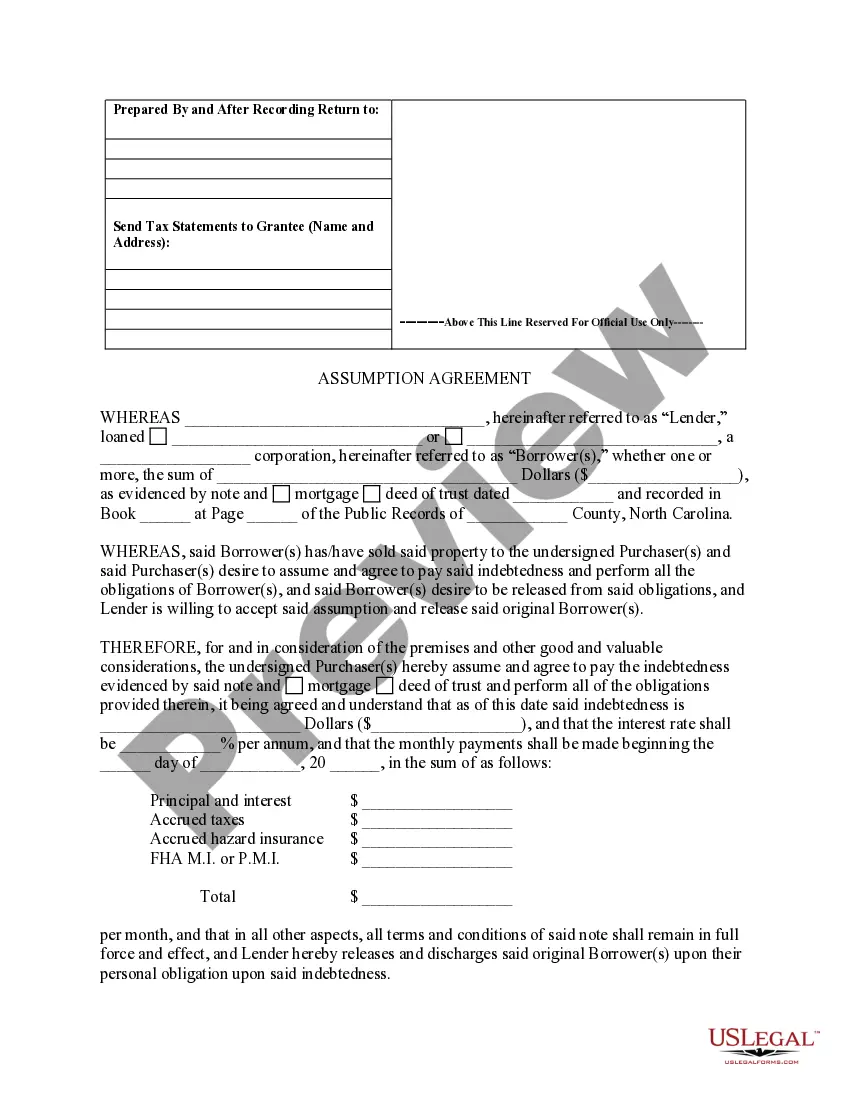

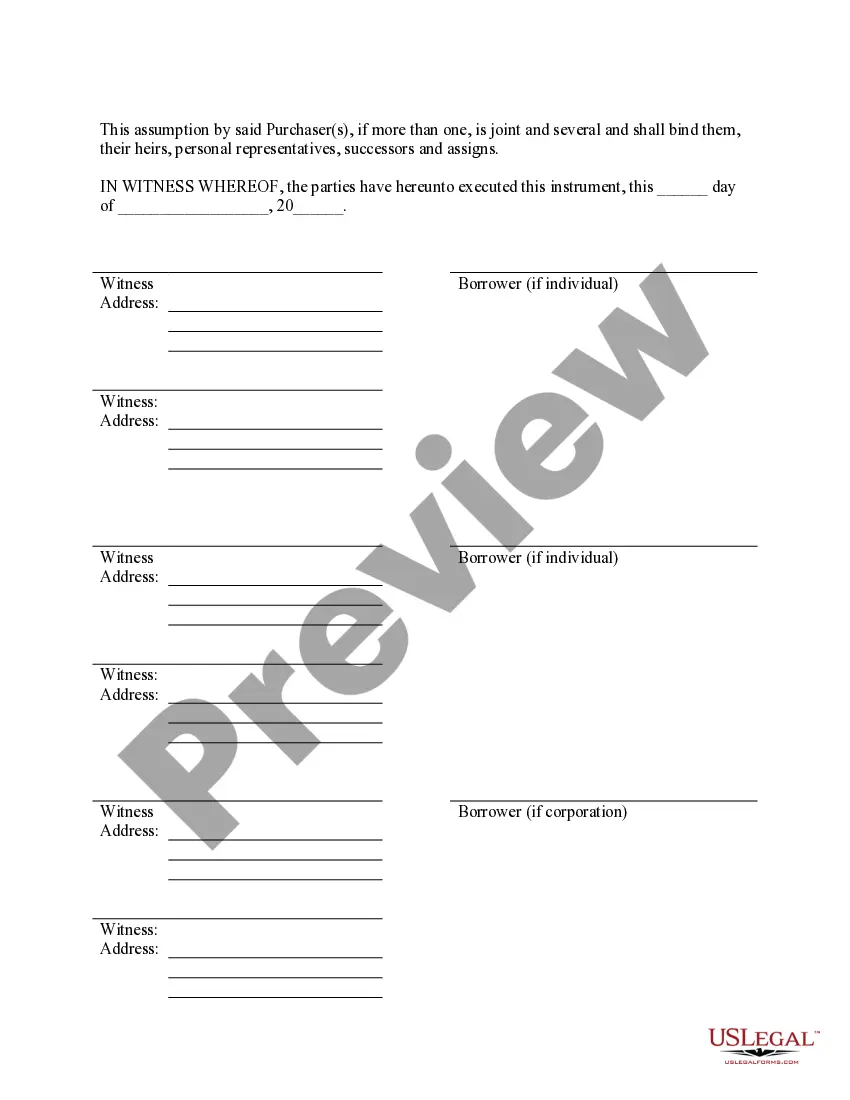

Mecklenburg County, located in the state of North Carolina, has its own unique regulations and legal agreements when it comes to real estate transactions, particularly in the context of mortgage assumptions. One such agreement is the Mecklenburg North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors. This legally binding document outlines the terms and conditions under which a new borrower can assume an existing mortgage and release the original mortgagors from their obligations. In Mecklenburg County, there are several types of Assumption Agreements of Deed of Trust and Release of Original Mortgagors that can be implemented, depending on specific circumstances. These include: 1. Standard Assumption Agreement: This is the most common type of assumption agreement in Mecklenburg County. It typically involves a new borrower assuming the responsibilities of the original mortgagors, taking over the mortgage payments, and becoming the legal owner of the property. The release of the original mortgagors is contingent upon the successful completion of the assumption process and meeting all the associated criteria. 2. Simple Assumption Agreement: Under this type of agreement, the new borrower assumes the mortgage without modifying the existing terms and conditions of the original loan. The original mortgagors are released from their obligations once the assumption is complete, and the new borrower takes full responsibility for the mortgage payments. 3. FHA or VA Assumption Agreement: This agreement comes into play when the original mortgage was insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA). In these cases, the new borrower must undergo an additional qualification process specific to FHA or VA loans, while adhering to Mecklenburg County's regulations. 4. Subject-to Assumption Agreement: This type of assumption agreement allows the new borrower to take over the mortgage without formally assuming liability for the loan. Instead, the new borrower acquires the property "subject to" the original mortgage. The original mortgagors are not released from their obligations under this agreement, and any default by the new borrower could still affect their creditworthiness. The Mecklenburg North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a critical legal document that supports smooth transitions in real estate ownership. It is essential for all parties involved to carefully review and understand the terms and conditions outlined in the agreement before proceeding. Hiring a knowledgeable real estate attorney or qualified professional can provide guidance and ensure compliance with Mecklenburg County's specific requirements throughout the assumption process.

Mecklenburg North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Mecklenburg North Carolina Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Do you need a reliable and affordable legal forms supplier to get the Mecklenburg North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Mecklenburg North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Start the search over in case the template isn’t good for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Mecklenburg North Carolina Assumption Agreement of Deed of Trust and Release of Original Mortgagors in any provided format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal papers online once and for all.