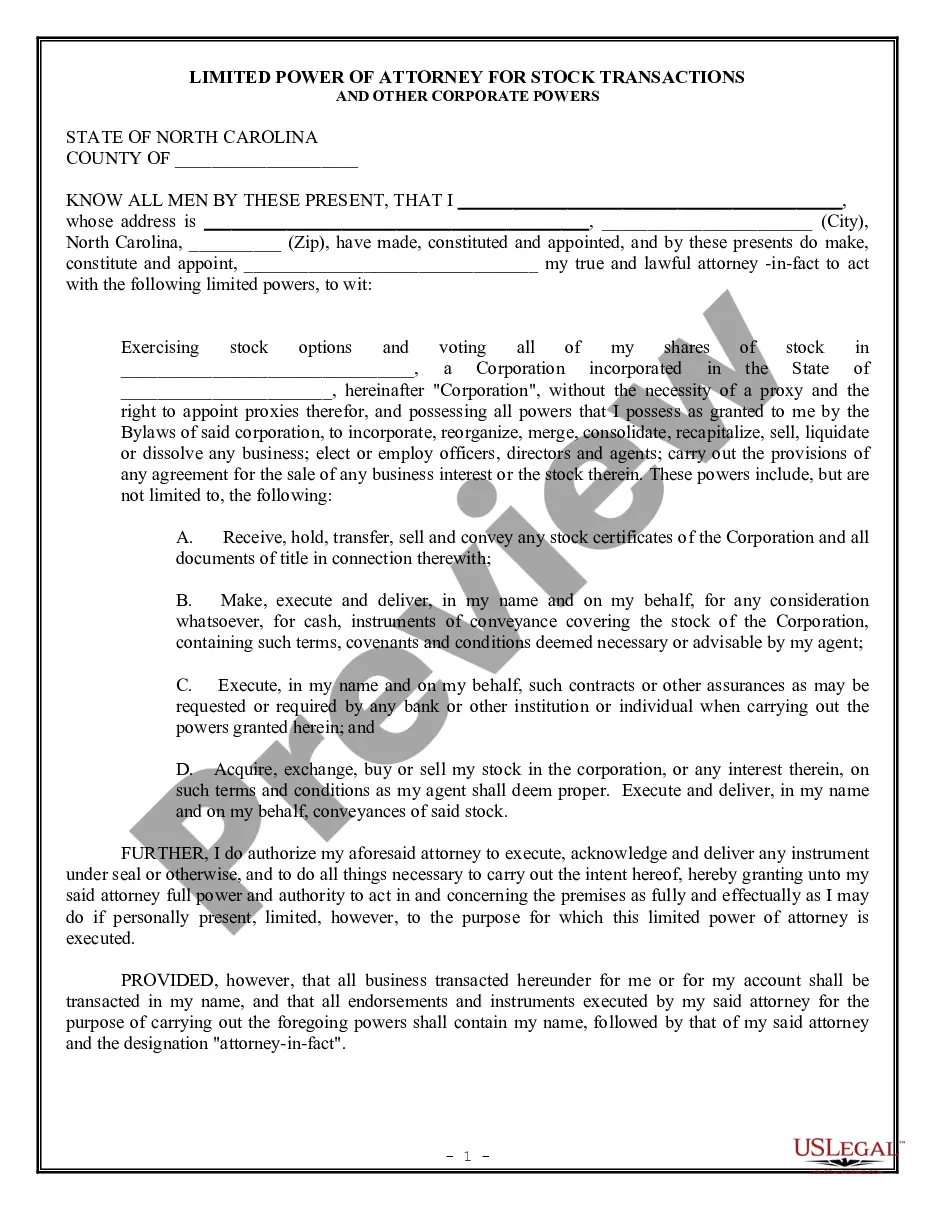

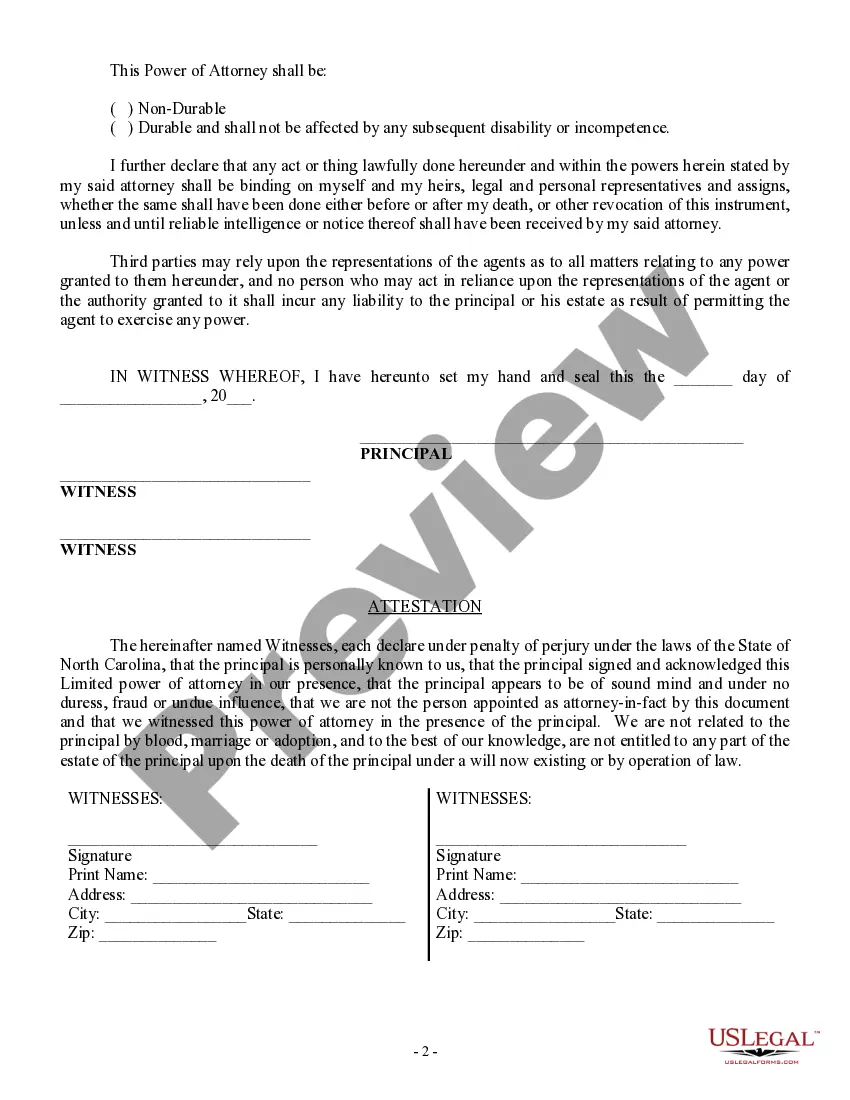

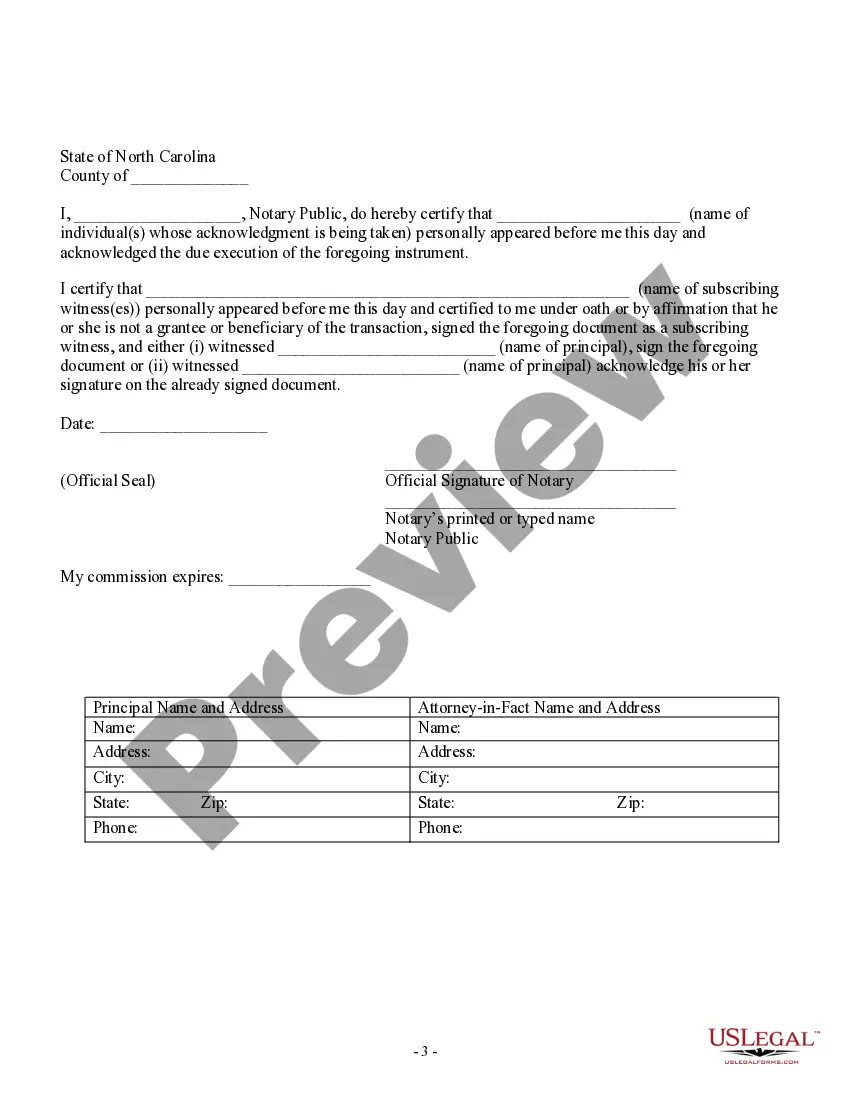

Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document that grants an individual or entity the authority to act on behalf of another in matters related to stock transactions and the exercise of corporate powers. This limited power of attorney is specifically designed to address the unique requirements of Wake County, North Carolina. With this limited power of attorney, the designated person or entity, known as the attorney-in-fact, is given the power to undertake various actions pertaining to stock transactions and corporate affairs. These powers may include, but are not limited to, the buying and selling of stocks, executing stock transfer agreements, attending shareholder meetings, exercising voting rights, and implementing corporate decisions. The Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers offers flexibility by allowing the principal to specify the exact powers and limitations granted to the attorney-in-fact. This provides a customizable framework that aligns with the principal's specific needs and preferences. The document can also outline the duration of the power of attorney, whether it is temporary or enduring. There are several types of Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers that cater to different situations or requirements: 1. Limited Power of Attorney for Stock Trading: This type specifically focuses on granting the attorney-in-fact the authority to engage in stock market activities, such as buying and selling securities, managing investment portfolios, and executing trading strategies, on behalf of the principal. 2. Limited Power of Attorney for Shareholder Meetings: This variation of the limited power of attorney is designed to enable the attorney-in-fact to represent the principal at shareholder meetings. They can cast votes, participate in discussions, and make decisions related to corporate matters. 3. Limited Power of Attorney for Corporate Decision-Making: This type allows the attorney-in-fact to make decisions on behalf of the principal related to corporate governance, such as entering into contracts, accessing and managing corporate bank accounts, and executing legal documents on behalf of the principal. 4. Limited Power of Attorney for Voting Rights: This particular variation grants the attorney-in-fact the authority to vote on behalf of the principal in corporate matters, including electing board members, approving mergers or acquisitions, and making other important corporate decisions. In Wake County, North Carolina, these various types of limited power of attorney documents for stock transactions and corporate powers serve to protect the interests of both the principal and the attorney-in-fact, ensuring transparency and accountability in stock-related and corporate affairs. It is crucial to consult with a qualified legal professional to draft and execute these documents in compliance with local regulations and the specific needs of the principal.

Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Wake North Carolina Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Benefit from the US Legal Forms and have immediate access to any form template you require. Our helpful platform with a large number of document templates allows you to find and obtain virtually any document sample you require. You are able to save, fill, and sign the Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers in a few minutes instead of browsing the web for many hours looking for a proper template.

Using our collection is a superb strategy to raise the safety of your record filing. Our professional attorneys regularly review all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you obtain the Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Furthermore, you can find all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Open the page with the form you need. Ensure that it is the form you were seeking: check its headline and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Save the document. Choose the format to get the Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy template libraries on the web. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Wake North Carolina Limited Power of Attorney for Stock Transactions and Corporate Powers.

Feel free to take advantage of our service and make your document experience as efficient as possible!