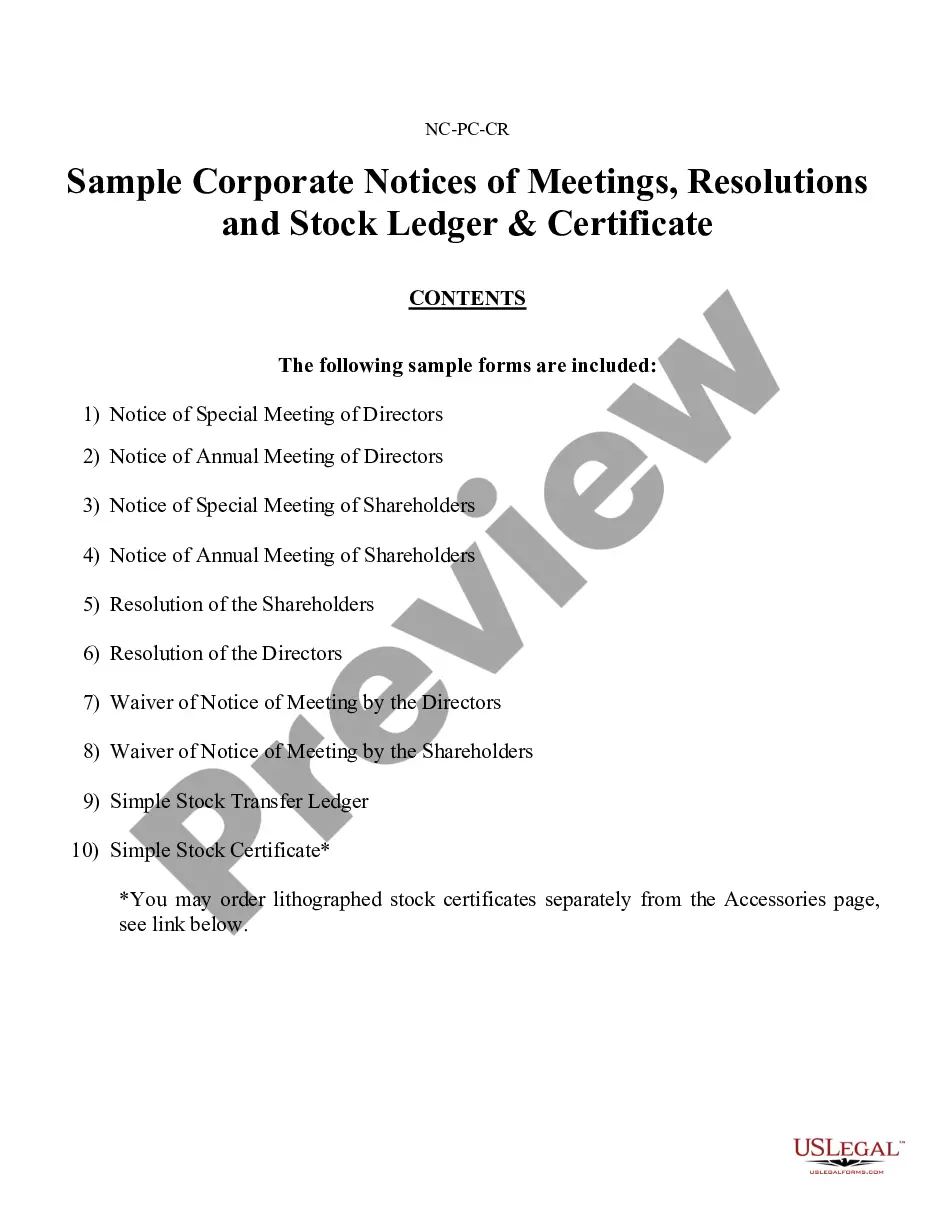

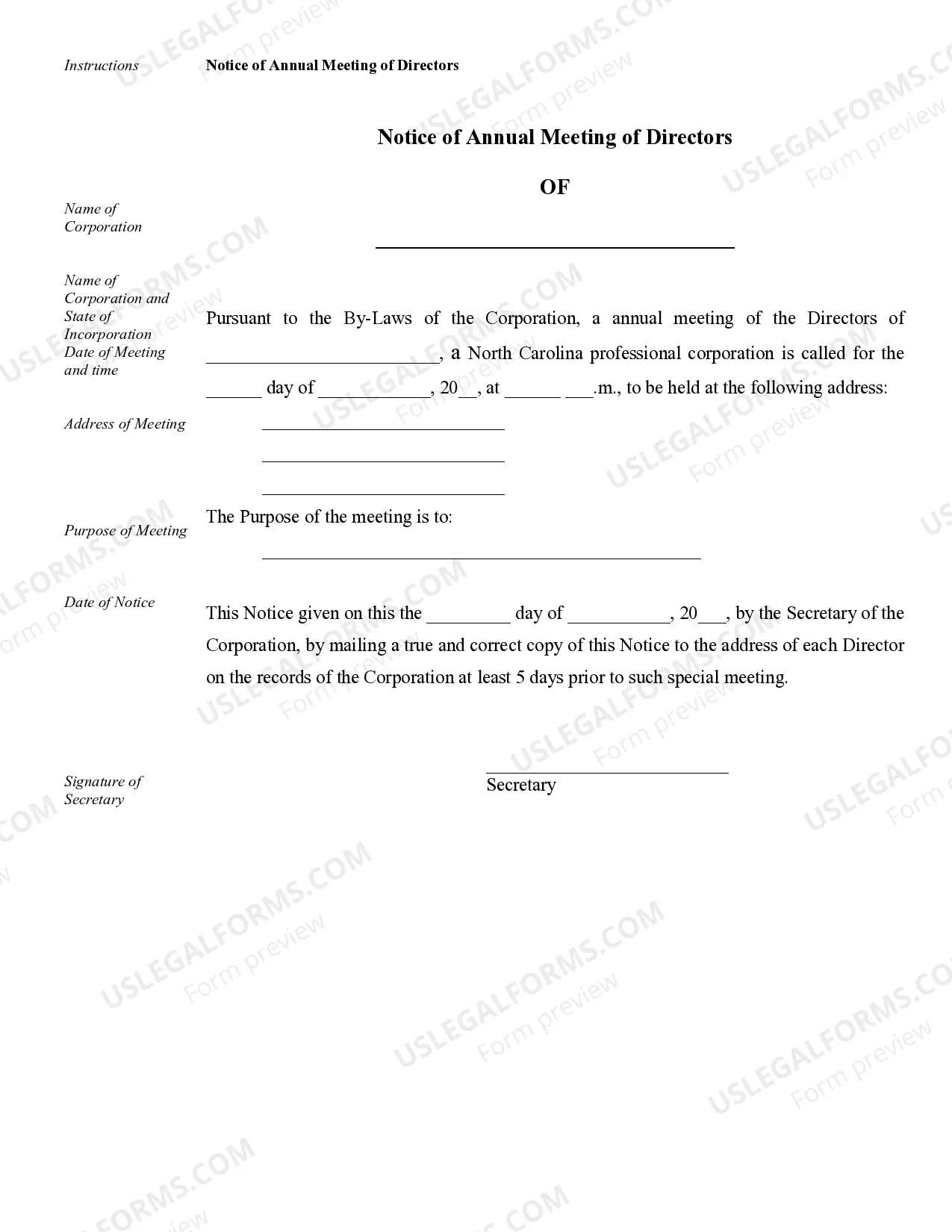

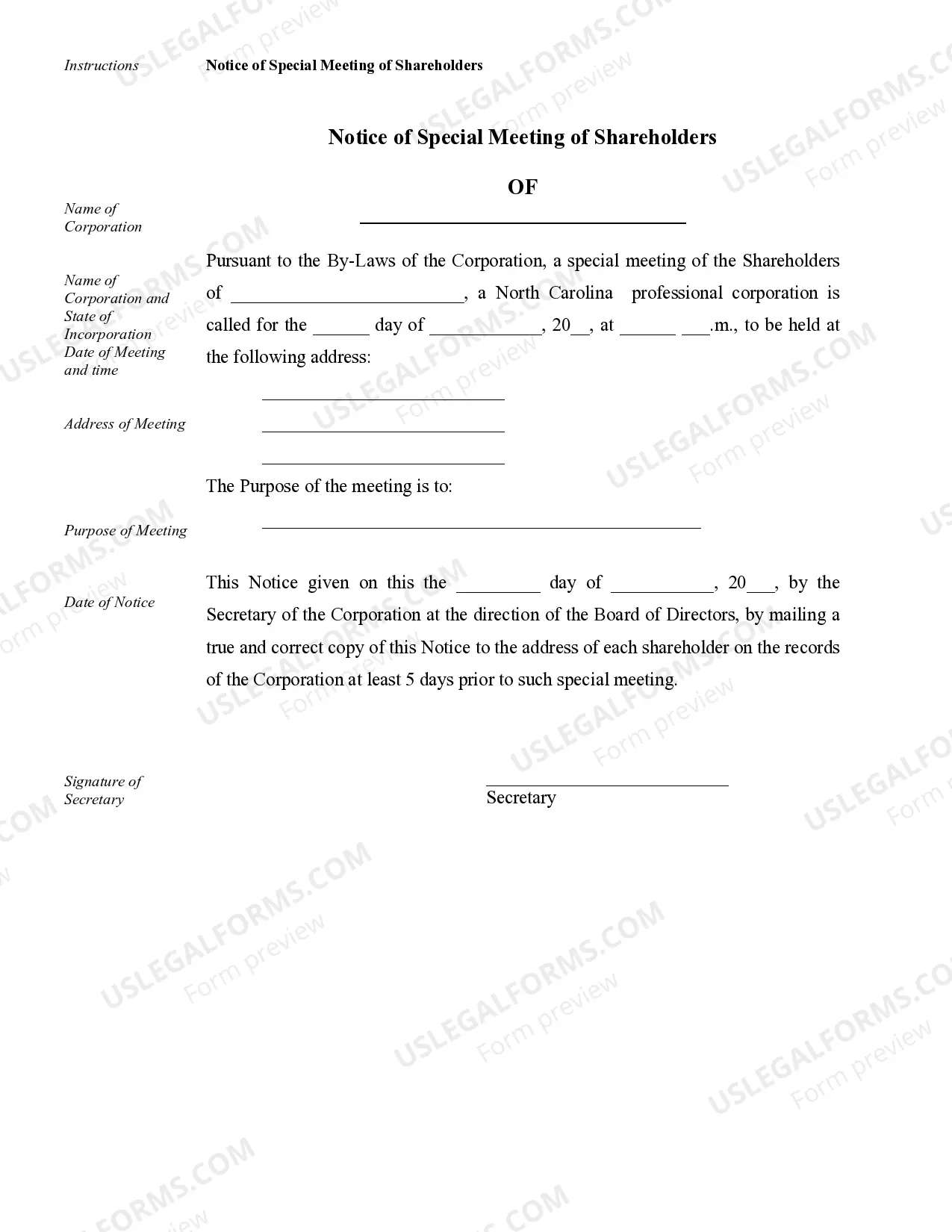

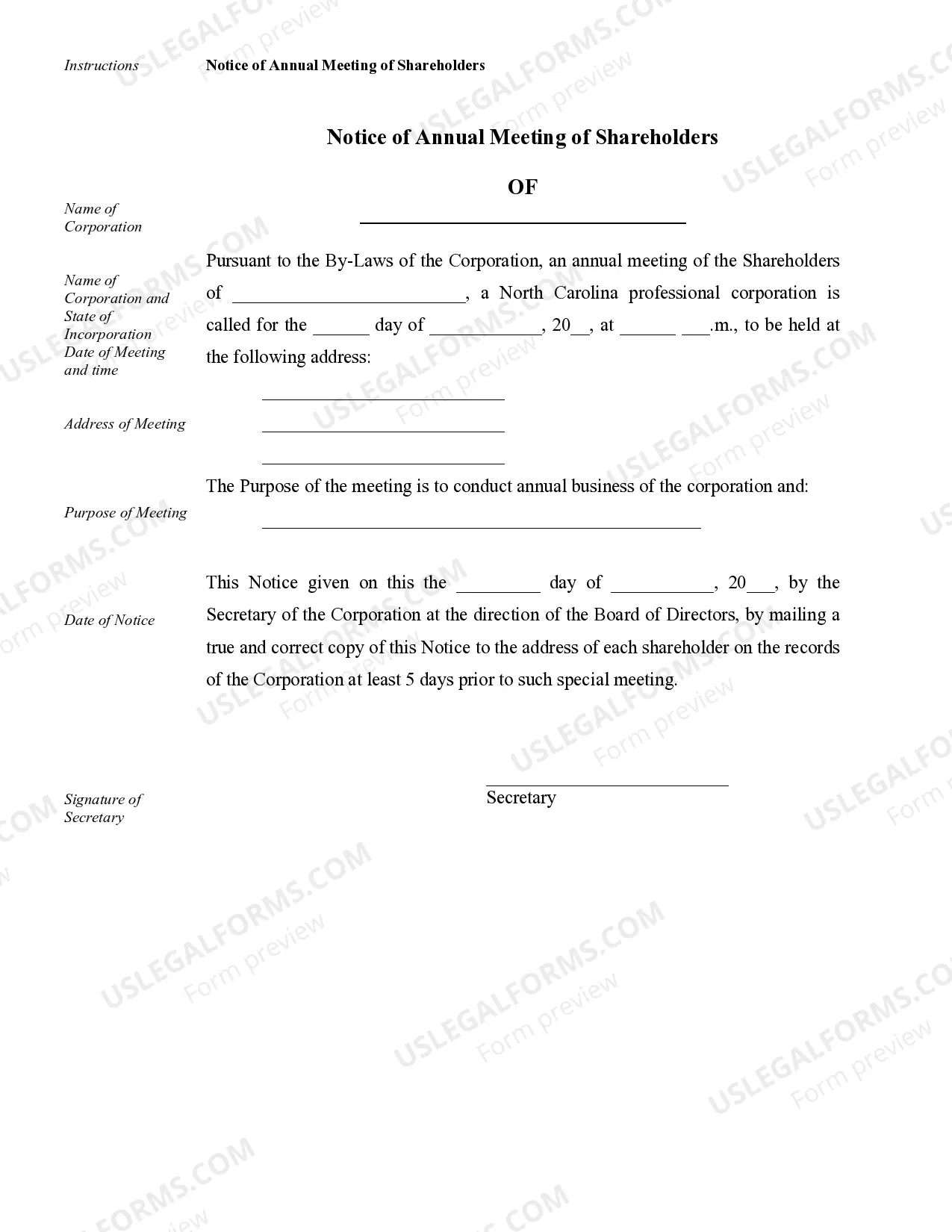

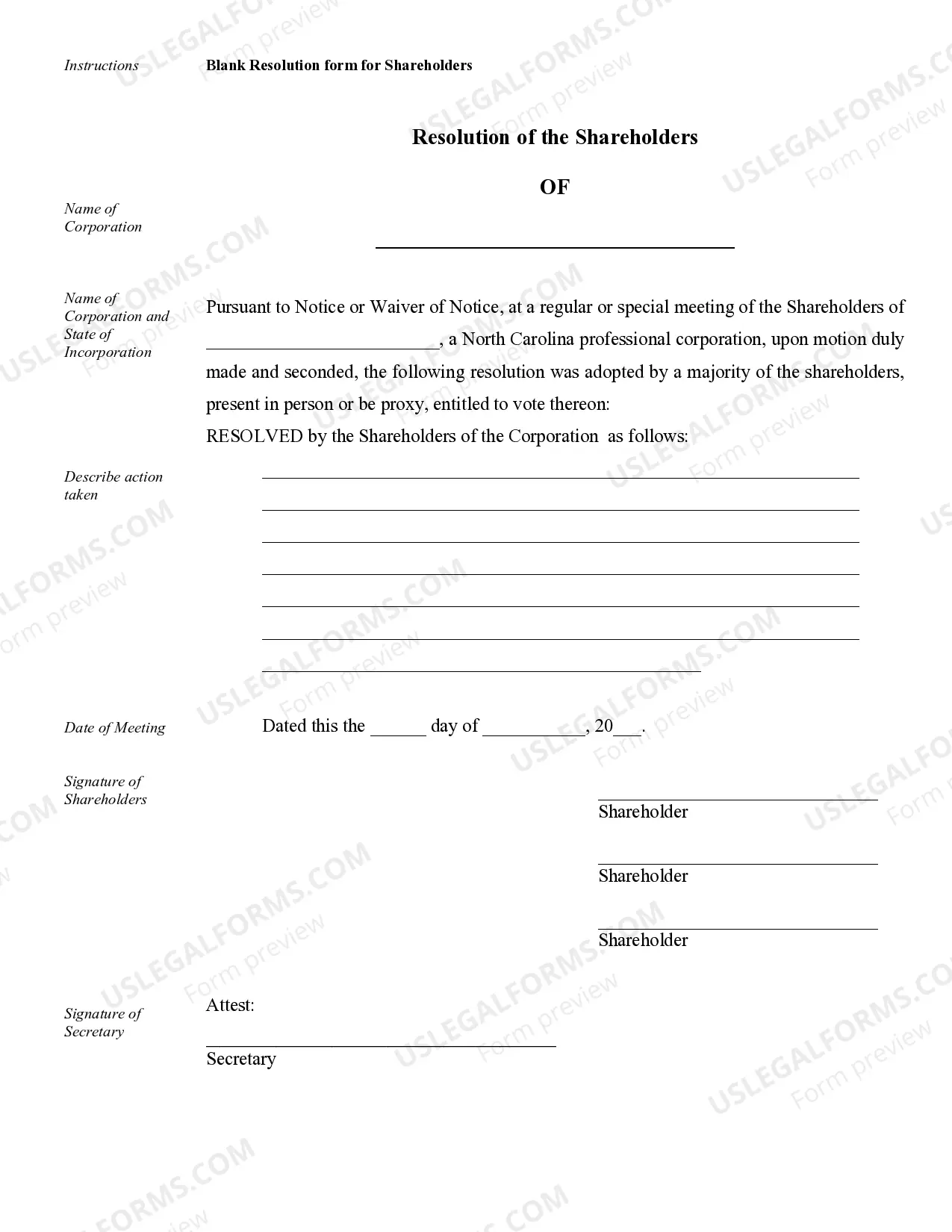

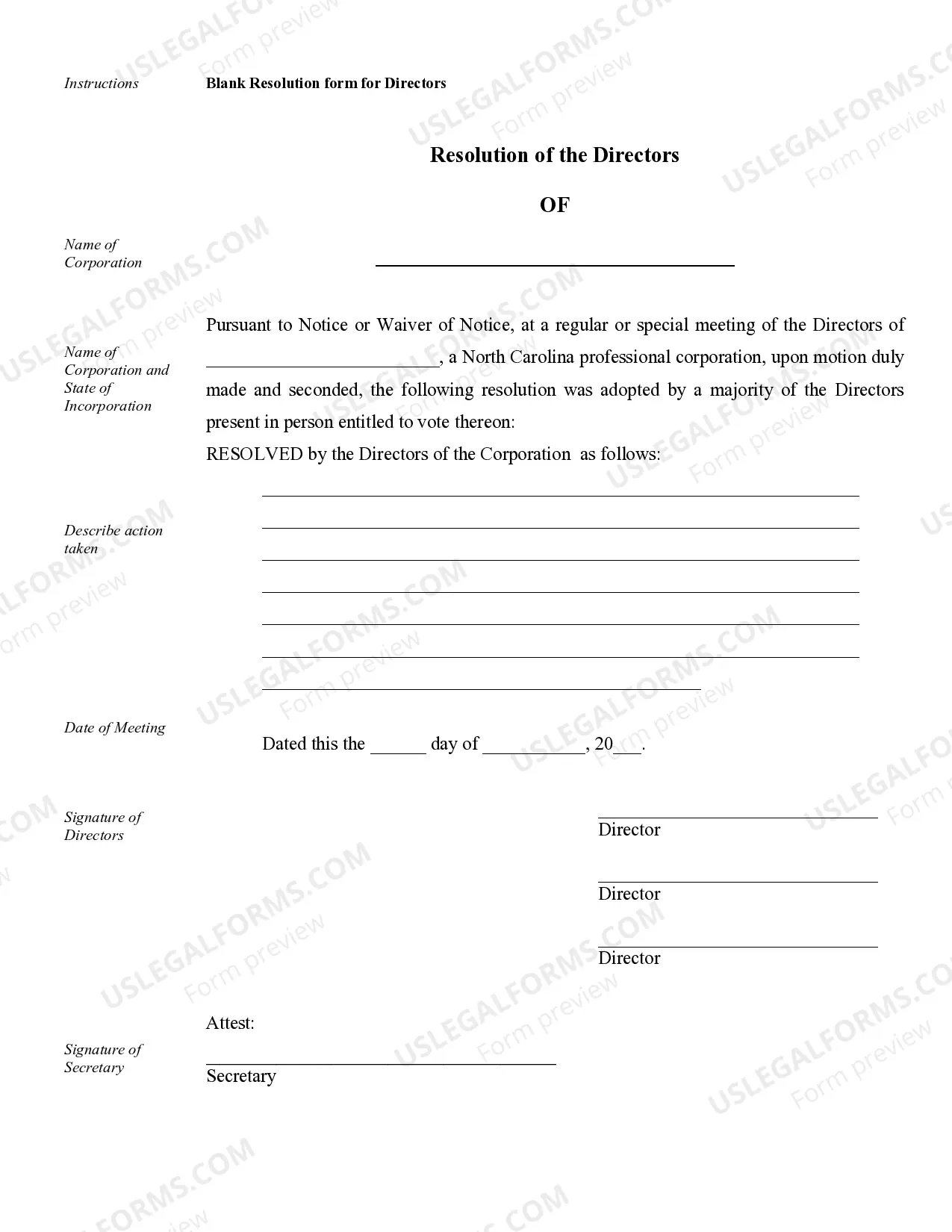

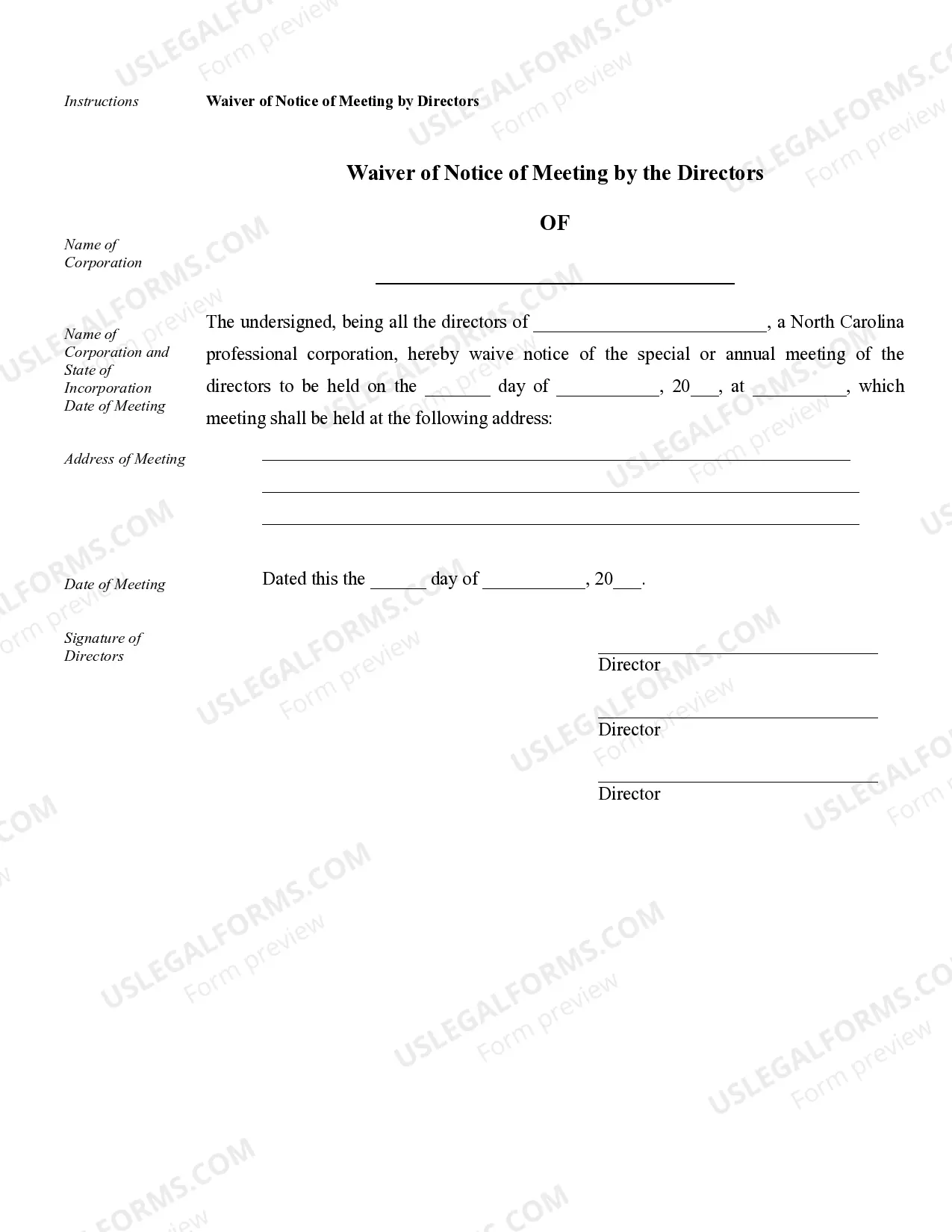

Fayetteville Sample Corporate Records for a North Carolina Professional Corporation provide a comprehensive and organized view of the company's corporate activities, internal procedures, and legal compliance procedures. These records are crucial for maintaining transparency and ensuring regulatory compliance. Below, we discuss the different types of corporate records that are typically maintained by a North Carolina Professional Corporation in Fayetteville. 1. Articles of Incorporation: This vital document establishes the legal existence of a professional corporation and outlines its purpose, structure, and registered agent information. 2. Bylaws: The bylaws serve as the internal operating guidelines for the corporation. It includes provisions for shareholder meetings, director responsibilities, voting procedures, and other essential corporate governance details. 3. Meeting Minutes: Keeping accurate meeting minutes is crucial for documenting decisions, discussions, and resolutions made during board of directors and shareholder meetings. These records help provide a historical account of corporate activities. 4. Shareholder Records: Shareholder records include information about each shareholder, such as their contact information, number of shares owned, and any transfer or issuance of shares. These records are vital for determining voting rights and distributing dividends. 5. Director and Officer Records: These records include details about the corporation's directors and officers, such as their names, addresses, positions, and any changes to their roles or responsibilities. 6. Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements, give a snapshot of the corporation's financial health. These records are crucial for investors, lenders, and regulatory authorities. 7. Annual Reports: North Carolina Professional Corporations are required to file annual reports with the Secretary of State's office. These reports provide updates on the corporate structure, shareholding information, current officers, and contact details of the corporation. 8. Stock Certificates: Stock certificates represent ownership of shares in the corporation. They provide tangible evidence of ownership and are essential for individuals or entities holding shares in the corporation. By maintaining these Fayetteville Sample Corporate Records, a North Carolina Professional Corporation can adhere to legal requirements and ensure transparency within the organization. These records also facilitate smooth audits, assist in resolving disputes, and demonstrate compliance to regulators, investors, and other stakeholders.

Fayetteville Sample Corporate Records for a North Carolina Professional Corporation

Description

How to fill out Fayetteville Sample Corporate Records For A North Carolina Professional Corporation?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone with no law education to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our service provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the Fayetteville Sample Corporate Records for a North Carolina Professional Corporation or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Fayetteville Sample Corporate Records for a North Carolina Professional Corporation in minutes employing our reliable service. In case you are presently a subscriber, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our platform, make sure to follow these steps before downloading the Fayetteville Sample Corporate Records for a North Carolina Professional Corporation:

- Ensure the template you have found is specific to your location because the regulations of one state or county do not work for another state or county.

- Preview the document and go through a quick description (if provided) of cases the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and look for the needed document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Fayetteville Sample Corporate Records for a North Carolina Professional Corporation once the payment is completed.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.