Certificate - Release or Satisfaction of Deed of Trust

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

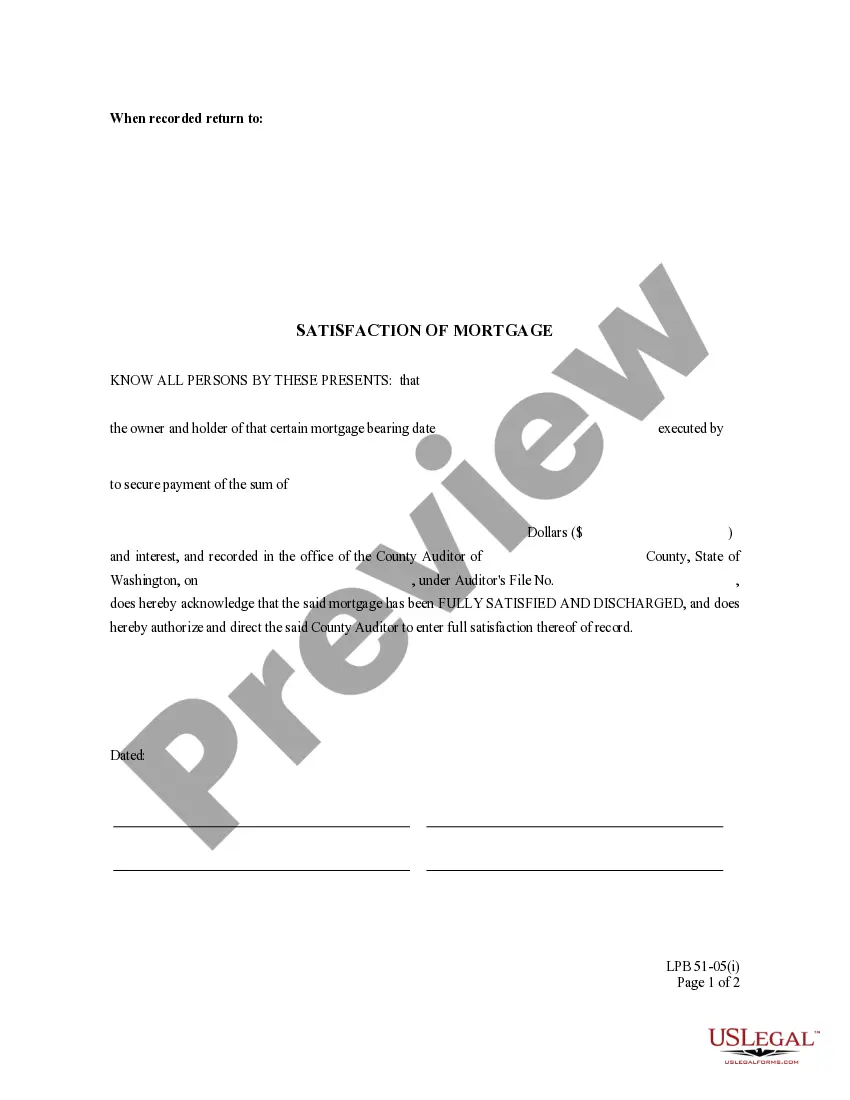

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

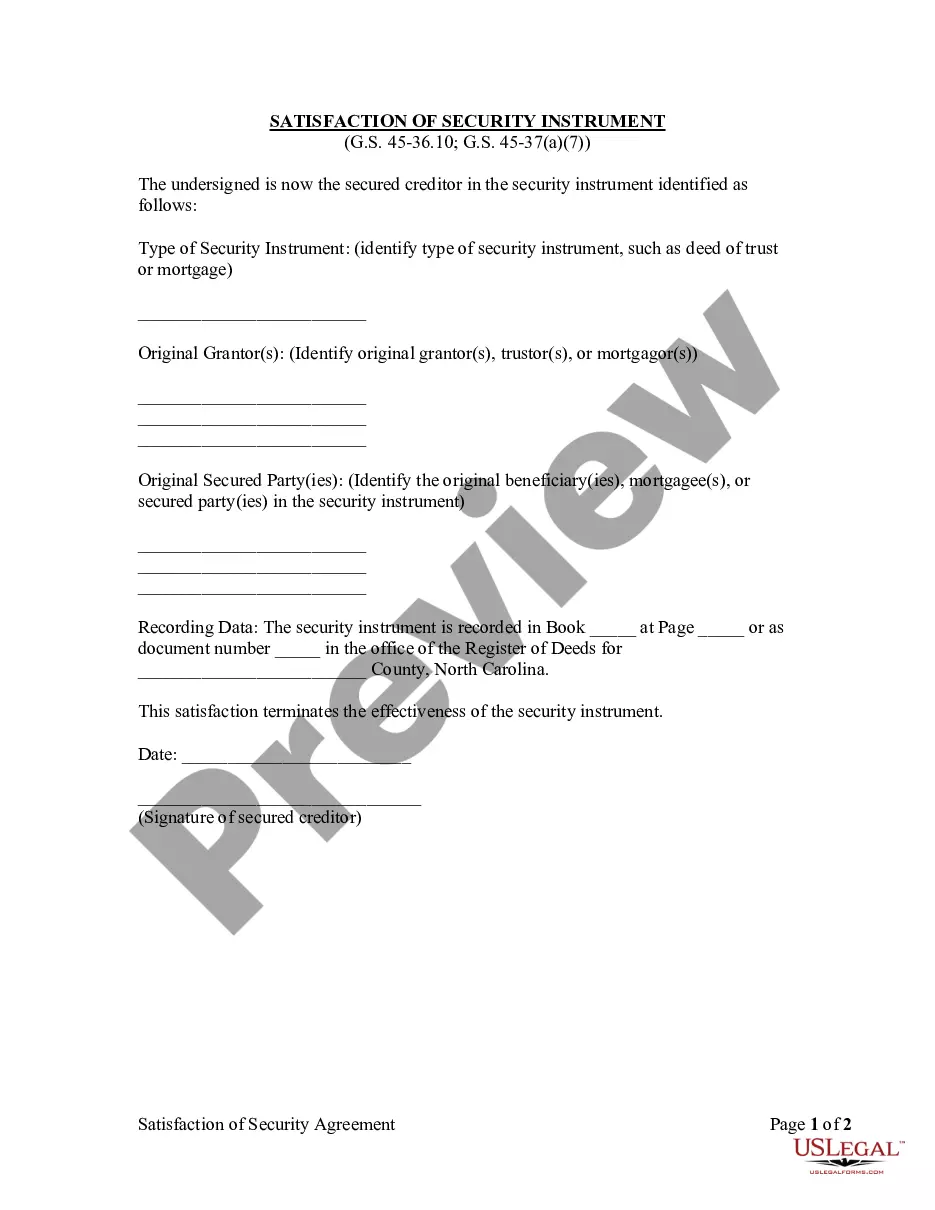

North Carolina Law

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: A petitioner may recover damages under this section only if he has given the mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill the requirements of this section. See code section 45-36.3(2)(b), below.

Recording Satisfaction: Upon full payoff, within 60 days lender must either forward satisfaction document to borrower, or have satisfaction recorded of record. See, 45-36.3, below.

Marginal Satisfaction: May be done in addition to recording satisfaction document. See 45-37, below.

Penalty: Any person, institution or agent who fails to comply with this section may be required to pay a civil penalty of not more than one thousand dollars ($1,000) in addition to reasonable attorneys' fees and any other damages awarded by the court to the grantor, trustor or mortgagor, or to a subsequent purchaser of the property from the grantor, trustor or mortgagor. See code section 45-36.3(2)(b) below.

Acknowledgment: An assignment or satisfaction must contain a proper North Carolina acknowledgment, or other acknowledgment approved by Statute.

North Carolina Statutes

§ 45-36.2. Obligation of good faith.

Every action or duty within this Article imposes an obligation of good faith in its performance or enforcement. (1953, c. 848; 2005-123, s. 1.)

§ 45-36.3. Notification by mortgagee of satisfaction of provisions of deed of trust or mortgage, or other instrument; civil penalty.

(a) After the satisfaction of the provisions of any deed of trust or mortgage, or other instrument intended to secure with real property the payment of money or the performance of any other obligation and registered as required by law, the holder of the evidence of the indebtedness, if it is a single instrument, or a duly authorized agent or attorney of such holder shall within 60 days:

(1) Discharge and release of record such documents and forward the cancelled documents to the grantor, trustor or mortgagor; or,

(2) Alternatively, the holder of the evidence of the indebtedness or a duly authorized agent or attorney of such holder, at the request of the grantor, trustor or mortgagor, shall forward said instrument and the deed of trust or mortgage instrument, with payment and satisfaction acknowledged in accordance with the requirements of G.S. 45-37, to the grantor, trustor or mortgagor.

(b) Any person, institution or agent who fails to comply with this section may be required to pay a civil penalty of not more than one thousand dollars ($1,000) in addition to reasonable attorneys' fees and any other damages awarded by the court to the grantor, trustor or mortgagor, or to a subsequent purchaser of the property from the grantor, trustor or mortgagor. A five hundred dollar ($500.00) civil penalty may be recovered by the grantor, trustor or mortgagor, and a five hundred dollar ($500.00) penalty may be recovered by the purchaser of the property from the grantor, trustor or mortgagor. If that purchaser of the property consists of more than a single grantee, then the civil penalty will be divided equally among all of the grantees. A petitioner may recover damages under this section only if he has given the mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill the requirements of this section.

(c) Should any person, institution or agent who is not the present holder of the evidence of indebtedness be required to pay a civil penalty, attorneys' fees, or other damages under this section, they will have an action against the holder of the evidence of indebtedness for all sums they were required to pay.

(d) This section applies only if the provisions of the deed of trust, mortgage, or other instrument are satisfied before October 1, 2005. (1979, c. 681, s. 1; 1987, c. 662, ss. 1-3; 2005-123, s. 1.)

§ 45-37. Satisfaction of record of security instruments.

(a) Subject to the provisions of G.S. 45-36.9(a) and G.S. 45-73 relating to security instruments which secure future advances, any security instrument intended to secure the payment of money or the performance of any other obligation registered as required by law may be satisfied of record and thereby discharged and released of record in the following manner:

(1) Security instruments satisfied of record prior to October 1, 2005, pursuant to this subdivision as it was in effect prior to October 1, 2005, shall be deemed satisfied of record, discharged, and released.

(2) Security instruments satisfied of record prior to October 1, 2011, pursuant to this subdivision as it was in effect prior to October 1, 2011, shall be deemed satisfied of record, discharged, and released.

(3) Security instruments satisfied of record prior to October 1, 2011, pursuant to this subdivision as it was in effect prior to October 1, 2011, shall be deemed satisfied of record, discharged, and released.

(4) Security instruments satisfied of record prior to October 1, 2011, pursuant to this subdivision as it was in effect prior to October 1, 2011, shall be deemed satisfied of record, discharged, and released.

(5) Security instruments satisfied of record prior to October 1, 2005, pursuant to this subdivision as it was in effect prior to October 1, 2005, shall be deemed satisfied of record, discharged, and released.<br />

<br />

(6) Security instruments satisfied of record prior to October 1, 2005, pursuant to this subdivision as it was in effect prior to October 1, 2005, shall be deemed satisfied of record, discharged, and released.<br />

<br />

(7) By recording:<br />

<br />

a. A satisfaction document that satisfies the requirements of G.S. 45-36.10,<br />

<br />

b. An affidavit of satisfaction that satisfies the requirements of G.S. 45-36.16, or<br />

<br />

c. A trustee’s satisfaction that satisfies the requirements of G.S. 45-36.20, but only if the security instrument is a deed of trust.<br />

<br />

The register of deeds shall not be required to verify or make inquiry concerning (i) the truth of the matters stated in any satisfaction document, affidavit of satisfaction, or trustee’s satisfaction, or (ii) the authority of the person executing any satisfaction document, affidavit, or trustee’s satisfaction to do so.<br />

<br />

(b) It shall be conclusively presumed that the conditions of any security instrument recorded before October 1, 2011, securing the payment of money or securing the performance of any other obligation or obligations have been complied with or the debts secured thereby paid or obligations performed, as against creditors or purchasers for valuable consideration from the mortgagor or grantor, from and after the expiration of 15 years from whichever of the following occurs last:<br />

<br />

(1) The date when the conditions of the security instrument were required by its terms to have been performed, or<br />

<br />

(2) The date of maturity of the last installment of debt or interest secured thereby;<br />

<br />

provided that on or before October 1, 2011, and before the lien has expired pursuant to this subsection, the holder of the indebtedness secured by the security instrument or party secured by any provision thereof may file an affidavit with the register of deeds which affidavit shall specifically state:<br />

<br />

(1) The amount of debt unpaid, which is secured by the security instrument; or<br />

<br />

(2) In what respect any other condition thereof shall not have been complied with; or<br />

<br />

may record a separate instrument signed by the secured creditor and witnessed by the register of deeds stating:<br />

<br />

(1) Any payments that have been made on the indebtedness or other obligation secured by the security instrument including the date and amount of payments and<br />

<br />

(2) The amount still due or obligations not performed under the security instrument.<br />

<br />

The effect of the filing of the affidavit or the recording of a separate instrument made as herein provided shall be to postpone the effective date of the conclusive presumption of satisfaction to a date 15 years from the filing of the affidavit or from the recording of the separate instrument. There shall be only one postponement of the effective date of the conclusive presumption provided for herein. The register of deeds shall record and index the affidavit provided for herein or the separate instrument made as herein provided as a subsequent instrument in accordance with G.S. 161-14.1. This subsection shall not apply to any security instrument made or given by any railroad company, or to any agreement of conditional sale, equipment trust agreement, lease, chattel mortgage or other instrument relating to the sale, purchase or lease of railroad equipment or rolling stock, or of other personal property.<br />

<br />

The lien of any security instrument that secured the payment of money or the performance of any other obligation or obligations and that was conclusively presumed to have been fully paid and performed prior to October 1, 2011, pursuant to the provisions of this subsection is conclusively deemed to have expired and shall be of no further force or effect. No release, satisfaction, or other instrument is necessary to discharge the lien of a security instrument that has expired; however, nothing in this section shall be construed as affecting or preventing the execution and recordation of any such release, satisfaction, or other document.<br />

<br />

This subsection shall apply only to security instruments securing the payment of money or securing the performance of any other obligation or obligations that were conclusively presumed pursuant to this subsection to have been fully paid and performed prior to October 1, 2011. All other security instruments shall be subject to the provisions of G.S. 45-36.24.<br />

<br />

(c) Repealed by Session Laws 1991, c. 114, s. 4.<br />

<br />

(d) Repealed by Session Laws 2005-123, s. 1.<br />

<br />

(e) Any transaction subject to the provisions of the Uniform Commercial Code, Chapter 25 of the General Statutes, is controlled by the provisions of that act and not by this section.<br />

<br />

(f) Whenever this section requires a signature or endorsement, that signature or endorsement shall be followed by the name of the person signing or endorsing the document printed, stamped, or typed so as to be clearly legible.<br />

<br />

(g) The satisfaction of record of a security instrument pursuant to this section shall operate and have the same effect as a duly executed and recorded deed of release or reconveyance of the property described in the security instrument and shall release and discharge (i) all the interest of the secured creditor in the real property arising from the security instrument and, (ii) if the security instrument is a deed of trust, all the interest of the trustee or substitute trustee in the real property arising from the deed of trust. (1870-1, c. 217; Code, s. 1271; 1891, c. 180; 1893, c. 36; 1901, c. 46; Rev., s. 1046; 1917, c. 49, s. 1; c. 50, s. 1; C.S., s. 2594; 1923, c. 192, s. 1; c. 195; 1935, c. 47; 1945, c. 988; 1947, c. 880; 1951, c. 292, s. 1; 1967, c. 765, ss. 1-5; 1969, c. 746; 1975, c. 305; 1985, c. 219; 1987, c. 405, s. 1; c. 620, s. 1; 1989, c. 434, s. 1; 1991, c. 114, s. 4; 1995, c. 292, ss. 1, 2, 5; 1995 (Reg. Sess., 1996), c. 604, s. 1; 2005-123, s. 1; 2006-226, s. 12; 2006-259, s. 2; 2006-264, s. 40(b); 2011-246, s. 4; 2011-312, s. 12.)<br />

<br />

§ 45-37.2. Indexing satisfactions and other documents relating to security instruments.<br />

<br />

(a) The register of deeds shall record and index the following instruments in accordance with G.S. 161-14.1:<br />

<br />

(1) A substitution of trustee.<br />

<br />

(2) A document of rescission recorded pursuant to G.S. 45-36.6.<br />

<br />

(3) A deed of release or reconveyance.<br />

<br />

(4) A partial release recorded pursuant to G.S. 45-36.22.<br />

<br />

(5) An obligation release recorded pursuant to G.S. 45-36.23.<br />

<br />

(6) A satisfaction document, affidavit of satisfaction, or trustee’s satisfaction recorded pursuant to G.S. 45-37(a)(7).<br />

<br />

(7) A lien maturity extension agreement or notice of maturity date recorded pursuant to G.S. 45-36.24.<br />

<br />

No fee shall be charged by the register of deeds for recording a satisfaction document, affidavit of satisfaction, or a trustee’s satisfaction.<br />

<br />

(b) G.S. 161-14.1 (1963, c. 1021, s. 1; 1967, c. 765, s. 6; 1987, c. 620, s. 2; 1991, c. 114, s. 2; 1993, c. 425, s. 3; 1995, c. 292, s. 6; 2005-123, s. 1; 2011-246, s. 5; 2011-312, s. 13.)<br />

<br />

§ 45-41. Recorded deed of release of mortgagee’s representative.<br />

<br />

The personal representative of any mortgagee or trustee in any mortgage or deed of trust which has heretofore or which may hereafter be registered in the manner required by the laws of this State may satisfy of record, discharge and release the same and all property thereby conveyed by deed of quitclaim, release or conveyance executed, acknowledged and recorded as is now prescribed by law for the execution, acknowledgment and registration of deeds and mortgages in this State. (1909, c. 283, s. 1; C.S., s. 2596; 2005-123, s. 1.)<br />

<br />

§ 45-42. Satisfaction of corporate mortgages by corporate officers.<br />

<br />

All security instruments executed to a corporation may be satisfied and so marked of record as by law provided for the satisfaction of security instruments, by any officer of the corporation indicating the office held. For the purposes of recordation and satisfaction, such signature shall be deemed to be a certification by the signer that he is an officer and is authorized to execute the satisfaction on behalf of such corporation. Where security instruments were marked “satisfied” on the records before the twenty-third day of February, 1909, by any president, secretary, treasurer or cashier of any corporation by such officer writing his own name and affixing thereto the title of his office in such corporation, such satisfaction is validated, and is as effective to all intents and purposes as if a deed of release duly executed by such corporation had been made, acknowledged and recorded. (1909, c. 283, ss. 2, 3; C.S., s. 2597; 1935, c. 271; 1963, c. 193; 1991, c. 647, s. 6; 2005-123, s. 1.)