A High Point North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document outlining the terms and conditions of a loan agreement in which the borrower promises to repay a specific amount of money to the lender over a set period of time, with interest at a fixed rate. In this case, the loan is secured by commercial real estate located in High Point, North Carolina. This type of promissory note provides a sense of security to the lender, as it allows them to seize the commercial property in the event of default, minimizing their risk. It also offers benefits to the borrower, as they can typically obtain more favorable loan terms and interest rates due to the collateralized nature of the loan. In High Point, North Carolina, there may be various types of Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate available. Some common variations include: 1. Commercial Mortgages: This type of promissory note is used specifically for financing commercial properties such as office buildings, retail spaces, or industrial warehouses in High Point. The property acts as collateral, making it easier for borrowers to secure financing for their business needs. 2. Construction Loans: These promissory notes are designed for real estate developers or individuals planning to construct a new commercial building or renovate an existing one in High Point. The loan typically has a fixed rate and is structured in installments, with funds released in stages throughout the construction process. 3. Bridge Loans: Bridge loans are short-term financing options that help bridge the gap between the purchase of a new commercial property and the sale of an existing one. They are ideal for businesses in High Point looking to secure a property before selling their current one, providing temporary financing until the sale is completed. 4. Small Business Administration (SBA) Loans: SBA loans are government-backed loan programs designed to support small businesses in High Point and provide affordable financing options. These loans can be utilized for various purposes, including acquiring or refinancing commercial real estate. When entering into a High Point North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is crucial for both parties to clearly understand the terms and obligations. It is recommended to consult with legal professionals experienced in real estate and lending matters to ensure compliance with all applicable laws and regulations.

High Point North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out High Point North Carolina Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the High Point North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the High Point North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

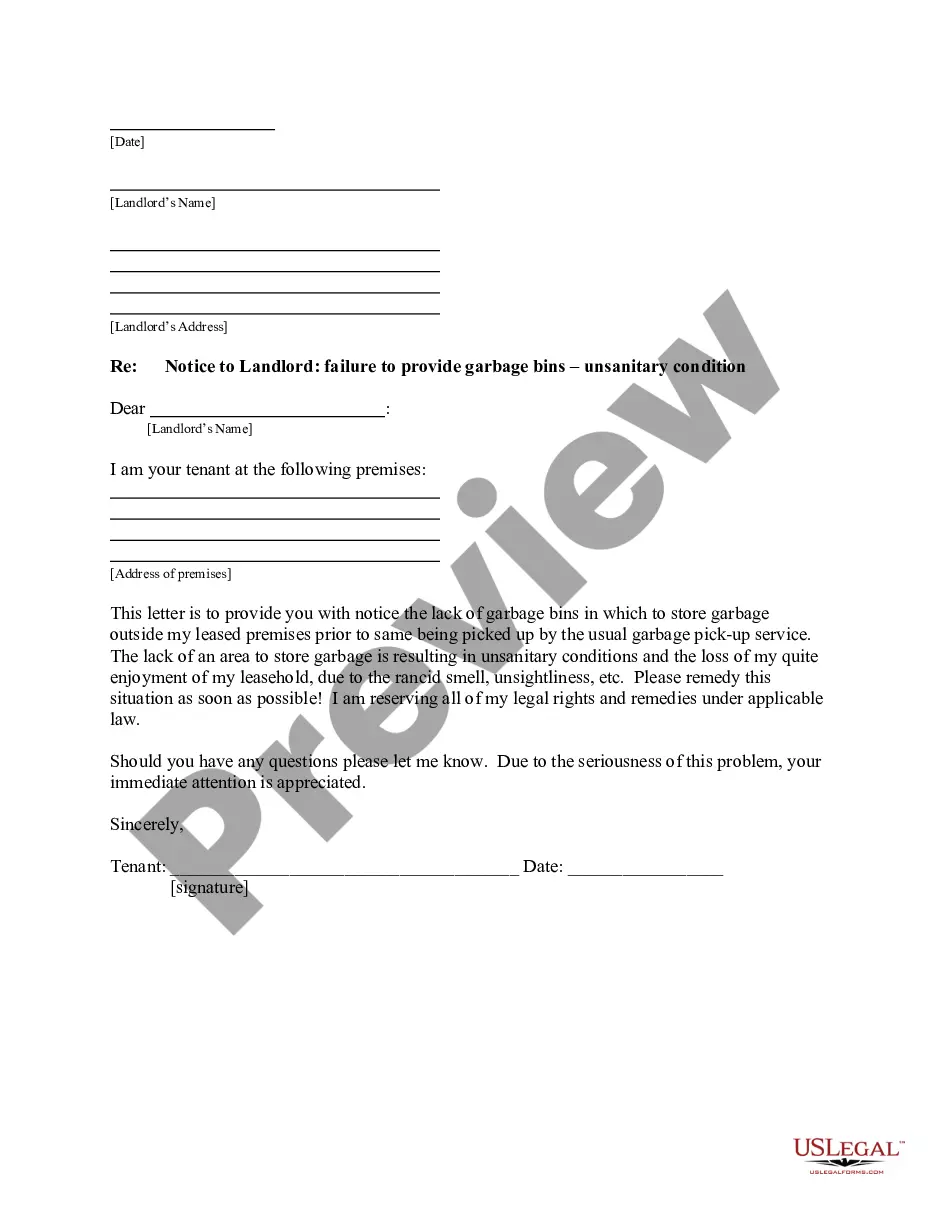

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the High Point North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!