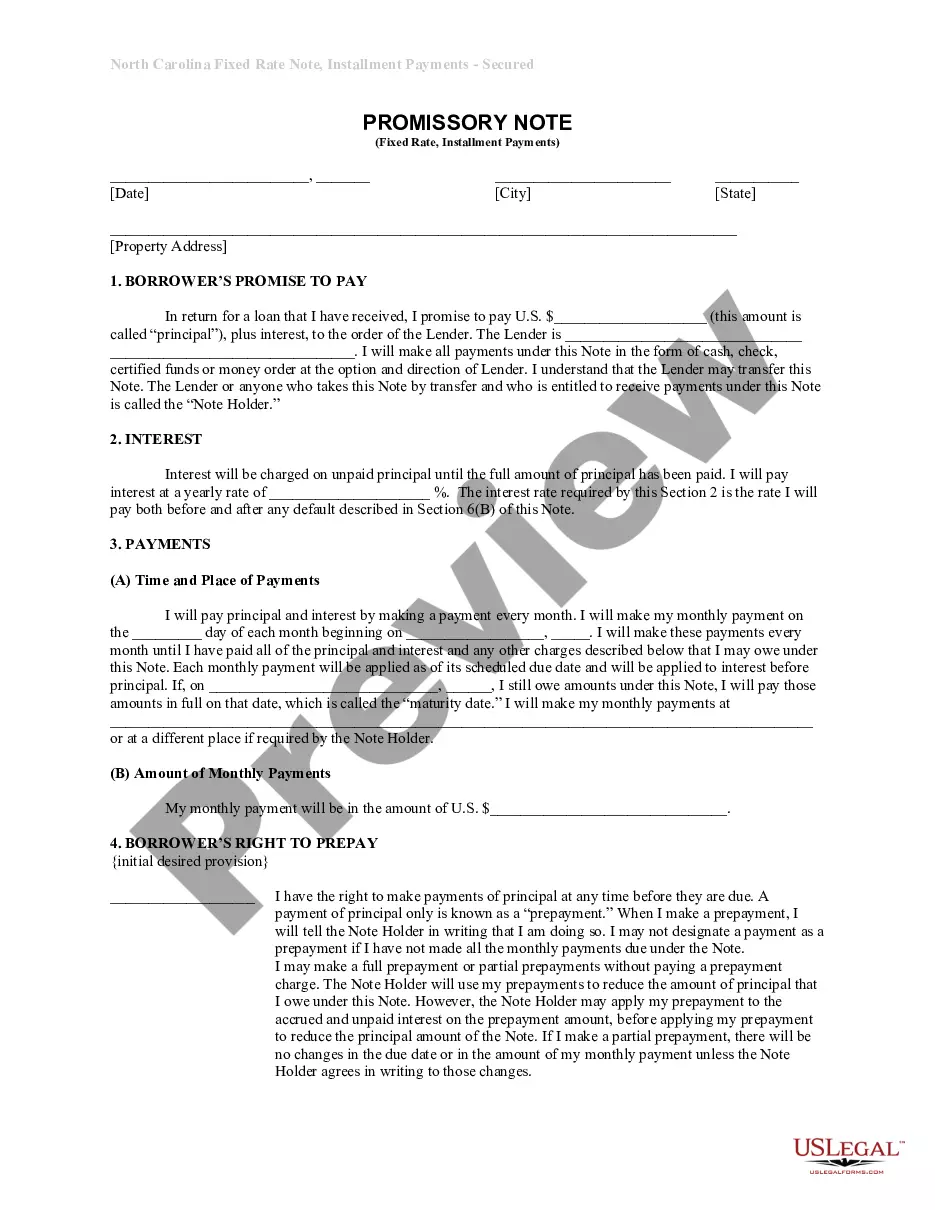

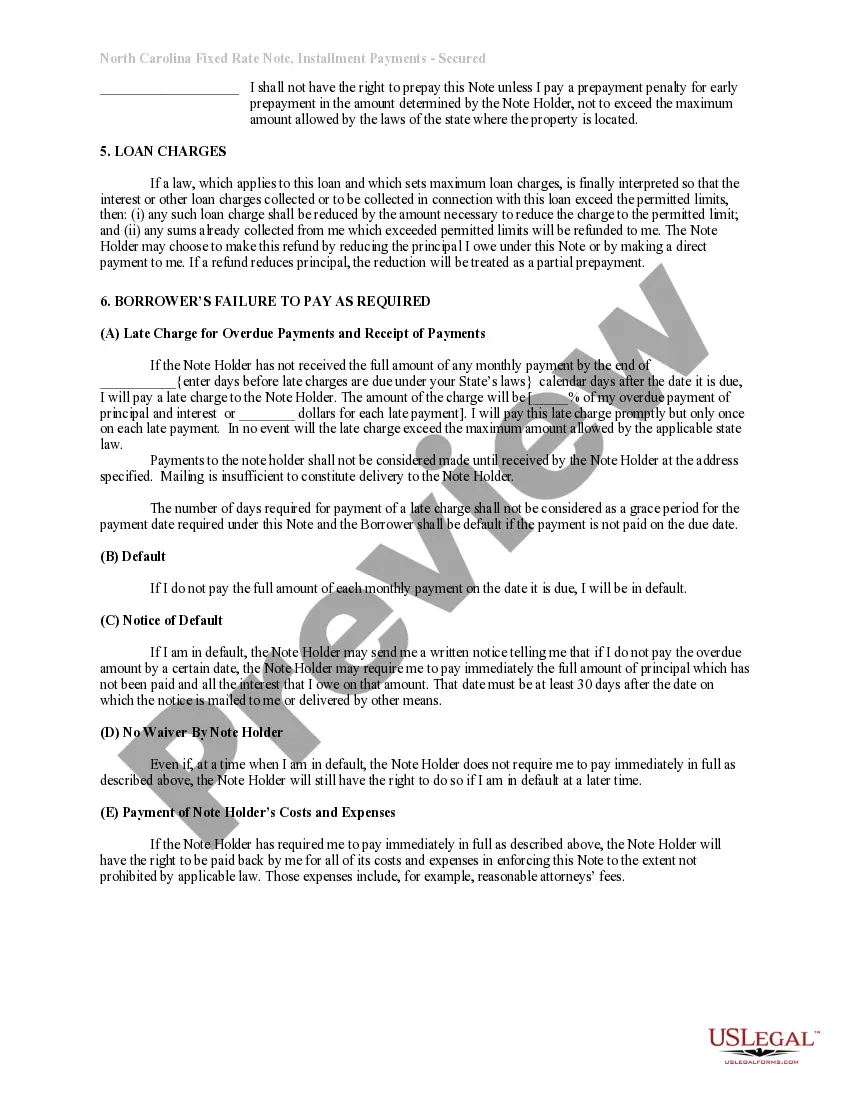

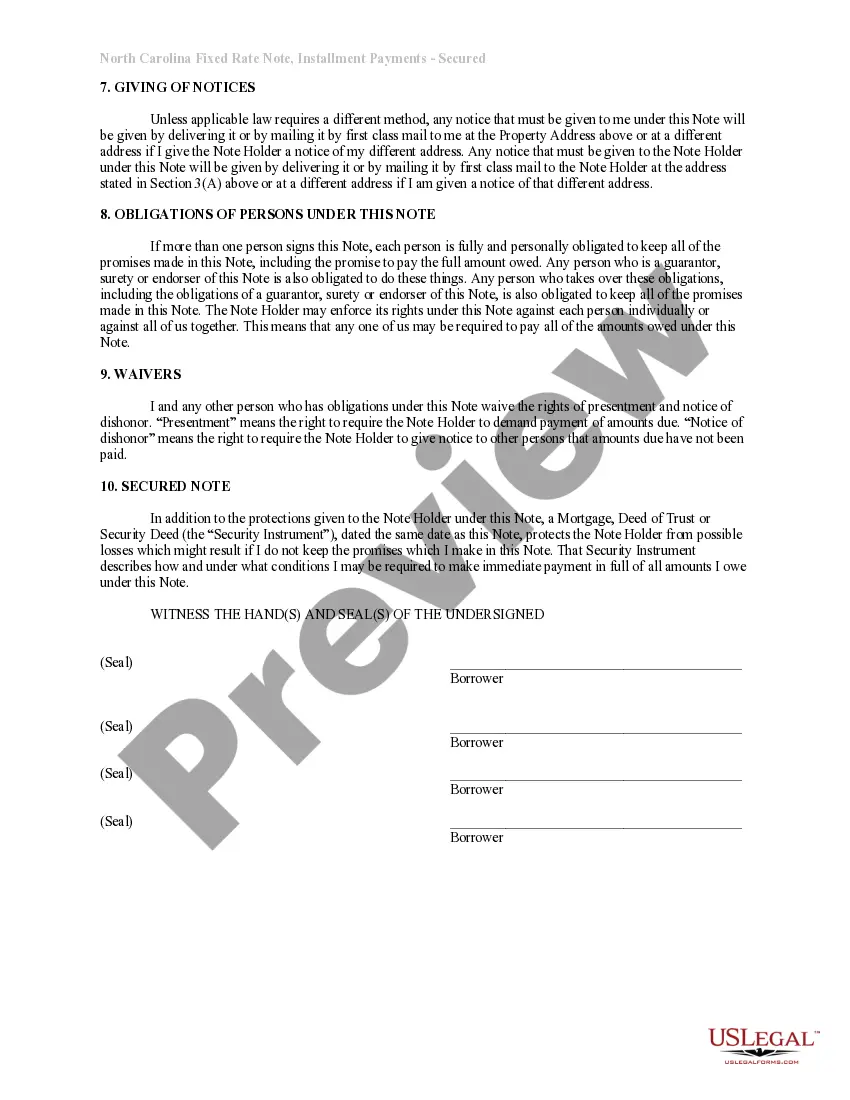

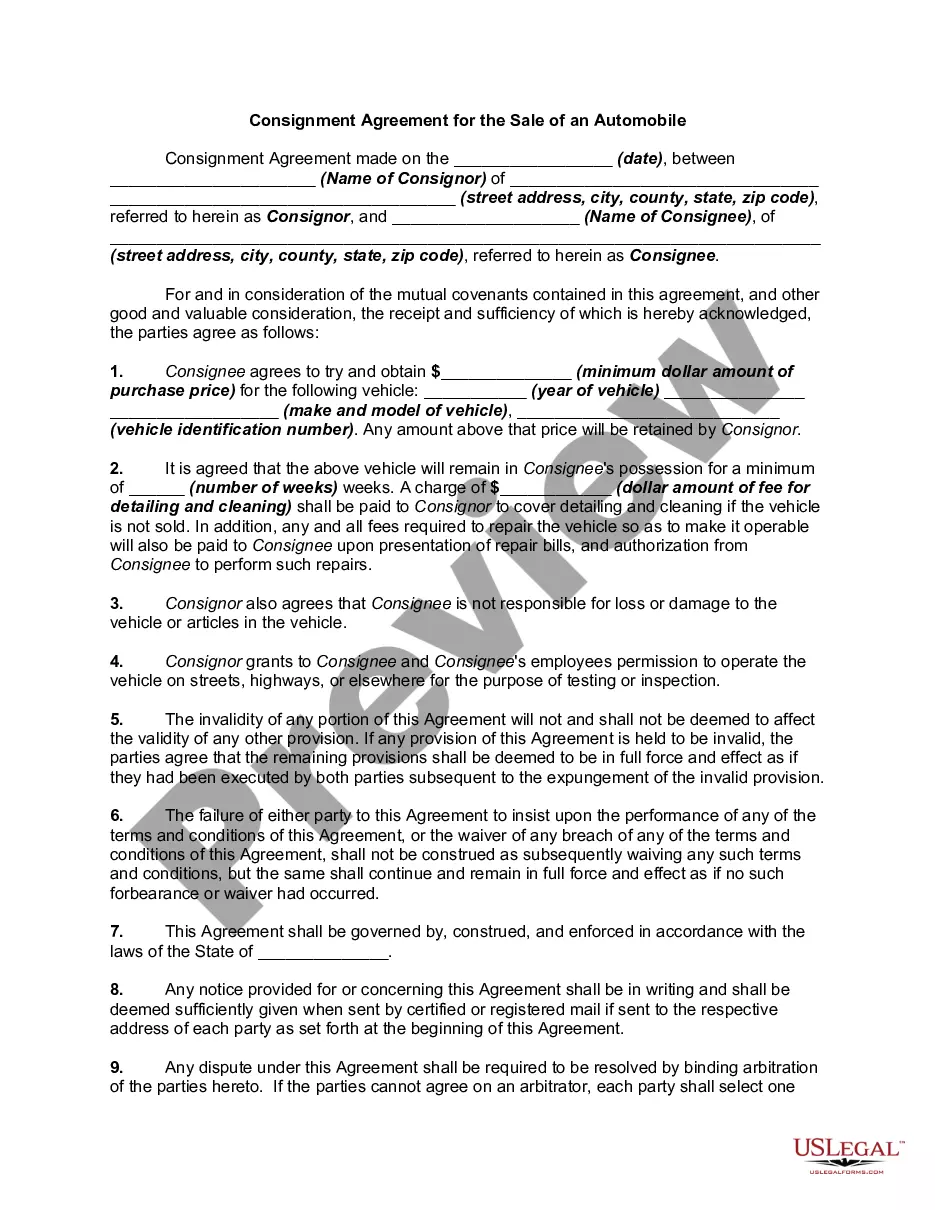

A Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Mecklenburg County, North Carolina. This type of promissory note is specifically secured by residential real estate, providing the lender with collateral in case of default. The Mecklenburg North Carolina Installments Fixed Rate Promissory Note ensures that both parties understand their obligations and protects their rights throughout the loan period. It is crucial for borrowers to carefully review and comprehend the terms before signing. Here are some key features and relevant keywords associated with the Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Loan Amount: The note specifies the principal amount borrowed by the borrower, which can vary based on individual circumstances and needs. 2. Interest Rate: The fixed interest rate is determined at the inception of the loan and remains consistent throughout the loan term. This provides stability and predictability for both the borrower and lender. 3. Installment Payments: The borrower is required to make regular installment payments, typically on a monthly basis, to repay the loan over a specified period. Failure to make timely payments can result in penalties or default. 4. Loan Duration: The note outlines the length of time the borrower has to repay the loan, known as the loan term. It can range from a few years to several decades. 5. Collateral: This type of promissory note is secured by residential real estate, which serves as collateral. In the event of default, the lender can proceed with foreclosure and sell the property to recoup the loan amount. 6. Late Payment Penalties: The note may include provisions for late payment penalties if the borrower fails to make their installment payments on time. This encourages timely payments and protects the lender's interests. 7. Prepayment Options: Some promissory notes offer borrowers the option to make early or additional payments towards the principal, reducing the overall interest paid and shortening the loan term. However, specific terms and limitations regarding prepayment may vary. 8. Acceleration Clause: This clause allows the lender to demand immediate payment of the entire outstanding loan balance if the borrower breaches the terms of the promissory note. 9. Loan Default: The note defines the conditions under which the borrower is considered in default. This can include non-payment, bankruptcy, or violation of other terms. Default can trigger foreclosure proceedings. 10. Governing Law: The note specifies that it is governed by the laws of Mecklenburg County, North Carolina, ensuring compliance with local regulations and statutes. Different variations or subtypes of Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate may exist, depending on specific loan variations or customization. However, the keywords mentioned above encompass the fundamental aspects of this type of promissory note.

Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney services that, usually, are very expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate is proper for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!