Wilmington North Carolina Financial Account Transfer to Living Trust

Description

How to fill out North Carolina Financial Account Transfer To Living Trust?

If you have previously taken advantage of our service, Log In to your account and retrieve the Wilmington North Carolina Financial Account Transfer to Living Trust on your device by clicking the Download button. Ensure your subscription remains active. If not, renew it in line with your chosen payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continual access to all paperwork you have acquired: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to effortlessly find and preserve any template for your personal or professional needs!

- Confirm you’ve located the correct document. Review the description and utilize the Preview feature, if available, to ascertain whether it fulfills your needs. If it’s not suitable, employ the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize the payment. Provide your credit card information or select the PayPal option to complete the transaction.

- Receive your Wilmington North Carolina Financial Account Transfer to Living Trust. Select the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

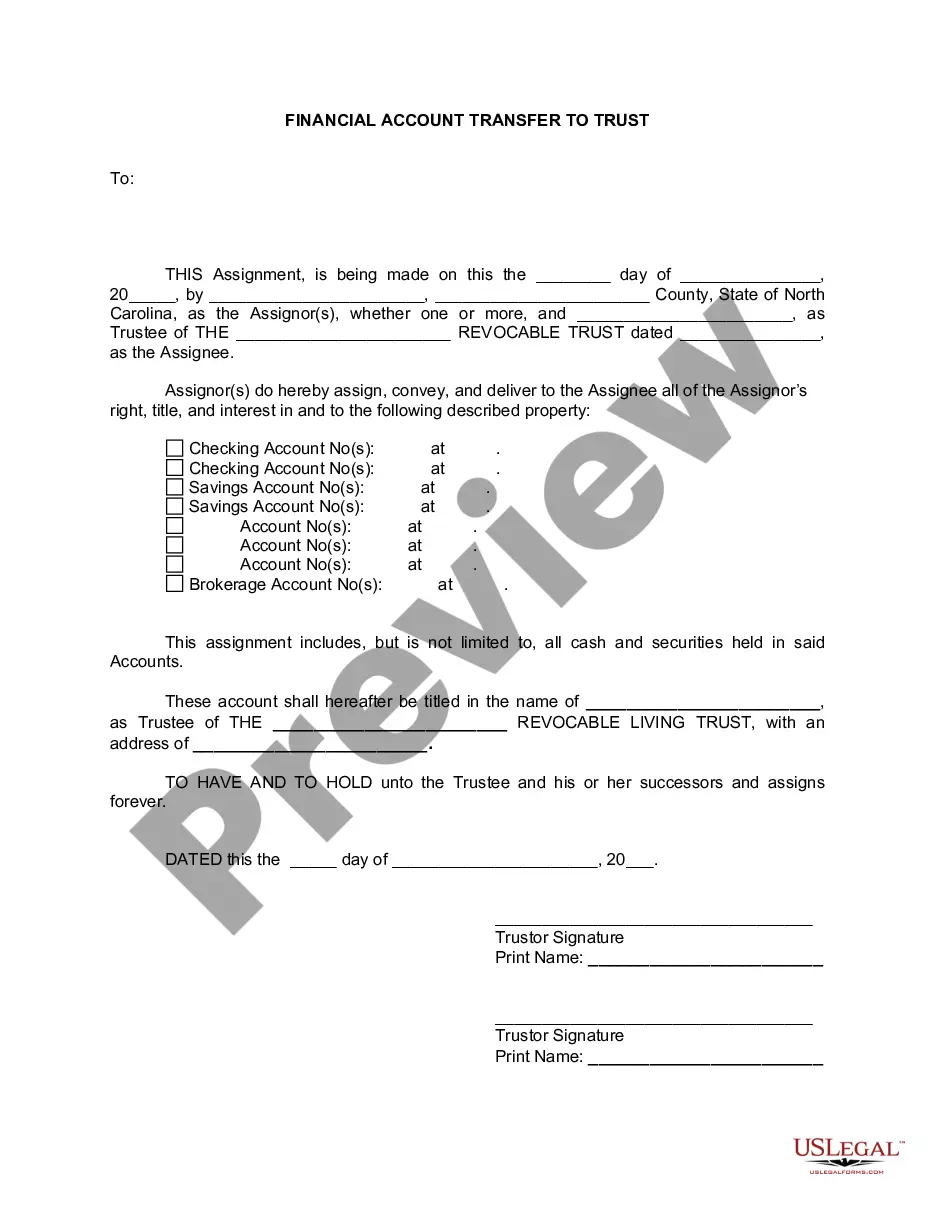

To transfer a living trust effectively, you must first gather all relevant financial account details that you wish to transfer under your Wilmington North Carolina Financial Account Transfer to Living Trust. Next, contact your financial institutions to obtain the required forms for transferring accounts into the trust. After completing these forms, you will submit them along with any necessary documentation to confirm the trust’s validity. This process ensures that your assets are correctly managed and protected within your living trust.

When you transfer stock to a revocable trust in Wilmington North Carolina, there are typically no immediate tax consequences. Your assets remain under your control, and you can manage them just as you would outside the trust. However, once your trust becomes irrevocable, it may be subject to different tax rules. It is wise to consult a tax professional to understand your specific situation and ensure compliance during the Wilmington North Carolina Financial Account Transfer to Living Trust.

Transferring a brokerage account to a living trust in Wilmington North Carolina involves several key steps. First, you'll need to contact your brokerage firm to request the necessary forms for account transfer. Next, fill out the forms with your trust information, ensuring that the trust is properly established and funded. Finally, submit these forms to your brokerage to complete the Wilmington North Carolina Financial Account Transfer to Living Trust process.

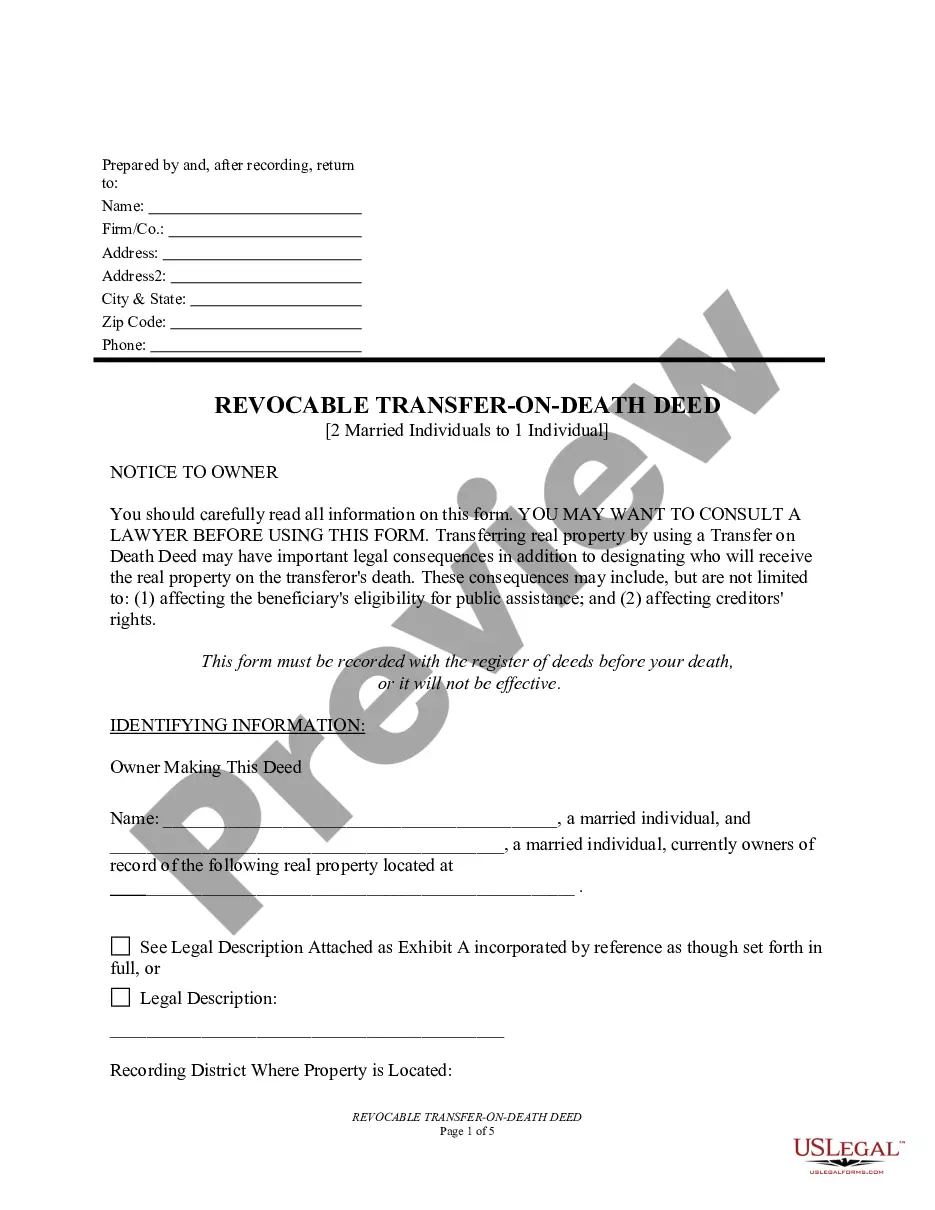

To transfer property to a trust in North Carolina, you will need to create a deed reflecting the trust as the new owner. This document must be signed, notarized, and recorded in the local county register of deeds. It's crucial to handle the Wilmington North Carolina Financial Account Transfer to Living Trust accurately to avoid possible estate issues in the future.

Transferring a brokerage account to a living trust involves contacting your brokerage firm for their specific procedures. Generally, you will be required to fill out a transfer form to execute the Wilmington North Carolina Financial Account Transfer to Living Trust. Utilizing a platform like USLegalForms can simplify the documentation process and ensure that your transfer is completed correctly.

If your parents are considering estate planning options, placing their assets in a trust can be beneficial for some families. It can simplify the transfer process and provide control over asset distribution. However, it's essential for them to consult with a legal professional to ensure that a proper Wilmington North Carolina Financial Account Transfer to Living Trust aligns with their goals.

One downside of placing assets in a trust is the potential loss of control over those assets during your lifetime. When you allocate property to the trust, you must adhere to its terms, which may restrict how you can access or use those assets. Additionally, there may be tax implications or legal complexities involved in proper Wilmington North Carolina Financial Account Transfer to Living Trust.

To transfer your checking account to your living trust, you will need to contact your bank for guidance. Typically, you will fill out a new account application in the name of your living trust, allowing for the Wilmington North Carolina Financial Account Transfer to Living Trust. Your bank will provide specific instructions, and you may need to show documentation of your trust's existence.

Often, parents overlook proper funding of the trust, which means that their assets may not be included in the estate plan. Without proper Wilmington North Carolina Financial Account Transfer to Living Trust, beneficiaries might not receive the intended support. It is crucial to review and update the trust regularly to reflect changes in family or financial situations.

A primary concern when creating a trust is the complexity and potential costs associated with its setup and management. Many people in Wilmington North Carolina face challenges with legal requirements and ongoing administration fees. Additionally, if not properly managed, a trust can inadvertently limit access to funds during its lifetime, creating frustration for beneficiaries.