Notice of Upset Bid Notice to Trustee or Mortagee: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Raleigh North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee

Description

How to fill out North Carolina Notice Of Upset Bid Notice To Trustee Or Mortgagee?

We consistently strive to minimize or evade legal liabilities when navigating complex legal or financial issues.

To achieve this, we seek legal solutions that are typically very expensive.

However, not all legal issues are of the same intricacy; many can be addressed independently.

US Legal Forms represents an online directory of current DIY legal documents ranging from wills and power of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always retrieve it again from the My documents section. The process remains equally simple even if you're new to the platform! You can set up your account in just a few minutes. Ensure that the Raleigh North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee aligns with the laws and regulations of your state and locality. Additionally, it’s crucial to review the form's outline (if available), and should you find any inconsistencies with your original requirements, seek out an alternative template. Once you confirm that the Raleigh North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee suits your needs, you can select a subscription plan and proceed to payment. Following that, you can download the form in the format you prefer. With over 24 years in the industry, we've assisted millions of individuals by offering customizable and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform empowers you to manage your affairs independently without the need for legal representation.

- We provide access to legal document templates that are not always readily accessible.

- Our templates cater to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you require to locate and download the Raleigh North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee or any other document rapidly and securely.

Form popularity

FAQ

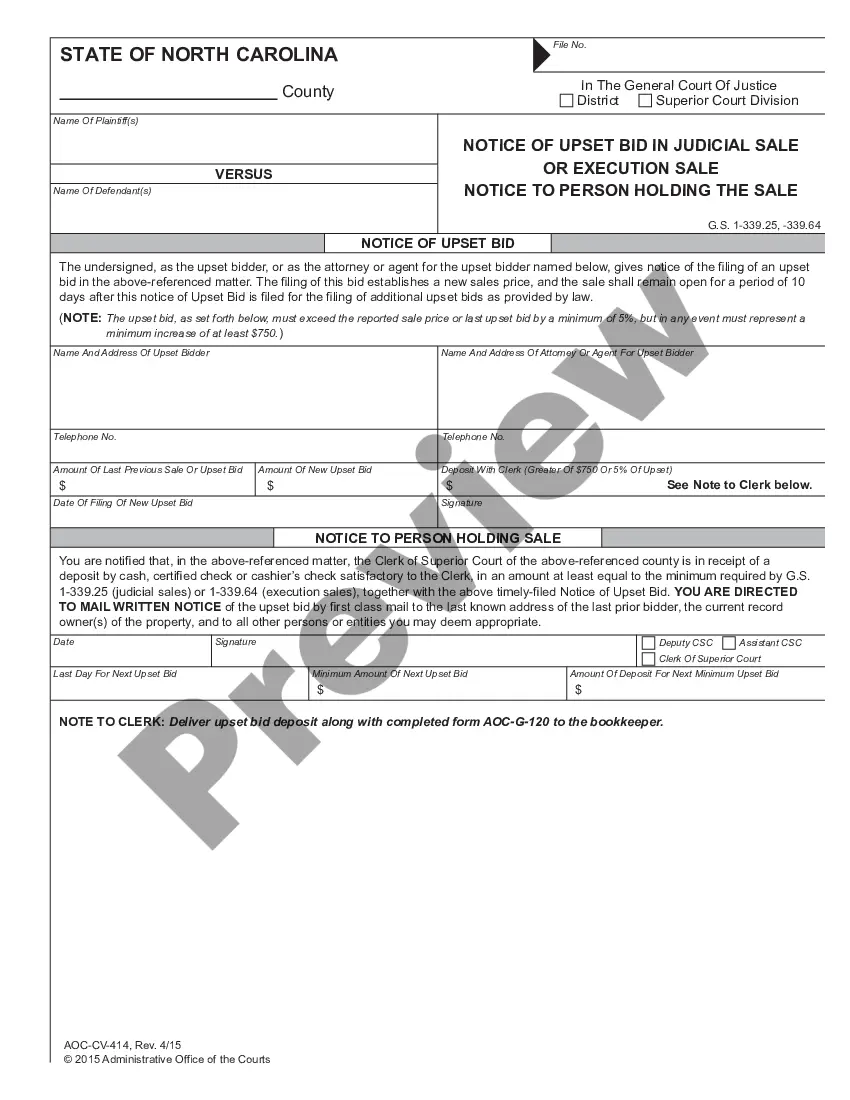

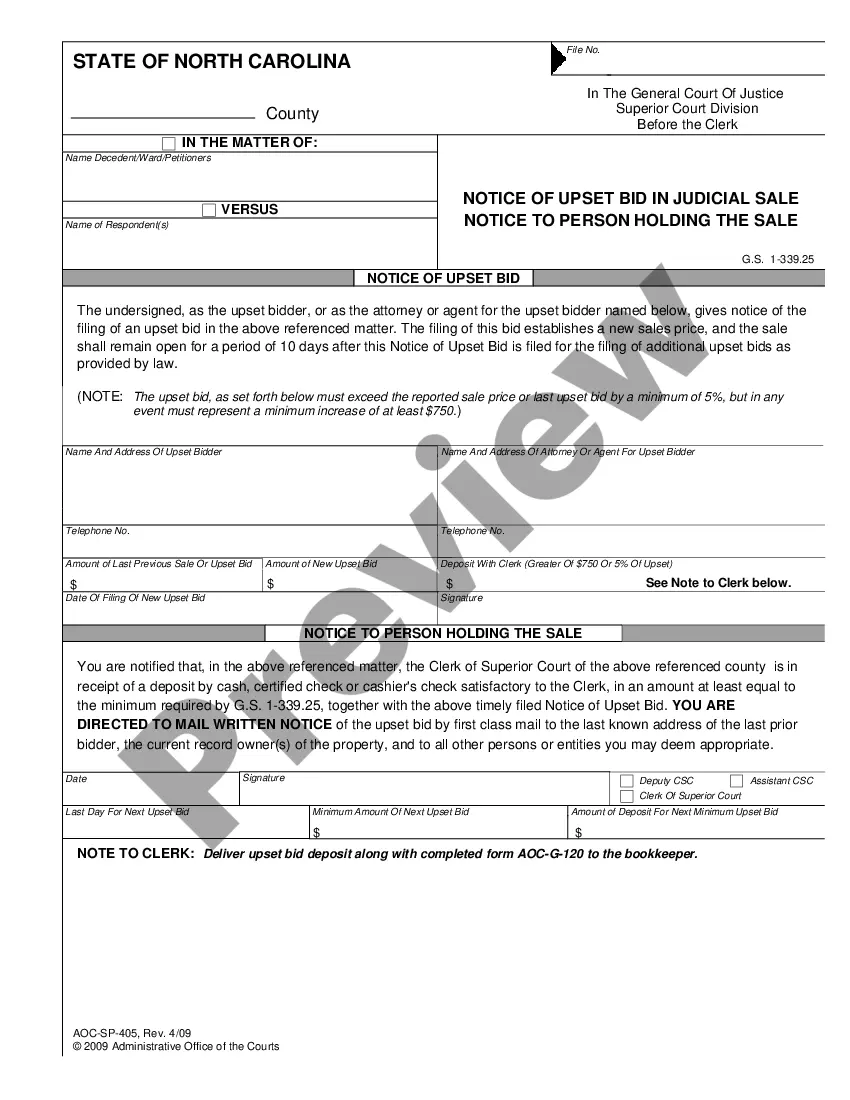

The Outbid Period is a 10-day period in which someone can place a higher bid than the previous bid, usually 5% or $750 higher, whichever is greater. Each time a new high bid is placed through the county clerk, the 10 days start over.

An upset price is intended as a minimum price. In a decree for a Judicial Sale, it constitutes a direction to the officer conducting the sale not to accept any bid that falls below the fixed price.

(a) An upset bid is an advanced, increased, or raised bid whereby any person offers to purchase real property theretofore sold, for an amount exceeding the reported sale price or last upset bid by a minimum of five percent (5%) thereof, but in any event with a minimum increase of seven hundred fifty dollars ($750.00).

This basically refers to the minimum price that the seller is willing to accept, and it may be either more or less than the total amount they need to recover their investment. Note that, if nobody is willing to bid the upset price (or higher), the property will not be sold at the auction that day.

An upset bid period is a time period that exists after a foreclosure sale. In North Carolina, after the sale of a property in a foreclosure there are ten (10) days for another party to offer a higher bid on the property or for the owner of the property to file a bankruptcy to stop the foreclosure.

In order to raise the bid, you will need to go to the Clerk of Court's office in the county where the foreclosure is pending. The Clerk will have you fill out AOC form 403, which can be found on the NC Courts website. What is the deposit requirement? The high bidder must pay a bid deposit at the sale.

(a) An upset bid is an advanced, increased, or raised bid whereby any person offers to purchase real property theretofore sold, for an amount exceeding the reported sale price or last upset bid by a minimum of five percent (5%) thereof, but in any event with a minimum increase of seven hundred fifty dollars ($750.00).

The seller will conduct the sale by reading the entirety of the posting, which includes the property location, rules of the sale, and that the property is being sold ?as is.? The sale will start with an opening bid from the foreclosing mortgage company, then you and other bidders will then increase the bid amount until

Foreclosure auction If you submit the winning bid, you'll need to give the trustee a certified check for the deposit, which is usually 10% of the winning bid. Then, you have to wait 10 days to see if anyone outbids you during the upset period before you pay the full amount and receive the title to the property.