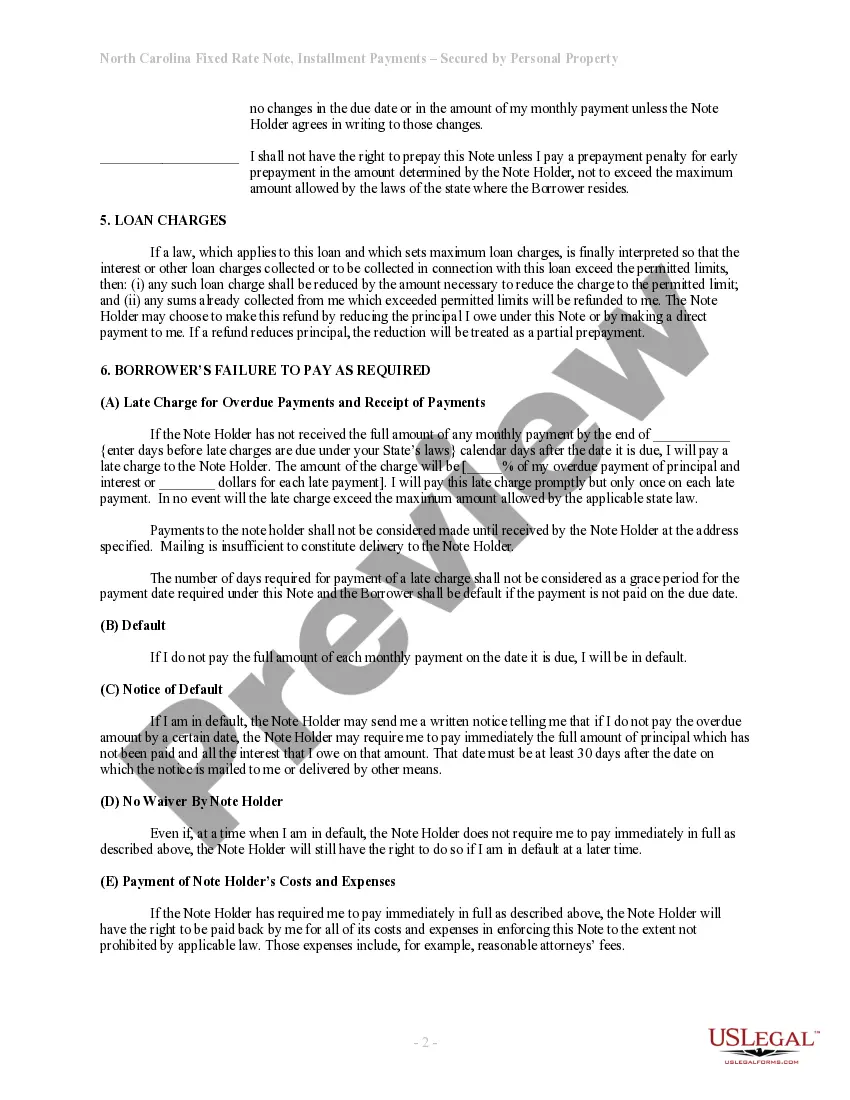

A Mecklenburg North Carolina Installment Fixed Rate Promissory Note Secured by Personal Property is a legally binding document that outlines the terms and conditions for a loan agreement. This type of promissory note is commonly used in Mecklenburg County, North Carolina, and is secured by personal property owned by the borrower. The purpose of this promissory note is to establish a clear agreement between a lender and borrower regarding the repayment of a loan over a specified period of time. It ensures that both parties are aware of their responsibilities and rights regarding the loan. The promissory note includes various important elements such as the loan amount, interest rate, repayment schedule, and the consequences of defaulting on the loan. The fixed rate feature means that the interest rate charged on the loan remains constant throughout the loan term. This provides stability and predictability for the borrower, as they know exactly how much interest they will be paying each month. The promissory note is secured by personal property owned by the borrower. This means that if the borrower fails to repay the loan, the lender has the right to take possession of the designated personal property and sell it to recover the outstanding balance. The personal property acts as collateral, providing security to the lender. Different types of Mecklenburg North Carolina Installment Fixed Rate Promissory Note Secured by Personal Property may include: 1. Auto Loan Promissory Note: This type of promissory note is specific to loans taken out to purchase a vehicle. The personal property being used as collateral is the vehicle itself. 2. Equipment Loan Promissory Note: This promissory note is used when a borrower wishes to secure a loan for the purchase of equipment or machinery. The personal property being used as collateral is the equipment. 3. Home Equity Loan Promissory Note: This type of promissory note is used when a borrower wants to borrow against the equity in their home. The personal property being used as collateral is the borrower's home. 4. Personal Property Loan Promissory Note: This promissory note is used for loans where personal property, such as jewelry, electronics, or other valuable assets, is being used as collateral. In summary, a Mecklenburg North Carolina Installment Fixed Rate Promissory Note Secured by Personal Property is a binding document that establishes the terms of a loan agreement between a lender and borrower. It provides stability through a fixed interest rate and security through the use of personal property as collateral. Different types of this promissory note may include auto loans, equipment loans, home equity loans, and personal property loans.

Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured By Personal Property?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal solutions that, usually, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

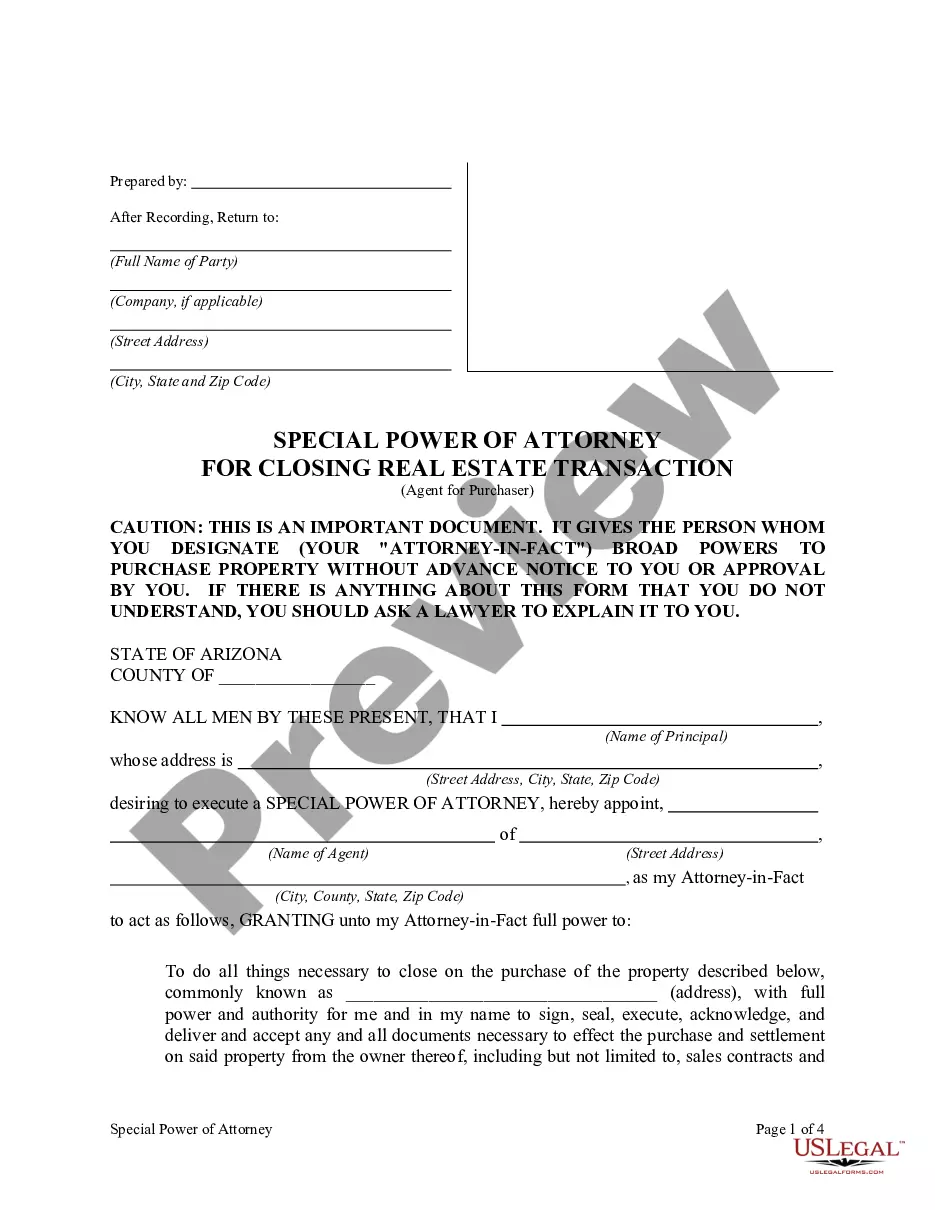

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Mecklenburg North Carolina Installments Fixed Rate Promissory Note Secured by Personal Property is proper for you, you can pick the subscription option and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!