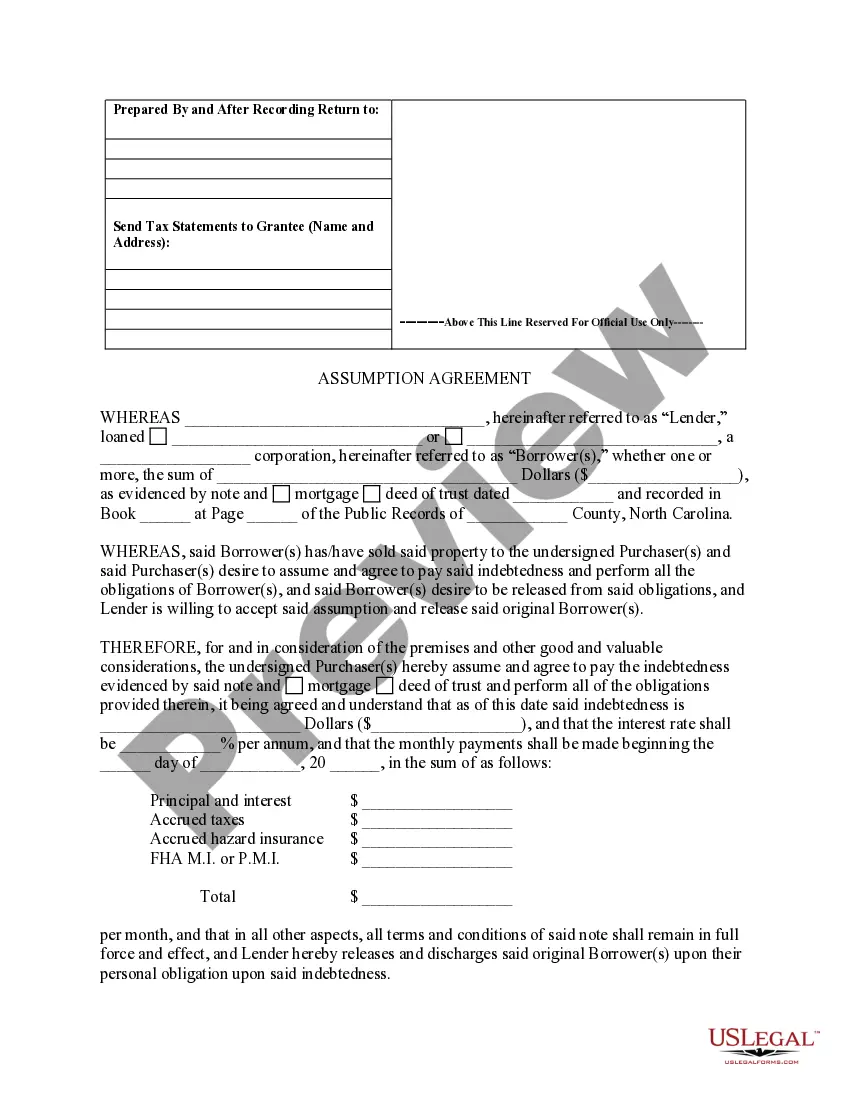

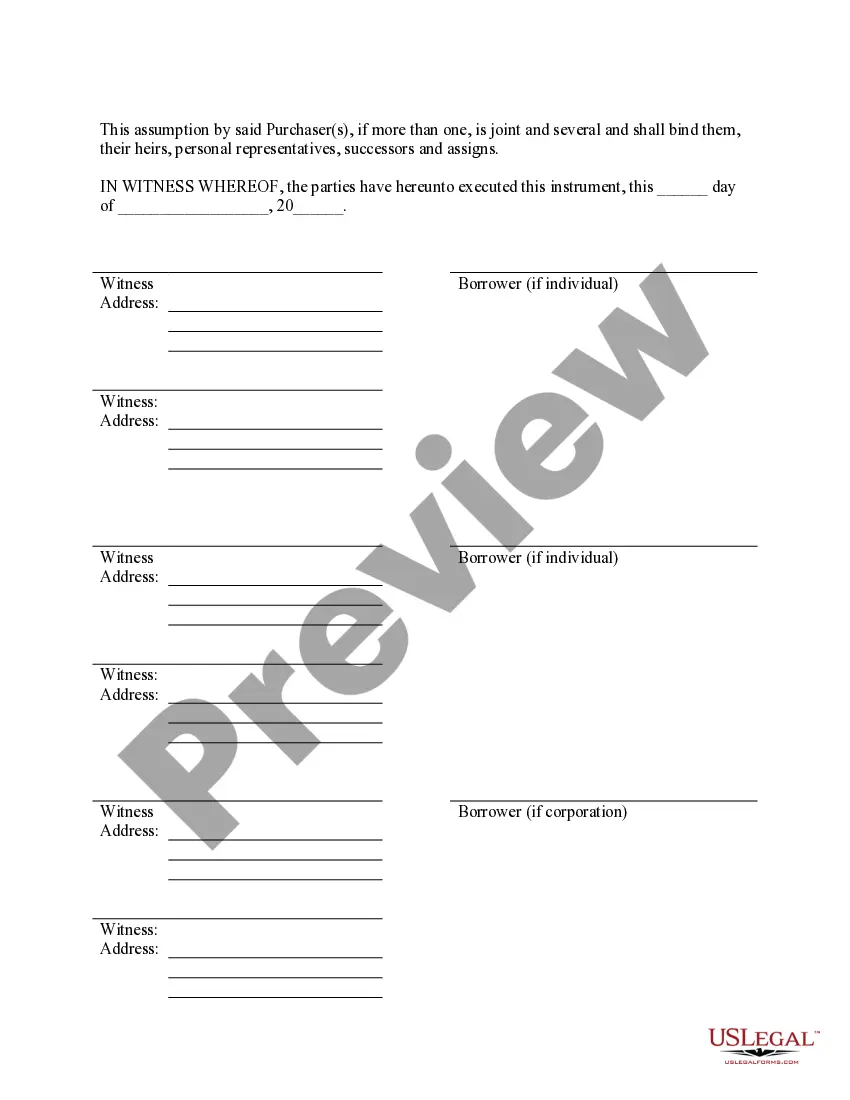

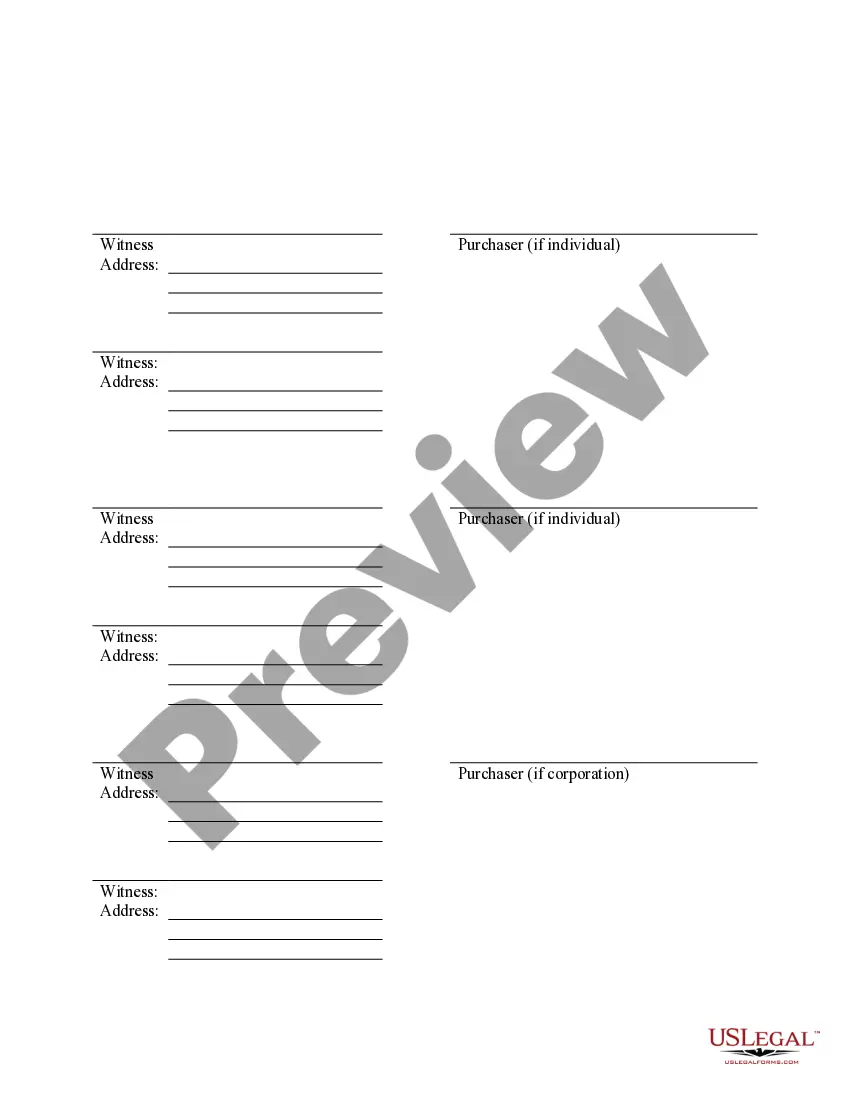

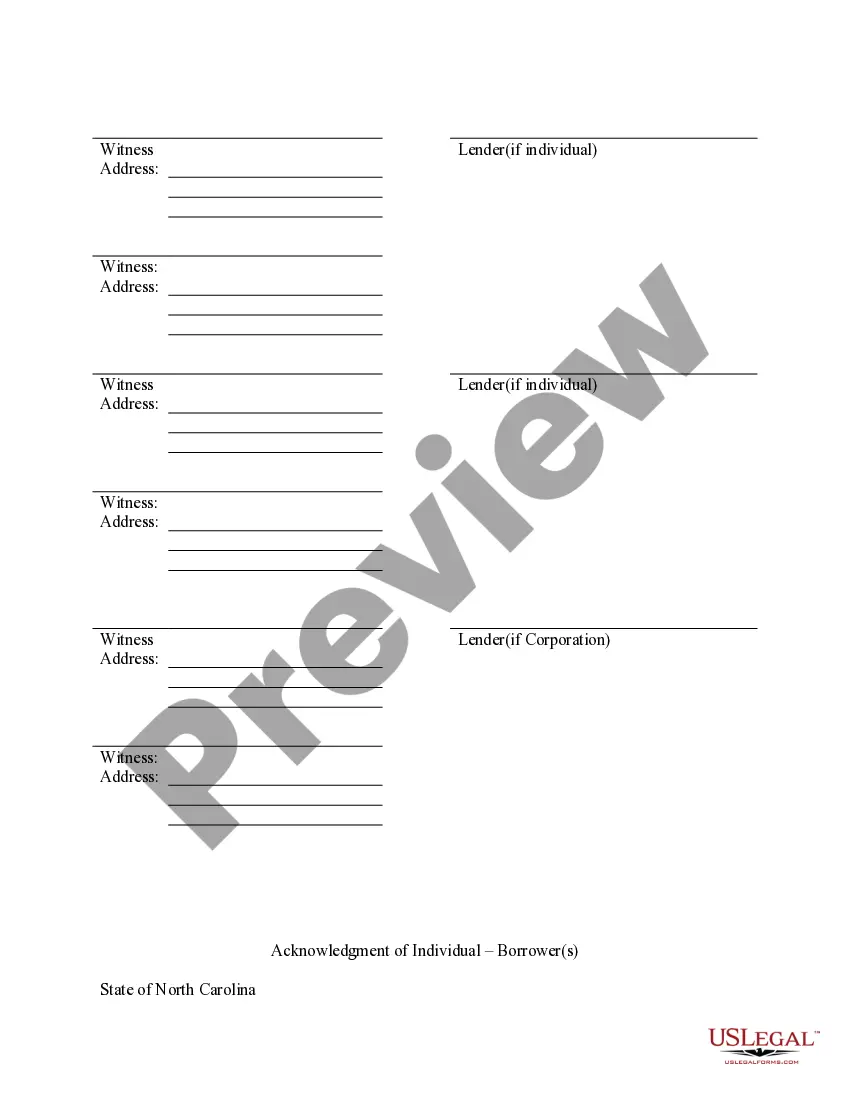

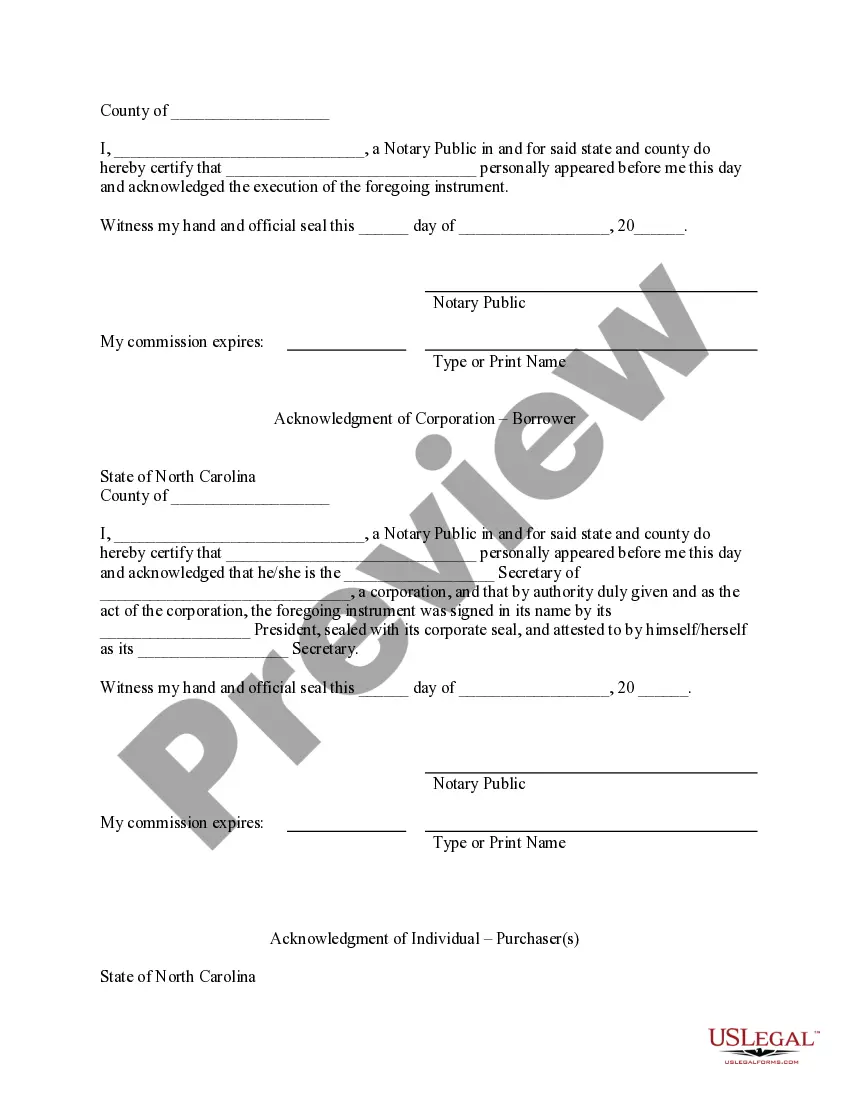

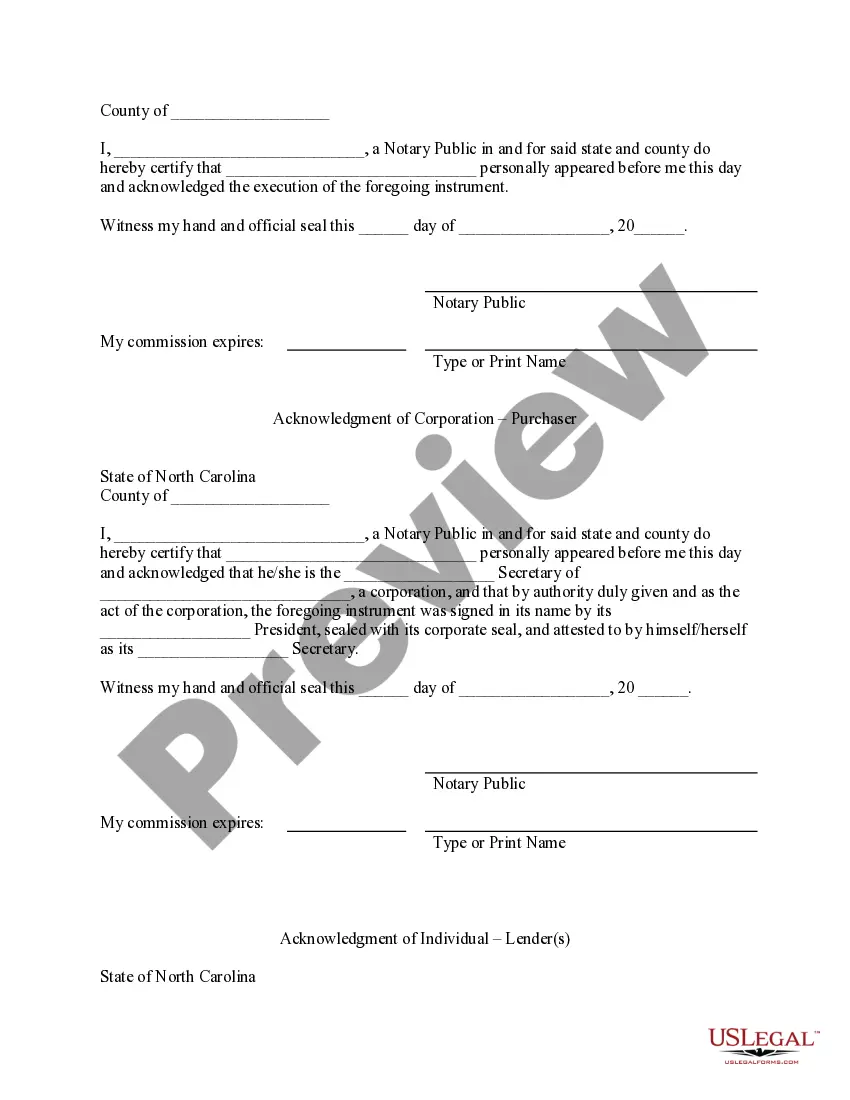

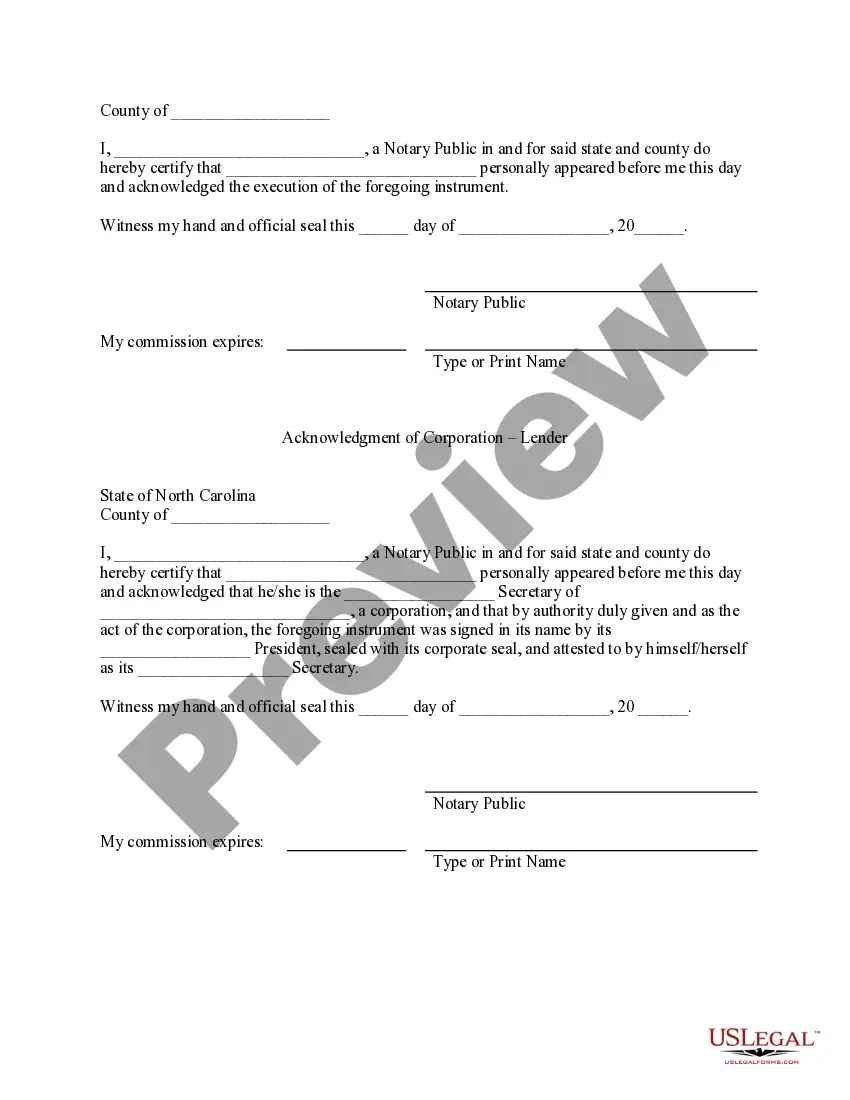

A High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the terms and conditions under which a new borrower assumes an existing mortgage loan, taking over the responsibilities and obligations of the original mortgagors. This agreement serves as a formal agreement between the new borrower (known as the assumption) and the original mortgagors, as well as the lender. In High Point, North Carolina, there are several types of Assumption Agreement of Deed of Trust and Release of Original Mortgagors that can be entered into, depending on the circumstances and parties involved. One such type is the "Simple Assumption Agreement," which is a straightforward agreement where the new borrower simply assumes the existing mortgage loan without any additional terms or conditions. Another type is the "Subject to" Assumption Agreement, which is commonly used when the original mortgagor wants to be released from liability for the mortgage debt, but the lender is not willing to release them. In this scenario, the original mortgagors transfer the property's ownership and mortgage liability to the new borrower while retaining a contingent liability for any potential default by the new borrower. Additionally, the "Novation Assumption Agreement" is another variant that can be executed when the lender agrees to release the original mortgagors from all liability and substitutes the new borrower as the sole obligated party. This type of agreement requires the lender's consent and involves the cancellation of the original mortgage and the creation of a new mortgage deed with the new borrower. The High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors typically includes vital information such as the names and contact information of all parties involved, the property's legal description, the loan amount, interest rate, and remaining term of the mortgage, as well as the terms of assumption, release, and any additional provisions or conditions agreed upon. This agreement also specifies the rights and responsibilities of the new borrower, including the obligation to make timely mortgage payments, maintain homeowner's insurance, pay property taxes, and any other terms specified by the lender. It is essential for both the new borrower and original mortgagors to carefully review and understand all the terms and conditions before signing the Assumption Agreement. In conclusion, a High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an important legal document that allows for the transfer of an existing mortgage loan to a new borrower. The different types of agreements include Simple Assumption, Subject to Assumption, and Novation Assumption. Each type has its own unique characteristics and requirements, serving different purposes based on the circumstances of the parties involved. It is crucial for all parties to seek legal advice and thoroughly understand the terms and conditions outlined in the agreement before entering into it.

High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out High Point North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Take advantage of the US Legal Forms and obtain immediate access to any form you require. Our useful platform with a large number of document templates allows you to find and obtain virtually any document sample you will need. It is possible to export, complete, and certify the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors in just a couple of minutes instead of browsing the web for several hours trying to find a proper template.

Using our collection is a superb way to improve the safety of your document filing. Our experienced lawyers on a regular basis review all the records to make sure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Moreover, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Open the page with the form you need. Make sure that it is the form you were looking for: check its title and description, and use the Preview option when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the document. Choose the format to obtain the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable document libraries on the web. Our company is always happy to assist you in any legal case, even if it is just downloading the High Point North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Feel free to benefit from our service and make your document experience as convenient as possible!