Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our advantageous platform featuring a vast collection of document samples streamlines the process of locating and obtaining nearly any document template you need.

You can download, complete, and validate the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors in mere minutes instead of spending hours online searching for an appropriate template.

Utilizing our library is an excellent way to enhance the security of your document submissions. Our skilled legal experts frequently assess all documents to ensure that the templates are suitable for a specific area and adhere to new laws and regulations.

If you haven't set up an account yet, follow the steps outlined below.

Navigate to the page containing the desired form. Ensure it is the template you were seeking: review its title and description, and utilize the Preview feature if available. If not, use the Search bar to locate the correct one.

- How do you acquire the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

- If you already possess an account, simply Log In to your account. The Download option will be available on all the documents you view.

- Furthermore, you can access all saved documents in the My documents section.

Form popularity

FAQ

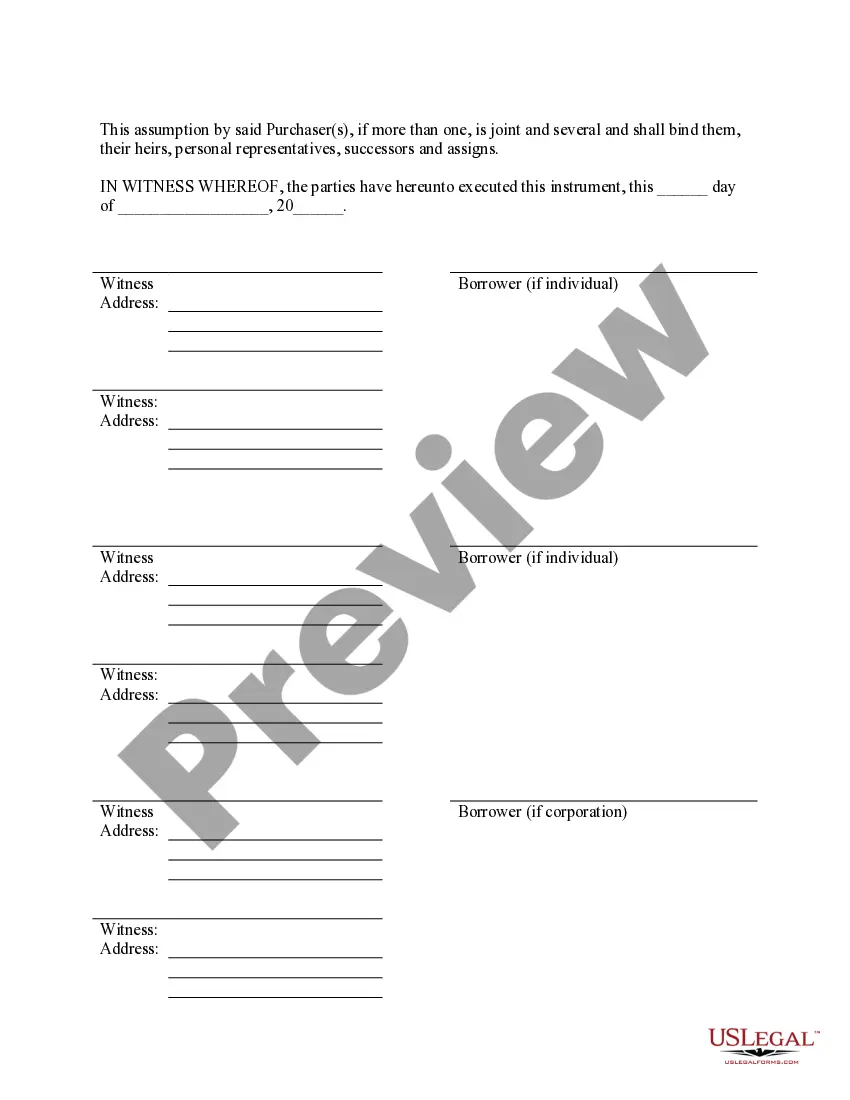

To release a deed of trust, the borrower must fulfill all payment obligations defined in the agreement. Once satisfied, the lender will issue a 'Request for Release of Deed of Trust' document, which must be filed with the county clerk. If you are navigating a Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, using legal services like USLegalForms can simplify this process, ensuring everything is completed correctly and promptly.

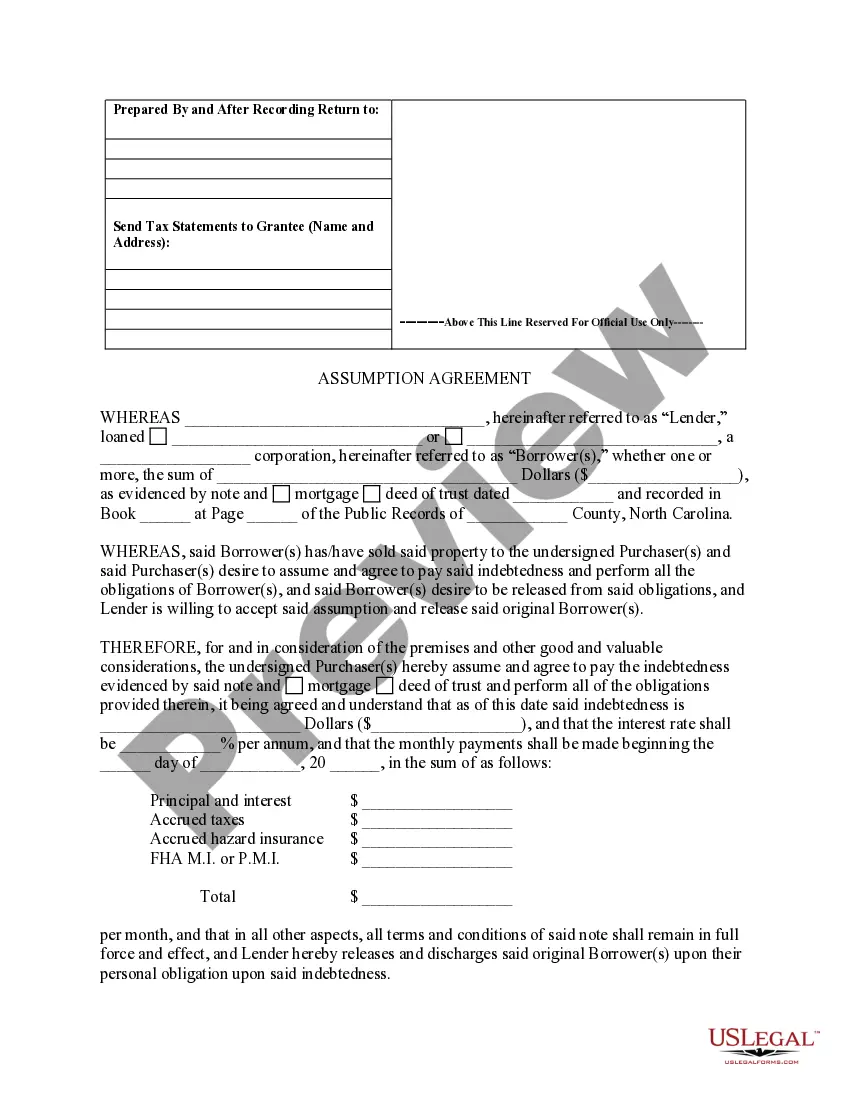

Using a deed of trust provides several benefits compared to a traditional mortgage. It allows lenders to initiate a non-judicial foreclosure process, which is typically faster and less costly. Therefore, if you engage in a Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, you may find the deed of trust to be a more efficient option for securing real estate financing.

North Carolina primarily uses a deed of trust instead of a traditional mortgage for real property transactions. A deed of trust allows for a more streamlined process in foreclosure situations, protecting both lenders and borrowers. When dealing with a Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, understanding this distinction is crucial for all parties involved.

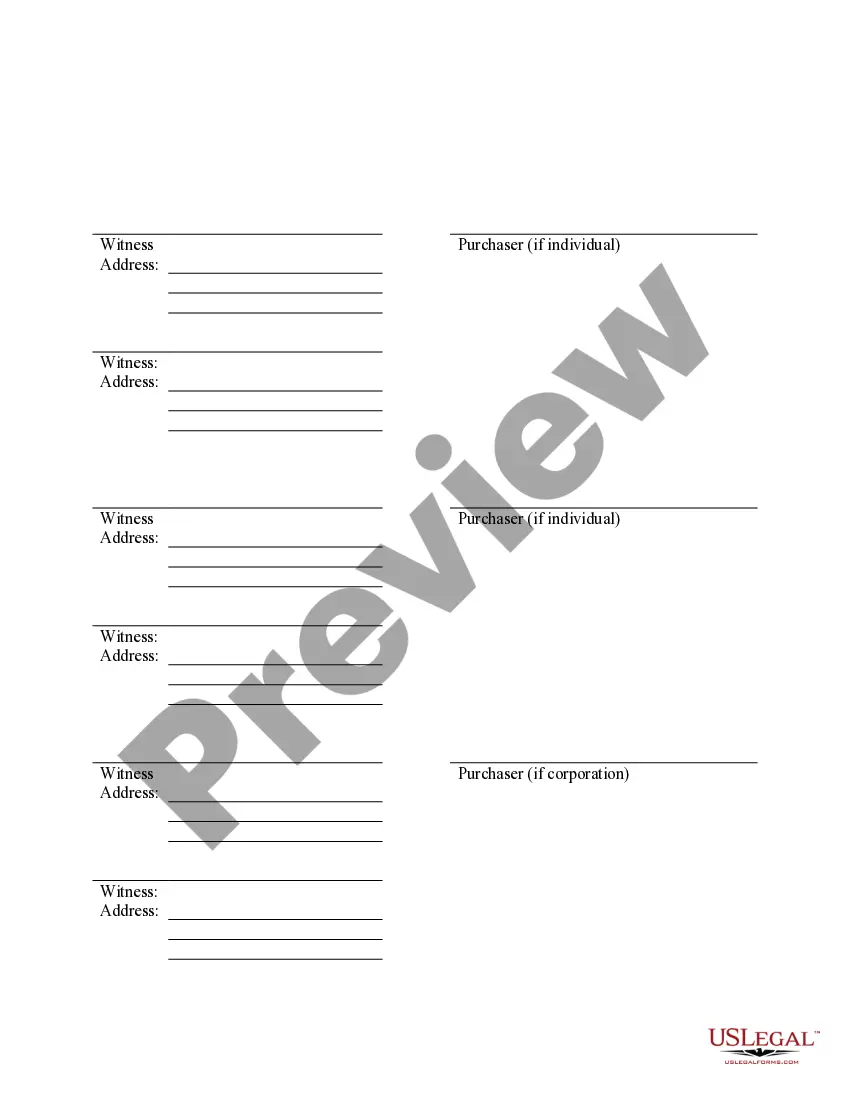

To obtain a copy of the deed to your house in North Carolina, you can visit the local county register of deeds office where the property is located. Alternatively, you can access online databases that may provide copies of recorded documents. Remember to have your property details ready, such as the address and the owner's name. If you are dealing with a Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, using platforms like uslegalforms can simplify the process and provide the necessary forms to facilitate your needs.

North Carolina primarily operates as a deed of trust state, meaning that real estate transactions often utilize trust deeds instead of traditional mortgages. This process allows for quicker foreclosure actions and can streamline the borrowing experience. Understanding this distinction is important for navigating the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors effectively.

The assumption of a trustee refers to the process where a new party takes over the responsibilities of a trustee managing a trust deed. This can happen during the transfer or sale of property, particularly in North Carolina, with the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors playing a crucial role. It ensures that the new trustee understands and is willing to fulfill the obligations associated with the trust.

A deed of assumption is a legal document that allows a buyer to take over a seller's mortgage obligation on a property. This type of deed is particularly relevant in the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, as it enables the new buyer to step into the mortgage with the same terms. Understanding this concept can simplify the transfer of property and avoid complications.

In North Carolina, while it is not legally required for an attorney to prepare a deed, it is highly recommended. An experienced attorney can ensure the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors complies with state laws and protects your interests. This legal preparation can prevent potential disputes or issues in the future.

To release a deed of trust, you typically need to complete a release document that states the terms of release and then file it with the county clerk or recorder’s office. In the case of the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors, ensure compliance with local laws and regulations. Utilizing a trusted platform like US Legal Forms can simplify this process.

If there is no release clause, the original mortgagors may remain liable for the mortgage, even after the assumption by another party. This situation could lead to complications if the new borrower defaults. Including a release clause in the Cary North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors is essential to protect original mortgagors from ongoing financial responsibility.