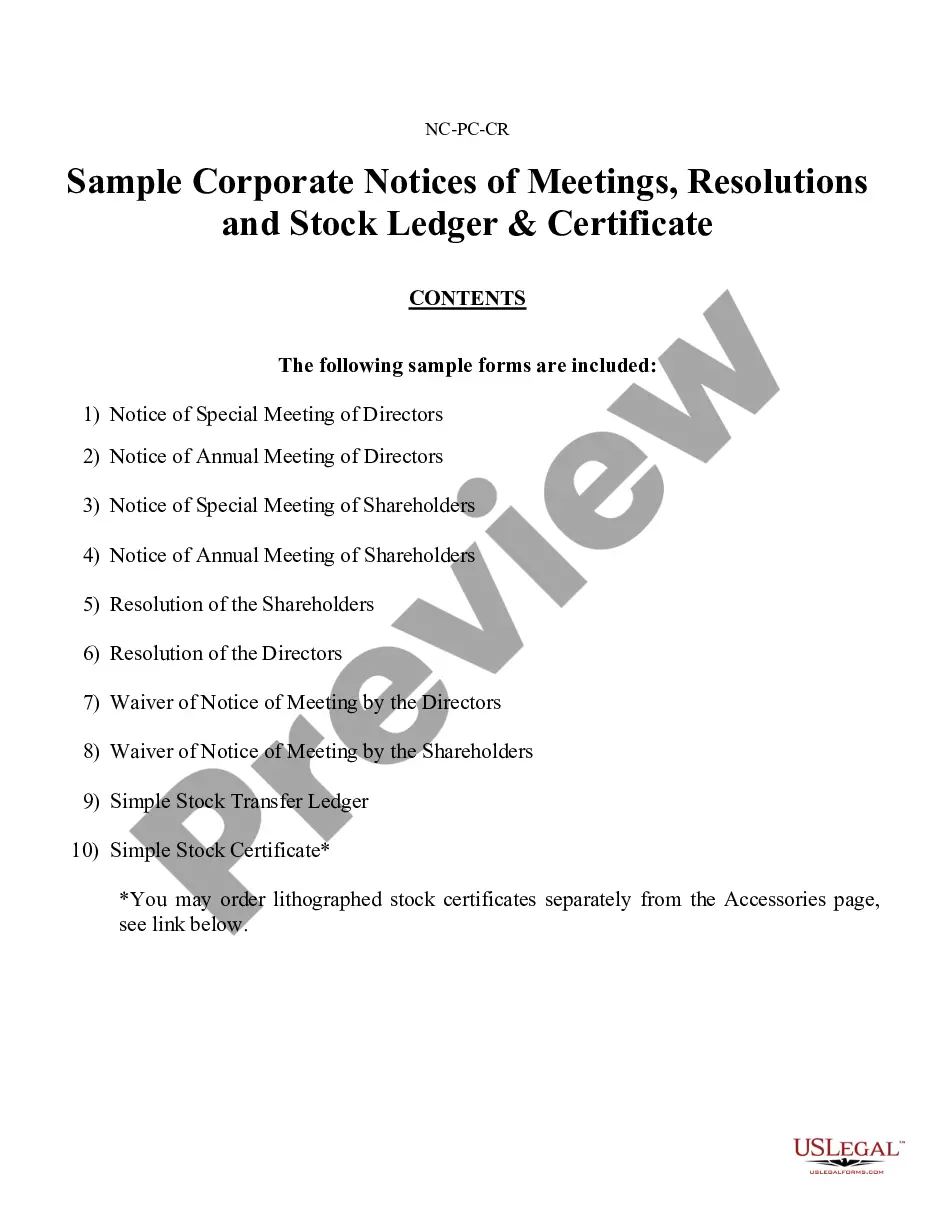

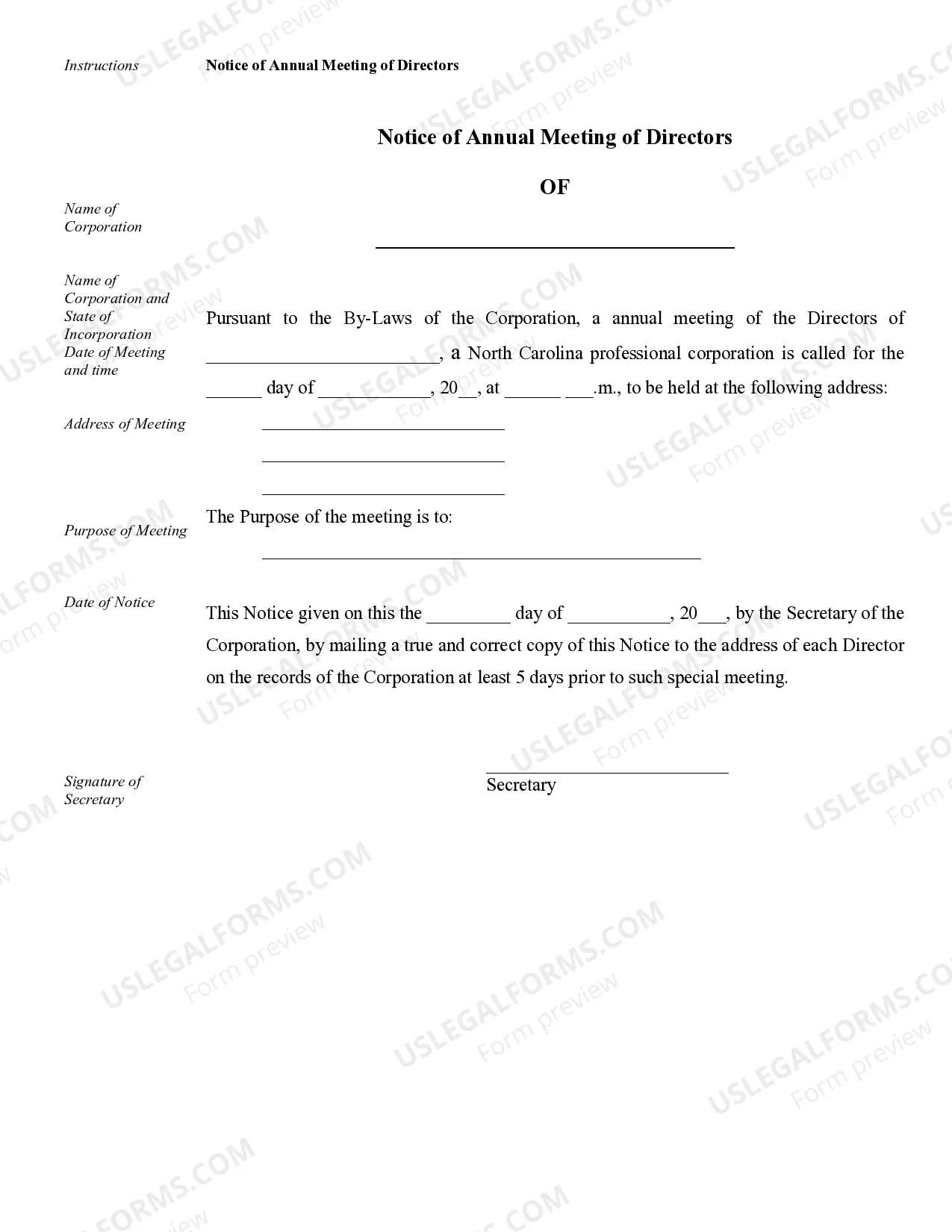

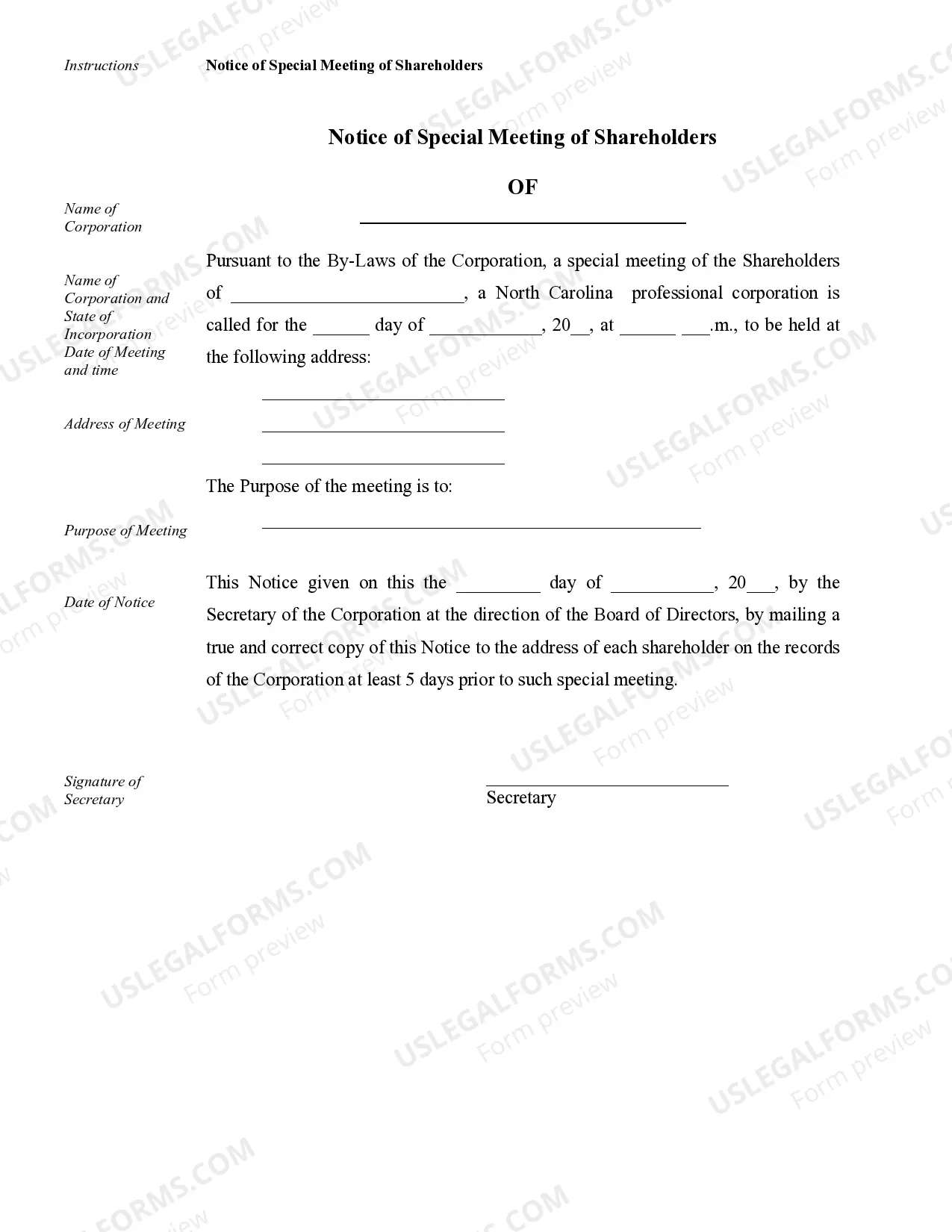

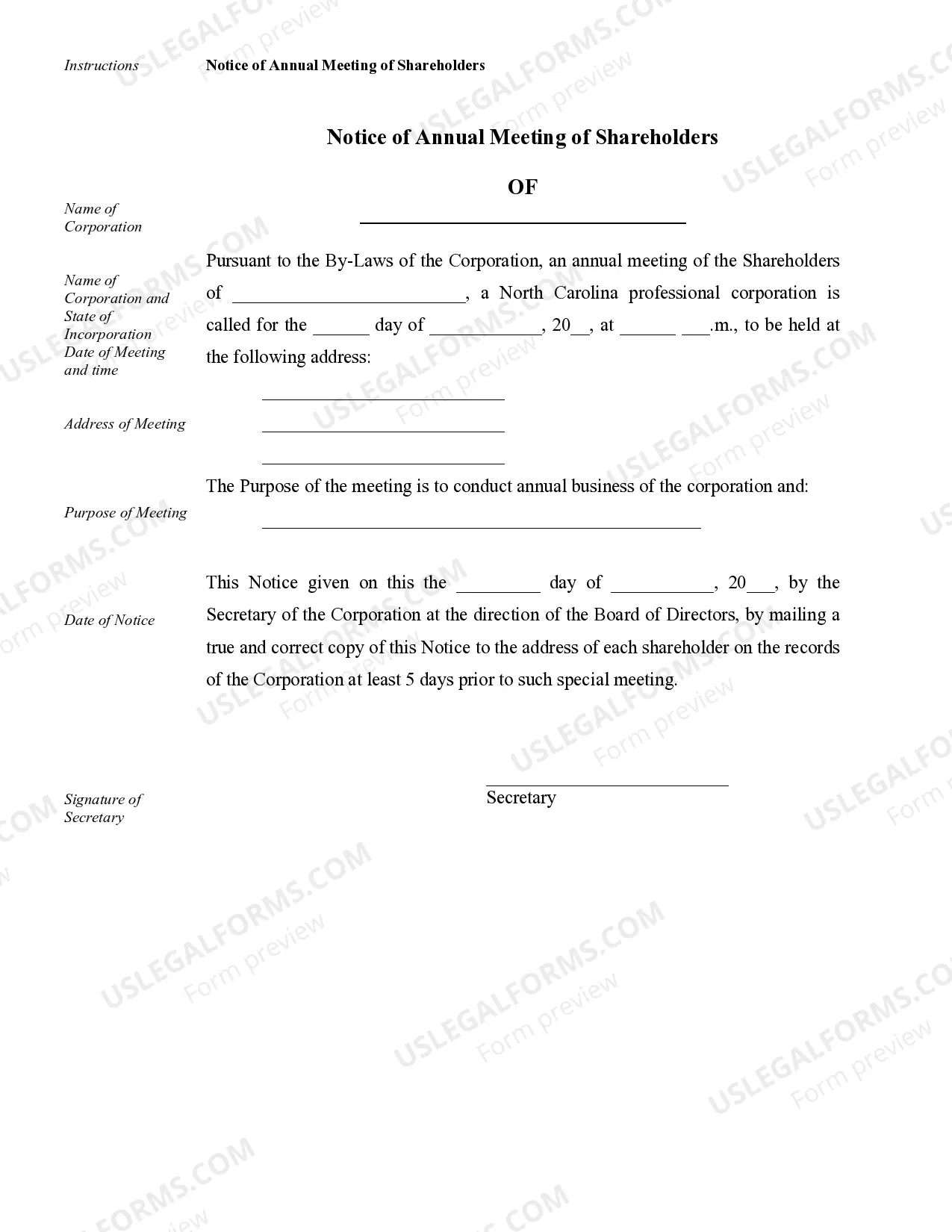

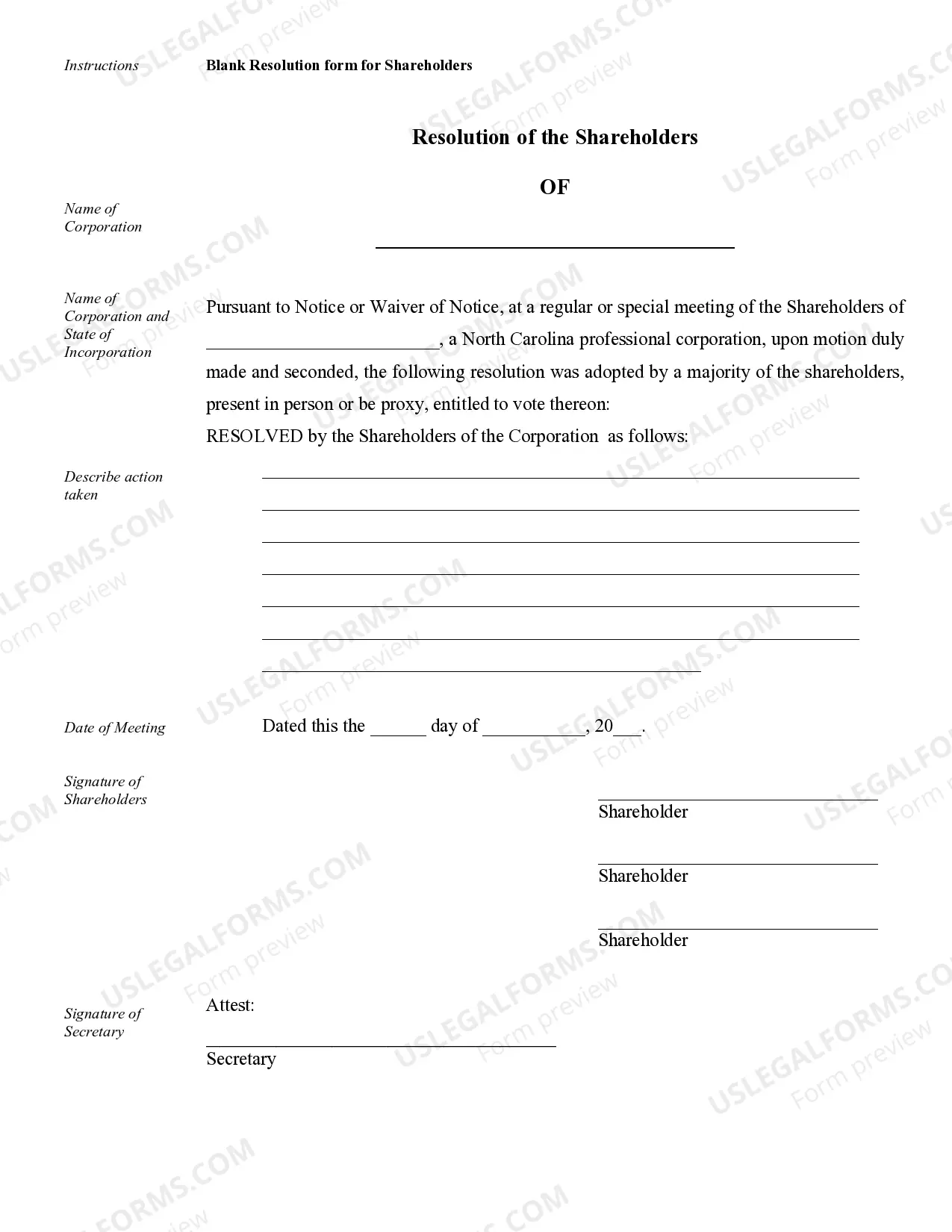

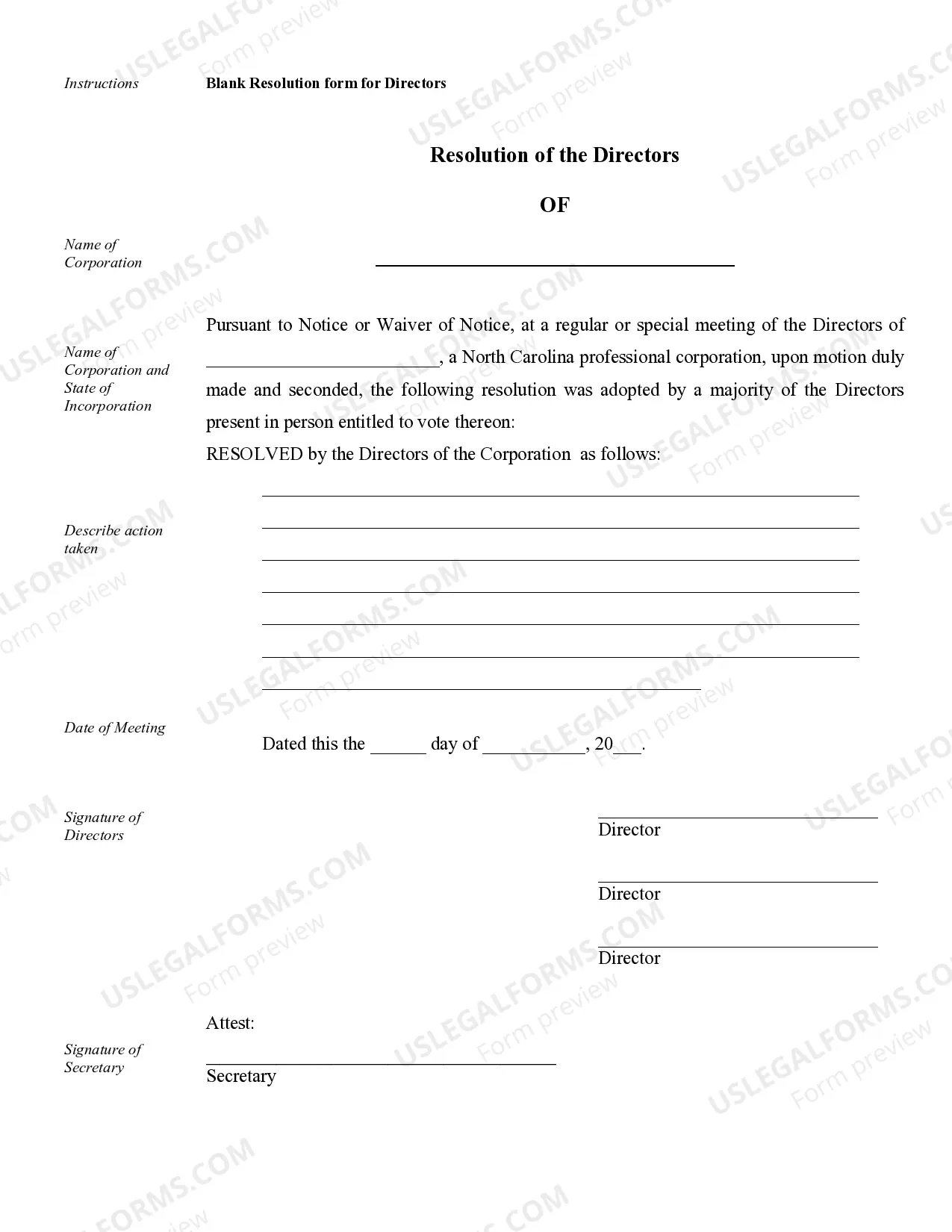

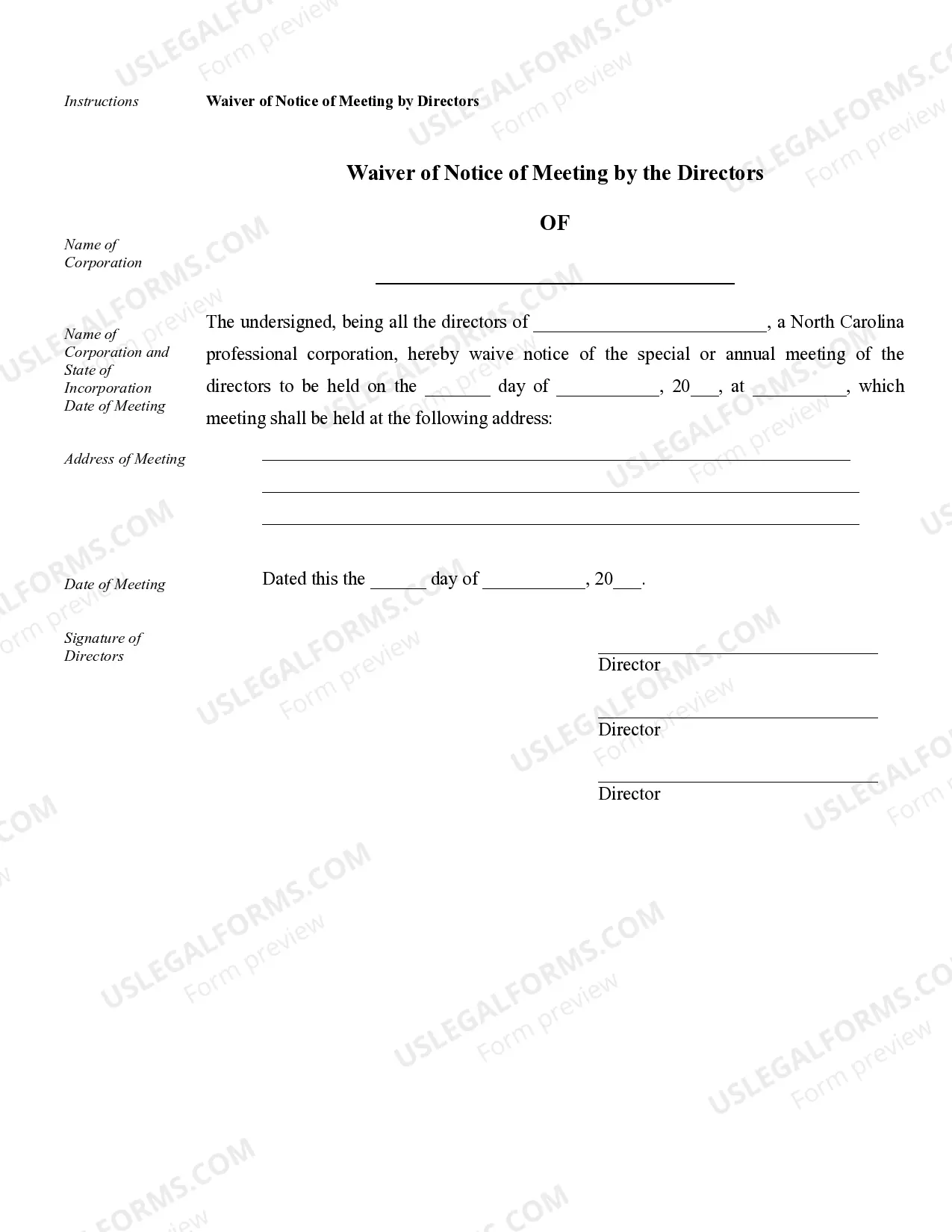

Wake Sample Corporate Records for a North Carolina Professional Corporation play a crucial role in documenting and maintaining the legal and financial activities of a professional corporation in Wake County, North Carolina. These records are essential for ensuring compliance with state regulations and laws, as well as for providing transparency and accountability to shareholders and stakeholders. Here are some key types of Wake Sample Corporate Records for a North Carolina Professional Corporation: 1. Articles of Incorporation: This initial document establishes the formation of the professional corporation and contains important details such as the corporation's name, purpose, registered agent, and duration. 2. Bylaws: The bylaws outline the internal rules and procedures that govern the operations and decision-making processes of the corporation. This includes information on directors, officers, stockholders, and meetings. 3. Meeting Minutes: Meeting minutes offer a detailed record of discussions, decisions, and actions taken during corporate meetings, including board of directors meetings, stockholders' meetings, and committee meetings. These minutes are vital for legal and historical purposes. 4. Shareholder Records: These records contain information about the corporation's shareholders, including their names, addresses, shareholdings, and any transfers or changes to their ownership. These records help maintain transparency and facilitate communication between the corporation and its shareholders. 5. Financial Statements: Financial statements, such as income statements, balance sheets, and cash flow statements, provide a comprehensive overview of the corporation's financial health, performance, and position. These records are important for investors, auditors, and regulators. 6. Annual Reports: Professional corporations in North Carolina are typically required to file annual reports with the Secretary of State's office. These reports provide an update on the corporation's activities, directors, officers, and registered agent. They ensure compliance with state regulations and facilitate the payment of necessary fees. 7. Contracts and Agreements: Wake Sample Corporate Records should include copies of all contracts, agreements, and legal documents entered into by the corporation. This may include employment contracts, lease agreements, vendor contracts, and client agreements. 8. Licensing and Permit Documents: If the professional corporation requires specific licenses or permits operating in Wake County, these records must be included in the corporate records. This ensures compliance with local, state, and federal regulations. 9. Tax Records: Copies of tax returns, tax payments, and any related correspondence with tax authorities should be included in the Wake Sample Corporate Records. This ensures the corporation complies with the relevant tax laws and regulations. 10. Intellectual Property Documentation: If the professional corporation owns intellectual property, such as trademarks or patents, these records must be maintained. This includes registration certificates, renewal notices, and any relevant legal agreements. Maintaining accurate and up-to-date Wake Sample Corporate Records is crucial for a North Carolina Professional Corporation to maintain its legal standing, protect its rights and interests, and ensure compliance with rules and regulations. These records act as a comprehensive archive of the corporation's activities and enable easy retrieval of information when required.

Wake Sample Corporate Records for a North Carolina Professional Corporation

Description

How to fill out Wake Sample Corporate Records For A North Carolina Professional Corporation?

If you are searching for a valid form template, it’s extremely hard to choose a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the web. With this library, you can get thousands of document samples for business and individual purposes by categories and regions, or key phrases. With the high-quality search option, getting the newest Wake Sample Corporate Records for a North Carolina Professional Corporation is as elementary as 1-2-3. Furthermore, the relevance of every record is verified by a group of professional lawyers that on a regular basis review the templates on our website and update them based on the newest state and county requirements.

If you already know about our platform and have a registered account, all you should do to receive the Wake Sample Corporate Records for a North Carolina Professional Corporation is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the form you require. Look at its information and utilize the Preview option to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to get the appropriate document.

- Confirm your choice. Select the Buy now option. Next, pick your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to complete the registration procedure.

- Receive the form. Select the file format and save it on your device.

- Make modifications. Fill out, edit, print, and sign the obtained Wake Sample Corporate Records for a North Carolina Professional Corporation.

Every single form you add to your account has no expiration date and is yours forever. You always have the ability to access them using the My Forms menu, so if you need to get an extra copy for modifying or printing, you can return and download it again at any moment.

Take advantage of the US Legal Forms professional library to gain access to the Wake Sample Corporate Records for a North Carolina Professional Corporation you were seeking and thousands of other professional and state-specific samples in one place!