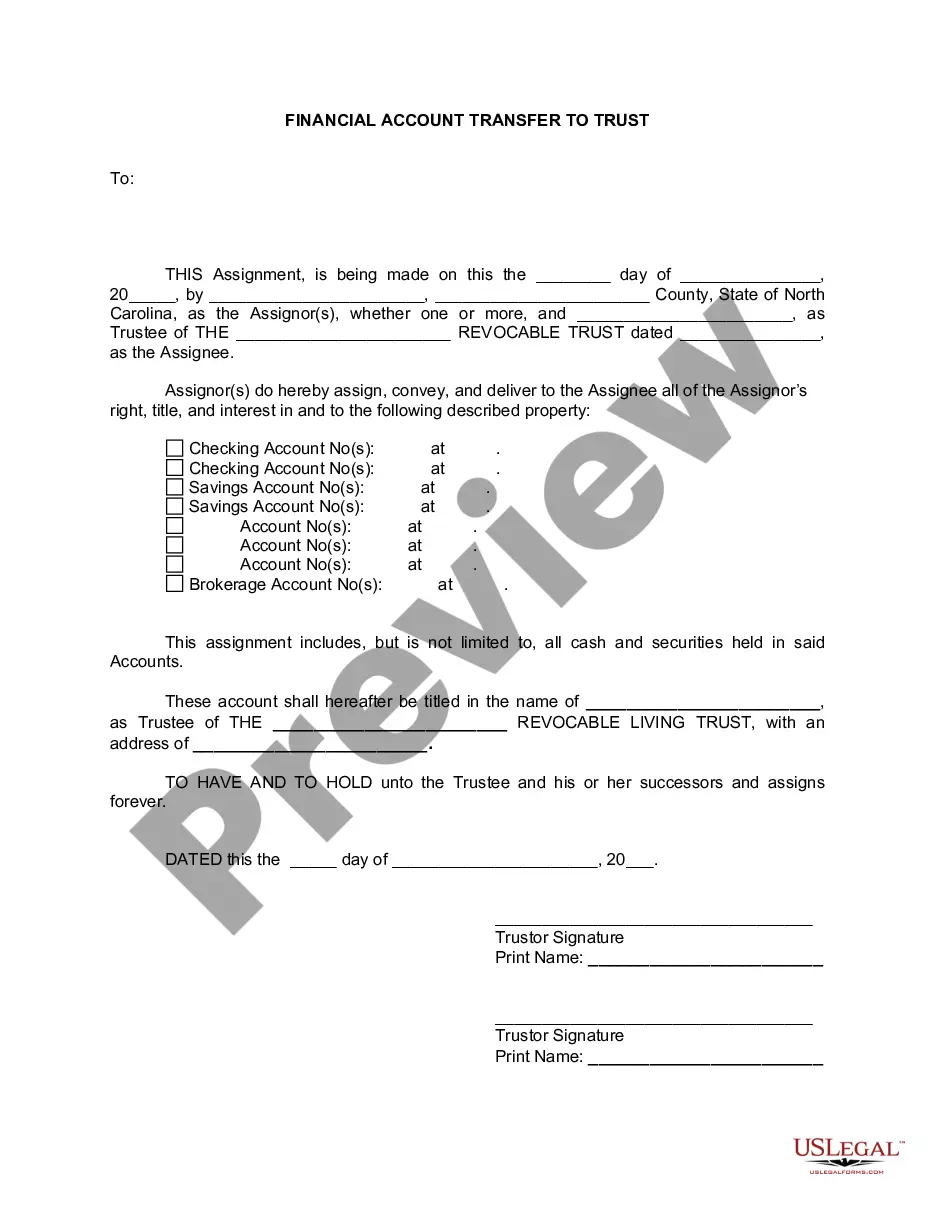

The Greensboro North Carolina financial account transfer to living trust refers to the process of transferring one's financial accounts, such as savings accounts, checking accounts, investment accounts, and retirement accounts, to a living trust in Greensboro, North Carolina. This legal procedure allows individuals to transfer assets into a trust that is managed by a trustee for the benefit of the trust's beneficiaries. Living trusts are commonly used estate planning tools that offer several benefits, including privacy, probate avoidance, and the ability to control the distribution of assets after one's passing. By transferring financial accounts to a living trust, individuals can ensure that their assets are protected and efficiently managed according to their wishes. There are various types of financial account transfers to living trusts available in Greensboro, North Carolina, depending on the specific needs and goals of the individual. Some common types include: 1. Savings account transfer: This involves transferring funds from a personal savings account to a living trust. This ensures that the funds remain protected and accessible to the trust beneficiaries. 2. Checking account transfer: This type of transfer involves moving funds from a personal checking account into a living trust. It allows the trustee of the trust to manage day-to-day expenses on behalf of the trust beneficiaries. 3. Investment account transfer: Individuals can transfer stocks, bonds, mutual funds, or other investment assets into a living trust. By doing so, the trust becomes the official owner, and the appointed trustee gains control over managing these investments. 4. Retirement account transfer: Retirement accounts, such as individual retirement accounts (IRAs) or 401(k) plans, can be transferred to a living trust to provide beneficiaries with continued tax advantages and controlled distributions. 5. Trust consolidation: In some cases, individuals may have multiple accounts scattered across different financial institutions. Consolidating these accounts into a living trust simplifies administration and provides a comprehensive overview of their financial holdings. It's crucial to consult with an experienced lawyer or estate planning professional in Greensboro, North Carolina, to understand the specific legal requirements and implications of transferring financial accounts to a living trust. Understanding the benefits and potential drawbacks of each type of transfer will help individuals make informed decisions and ensure their estate plans align with their long-term goals.

Greensboro North Carolina Financial Account Transfer to Living Trust

Description

How to fill out Greensboro North Carolina Financial Account Transfer To Living Trust?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone without any legal education to draft this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI tpapers.

Whether you need the Greensboro North Carolina Financial Account Transfer to Living Trust or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Greensboro North Carolina Financial Account Transfer to Living Trust quickly employing our trustworthy platform. If you are already a subscriber, you can go ahead and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Greensboro North Carolina Financial Account Transfer to Living Trust:

- Ensure the form you have chosen is suitable for your location because the regulations of one state or area do not work for another state or area.

- Review the document and go through a short outline (if provided) of cases the paper can be used for.

- If the one you chosen doesn’t meet your requirements, you can start again and look for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Greensboro North Carolina Financial Account Transfer to Living Trust as soon as the payment is done.

You’re good to go! Now you can go ahead and print out the document or fill it out online. In case you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.