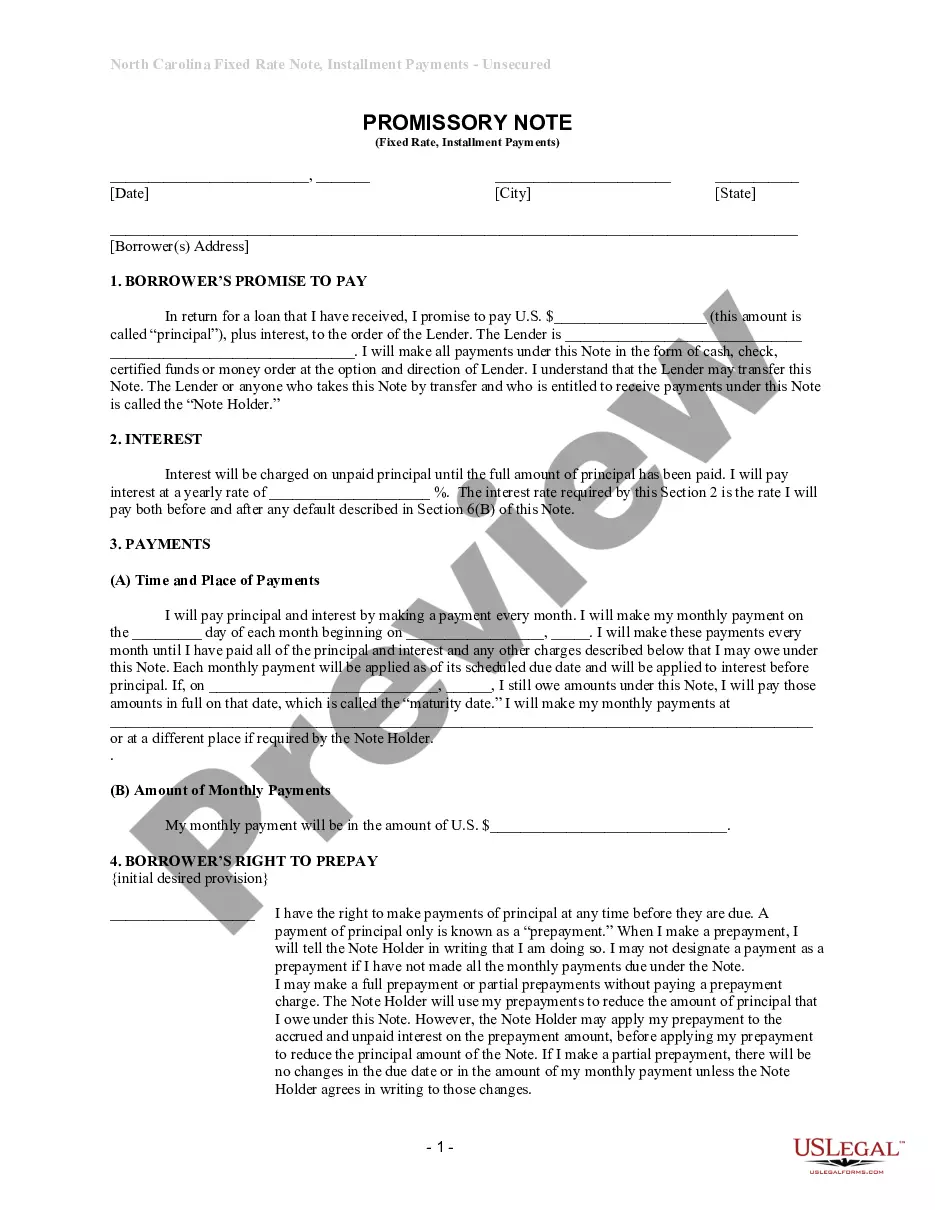

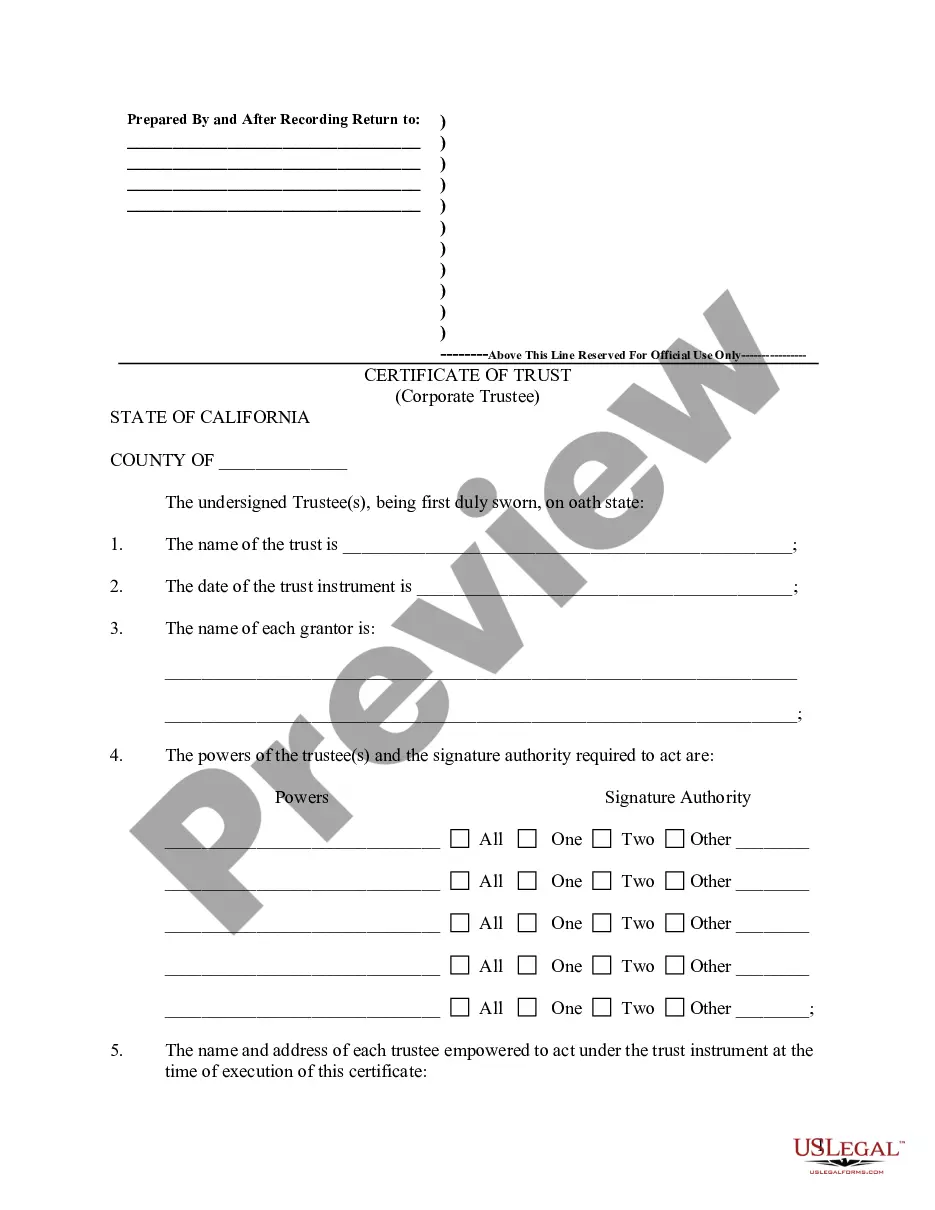

A Wake, North Carolina unsecured installment payment promissory note for a fixed rate is a legal document that outlines the terms and conditions of a borrower's obligation to repay a loan in predetermined installments. This type of promissory note is widely used in Wake, North Carolina, to ensure clarity and security in financial transactions. Some relevant keywords that can be included in the description are: 1. Wake, North Carolina: This specifies the geographic location where the promissory note is applicable, emphasizing its jurisdiction under North Carolina law. 2. Unsecured: This term signifies that the promissory note does not require the borrower to provide collateral, such as property or assets, as security for the loan. 3. Installment payment: This refers to the agreed schedule of regular payments that the borrower will make to the lender until the loan is fully repaid. It highlights the structured nature of the repayment process. 4. Promissory note: This is a legally binding document that includes the borrower's promise to repay a debt, along with the specific terms, conditions, and rights associated with the loan. 5. Fixed rate: This denotes that the interest rate on the loan remains constant throughout the repayment term, ensuring predictability and stability for both parties involved. Different types of Wake, North Carolina Unsecured Installment Payment Promissory Notes for Fixed Rate may include variations based on specific loan requirements or purposes. For instance: 1. Personal loans: These promissory notes may be utilized for personal expenses, like medical bills, vacation financing, or debt consolidation. 2. Business loans: These promissory notes may cater to small business owners seeking funds for equipment purchase, inventory financing, or working capital. 3. Student loans: Educational institutions or private lenders may employ promissory notes to provide financial aid to students, enabling them to cover tuition fees, housing, or educational expenses. 4. Consolidation loans: These promissory notes are designed for consolidating multiple debts into a single loan, simplifying repayment and potentially reducing interest rates. By tailoring the promissory note to meet specific loan requirements or purposes, borrowers and lenders can establish a clear understanding of their financial commitments, ensuring legal compliance and minimizing potential disputes.

Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out North Carolina Unsecured Installment Payment Promissory Note For Fixed Rate?

Utilize the US Legal Forms and gain immediate access to any form you require.

Our helpful website containing thousands of templates simplifies the process of locating and obtaining nearly any document sample necessary.

You can swiftly download, fill out, and sign the Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate in just minutes, rather than spending hours online searching for an appropriate template.

Leveraging our collection is a fantastic approach to enhance the security of your record keeping.

If you do not have an account yet, adhere to the following instructions.

Locate the form you require. Ensure it is the template you were looking for: confirm its title and description, and utilize the Preview option when available. Alternatively, use the Search bar to find the correct one.

- Our experienced attorneys frequently review all files to ensure that the templates are applicable to a specific region and adhere to new regulations and policies.

- How can you obtain the Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate.

- If you have an existing subscription, simply Log In to your account.

- The Download feature will be activated for all the documents you access.

- Furthermore, you can locate all your previously saved documents in the My documents menu.

Form popularity

FAQ

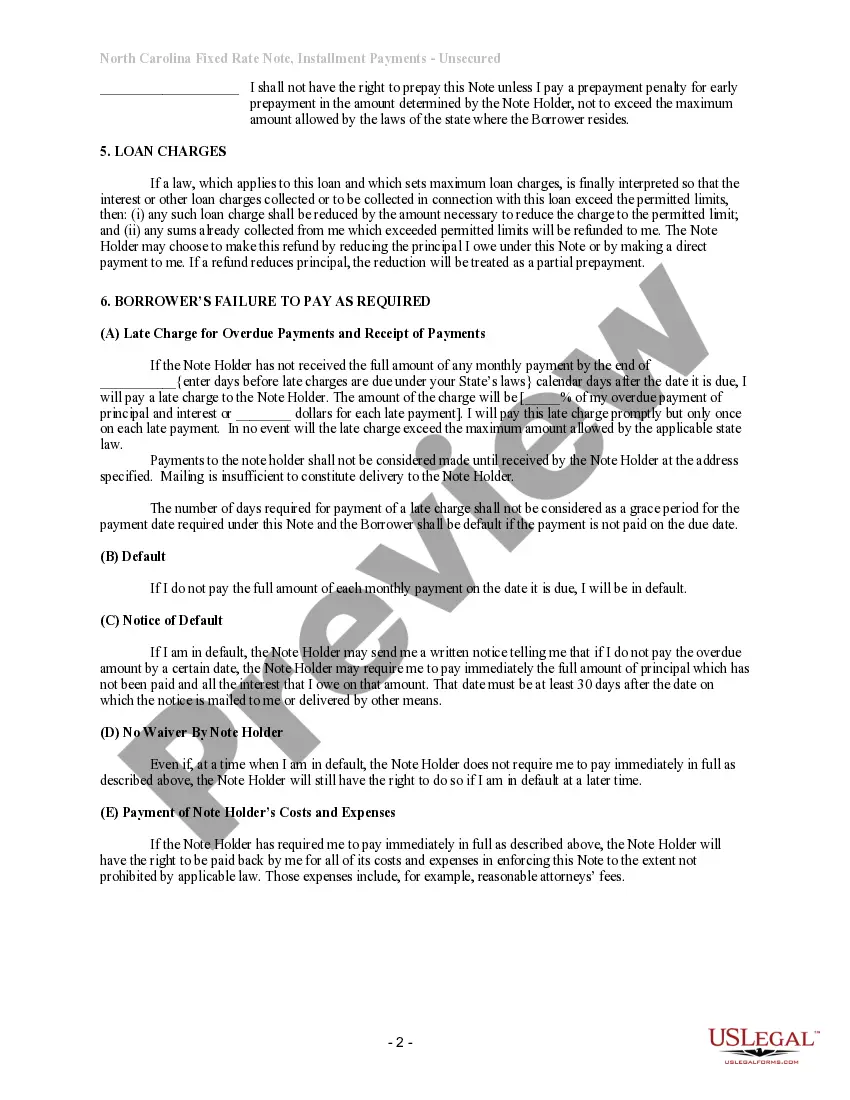

Generally, a promissory note is enforceable in court, provided that it meets legal requirements. If disputes arise, the terms within your Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate can be used as key evidence. To ensure your promissory note is solid and enforceable, consider drafting it through a trusted platform like uslegalforms that specializes in legal documents.

An installment promissory note is a type of agreement where the borrower repays the principal amount in regular installments over a set period. This structure often makes it easier for borrowers to manage their finances, as they know their monthly obligations. Using a Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate can provide a predictable payment schedule, which aids in budgeting.

An unsecured promissory note is a financial promise that is not backed by collateral. This means that if the borrower fails to repay, the lender cannot claim any specific property to recoup their losses. In the context of a Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, the absence of collateral may involve higher interest rates to compensate for the increased risk taken by the lender.

In North Carolina, a promissory note does not necessarily require notarization to be legally binding. However, having your Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate notarized can add an extra layer of validity and help prevent disputes in the future. It’s often a good practice to have it notarized, especially if you are dealing with significant sums.

Filing a promissory note usually involves creating a physical or electronic record. If you want to make it public, you might file it with your local county office, depending on state regulations. Using a platform like uslegalforms can simplify this process and help you utilize your Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate effectively.

A promissory note can be recorded in various places depending on state laws and personal preferences. You might choose to keep it in a secure digital format or in physical form in a safe place. If your Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate is significant, consider consulting a legal service for proper guidance on recording practices.

To record a promissory note payment, you should document the date, amount, and method of payment in your financial records. This ensures that you have an accurate account of the transactions associated with your Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate. A dedicated tracking system can simplify this process and help maintain transparency.

Reporting a promissory note on your taxes usually depends on whether you are the lender or the borrower. The lender must report interest income received, while the borrower may deduct interest if certain criteria are met. It is wise to consult a tax professional when dealing with your Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate to ensure compliance with tax laws.

A promissory note itself does not typically appear on your credit record unless it goes into default. If you fail to make the required payments, the lender may report this information to credit bureaus, which can impact your credit score. Understanding the implications of your Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate can help you manage your credit effectively.

To fill out a promissory demand note, start by clearly stating the borrower’s name and address. Next, include the lender’s information, the principal amount, and the interest rate. Then, specify the payment schedule and conditions for repayment. Using our platform, you can easily access a template specifically designed for a Wake North Carolina Unsecured Installment Payment Promissory Note for Fixed Rate, ensuring all necessary elements are included.