High Point, North Carolina Assignment to Living Trust: A Comprehensive Guide Living trusts are commonly used estate planning tools that allow individuals to organize their assets, minimize estate taxes, avoid probate, and ensure the smooth transfer of property upon death. In High Point, North Carolina, the Assignment to Living Trust process is vital to protect your assets and simplify the distribution of your estate. This detailed description provides insights into what an Assignment to Living Trust entails, its benefits, and the various types that can be established in High Point. 1. What is an Assignment to Living Trust? An Assignment to Living Trust refers to the legal act of transferring ownership of one's assets to a living trust during their lifetime. This involves reassigning titles and ownership documents of various properties, including real estate, bank accounts, investments, business holdings, and personal belongings, to the living trust. By doing so, the individual becomes the granter, while the trust becomes the legal owner of the assets. 2. Benefits of High Point Assignment to Living Trust: a. Avoidance of Probate: Probate is a court-supervised process that determines the authenticity of a will and oversees the distribution of assets. Assigning assets to a living trust helps bypass probate, saving time, expenses, and maintaining privacy. b. Minimization of Estate Taxes: High Point Assignment to Living Trust can help reduce estate taxes and transfer taxes, allowing more assets to be passed on to beneficiaries. c. Incapacity Planning: A living trust includes provisions for managing your assets if you become incapacitated, ensuring continuity of financial affairs without court involvement. d. Control and Flexibility: The granter retains complete control over the living trust during their lifetime and has the flexibility to amend or revoke it whenever necessary. 3. Types of Living Trusts in High Point, North Carolina: a. Revocable Living Trust: This is the most common type of living trust as it allows the granter to modify, revoke, or amend the trust as they see fit during their lifetime. Upon the granter's death or incapacitation, the preselected successor trustee takes over the management and distribution of assets. b. Irrevocable Living Trust: Once established, an irrevocable living trust cannot be altered or revoked without the beneficiaries' consent. This type offers enhanced asset protection, potential tax advantages, and may be used for Medicaid planning or charitable giving. c. Special Needs Trust: This trust is specifically designed for individuals with special needs or disabilities to ensure their financial well-being while preserving their eligibility for government assistance programs. d. Testamentary Trust: Unlike revocable living trusts, testamentary trusts are created via a person's will and take effect only upon the granter's death. These trusts can provide for the care and support of minor or disabled beneficiaries, holding and managing assets until beneficiaries reach a certain age. In conclusion, High Point, North Carolina Assignment to Living Trust is a crucial estate planning tool that offers numerous benefits while ensuring that your assets are protected and efficiently distributed. Consulting with an experienced estate planning attorney can help guide you through the process and assist in determining the most suitable type of living trust for your specific needs and goals.

High Point North Carolina Assignment to Living Trust

Description

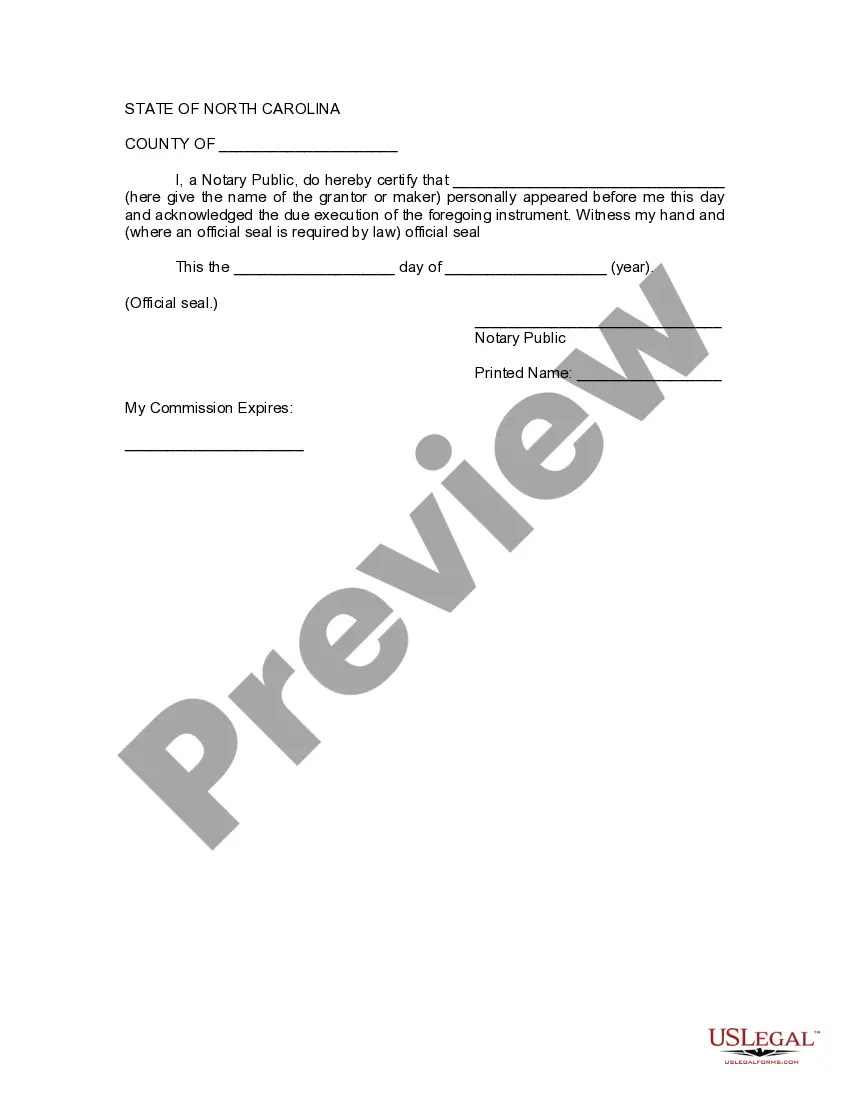

How to fill out High Point North Carolina Assignment To Living Trust?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney services that, as a rule, are very costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the High Point North Carolina Assignment to Living Trust or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the High Point North Carolina Assignment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the High Point North Carolina Assignment to Living Trust would work for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!