A Wilmington North Carolina Quitclaim Deed from Husband and Wife to Trust is a legal document used to transfer property ownership rights from a married couple to a trust. This type of deed is commonly used to ensure the smooth transfer of property to a trust, without the need for a traditional sale or purchase transaction. The Quitclaim Deed is a legal instrument that effectively transfers the interest of the husband and wife in the property to the designated trust. By executing this deed, the couple relinquishes all present and future rights, titles, and interests they may hold in the property. The trust then becomes the sole owner of the property in question. In Wilmington, North Carolina, there are various types of Quitclaim Deeds that can be utilized when transferring property from a husband and wife to a trust. Some different types include: 1. Enhanced Life Estate Deed: This type of Quitclaim Deed grants the husband and wife the right to live in the property while they are alive, but upon their death, full ownership is automatically transferred to the designated trust. 2. Joint Tenancy Deed: With this Quitclaim Deed, the husband and wife jointly transfer their ownership interest in the property to the trust. In the event of one spouse's death, the remaining spouse's interest automatically passes to the trust, avoiding probate. 3. Tenancy by the Entirety Deed: This type of Quitclaim Deed is available only to married couples in North Carolina. It ensures that the property is owned by both spouses as a single entity rather than as separate individuals. Upon transferring the property to the trust, the trust becomes the new owner. 4. Community Property with Right of Survivorship Deed: This Quitclaim Deed grants equal ownership rights to the husband and wife as community property. In the event of one spouse's death, the deceased spouse's interest passes to the surviving spouse, and eventually to the trust via the Quitclaim Deed. 5. Revocable Living Trust Deed: This Quitclaim Deed is often used to establish a revocable living trust, which allows the husband and wife to maintain control over their property during their lifetime while providing for an easy transfer to the trust upon their death. When considering a Quitclaim Deed from Husband and Wife to Trust in Wilmington, North Carolina, it is crucial to consult with a qualified real estate attorney or legal professional to ensure the legality and validity of the transfer. The attorney can guide you through the process, explain the different deed options available, and ensure all necessary legal requirements are met.

Wilmington North Carolina Quitclaim Deed from Husband and Wife to Trust

Description

How to fill out Wilmington North Carolina Quitclaim Deed From Husband And Wife To Trust?

We consistently endeavor to reduce or evade legal complications when navigating intricate legal or financial matters.

To achieve this, we seek legal services that are often quite expensive.

However, not all legal matters possess the same level of complexity; many can be managed independently.

US Legal Forms is an online repository of current DIY legal forms addressing a wide range of issues from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply sign in to your account and click the Get button next to it. If you happen to misplace the form, you can always download it again from the My documents section. The procedure is just as straightforward if you are a newcomer to the site! You can establish your account within a few minutes. Ensure that the Wilmington North Carolina Quitclaim Deed from Husband and Wife to Trust adheres to the statutes and regulations of your specific state and area. Additionally, it's imperative that you review the form's outline (if applicable), and if you find any inconsistencies with what you initially sought, look for a different form. Once you confirm that the Wilmington North Carolina Quitclaim Deed from Husband and Wife to Trust meets your requirements, you can select a subscription plan and proceed to payment. After that, you can download the form in any compatible file format. For over 24 years in the marketplace, we have assisted millions by providing ready-to-customize and current legal forms. Leverage US Legal Forms now to conserve time and resources!

- Our platform empowers you to handle your affairs independently without the necessity of hiring an attorney.

- We offer access to legal document templates that may not always be readily available to the public.

- Our templates are tailored to specific states and regions, which significantly eases the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Wilmington North Carolina Quitclaim Deed from Husband and Wife to Trust or any other document promptly and securely.

Form popularity

FAQ

In North Carolina, you do not legally need a lawyer to prepare a quitclaim deed. However, many people find it beneficial to consult with a legal professional, especially when dealing with a Wilmington North Carolina Quitclaim Deed from Husband and Wife to Trust. A lawyer can help ensure that the deed is properly drafted and meet all the necessary legal requirements. Using platforms like US Legal Forms can also streamline the process, providing you with templates and guidance to create your deed accurately.

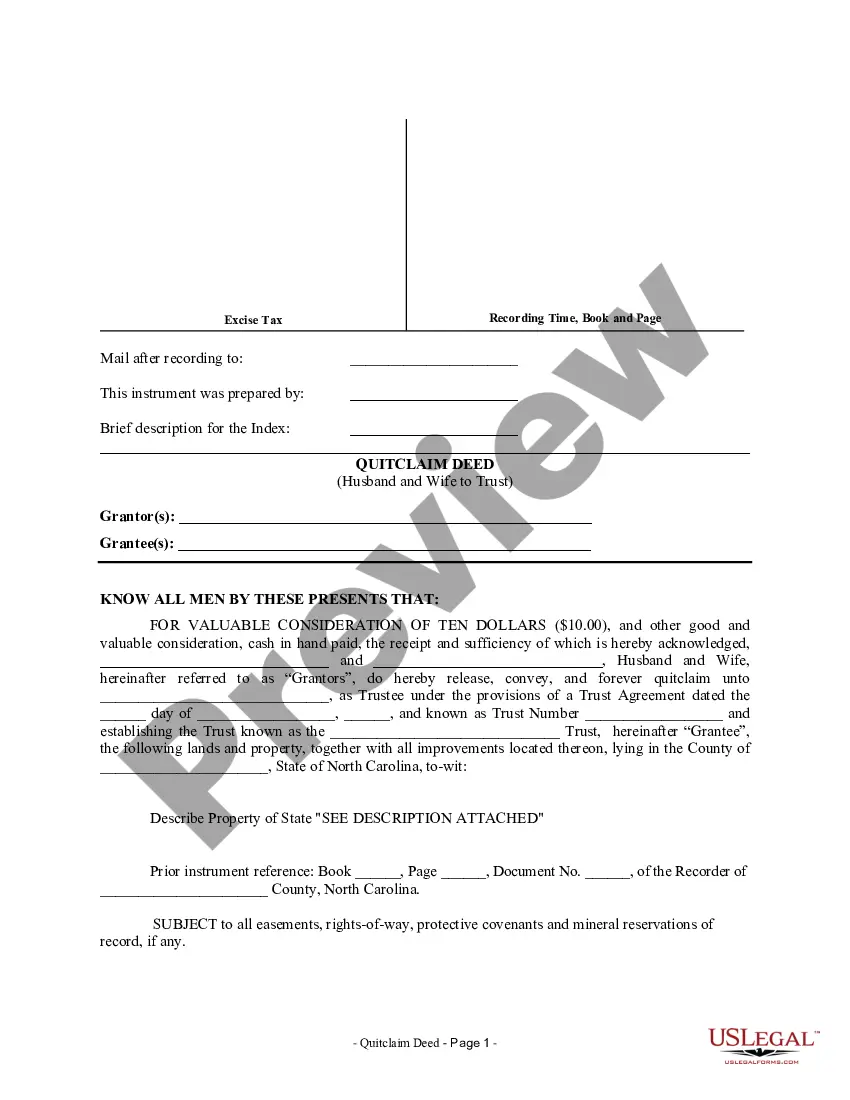

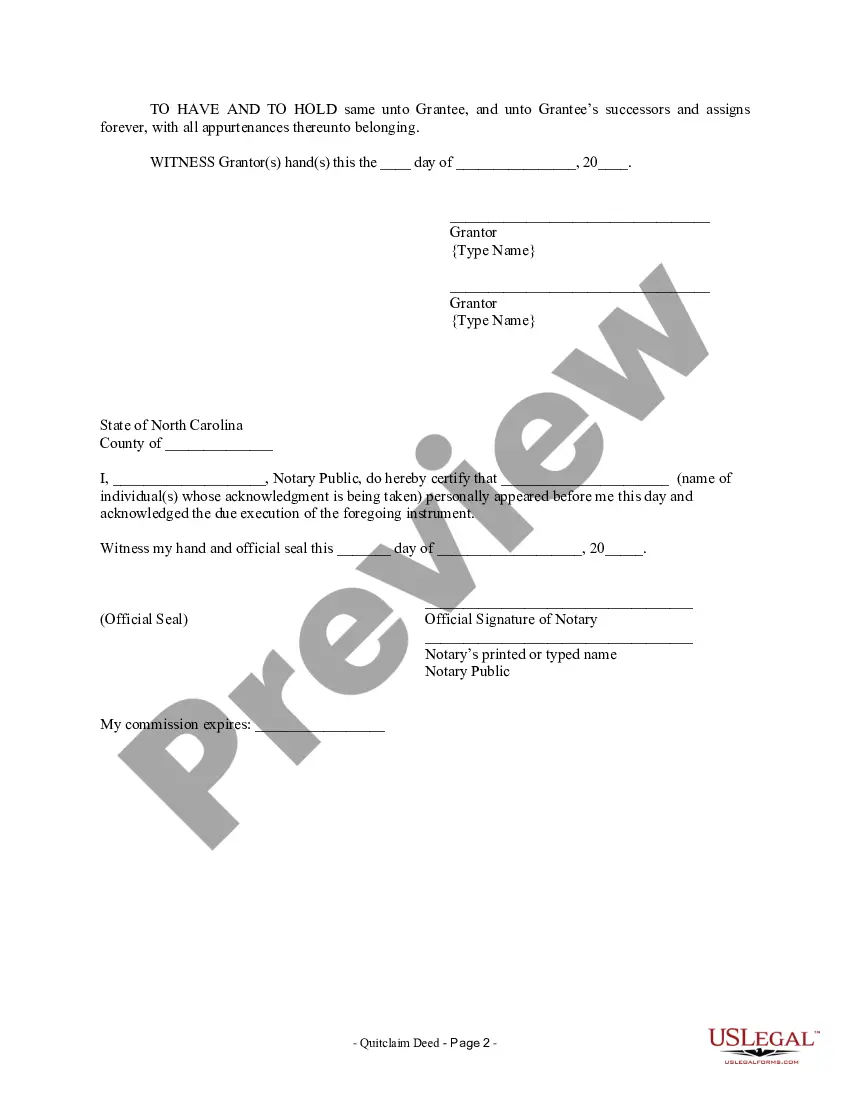

Filling out a quitclaim deed in North Carolina requires careful attention to detail. Start with the correct form, listing the grantor and grantee clearly, along with the complete property description. After providing the necessary information, both parties must sign the deed in front of a notary. To simplify this process, consider using US Legal Forms, which offers templates and guidance tailored to Wilmington North Carolina Quitclaim Deed from Husband and Wife to Trust.

In Wilmington North Carolina, after a spouse signs a quit claim deed, they may relinquish their claim to the property unless otherwise stated. This action typically means that the other spouse or the trust gains full ownership. However, rights to property can be complex, and consulting a legal expert can clarify these rights based on specific circumstances. Understanding these aspects is crucial to avoid future disputes.

To fill out a quitclaim deed to add a spouse, start by ensuring you have the correct form for Wilmington North Carolina. Clearly list both spouses' names as grantors and the name of the trust as the grantee. You must include the property description, sign, and date the deed in the presence of a notary public. It’s advisable to check resources like US Legal Forms for accurate templates and guidance.

Yes, a quitclaim deed can transfer property from a trust. In Wilmington North Carolina, when a husband and wife choose to execute a quitclaim deed to a trust, they can effectively transfer ownership. This method simplifies the transfer of property while retaining control over the assets. It’s a straightforward process, but consulting with a professional is wise to ensure compliance with local laws.

A quitclaim deed is likely the fastest, easiest, and most convenient way to transfer your ownership interest in a property or asset to a family member. Unlike other kinds of deeds, such as general and special warranty deeds, quitclaim deeds make no warranties or promises about what is being transferred.

Both spouses owning property ? Both parties must sign documents in purchase, sale, or refinance transactions. A married person buying property individually ? The owner needs to sign, but their spouse may not be required to sign documents at closing.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

Interesting Questions

More info

House of Representatives. Judiciary Committee. Subcommittee on Land and Federal Lands, No. 2, House Rules and Proceedings, 96th Congress, 2nd Session, October 3, 1987. (Available at. hcr.gov/ hf report//hf report-.CFM) Is there any reason to believe the mortgage on the property has been foreclosed? Can you provide any additional information about the lender, its title insurance, and any litigation involving the foreclosure of the property? The mortgage is a separate document. United States. Congress. House of Representatives. Judiciary Committee. Subcommittee on Land and Federal Lands, No. 2, House Rules and Proceedings, 96th Congress, 2nd Session, October 3, 1987. (Available at. hcr.gov/hfreport//hfreport-.cfm) Has the mortgage or any title application for title in possession in the possession of Title Trust in the past five years been filed with the federal government? A foreclosure is an event outside the period of possession.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.