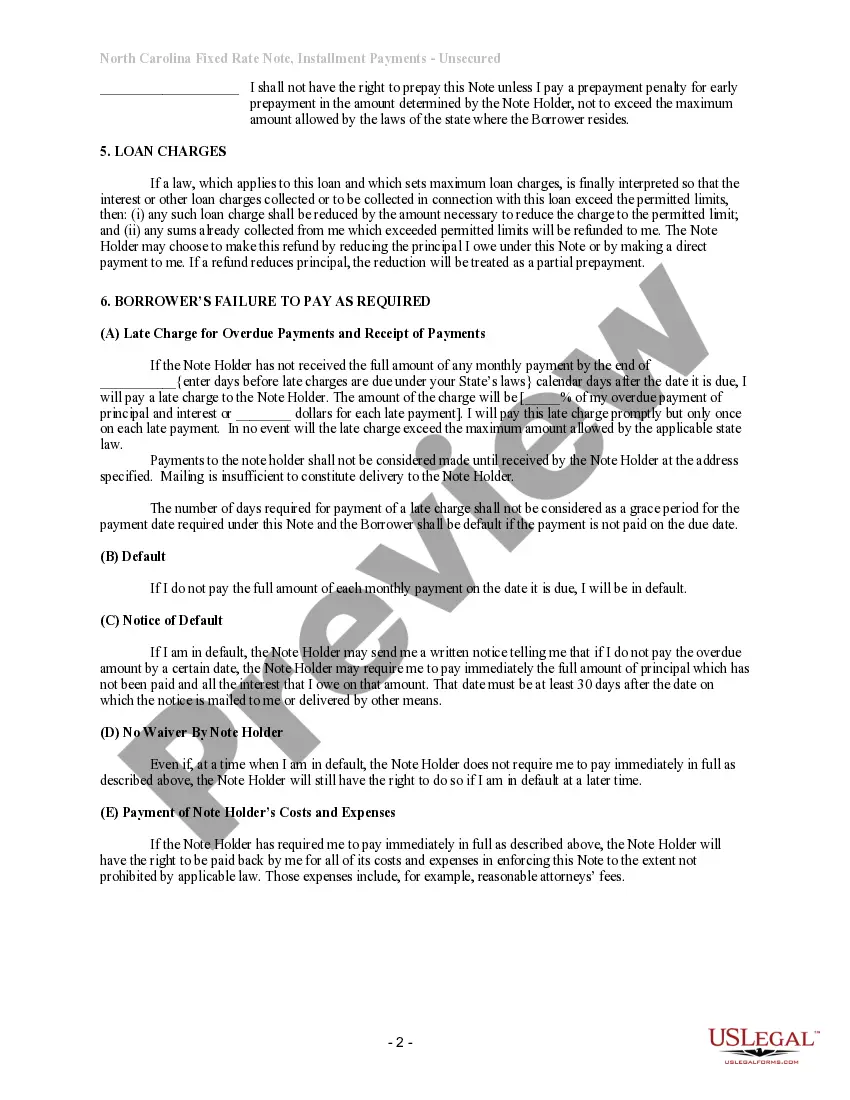

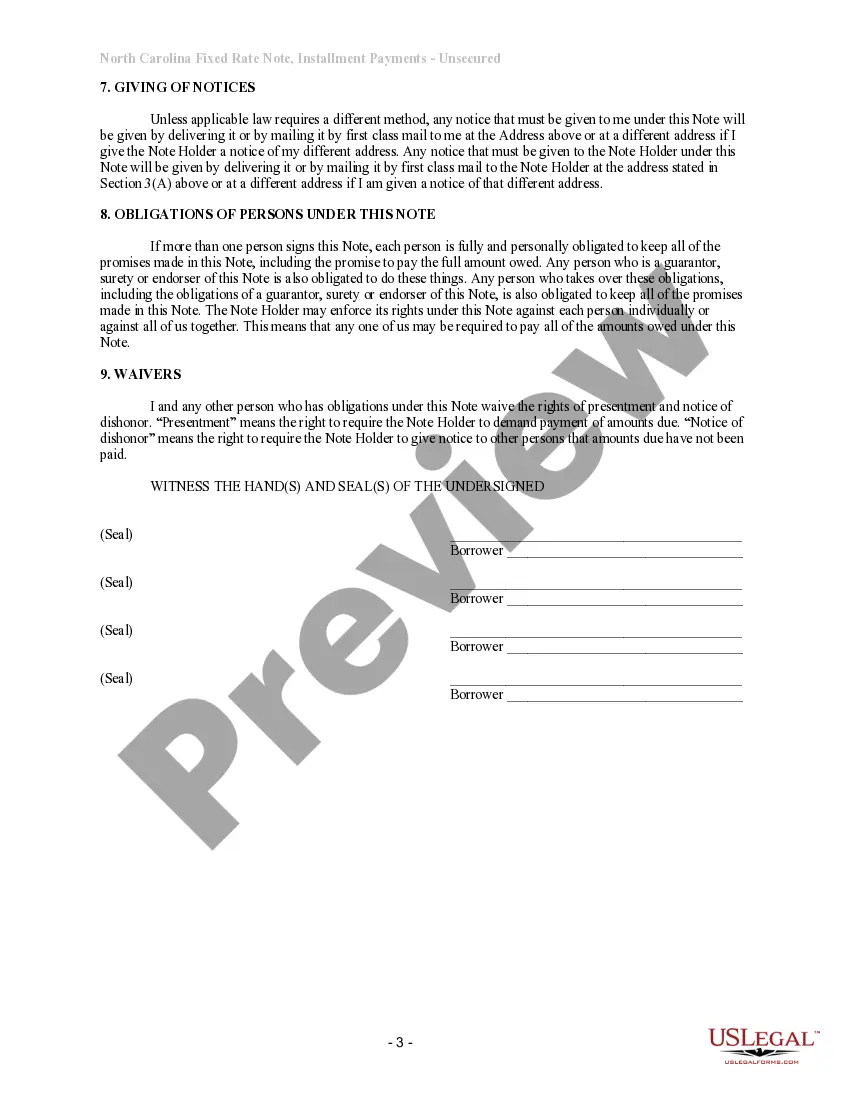

Title: Understanding the Raleigh, North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate Keywords: Raleigh, North Carolina, unsecured installment payment promissory note, fixed rate Introduction: The Raleigh, North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This note serves as evidence of the borrower's promise to repay a specific amount, borrowed for a particular purpose, in fixed installments within a specified time frame. Below, we'll delve into the details of this promissory note, highlighting its features and types. Features of Raleigh, North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate: 1. Unsecured Loan: The Raleigh, North Carolina Unsecured Installment Payment Promissory Note does not require any collateral, making it a widely used option for borrowers who may not possess valuable assets to secure the loan. Unlike secured loans, this note relies solely on the trustworthiness and creditworthiness of the borrower. 2. Installment Payments: The promissory note is structured to include predetermined fixed installment payments. These regular payments ensure that the borrowed amount, along with interest, is repaid over the agreed-upon loan term. Typically, the payment schedule is monthly but can be adjusted as per mutual agreement. 3. Fixed Interest Rate: The promissory note stipulates a fixed interest rate, meaning that the interest rate remains constant throughout the loan term. Borrowers can budget accurately as they know the exact interest amount they will pay each month. 4. Loan Amount and Term: The promissory note must specify the principal loan amount granted by the lender. Additionally, the note outlines the agreed-upon term, which includes the duration for repayment and the number of installments. Types of Raleigh, North Carolina Unsecured Installment Payment Promissory Notes for Fixed Rate: 1. Personal Loan Promissory Note: This type of promissory note is commonly used by individuals borrowing money from family or friends for personal purposes, such as debt consolidation, medical expenses, or home improvement. 2. Business Loan Promissory Note: This promissory note is relevant for entrepreneurs and business owners seeking financial support for business-related expenses, including inventory, equipment purchases, or operational costs. 3. Student Loan Promissory Note: This type of promissory note is specific to education-related expenses undertaken by students or their guardians. It outlines the terms of repayment for student loans used to cover tuition, accommodation, textbooks, and other educational costs. Conclusion: The Raleigh, North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate serves as a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. With various types tailored for personal, business, and educational purposes, this promissory note enables individuals and businesses to secure loans while providing clarity and protection to both parties involved.

Raleigh North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Raleigh North Carolina Unsecured Installment Payment Promissory Note For Fixed Rate?

If you have previously utilized our service, sign in to your profile and retrieve the Raleigh North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to easily discover and store any template for your personal or business requirements!

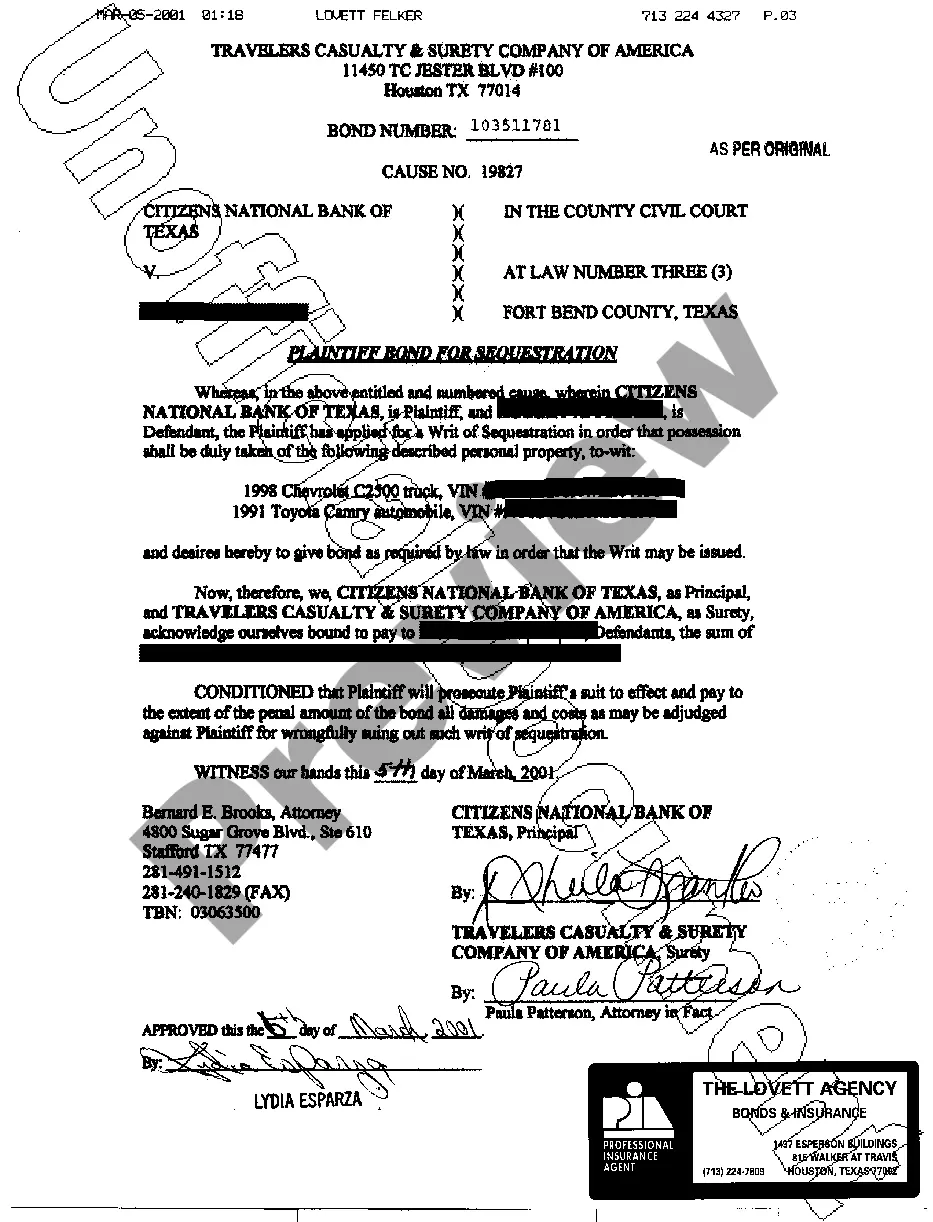

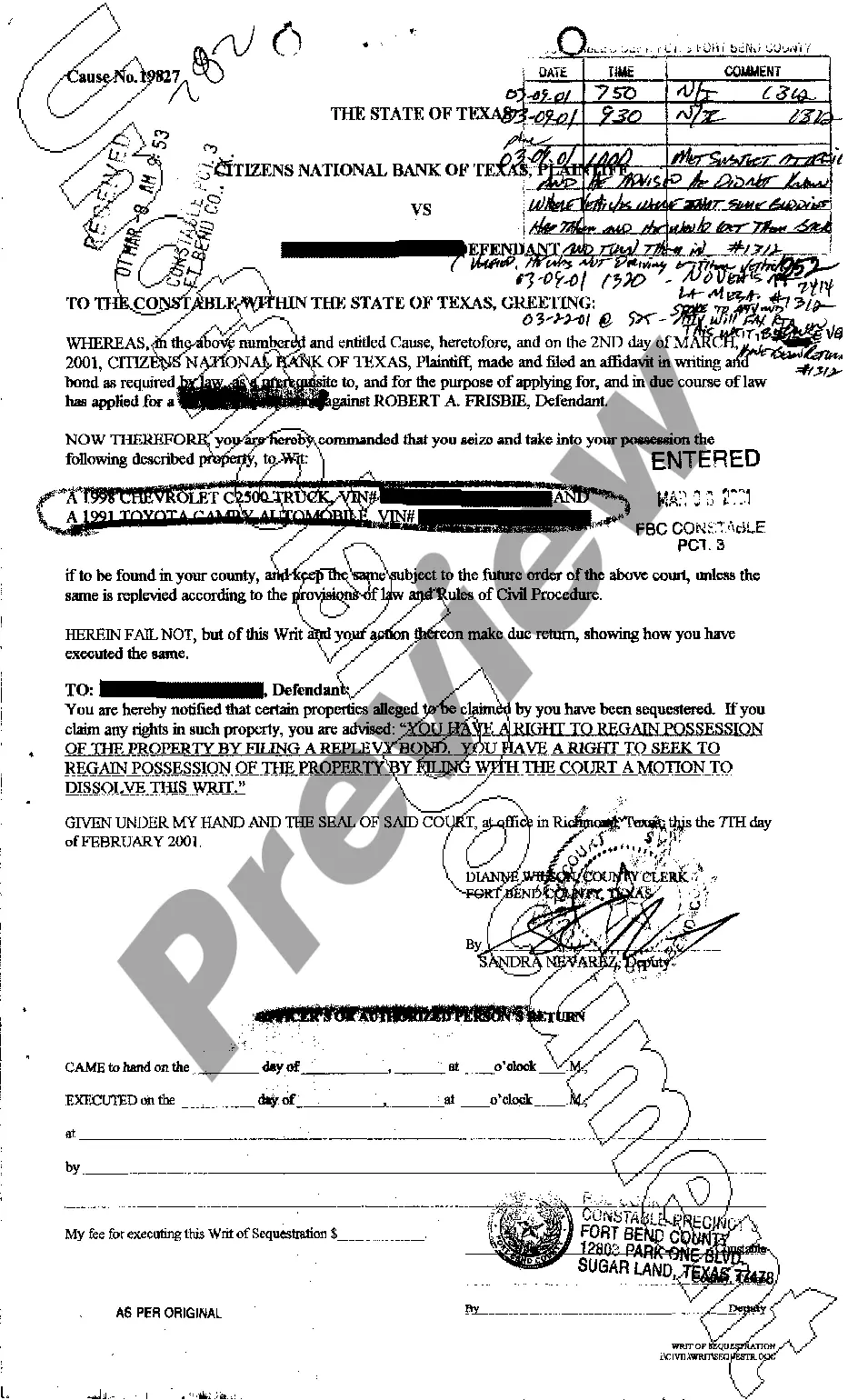

- Ensure you’ve located the correct document. Browse through the description and utilize the Preview option, if available, to verify if it suits your requirements. If it’s not suitable, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Raleigh North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize online professional editors to fill it out and sign it electronically.

Form popularity

FAQ

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Anyone lending money can issue a promissory note (like home sellers, credit unions, FinTech solutions, and nonmortgage-related banks, for instance) but specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

If you are borrowing money from a lending institution, they will have someone on staff who creates a promissory note. However, if you need a promissory note for a personal loan or a loan between friends and family, you can contact a lawyer or financial professional to help you create a promissory note.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

There is no legal requirement for most promissory notes to be witnessed or notarized in North Carolina.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.