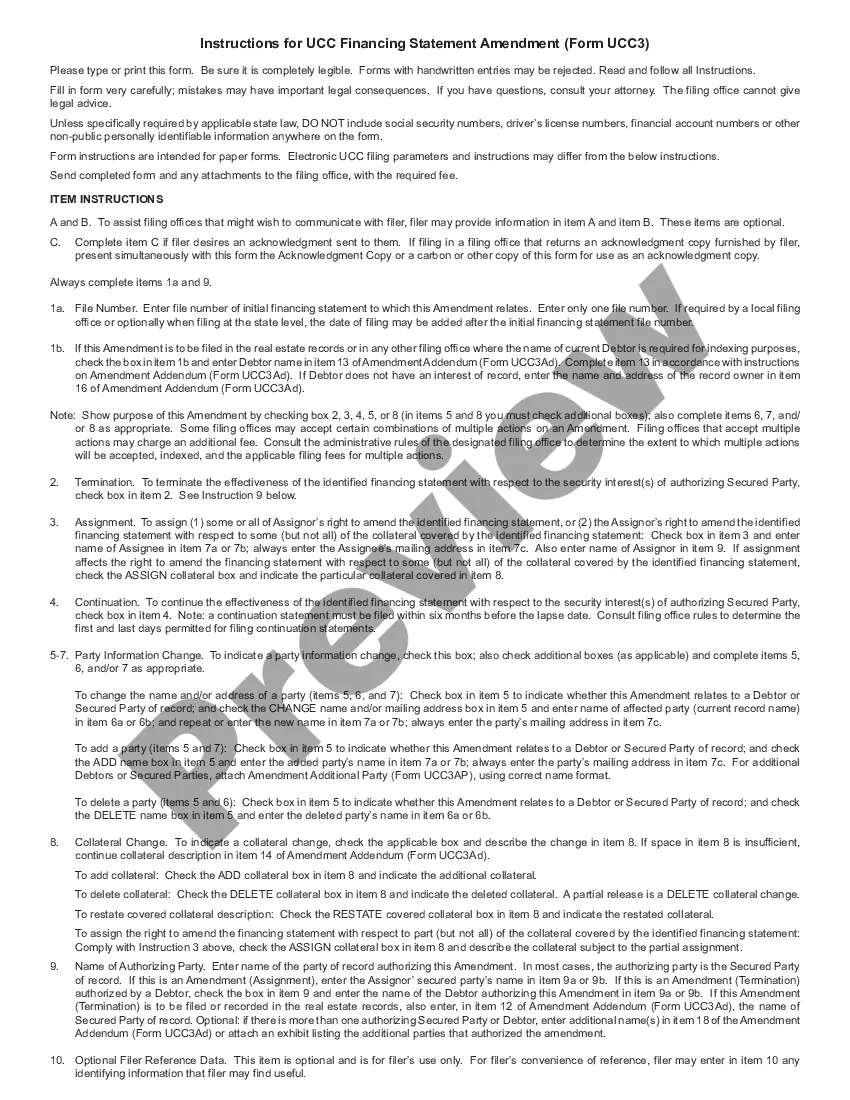

Raleigh, North Carolina is home to several types of UCC3 Financing Statement Amendment Addendums that play a crucial role in documenting and modifying certain financial transactions. These addendums comply with the Uniform Commercial Code (UCC) regulations and aim to ensure accuracy and transparency in commercial transactions. Let's explore these types and delve into their functionalities: 1. UCC3 Financing Statement Amendment Addendum for Security Interests: This type of addendum allows parties involved in a secured transaction to make corrections, additions, or updates to the initial UCC3 Financing Statement. It is often used when there are changes in collateral, debtor information, or creditor details. The addendum incorporates these modifications and becomes an integral part of the financing statement. 2. UCC3 Financing Statement Amendment Addendum for Assignment of Interests: In situations where a party desires to assign or transfer its interest in a previously filed UCC3 Financing Statement, this addendum comes into play. It outlines the details of the assignment, including the assignor's and assignee's information, date of assignment, and any relevant terms and conditions. By filing this addendum, the assignor formally relinquishes its interest in the financing statement, making way for the assignee's rights and obligations. 3. UCC3 Financing Statement Amendment Addendum for Termination: When a security interest or financing statement is no longer valid, either due to debt satisfaction or other reasons, the termination addendum is used. This addendum documents the termination of the financing statement by providing pertinent information such as the debtor's name, secured party's details, and the original filing date. By filing this addendum, parties ensure the public record reflects that the security interest or financing statement is no longer in effect. 4. UCC3 Financing Statement Continuation: Although not strictly an amendment addendum, the UCC3 Financing Statement Continuation supports the previously-filed financing statement's validity beyond its initial expiration date. This continuation addendum allows secured parties to extend the effectiveness of the financing statement by providing the essential details, such as the original filing number, debtor's information, and secured party's details. Continuations are typically filed within six months before the original financing statement expires and help avoid potential gaps in priority. In conclusion, Raleigh, North Carolina offers various UCC3 Financing Statement Amendment Addendums to address different scenarios that may arise in commercial transactions. These addendums enable parties to correct errors, assign interests, terminate previous filings, or extend the validity of financing statements. Proper utilization of these addendums ensures accuracy, accountability, and compliance with UCC regulations in Raleigh's vibrant business landscape.

Raleigh North Carolina UCC3 Financing Statement Amendment Addendum

Description

How to fill out Raleigh North Carolina UCC3 Financing Statement Amendment Addendum?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Raleigh North Carolina UCC3 Financing Statement Amendment Addendum gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Raleigh North Carolina UCC3 Financing Statement Amendment Addendum takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Raleigh North Carolina UCC3 Financing Statement Amendment Addendum. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!