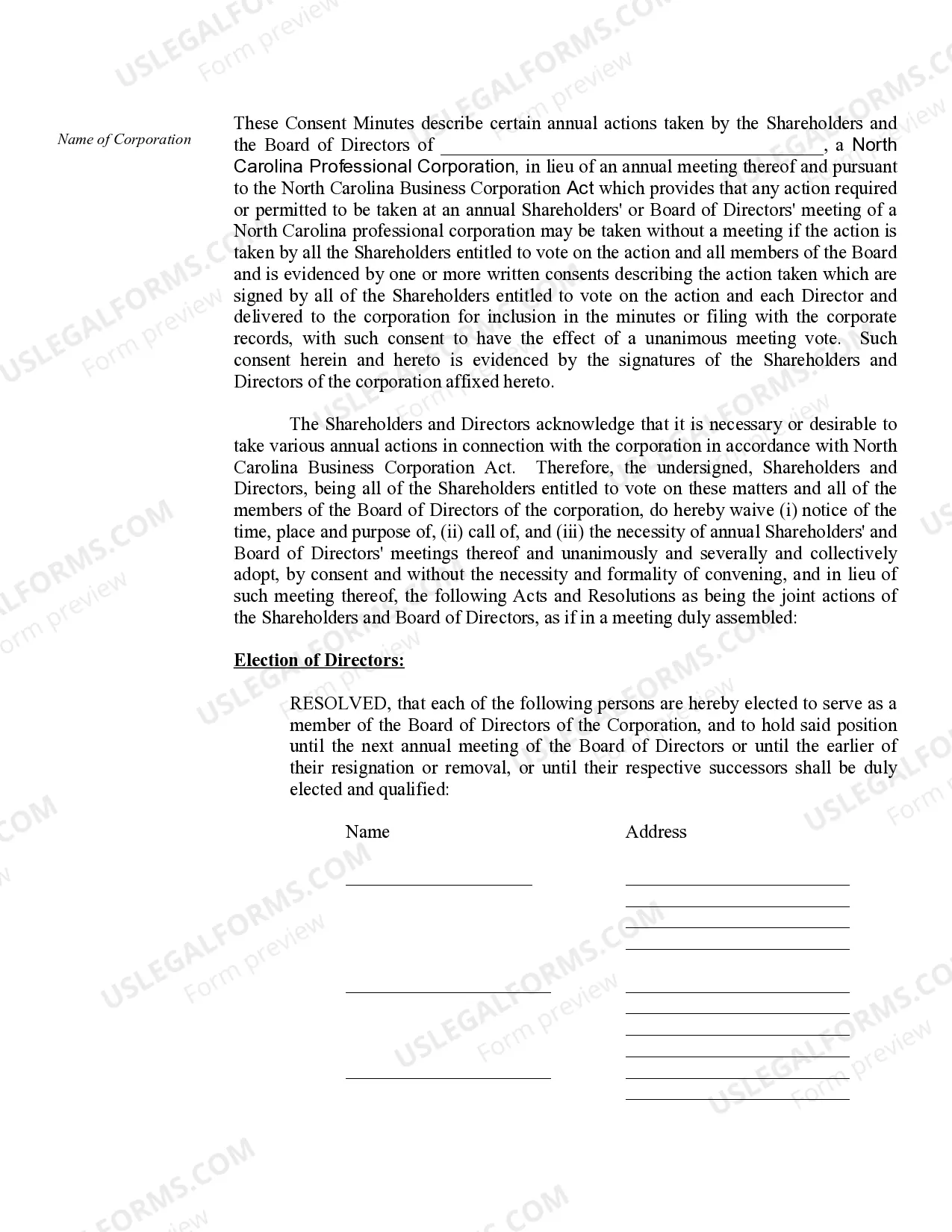

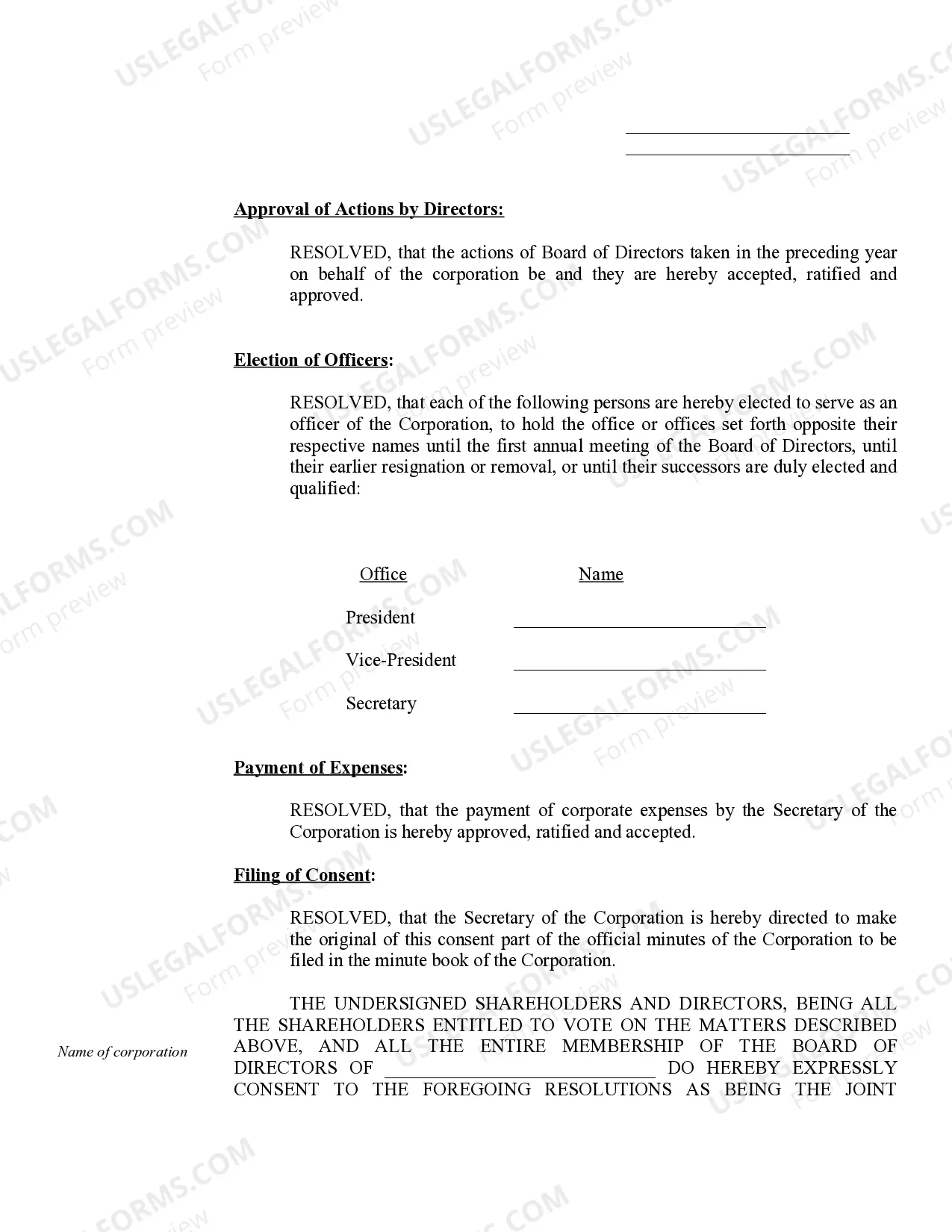

Cary Annual Minutes for a North Carolina Professional Corporation

Description

How to fill out Annual Minutes For A North Carolina Professional Corporation?

If you have previously utilized our service, sign in to your account and retrieve the Cary Annual Minutes for a North Carolina Professional Corporation on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment schedule.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifelong access to all the documents you have purchased: you can find it in your profile within the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to swiftly locate and store any template for your personal or professional requirements!

- Confirm you’ve found the correct document. Review the description and use the Preview feature, if available, to ascertain if it satisfies your needs. If it is unsuitable, utilize the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and complete a payment. Input your credit card details or select the PayPal option to finalize the transaction.

- Retrieve your Cary Annual Minutes for a North Carolina Professional Corporation. Choose the file format for your document and save it on your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

If you fail to file an annual report for your LLC in North Carolina, you may face penalties including late fees and potential administrative dissolution of your company. This means you could lose the legal status necessary to operate your business. Maintaining detailed Cary Annual Minutes for a North Carolina Professional Corporation ensures you don’t overlook filing deadlines and requirements. Stay proactive to avoid these challenges.

Yes, non-profit organizations in North Carolina are required to file annual reports. This practice ensures transparency and allows the state to maintain up-to-date records on non-profits. By effectively managing the Cary Annual Minutes for a North Carolina Professional Corporation or any non-profit, you can streamline your report preparation and filing process. Staying compliant with these requirements fosters trust within the community.

Annual report compliance for business entities requires complete and accurate reporting of the company’s status and changes. Each entity type may have specific requirements. As a proponent of best practices, focusing on your Cary Annual Minutes for a North Carolina Professional Corporation helps you adhere to compliance regulations. Consider utilizing platforms like uslegalforms for assistance in navigating these requirements.

Filing an annual report in North Carolina involves filling out the appropriate form and submitting it to the Secretary of State. You can file online for convenience or submit a paper form via mail. Maintaining your Cary Annual Minutes for a North Carolina Professional Corporation can simplify this filing process by having all necessary information readily available. Timeliness is crucial, so be sure to keep track of your filing deadlines.

To complete an annual report, gather your business's essential information, including its status, registered agent details, and financial data. Next, you can typically find a specific template or form on the North Carolina Secretary of State's website. By aligning this with your Cary Annual Minutes for a North Carolina Professional Corporation, you ensure all required details are accurately reflected. A structured approach can make the workflow smooth and efficient.

Indeed, a PLLC must file an annual report in North Carolina. This requirement aims to keep the state informed about the business's status and operations. As you manage your Cary Annual Minutes for a North Carolina Professional Corporation, regularly updating your annual report will become a routine task. This keeps your business in good standing and enhances its credibility.

Yes, a Professional Limited Liability Company (PLLC) is required to file an annual report in North Carolina. This requirement ensures that the PLLC remains compliant with state regulations. By staying on top of your annual minutes, you can easily prepare the necessary information needed for filing these reports. Maintaining accurate records will simplify this process significantly.

Yes, every corporation in North Carolina must prepare an annual report. This report is crucial for maintaining good standing with the state and informs officials about the corporation's current activities. If your corporation is a professional corporation in Cary, understanding the annual minutes process is essential for compliance. Regularly preparing these reports helps at every stage of business development.

Writing annual meeting minutes involves clearly documenting the meeting's key elements. Start by recording the date, time, location, and participants. Summarize discussions, decisions made, and any action items agreed upon. For your Cary Annual Minutes for a North Carolina Professional Corporation, ensure that the minutes are accurate and reflect the tone of the meeting, promoting accountability and transparency in your corporation's operations.

Failing to file your annual report in North Carolina can lead to serious consequences. Your Cary professional corporation may face penalties, and repeated failures can result in administrative dissolution. Losing your corporation's good standing can complicate business operations and diminish credibility. To avoid these pitfalls, consider using platforms like uslegalforms for guidance and support in fulfilling filing requirements.