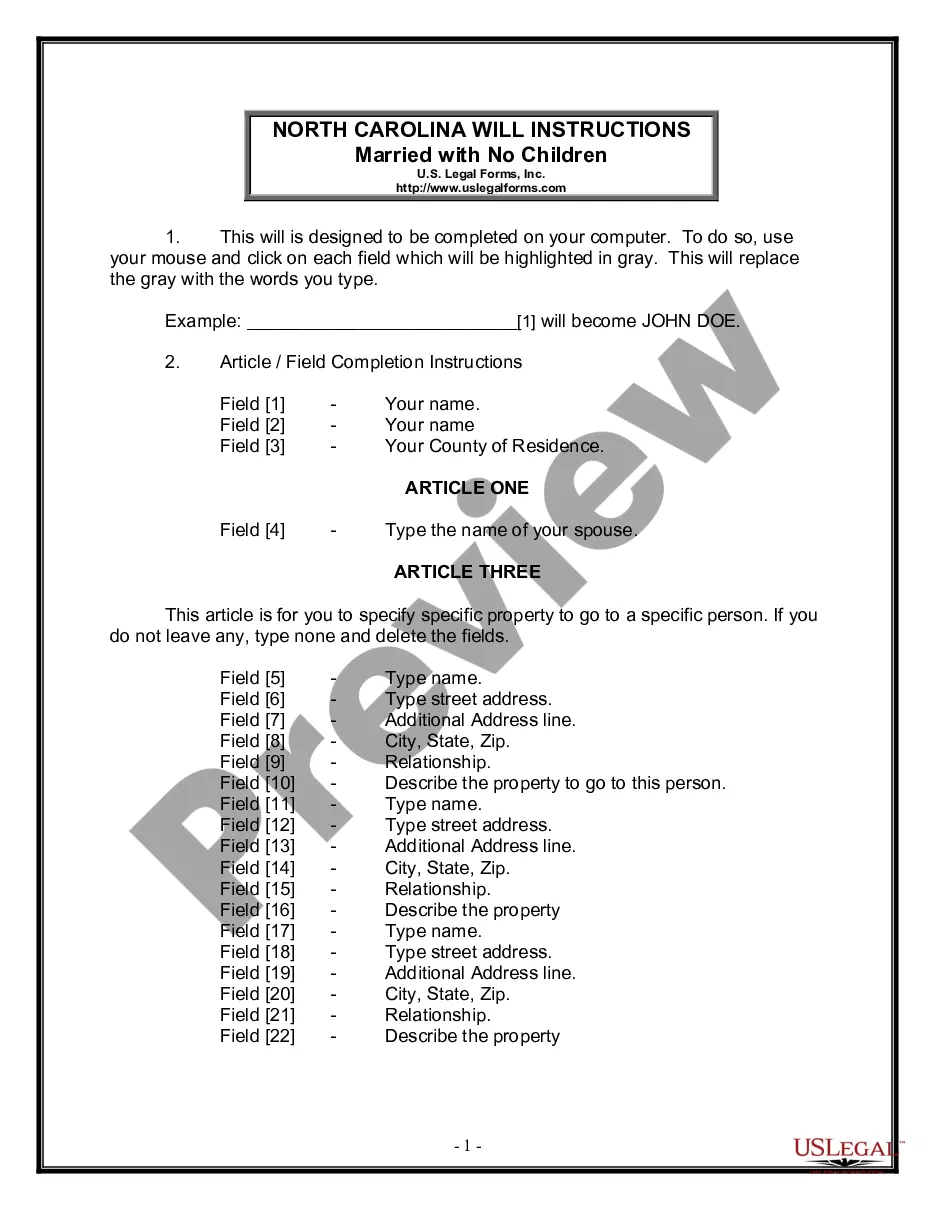

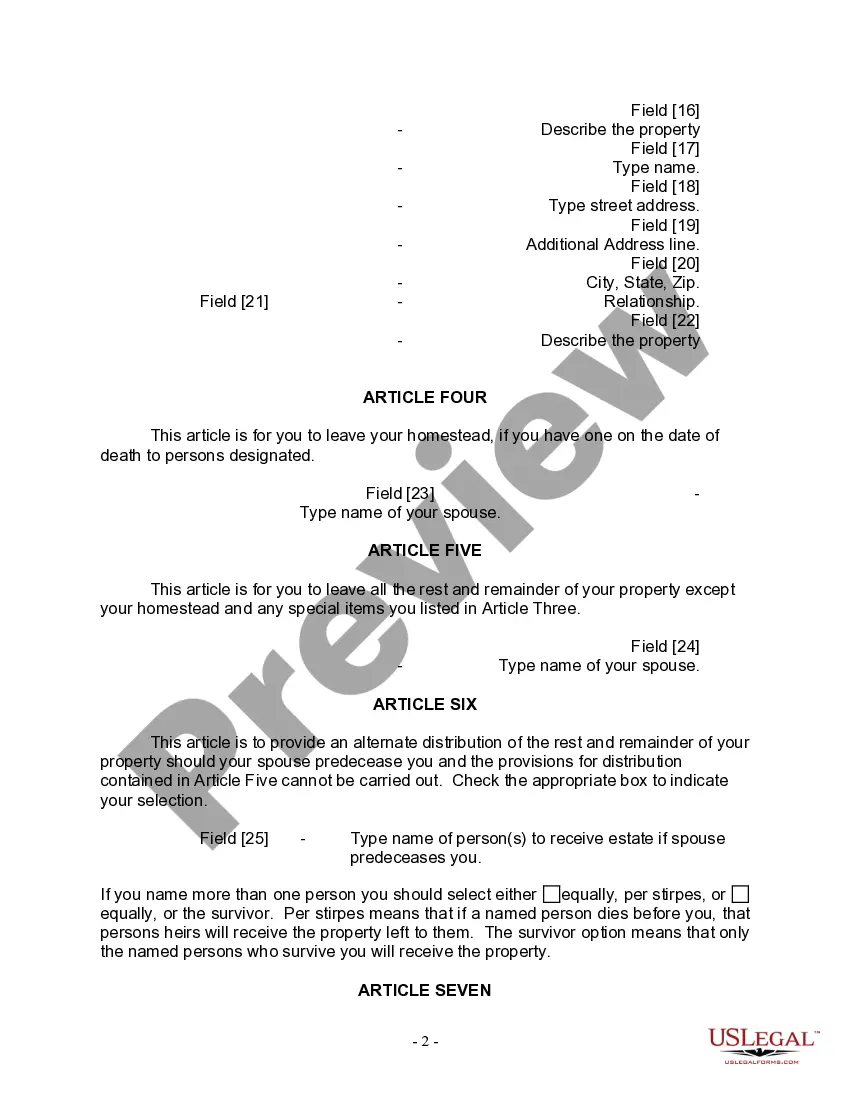

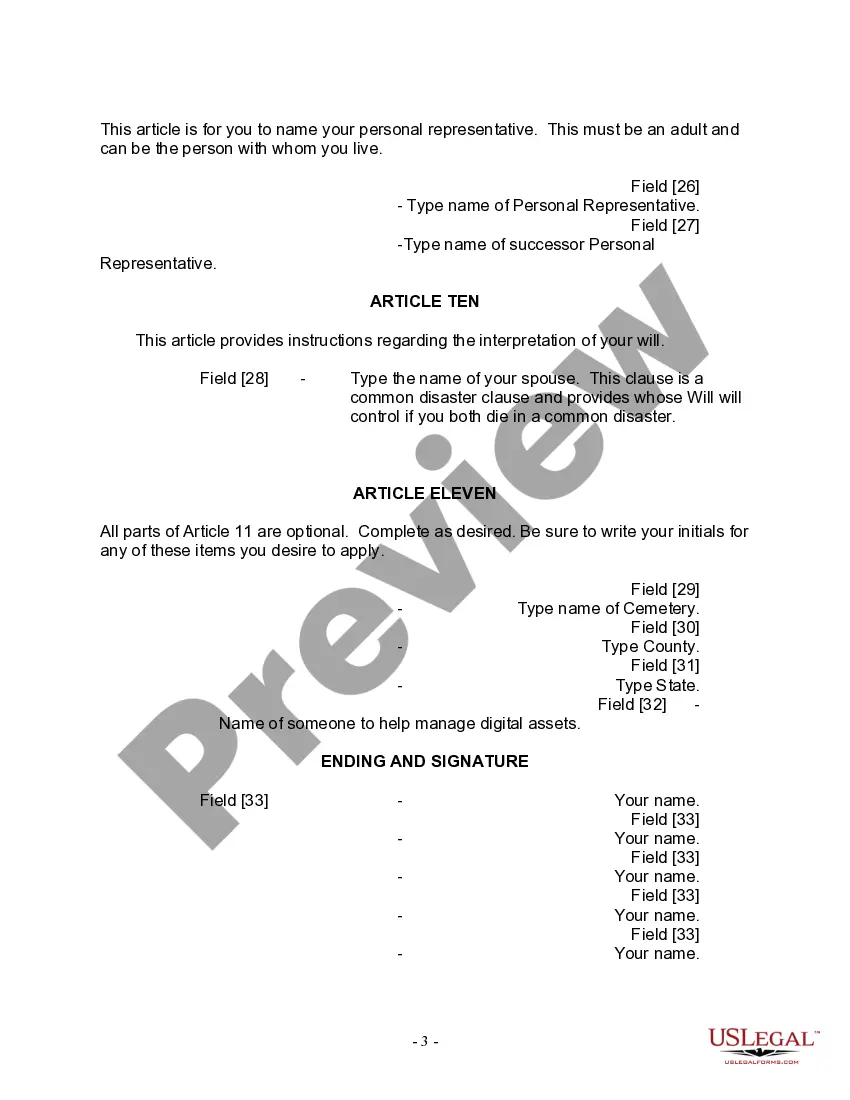

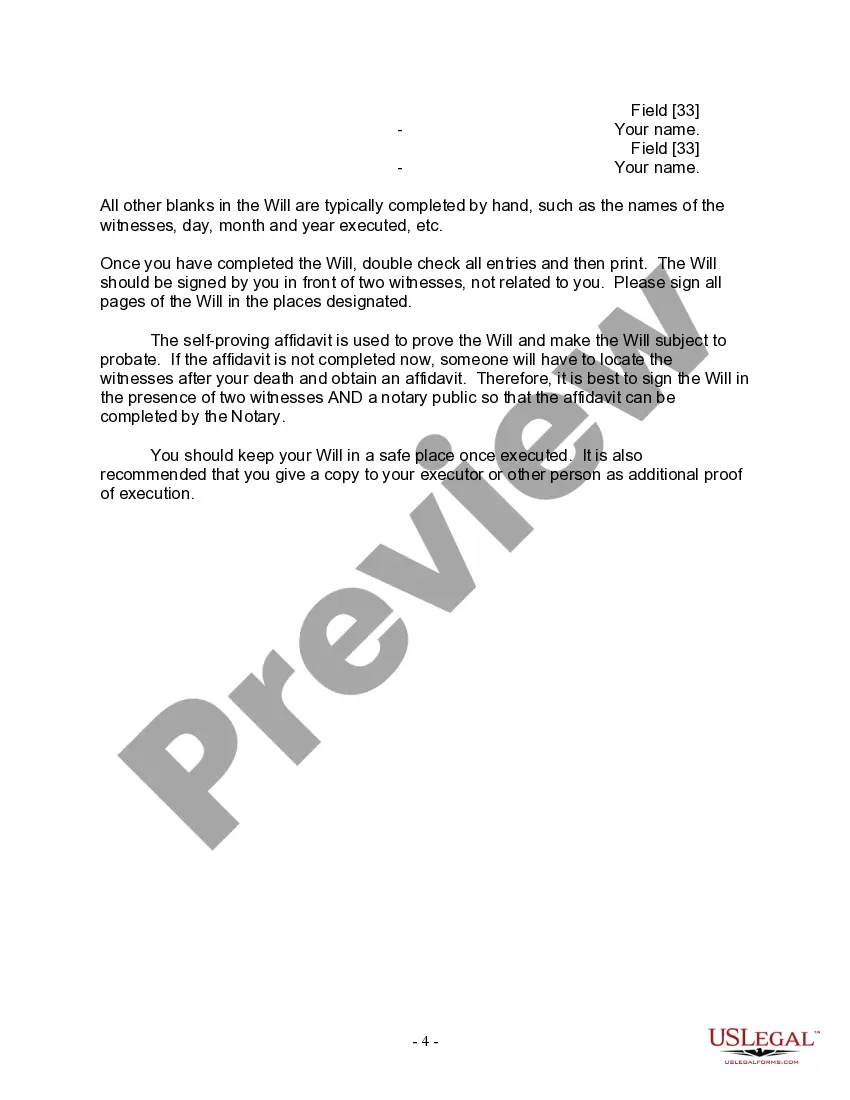

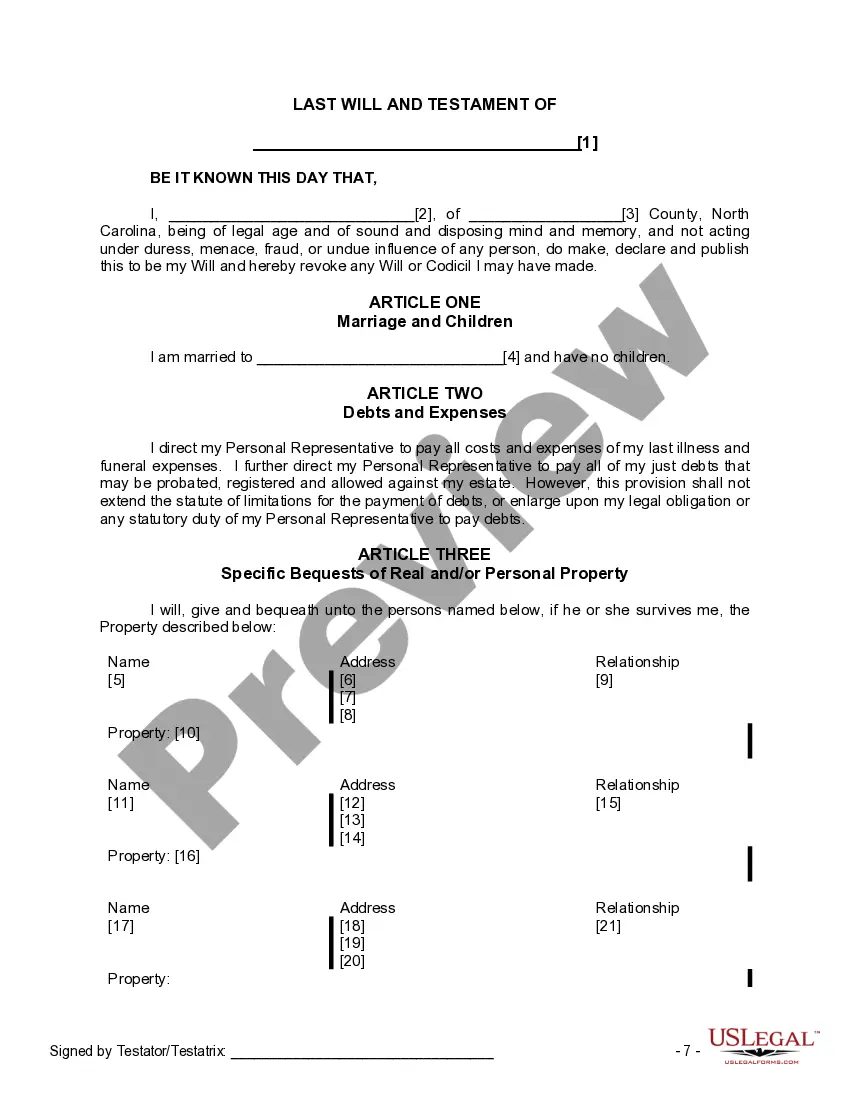

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children is a legal document that allows individuals residing in Wilmington, North Carolina, who are married and have no children, to outline their wishes for the distribution of their assets and the management of their affairs after their death. This document ensures that your estate is distributed according to your preferences and eliminates potential disputes among family members. In Wilmington, there are several types of Last Will and Testament forms available for married individuals with no children. These include: 1. Simple Last Will and Testament: This form is suitable for individuals who have a straightforward estate and want to specify their intentions clearly. It typically involves naming the spouse as the primary beneficiary and designating alternate beneficiaries in case the spouse predeceases the testator (the person creating the will). 2. Mutual Last Will and Testament: This form is often utilized by spouses who wish to create a single will document that reflects both of their wishes for the distribution of assets. With a mutual will, both spouses will outline their shared intentions, ensuring consistency and avoiding any misunderstandings after one spouse's passing. 3. Living Will: Although not specific to married individuals with no children, a living will is an essential document to consider alongside a Last Will and Testament. A living will outlines your healthcare preferences should you become unable to communicate them, ensuring that your wishes regarding medical treatments and end-of-life decisions are honored. Within the Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children, you can expect to include the following key details: 1. Identification: Begin the document with your full legal name, as well as your spouse's name, address, and contact information. 2. Executor nomination: Name an executor, who will be responsible for administering your estate according to the instructions outlined in the will. 3. Beneficiary designation: Clearly specify how you want your assets to be distributed upon your death. Identify your spouse as the primary beneficiary, and decide on alternate beneficiaries if necessary. 4. Asset distribution: Provide specific instructions on how various assets, such as property, bank accounts, investments, and personal belongings, should be distributed among beneficiaries. 5. Appointment of a guardian: Although not relevant for married persons with no children, individuals with dependents should include provisions for naming a guardian for their minor children. 6. Residual clause: Include a residual clause to assign any remaining assets or property that might not have been explicitly addressed in other sections of the will. 7. Signatures: Sign and date the document in the presence of witnesses, adhering to the legal requirements of Wilmington, North Carolina. Remember, it is crucial to consult with a qualified attorney to ensure that your Last Will and Testament is legally valid and meets all the specific requirements of Wilmington, North Carolina's jurisdiction.

The Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children is a legal document that allows individuals residing in Wilmington, North Carolina, who are married and have no children, to outline their wishes for the distribution of their assets and the management of their affairs after their death. This document ensures that your estate is distributed according to your preferences and eliminates potential disputes among family members. In Wilmington, there are several types of Last Will and Testament forms available for married individuals with no children. These include: 1. Simple Last Will and Testament: This form is suitable for individuals who have a straightforward estate and want to specify their intentions clearly. It typically involves naming the spouse as the primary beneficiary and designating alternate beneficiaries in case the spouse predeceases the testator (the person creating the will). 2. Mutual Last Will and Testament: This form is often utilized by spouses who wish to create a single will document that reflects both of their wishes for the distribution of assets. With a mutual will, both spouses will outline their shared intentions, ensuring consistency and avoiding any misunderstandings after one spouse's passing. 3. Living Will: Although not specific to married individuals with no children, a living will is an essential document to consider alongside a Last Will and Testament. A living will outlines your healthcare preferences should you become unable to communicate them, ensuring that your wishes regarding medical treatments and end-of-life decisions are honored. Within the Wilmington North Carolina Legal Last Will and Testament Form for a Married Person with No Children, you can expect to include the following key details: 1. Identification: Begin the document with your full legal name, as well as your spouse's name, address, and contact information. 2. Executor nomination: Name an executor, who will be responsible for administering your estate according to the instructions outlined in the will. 3. Beneficiary designation: Clearly specify how you want your assets to be distributed upon your death. Identify your spouse as the primary beneficiary, and decide on alternate beneficiaries if necessary. 4. Asset distribution: Provide specific instructions on how various assets, such as property, bank accounts, investments, and personal belongings, should be distributed among beneficiaries. 5. Appointment of a guardian: Although not relevant for married persons with no children, individuals with dependents should include provisions for naming a guardian for their minor children. 6. Residual clause: Include a residual clause to assign any remaining assets or property that might not have been explicitly addressed in other sections of the will. 7. Signatures: Sign and date the document in the presence of witnesses, adhering to the legal requirements of Wilmington, North Carolina. Remember, it is crucial to consult with a qualified attorney to ensure that your Last Will and Testament is legally valid and meets all the specific requirements of Wilmington, North Carolina's jurisdiction.