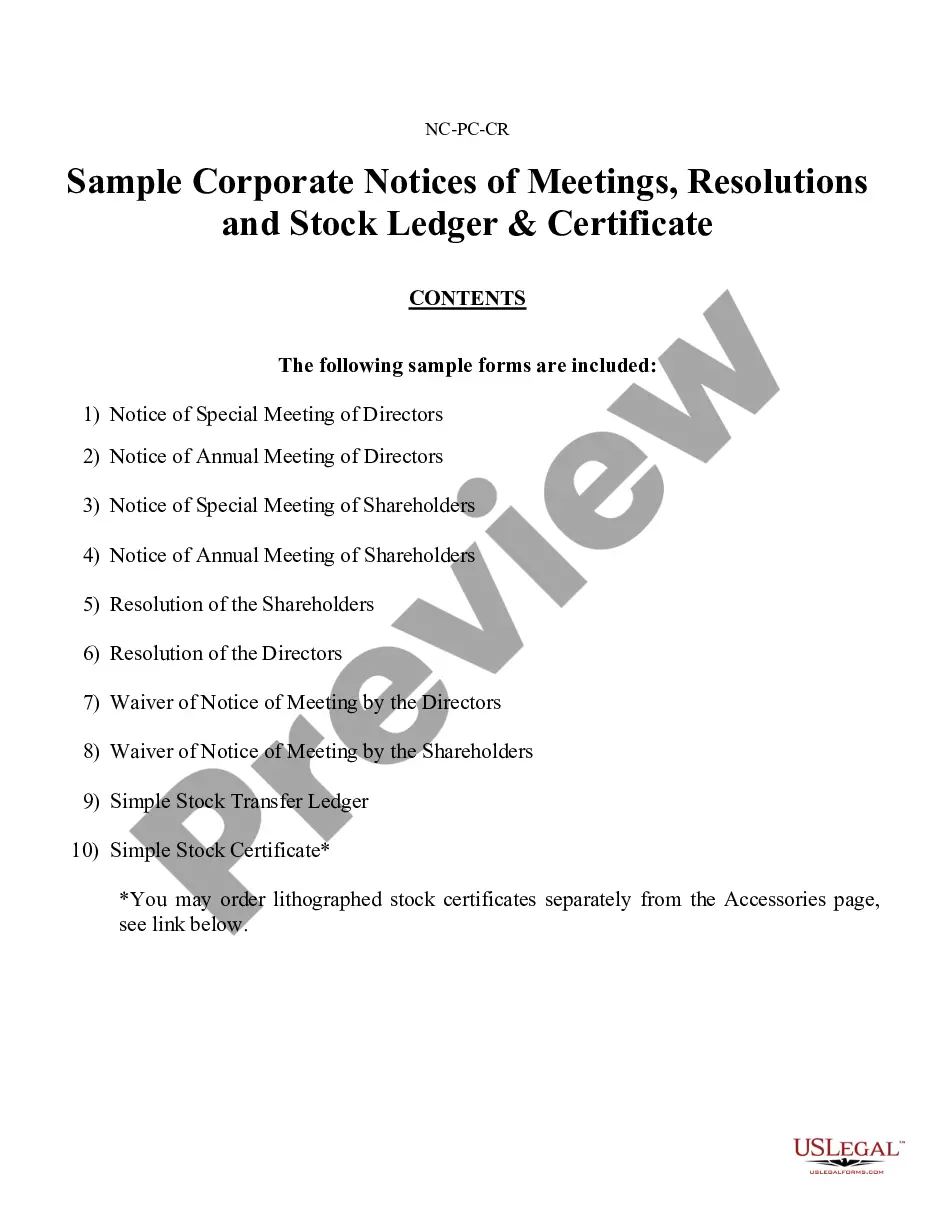

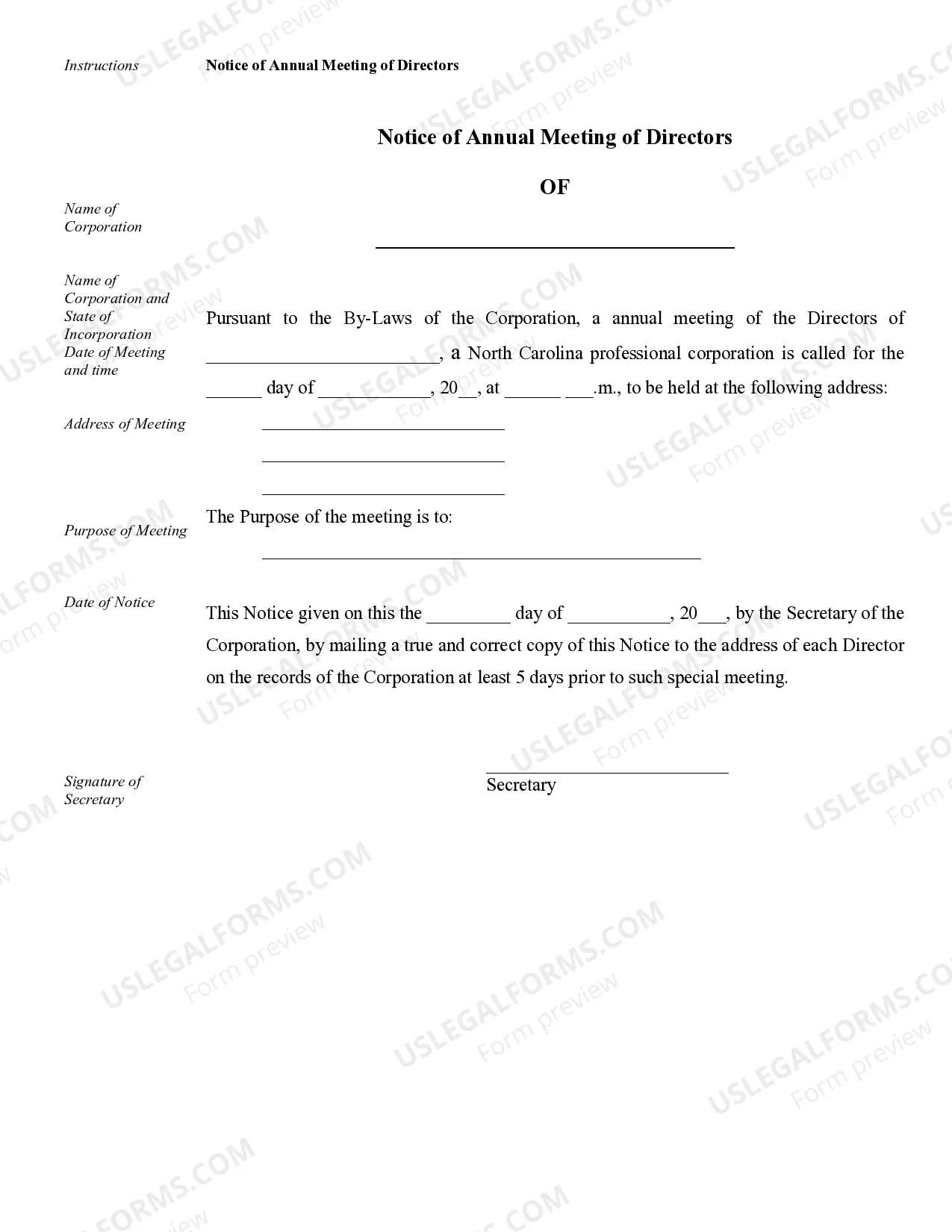

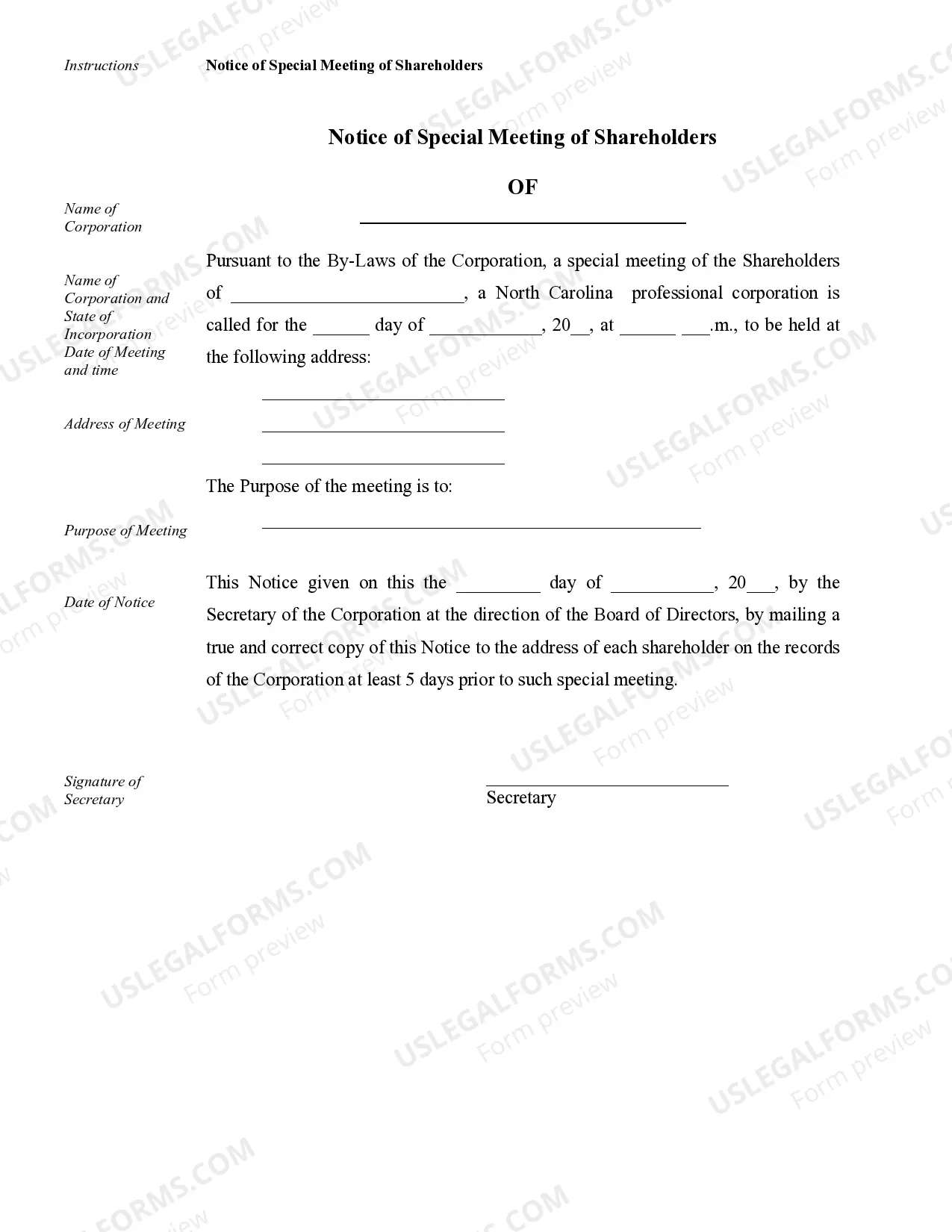

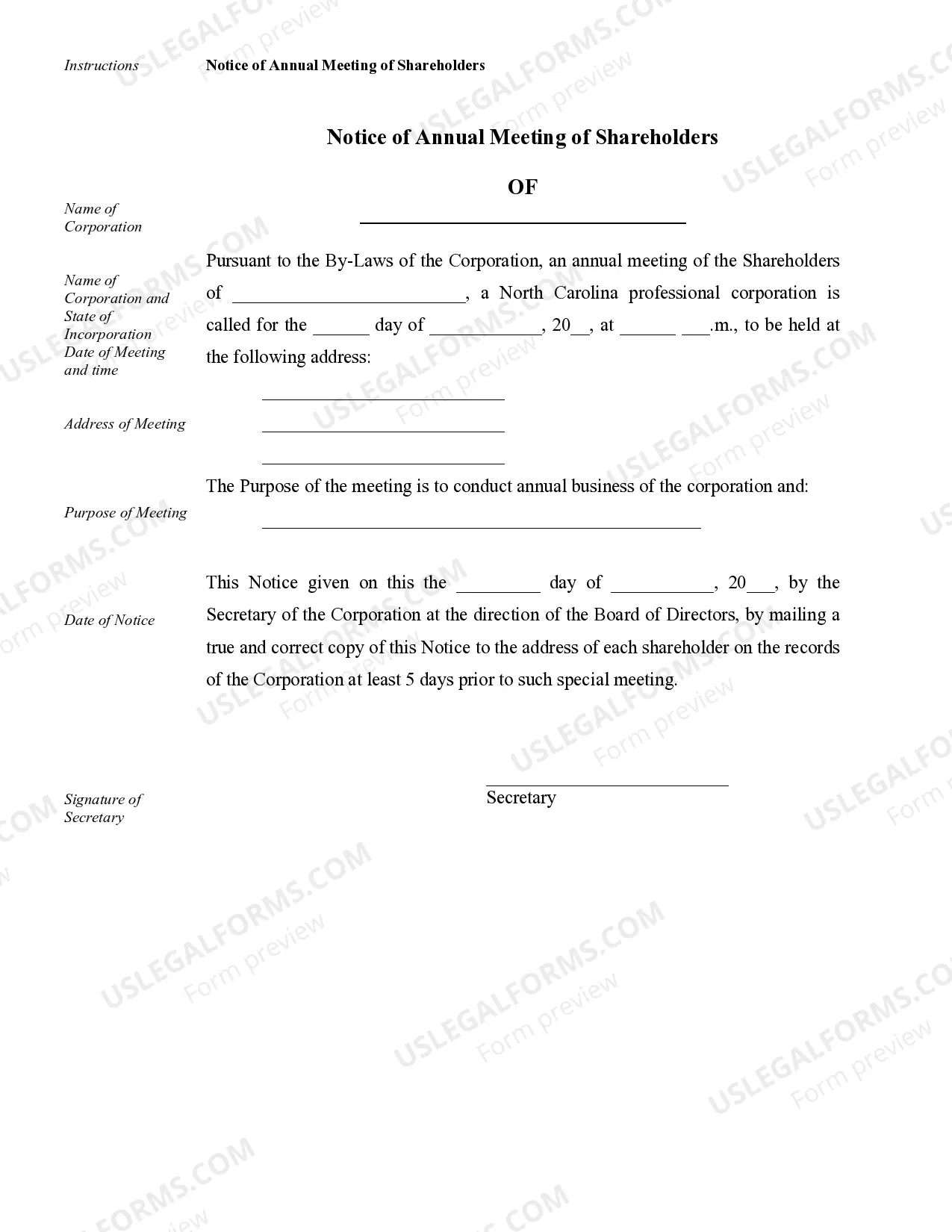

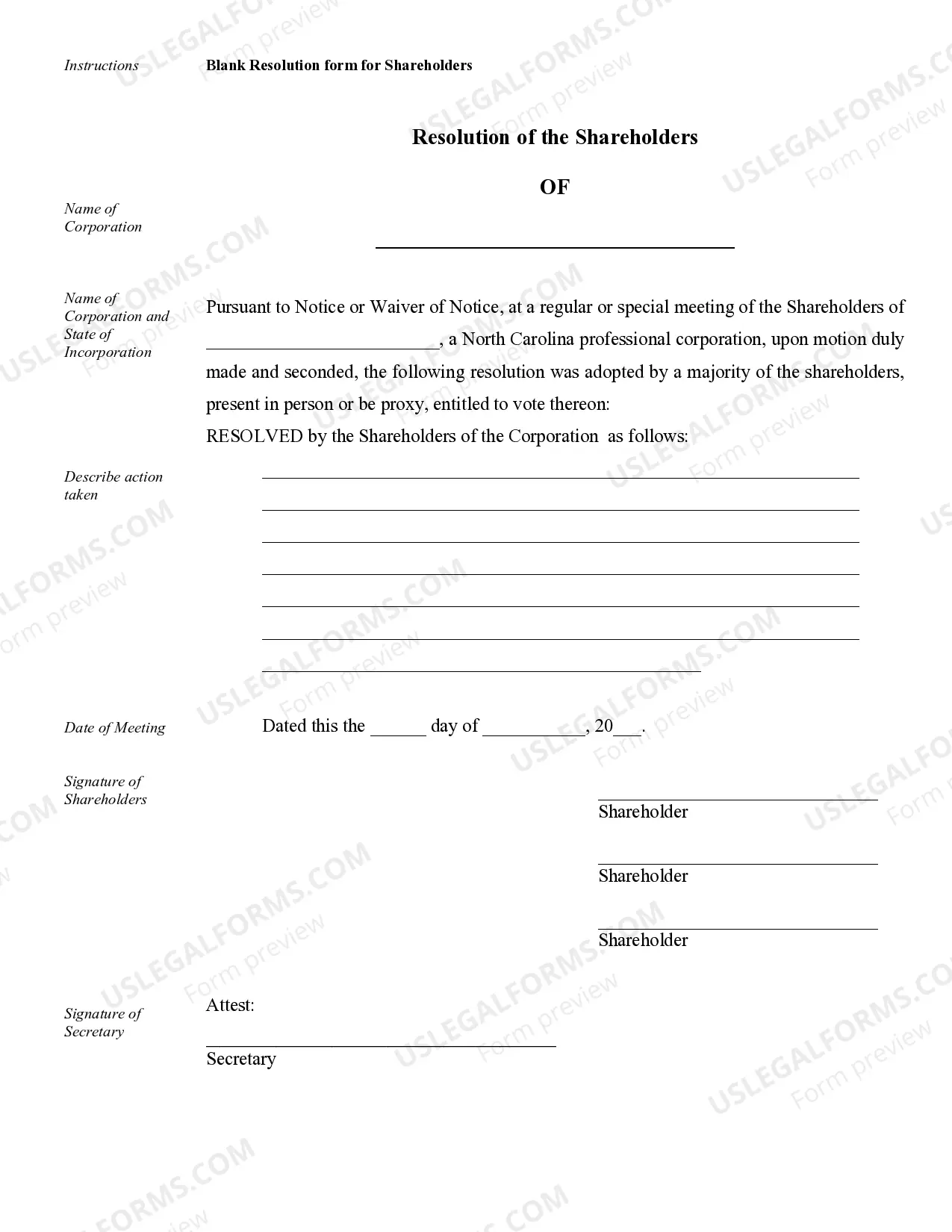

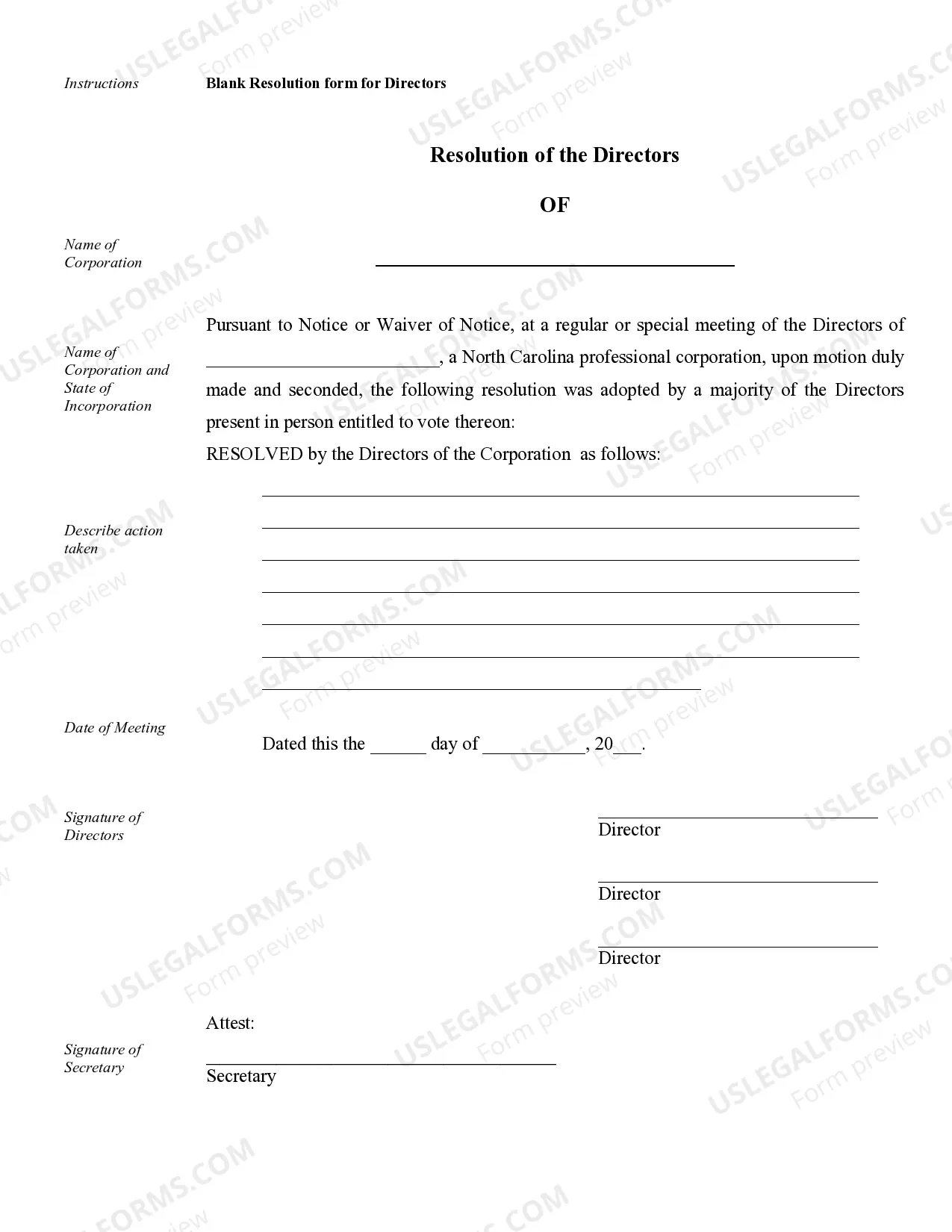

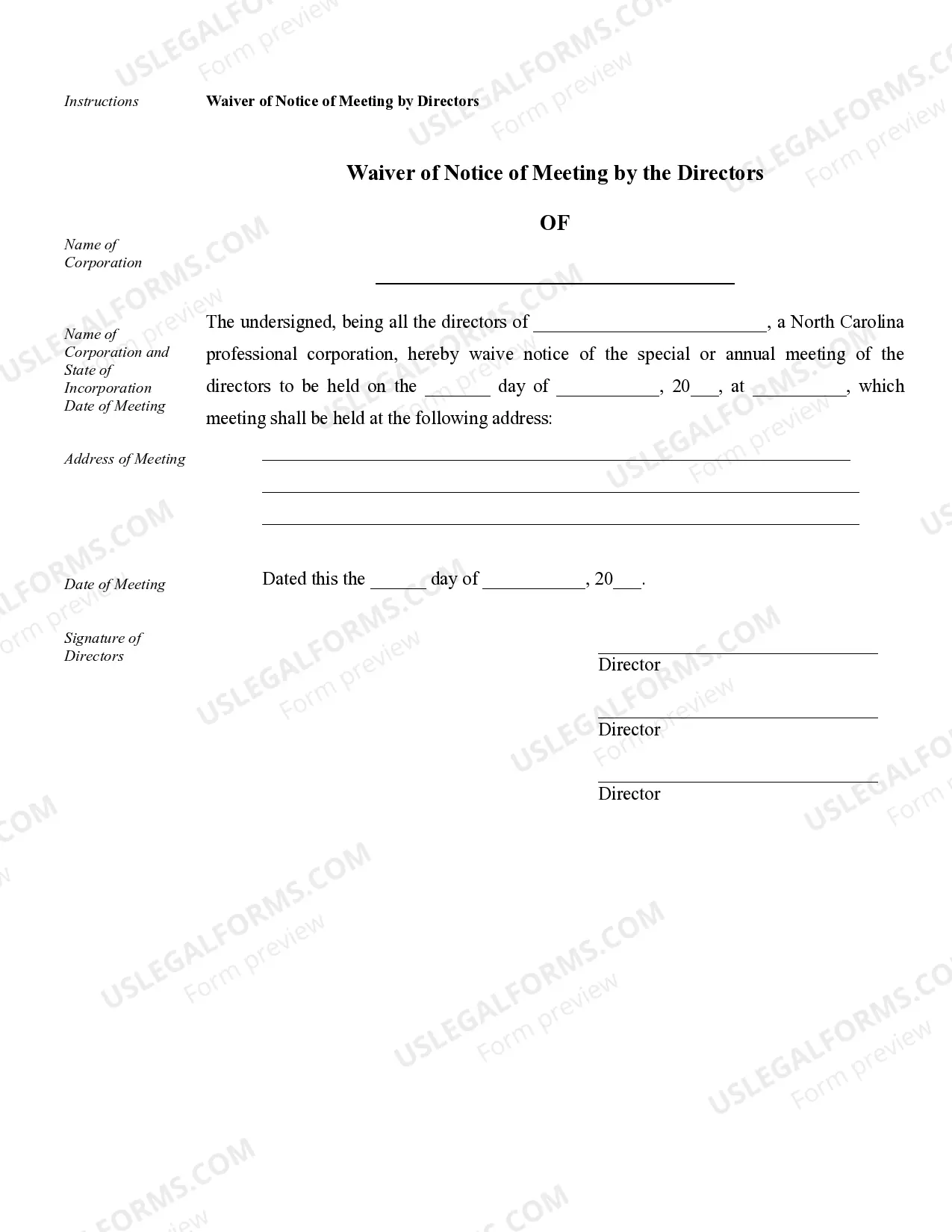

Charlotte Sample Corporate Records for a North Carolina Professional Corporation refer to the official documents and records that are maintained by a professional corporation based in Charlotte, North Carolina. These records are crucial for ensuring legal compliance, corporate transparency, and maintaining an accurate account of the company's activities and financial transactions. Some key elements and types of records found in Charlotte Sample Corporate Records for a North Carolina Professional Corporation include: 1. Articles of Incorporation: This document outlines the legal formation of the professional corporation and includes important details such as the company's name, purpose, registered agent, board members, and other key information. 2. Bylaws: The bylaws lay out the internal rules and regulations that govern the corporation's operations, decision-making processes, and shareholder rights. They cover areas like voting procedures, board meetings, stock issuance, and officer roles. 3. Shareholder Agreements: These agreements outline the rights and obligations of the corporation's shareholders, including the transfer of shares, voting rights, and restrictions on selling shares to outside parties. 4. Minutes of Meetings: Minutes of board meetings, annual general meetings, and special shareholder meetings are recorded and included in the corporate records. These minutes provide a detailed account of discussions, resolutions, and voting outcomes. 5. Financial Statements: Financial records such as income statements, balance sheets, cash flow statements, and tax filings are crucial for assessing the company's financial health, performance, and compliance with accounting standards. 6. Stock Ledger: A stock ledger records detailed information about the issuance, ownership, and transfer of the corporation's shares. It includes shareholder names, addresses, the number of shares held, and any changes in ownership. 7. Licensing and Certification Documents: Professional corporations in certain industries, such as law, medicine, and engineering, require specific licenses or certifications. These documents must be kept in the corporate records to demonstrate compliance with legal and professional standards. 8. Contracts and Agreements: Copies of contracts, agreements, and legal documents entered into by the professional corporation, such as client contracts, leases, and vendor agreements, are included in the corporate records. 9. Annual Reports: As per North Carolina law, professional corporations are required to file annual reports that provide updates on their activities, changes in officers or shareholders, and an updated registered agent. These reports are also part of the corporate records. 10. Employee Records: Employee-related documents, including employment contracts, offer letters, payroll records, and benefit plans, should be kept in the corporate records to ensure compliance with labor laws and protect the corporation's interests. These are some important types of Charlotte Sample Corporate Records for a North Carolina Professional Corporation. Maintaining complete, accurate, and up-to-date records is essential for legal compliance, regulatory requirements, and effective corporate governance. It helps professional corporations protect their interests, establish credibility, and ensure transparency in their operations.

Charlotte Sample Corporate Records for a North Carolina Professional Corporation

Description

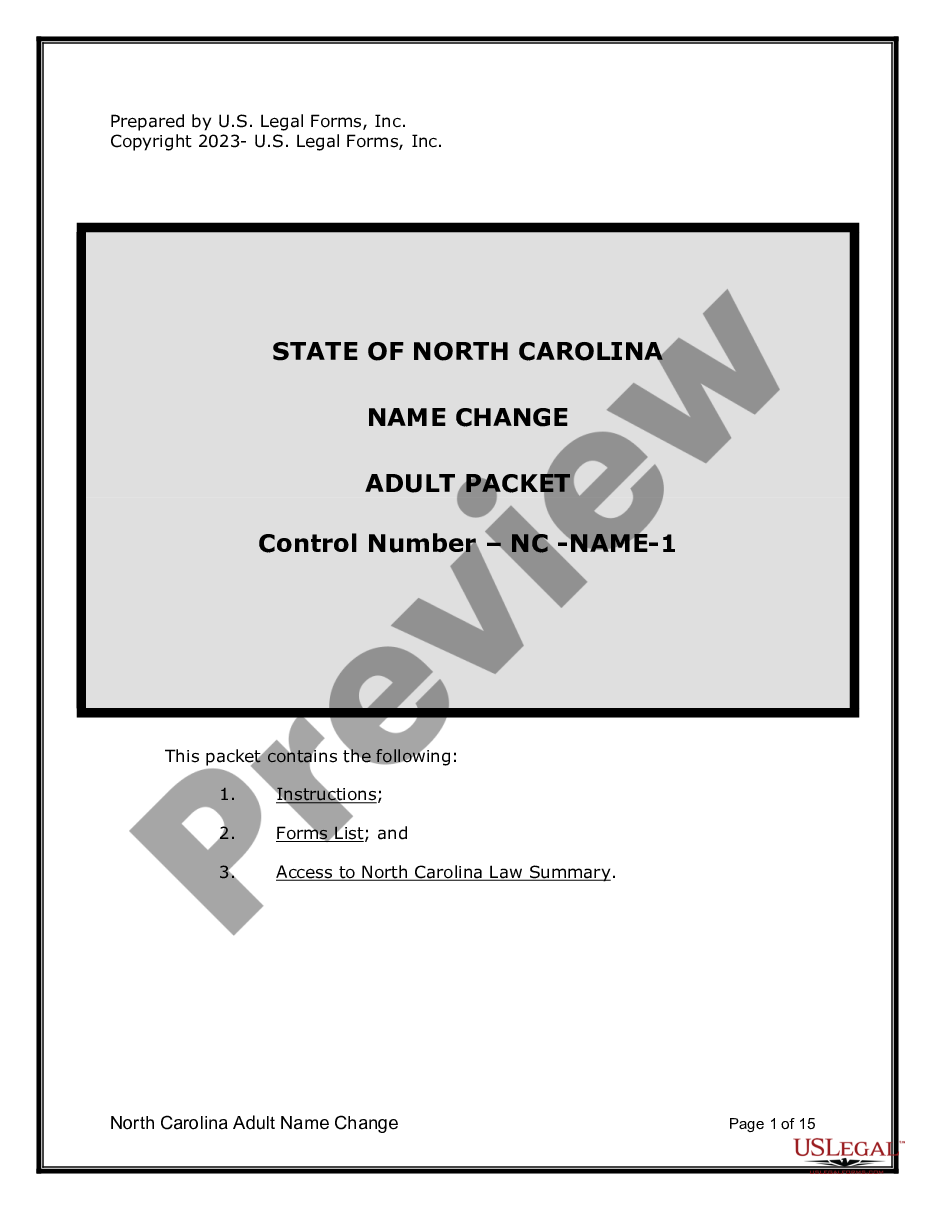

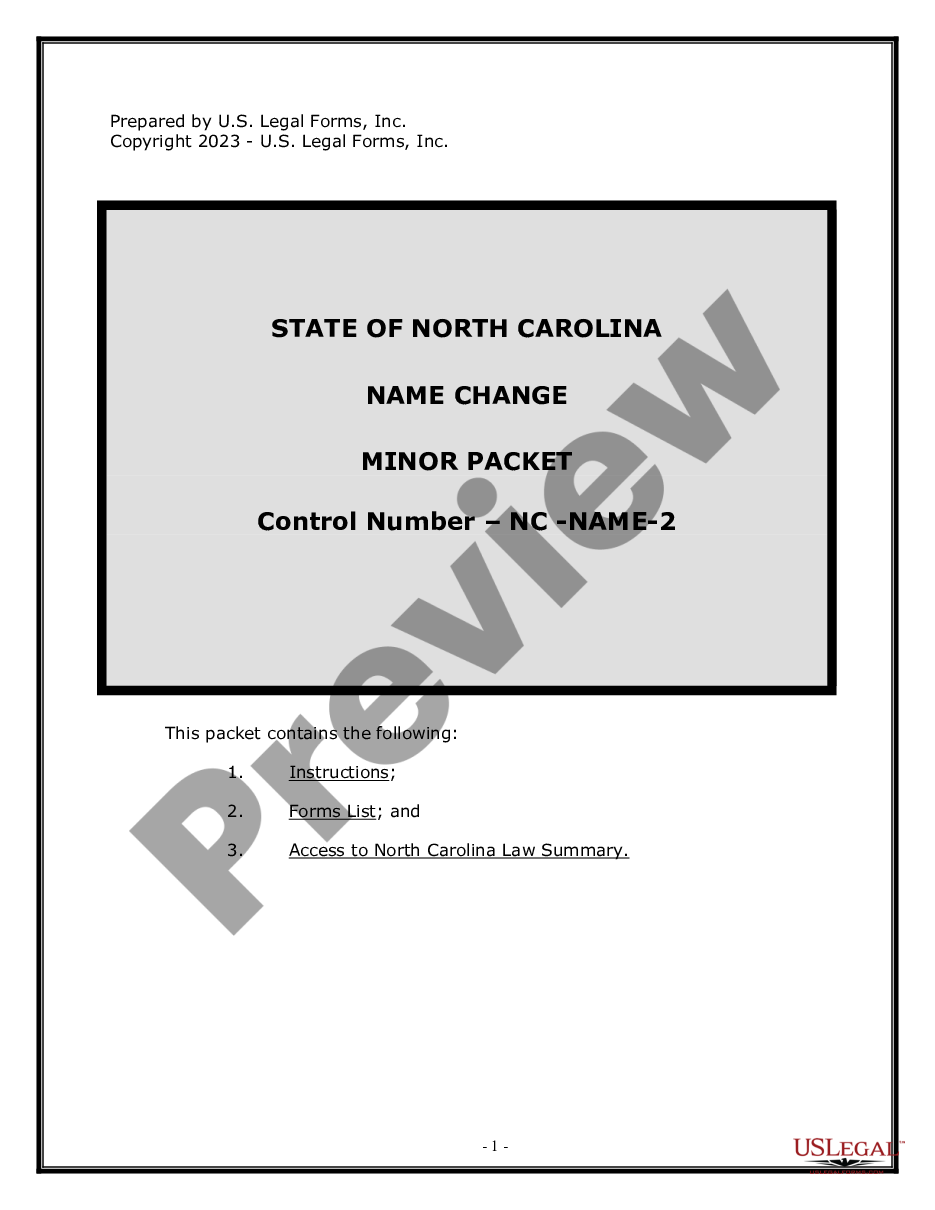

How to fill out Charlotte Sample Corporate Records For A North Carolina Professional Corporation?

Are you in search of a dependable and budget-friendly legal document provider to obtain the Charlotte Sample Corporate Records for a North Carolina Professional Corporation? US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish guidelines for living together with your partner or a set of paperwork to facilitate your divorce in court, we've got you covered. Our platform provides over 85,000 current legal template documents for personal and business use. All templates we grant access to are customized and structured according to the requirements of particular states and counties.

To retrieve the form, you need to Log In to your account, find the form you need, and click the Download button adjacent to it. Please note that you can download your previously acquired document templates anytime in the My documents section.

Are you a newcomer to our platform? No problem. You can create an account in just a few minutes, but before that, make sure to do the following.

Now you can set up your account. Then choose the subscription plan and proceed with payment. Once the payment is completed, download the Charlotte Sample Corporate Records for a North Carolina Professional Corporation in any available file format. You can return to the website at any time and redownload the form at no extra cost.

Finding current legal documents has never been simpler. Try US Legal Forms today and say goodbye to spending hours searching for legal paperwork online.

- Verify if the Charlotte Sample Corporate Records for a North Carolina Professional Corporation meets the laws of your state and locality.

- Review the form’s description (if available) to determine who and what the form is meant for.

- Restart your search if the form is not suitable for your particular situation.

Form popularity

FAQ

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone, in person, or online, but we recommend online. Online processing is immediate and costs $15 plus $1 per page.

You can find information on any corporation or business entity in North Carolina or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

How to Form a Corporation in North Carolina Choose a Corporate Name.File Articles of Incorporation.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Directors and Hold First Board Meeting.File Annual Report.Obtain an EIN.

How to Form a Corporation in North Carolina Choose a Corporate Name.File Articles of Incorporation.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Directors and Hold First Board Meeting.File Annual Report.Obtain an EIN.

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.

Professional corporations (PCs), or professional service corporations, are a unique corporate structure which is comprised of a specific group of professionals. An S corporation or a C corporation may be formed by certain professionals including physicians, attorneys, engineers, or accountants.

In order to qualify as a Professional Corporation the ownership of the company must meet N.C.G.S. 55B-6 and 55B-4(3), which requires at least 2/3 ownership by licensees and at least one North Carolina licensee for each profession that will be offered who is an officer, director and shareholder in the corporation.

Professional corporations may exist as part of a larger, more complicated, legal entity; for example, a law firm or medical practice might be organized as a partnership of several or many professional corporations.

Professional corporations provide a limit on the owners' personal liability for business debts and claims. Incorporating can't protect a professional against liability for his or her negligence or malpractice, but it can protect against liability for the negligence or malpractice of an associate.