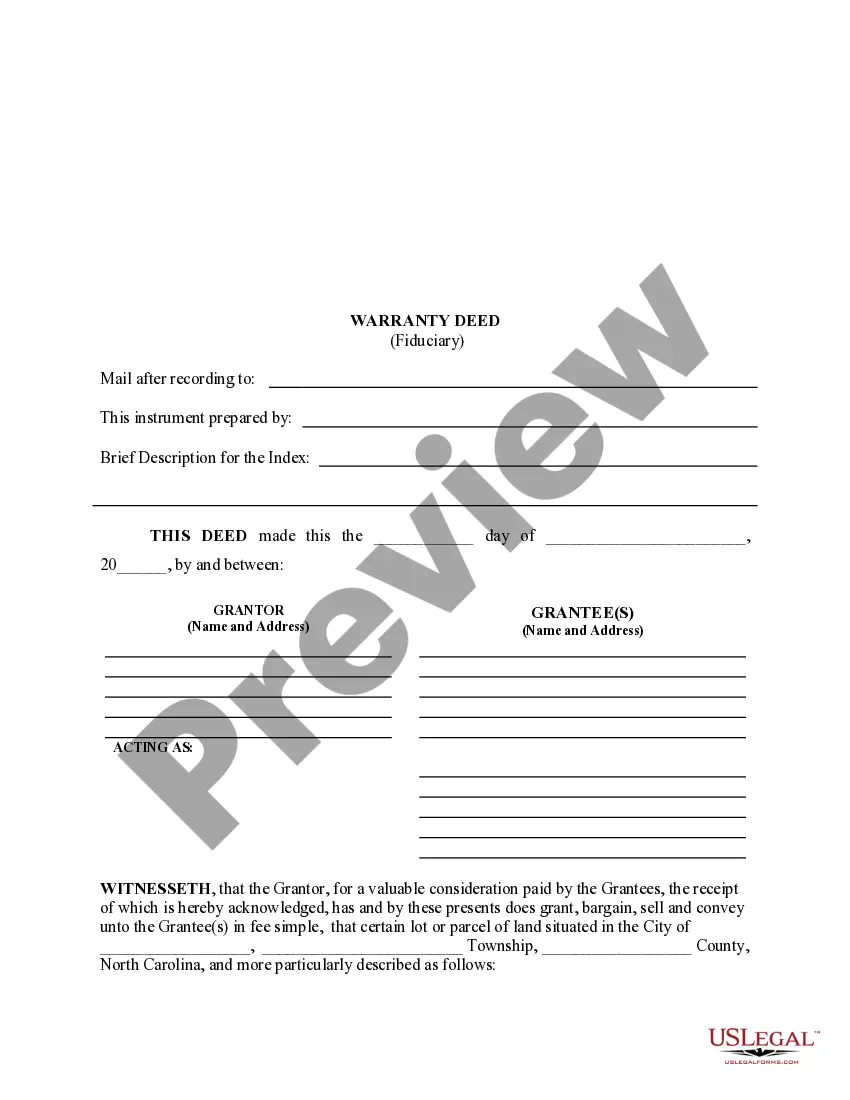

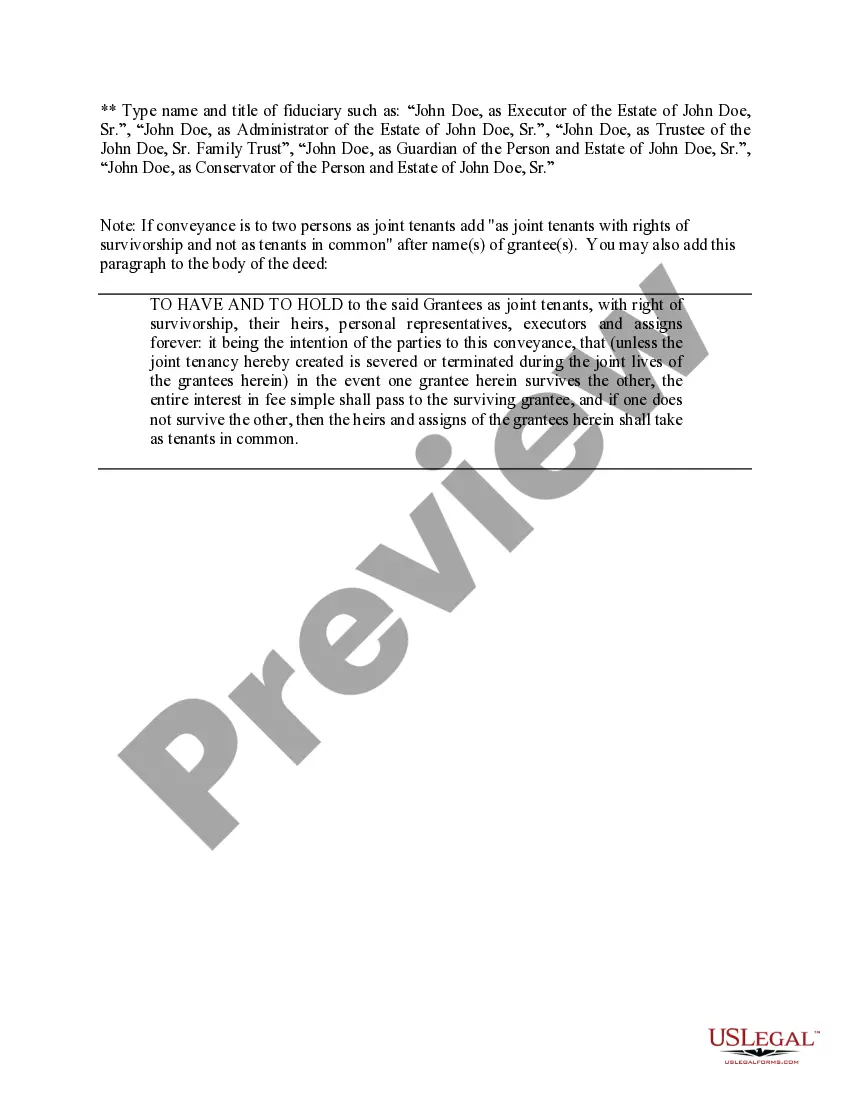

Mecklenburg County, located in North Carolina, provides a specific legal instrument known as the Mecklenburg North Carolina Fiduciary Deed, which is primarily used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries. This deed serves as a means to transfer property ownership from an individual, estate, or trust to a recipient, safeguarding the interests and complying with legal obligations. The Mecklenburg North Carolina Fiduciary Deed acknowledges the fiduciary responsibility of the executor, trustee, trust or, administrator, or any other individual entrusted with managing and distributing assets. It ensures that the property is accurately transferred and preserves the fiduciary's accountability throughout the process. It is crucial to note that although there might not be different types of Mecklenburg North Carolina Fiduciary Deeds, various scenarios warrant the use of this instrument. Some conceivable examples include: 1. Executor Fiduciary Deed: Executors are appointed to administer the assets of an estate after an individual's death, following the provisions outlined in the deceased's will. To transfer property from the estate to the rightful beneficiaries, the executor utilizes the Mecklenburg North Carolina Fiduciary Deed. 2. Trustee Fiduciary Deed: Trustees manage and distribute assets held in trust for the benefit of designated beneficiaries. When the trustee needs to convey the trust property to the beneficiaries or sell the assets, they rely on the Mecklenburg North Carolina Fiduciary Deed. 3. Trust or Fiduciary Deed: Occasionally, a trust or might act as both the granter and the trustee of a trust. In such cases, the trust or utilizes the Mecklenburg North Carolina Fiduciary Deed as the responsible party in transferring property within the trust or to beneficiaries. 4. Administrator Fiduciary Deed: In situations where an individual passes away without a valid will (intestate), an administrator is appointed by the court to manage and distribute the estate's assets. This fiduciary utilizes the Mecklenburg North Carolina Fiduciary Deed to transfer property to the rightful heirs or beneficiaries in accordance with the intestacy laws. By employing the Mecklenburg North Carolina Fiduciary Deed, Executors, Trustees, Trustees, Administrators, and other Fiduciaries can confidently carry out their responsibilities, ensuring that property transfers are conducted legally and efficiently. This instrument protects the interests of both parties involved and upholds the principles of transparency and accountability within the fiduciary role.

Mecklenburg North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

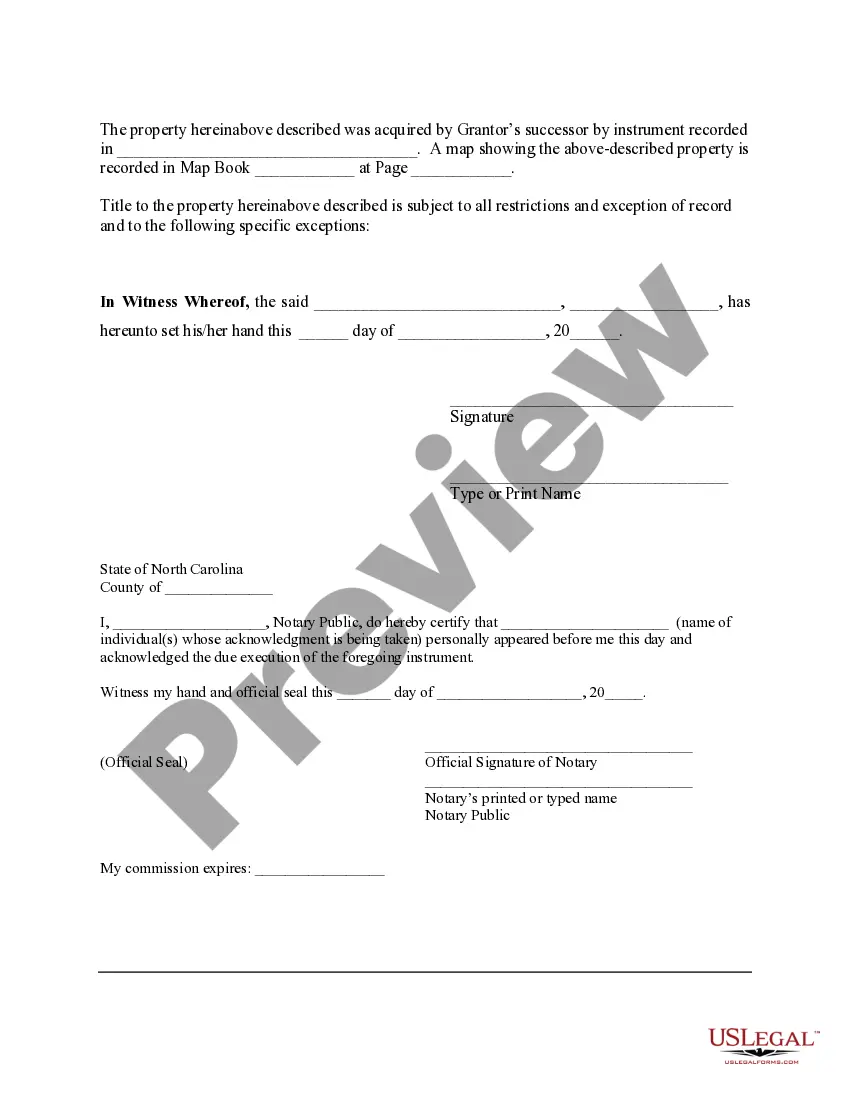

How to fill out Mecklenburg North Carolina Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Mecklenburg North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Mecklenburg North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Mecklenburg North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.

Failing to make sure that transferable assets that were bequeathed to heirs are indeed transferred correctly. Cancelling mortgage bonds in favour of the deceased when it is prejudicial to do so. Giving one-sided advice/instructions to a client, especially in the case of the massing of estates.

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

A fiduciary is someone who manages property or money on behalf of someone else. When you become a fiduciary, the law requires you to manage the person's assets for their benefit?and not your own. In a fiduciary relationship, the person who must prioritize their clients' interests over their own is called the fiduciary.

Unless the Will provides otherwise, under North Carolina law, Executors or Administrators may claim a commission of up to 5% of the Estate assets and receipts, as approved by the Clerk of Court.

How do I keep the Executor honest? - YouTube YouTube Start of suggested clip End of suggested clip File an account. If the executor of the estate of which you're a beneficiary. Just won't do thatMoreFile an account. If the executor of the estate of which you're a beneficiary. Just won't do that then you have the right to go to court.

Protect Yourself as Executor When Facing Estate Litigation Make sure you follow the written wishes of the deceased.Share information with anyone involved in the estate.Document everything that you do for the estate.

The fiduciary is responsible for collecting, appraising and having an inventory of the estate; paying bills, taxes and other expenses belonging to the decedent; and transferring property based on the will or the law. Being a fiduciary is a major responsibility and can be difficult.

You'll have to file a request in the county where the deceased person lived at the time of their death. The paperwork will ask for you to be officially acknowledged as the legal executor representing the estate. In addition to the petition, you'll need to file a valid will, if one exists, and the death certificate.