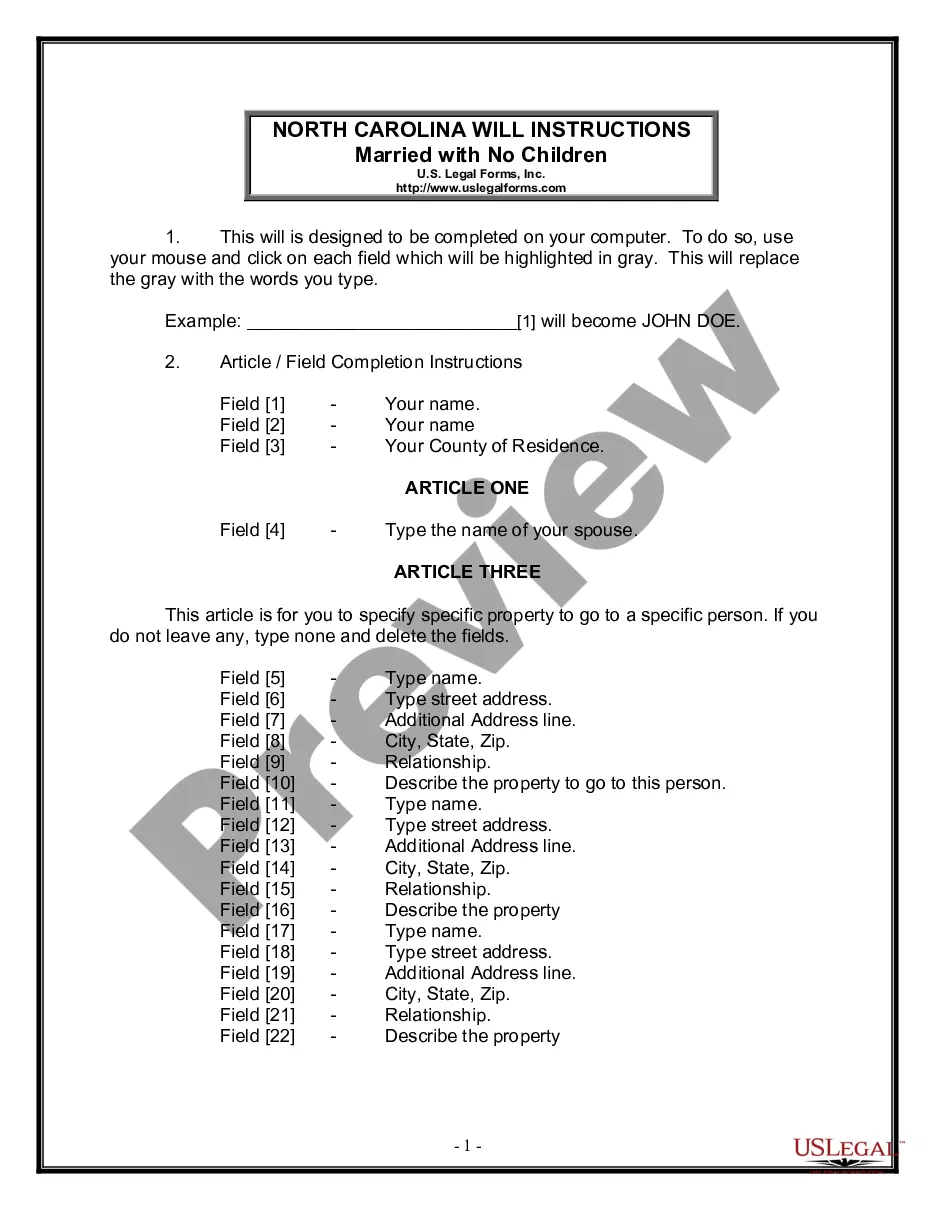

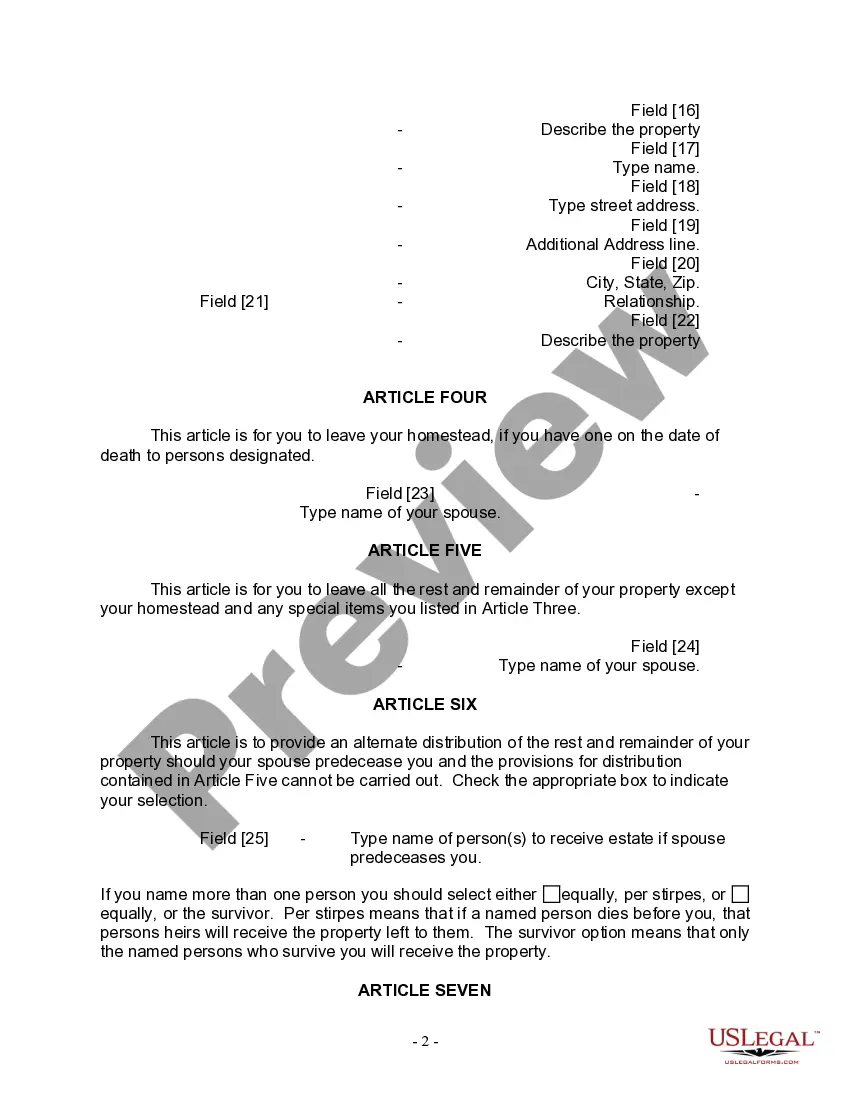

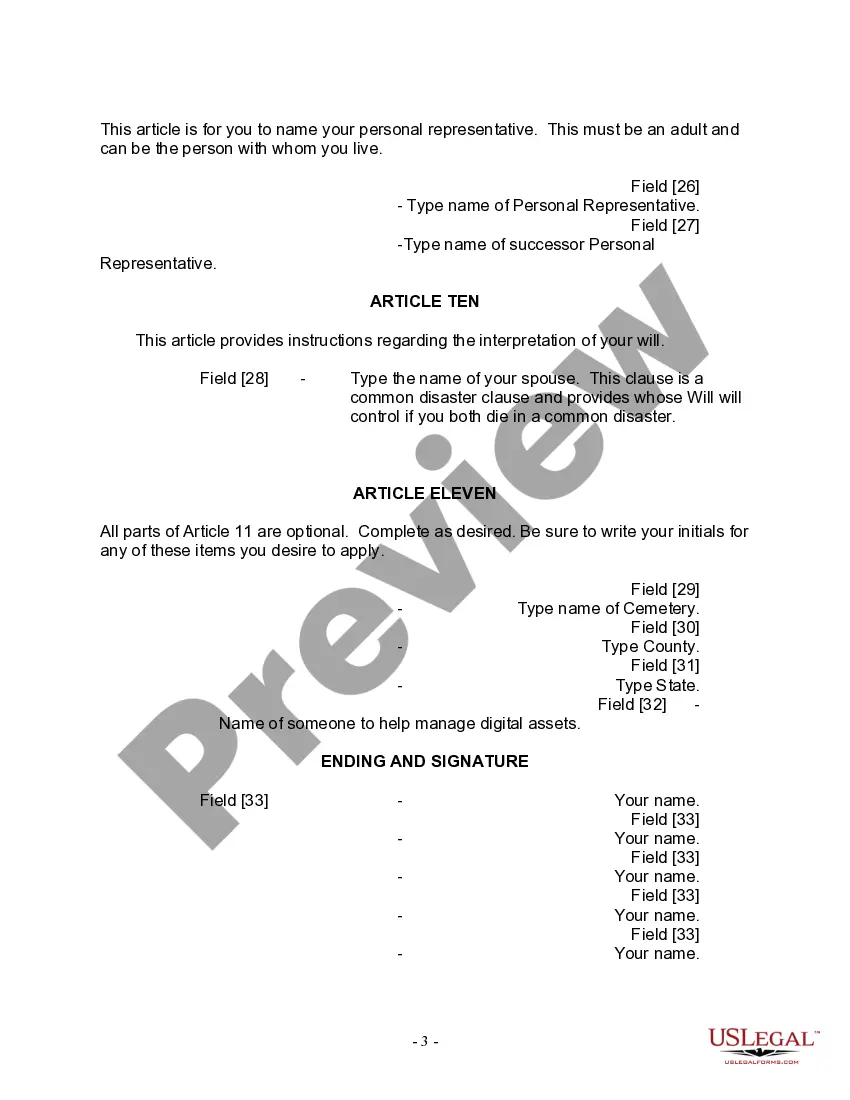

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Mecklenburg North Carolina Legal Last Will and Testament Form for a Married Person with No Children is an essential legal document that allows married individuals without children to specify how their assets and final wishes should be handled upon their passing. This legally binding document ensures that your property, finances, and personal belongings are distributed according to your desires and protects the interests of your surviving spouse. The Mecklenburg County Court provides different types of Last Will and Testament forms to cater to various circumstances and preferences. Some of these variations include: 1. Traditional Will: This is the most common type of last will and testament form, which allows you to outline the distribution of your assets, including bank accounts, real estate properties, investments, personal belongings, and any other valuable possessions. It also provides a platform to appoint an executor, the person responsible for managing the process of distributing your assets according to your wishes. 2. Living Will: Although not a testamentary will, a living will often is considered alongside a last will and testament. A living will allows you to express your healthcare preferences in case you become unable to communicate or make decisions about your medical treatment. It enables you to specify if you want life-sustaining treatments to be continued or discontinued in specific situations. 3. Pour-Over Will: If you have a revocable living trust, a pour-over will, can be used in conjunction with it. This will ensure that any assets not already transferred to the trust during your lifetime are "poured over" into the trust after your death. It acts as a safety net to guarantee that all your assets are consolidated within the trust and distributed according to its terms. 4. Joint Will: A joint will is a unique form designed for married couples who share identical wishes and want to create a single will document together. It outlines the distribution of assets after the death of both spouses, ensuring that the surviving spouse inherits all the assets. However, using a joint will prevents the surviving spouse from modifying the will after the other spouse has passed away. When completing the Mecklenburg North Carolina Legal Last Will and Testament Form for a Married Person with No Children, ensure you include accurate and up-to-date information. It's advisable to consult an attorney or use online resources to help you properly draft and execute your will, ensuring it meets all legal requirements in the state of North Carolina.

The Mecklenburg North Carolina Legal Last Will and Testament Form for a Married Person with No Children is an essential legal document that allows married individuals without children to specify how their assets and final wishes should be handled upon their passing. This legally binding document ensures that your property, finances, and personal belongings are distributed according to your desires and protects the interests of your surviving spouse. The Mecklenburg County Court provides different types of Last Will and Testament forms to cater to various circumstances and preferences. Some of these variations include: 1. Traditional Will: This is the most common type of last will and testament form, which allows you to outline the distribution of your assets, including bank accounts, real estate properties, investments, personal belongings, and any other valuable possessions. It also provides a platform to appoint an executor, the person responsible for managing the process of distributing your assets according to your wishes. 2. Living Will: Although not a testamentary will, a living will often is considered alongside a last will and testament. A living will allows you to express your healthcare preferences in case you become unable to communicate or make decisions about your medical treatment. It enables you to specify if you want life-sustaining treatments to be continued or discontinued in specific situations. 3. Pour-Over Will: If you have a revocable living trust, a pour-over will, can be used in conjunction with it. This will ensure that any assets not already transferred to the trust during your lifetime are "poured over" into the trust after your death. It acts as a safety net to guarantee that all your assets are consolidated within the trust and distributed according to its terms. 4. Joint Will: A joint will is a unique form designed for married couples who share identical wishes and want to create a single will document together. It outlines the distribution of assets after the death of both spouses, ensuring that the surviving spouse inherits all the assets. However, using a joint will prevents the surviving spouse from modifying the will after the other spouse has passed away. When completing the Mecklenburg North Carolina Legal Last Will and Testament Form for a Married Person with No Children, ensure you include accurate and up-to-date information. It's advisable to consult an attorney or use online resources to help you properly draft and execute your will, ensuring it meets all legal requirements in the state of North Carolina.