A Wilmington North Carolina Assignment to Living Trust is a legal document that allows an individual, known as a granter or trust or, to transfer their assets, such as property, bank accounts, investments, or personal belongings, into a trust during their lifetime. This assignment to a living trust helps the granter maintain control and management of their assets while ensuring a smooth transfer to their designated beneficiaries upon their death, without the need for probate. One type of Wilmington North Carolina Assignment to Living Trust is a Revocable Living Trust. This type of trust allows the granter to retain full control over their assets and make changes or revoke the trust at any time during their lifetime, providing flexibility and the ability to adapt to changing circumstances. With a revocable living trust, the granter can also act as the trustee, managing the trust assets personally. Another type of Wilmington North Carolina Assignment to Living Trust is an Irrevocable Living Trust. As the name suggests, this type of trust cannot be amended or revoked once it is created, providing a higher level of asset protection and tax planning benefits. With an irrevocable living trust, the granter transfers ownership and control of their assets to the trust and designates a trustee to manage the assets on behalf of the beneficiaries. A Wilmington North Carolina Assignment to Living Trust offers several advantages. Firstly, it allows for the private and efficient distribution of assets after the granter's death, avoiding the cost, delays, and public scrutiny associated with probate. It also enables the granter to provide instructions on how their assets should be managed and distributed, allowing for a personalized and customized approach to estate planning. Additionally, a living trust can help minimize estate taxes and protect assets from creditors or lawsuits, making it a useful tool in protecting one's legacy and ensuring financial security for loved ones. Moreover, for individuals owning property in multiple states, a living trust can help avoid the need for ancillary probate, simplifying the asset transfer process. To create a Wilmington North Carolina Assignment to Living Trust, one must consult with an experienced estate planning attorney who is familiar with the state's specific laws and regulations. The attorney will assist in drafting the trust document, designating a trustee, and ensuring all legal requirements are met for a valid trust arrangement. In conclusion, a Wilmington North Carolina Assignment to Living Trust is a powerful estate planning tool that allows individuals to maintain control over their assets during their lifetime and efficiently transfer them to beneficiaries after their death. Whether opting for a revocable or irrevocable living trust, the granter can experience peace of mind knowing their assets are protected, their wishes are preserved, and their loved ones are provided for.

Wilmington North Carolina Assignment to Living Trust

Category:

State:

North Carolina

City:

Wilmington

Control #:

NC-E0178E

Format:

Word;

Rich Text

Instant download

Description

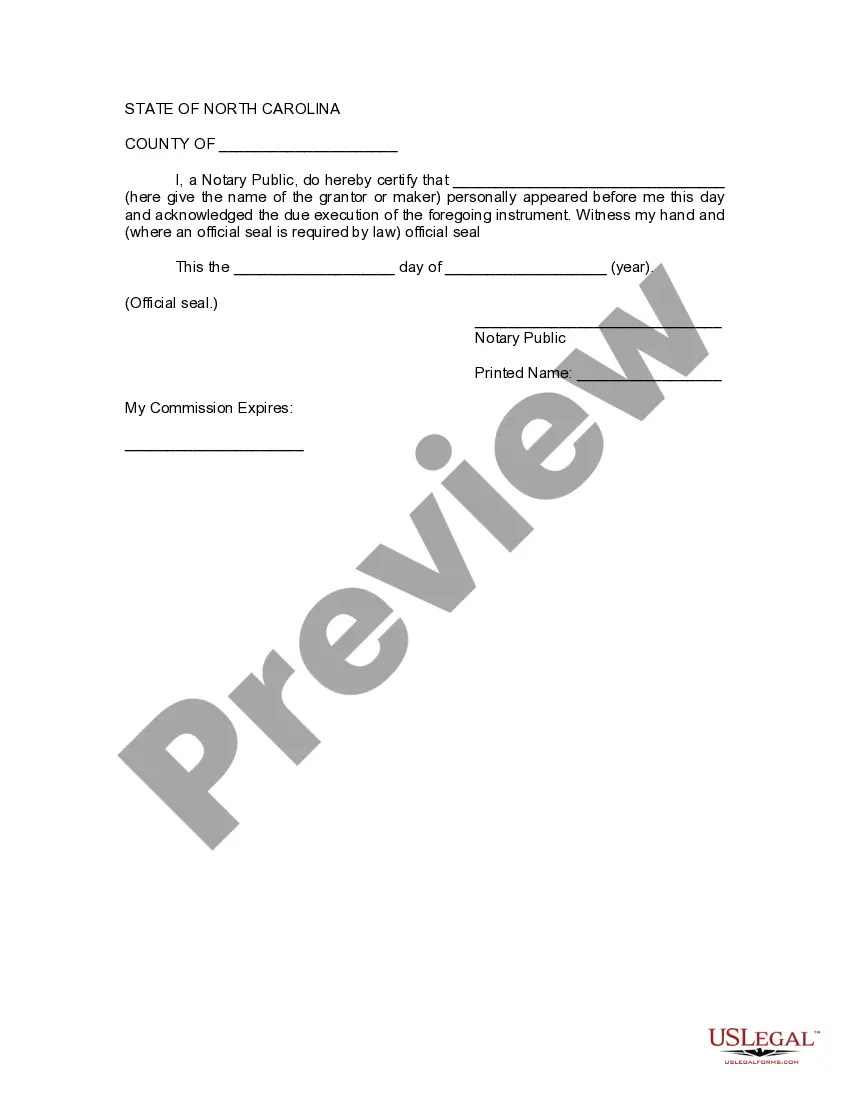

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

A Wilmington North Carolina Assignment to Living Trust is a legal document that allows an individual, known as a granter or trust or, to transfer their assets, such as property, bank accounts, investments, or personal belongings, into a trust during their lifetime. This assignment to a living trust helps the granter maintain control and management of their assets while ensuring a smooth transfer to their designated beneficiaries upon their death, without the need for probate. One type of Wilmington North Carolina Assignment to Living Trust is a Revocable Living Trust. This type of trust allows the granter to retain full control over their assets and make changes or revoke the trust at any time during their lifetime, providing flexibility and the ability to adapt to changing circumstances. With a revocable living trust, the granter can also act as the trustee, managing the trust assets personally. Another type of Wilmington North Carolina Assignment to Living Trust is an Irrevocable Living Trust. As the name suggests, this type of trust cannot be amended or revoked once it is created, providing a higher level of asset protection and tax planning benefits. With an irrevocable living trust, the granter transfers ownership and control of their assets to the trust and designates a trustee to manage the assets on behalf of the beneficiaries. A Wilmington North Carolina Assignment to Living Trust offers several advantages. Firstly, it allows for the private and efficient distribution of assets after the granter's death, avoiding the cost, delays, and public scrutiny associated with probate. It also enables the granter to provide instructions on how their assets should be managed and distributed, allowing for a personalized and customized approach to estate planning. Additionally, a living trust can help minimize estate taxes and protect assets from creditors or lawsuits, making it a useful tool in protecting one's legacy and ensuring financial security for loved ones. Moreover, for individuals owning property in multiple states, a living trust can help avoid the need for ancillary probate, simplifying the asset transfer process. To create a Wilmington North Carolina Assignment to Living Trust, one must consult with an experienced estate planning attorney who is familiar with the state's specific laws and regulations. The attorney will assist in drafting the trust document, designating a trustee, and ensuring all legal requirements are met for a valid trust arrangement. In conclusion, a Wilmington North Carolina Assignment to Living Trust is a powerful estate planning tool that allows individuals to maintain control over their assets during their lifetime and efficiently transfer them to beneficiaries after their death. Whether opting for a revocable or irrevocable living trust, the granter can experience peace of mind knowing their assets are protected, their wishes are preserved, and their loved ones are provided for.

Free preview

How to fill out Wilmington North Carolina Assignment To Living Trust?

If you’ve already used our service before, log in to your account and download the Wilmington North Carolina Assignment to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Wilmington North Carolina Assignment to Living Trust. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!