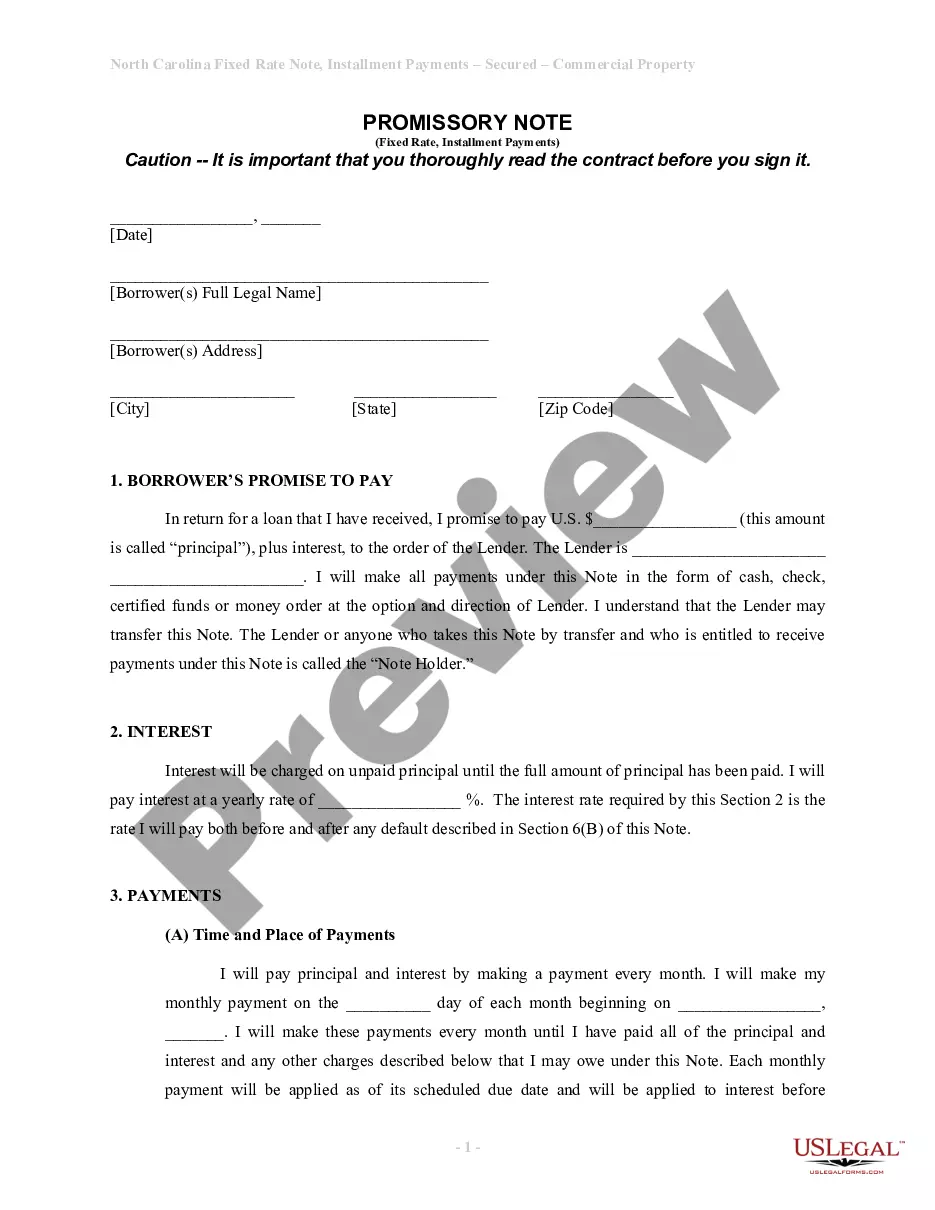

A Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It is specifically designed for transactions where the borrower intends to obtain financing for commercial real estate properties located in Wake County, North Carolina. This type of promissory note is used when the borrower needs a significant amount of funding for the purchase, refinancing, or improvement of commercial properties such as office buildings, retail spaces, industrial facilities, or multi-family residential complexes in Wake County. The note creates a lien on the property, providing the lender with added security. The promissory note contains several key elements, including: 1. Parties: It identifies the borrower and lender involved in the transaction, establishing their legal identities and contact details. 2. Loan Amount and Interest Rate: The note specifies the principal amount being borrowed by the borrower and the fixed interest rate attached to the loan. This ensures that both parties are clear on the repayment terms. 3. Repayment Schedule: The note outlines how the loan will be repaid by the borrower over a specified period. It typically involves a predetermined number of monthly installments, which include both principal and interest payments. 4. Late Fees and Penalties: In case the borrower fails to make timely payments, the note may outline late fees, penalties, and additional charges that the borrower will be responsible for. 5. Collateral: The promissory note establishes the commercial real estate property being used as collateral for the loan. It outlines the property's details, including its address, legal description, and any restrictions on its use. 6. Default and Remedies: The note defines the circumstances under which the borrower would be considered in default and outlines the remedies available to the lender in such situations. This may include acceleration of the debt or foreclosure of the property. Some variations or different types of Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate include: 1. Construction Loan Promissory Note: Specifically designed for borrowers seeking financing for construction or substantial renovation projects on commercial properties in Wake County. 2. Bridge Loan Promissory Note: Suitable for borrowers who require short-term financing to bridge the gap between the purchase or sale of commercial properties. 3. Balloon Payment Promissory Note: This type of promissory note includes a large lump-sum payment due at the end of the loan term, providing a more flexible financing option for commercial property buyers. In summary, a Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal agreement that enables borrowers to obtain financing for commercial properties in Wake County. These notes provide clear terms, repayment schedules, collateral details, and penalties for late payments, ensuring a transparent and secure lending arrangement.

Wake Estate

State:

North Carolina

County:

Wake

Control #:

NC-NOTESEC3

Format:

Word;

Rich Text

Instant download

Description

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

A Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It is specifically designed for transactions where the borrower intends to obtain financing for commercial real estate properties located in Wake County, North Carolina. This type of promissory note is used when the borrower needs a significant amount of funding for the purchase, refinancing, or improvement of commercial properties such as office buildings, retail spaces, industrial facilities, or multi-family residential complexes in Wake County. The note creates a lien on the property, providing the lender with added security. The promissory note contains several key elements, including: 1. Parties: It identifies the borrower and lender involved in the transaction, establishing their legal identities and contact details. 2. Loan Amount and Interest Rate: The note specifies the principal amount being borrowed by the borrower and the fixed interest rate attached to the loan. This ensures that both parties are clear on the repayment terms. 3. Repayment Schedule: The note outlines how the loan will be repaid by the borrower over a specified period. It typically involves a predetermined number of monthly installments, which include both principal and interest payments. 4. Late Fees and Penalties: In case the borrower fails to make timely payments, the note may outline late fees, penalties, and additional charges that the borrower will be responsible for. 5. Collateral: The promissory note establishes the commercial real estate property being used as collateral for the loan. It outlines the property's details, including its address, legal description, and any restrictions on its use. 6. Default and Remedies: The note defines the circumstances under which the borrower would be considered in default and outlines the remedies available to the lender in such situations. This may include acceleration of the debt or foreclosure of the property. Some variations or different types of Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate include: 1. Construction Loan Promissory Note: Specifically designed for borrowers seeking financing for construction or substantial renovation projects on commercial properties in Wake County. 2. Bridge Loan Promissory Note: Suitable for borrowers who require short-term financing to bridge the gap between the purchase or sale of commercial properties. 3. Balloon Payment Promissory Note: This type of promissory note includes a large lump-sum payment due at the end of the loan term, providing a more flexible financing option for commercial property buyers. In summary, a Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal agreement that enables borrowers to obtain financing for commercial properties in Wake County. These notes provide clear terms, repayment schedules, collateral details, and penalties for late payments, ensuring a transparent and secure lending arrangement.

Free preview

How to fill out Wake North Carolina Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you’ve already utilized our service before, log in to your account and download the Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Wake North Carolina Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!