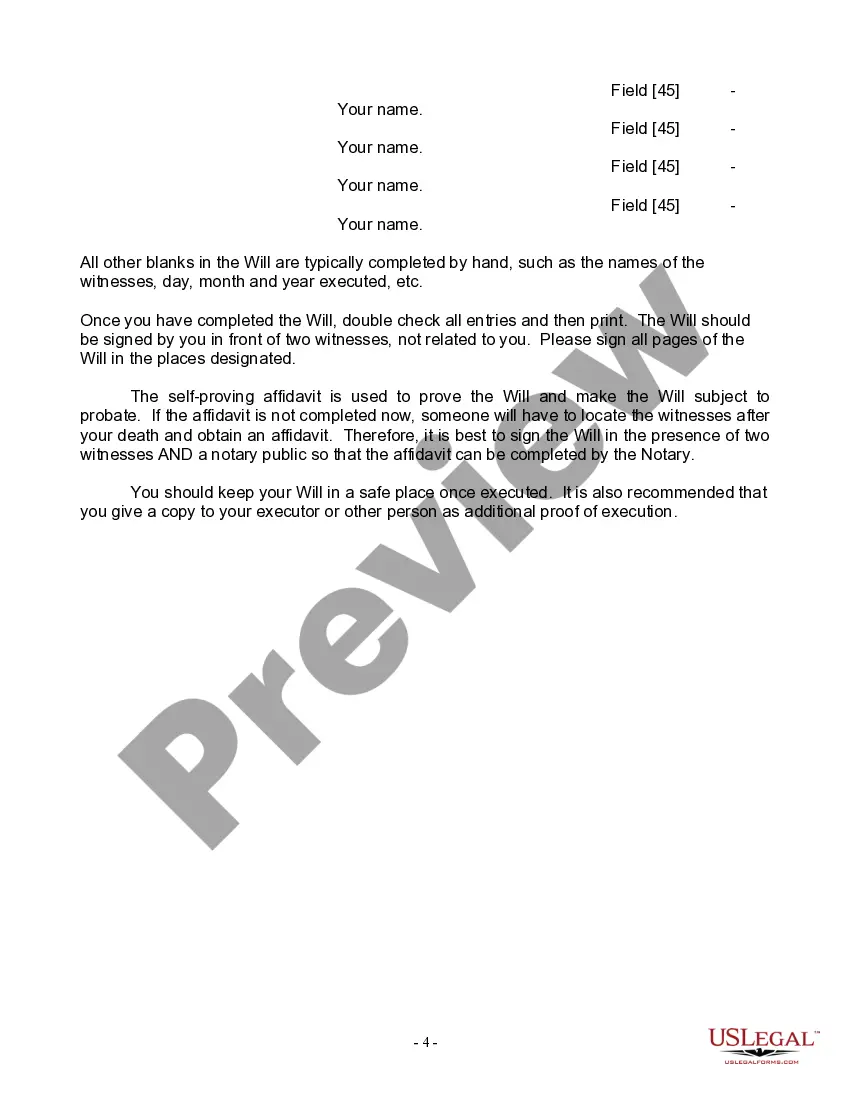

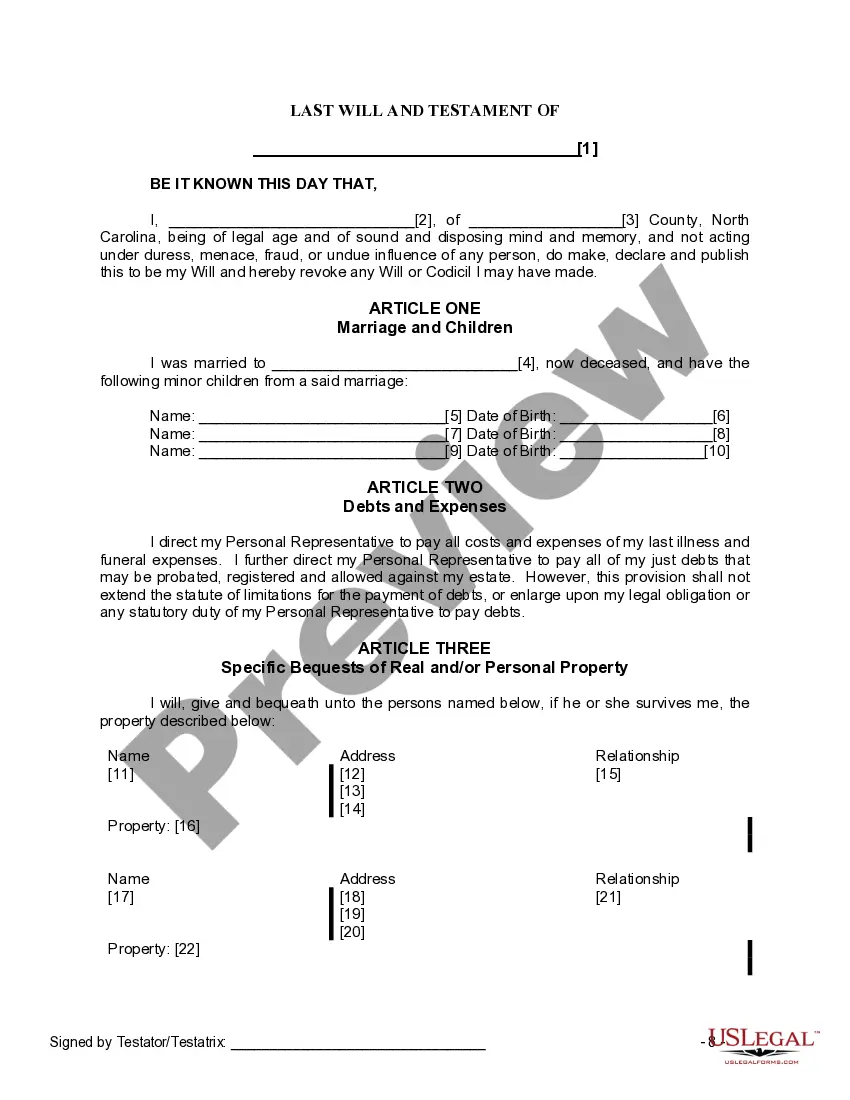

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that enables widows or widowers residing in Mecklenburg County, North Carolina to create a comprehensive estate plan for the distribution of their assets and the care of their minor children after their demise. This particular legal form addresses the specific circumstances of widows or widowers who have children under the age of 18. It prioritizes the children's welfare, ensuring that they receive proper care and guardianship, and their inheritance is managed responsibly until they come of age. The Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children encompasses several vital elements to consider. Firstly, it allows individuals to designate an executor or personal representative who will oversee the administration of their estate. This executor will play a crucial role in ensuring that the deceased's wishes are carried out, debts are settled, and assets are distributed according to the provisions of the will. Furthermore, this legal form enables widows or widowers to appoint a guardian for their minor children. It gives them the ability to select a suitable person who will be responsible for the upbringing and wellbeing of their children in the event of their untimely passing. The form also allows the appointment of alternate guardians to ensure that contingency plans are in place. Additionally, the Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children allows parents to outline the specific provisions for their children's inheritance. This may include creating trusts or funds to manage and protect the assets until the children reach a predetermined age or milestone, such as turning 18 or completing their education. It is crucial to note that there may be variations or different versions of the Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children, depending on specific requirements or preferences. Some versions may provide additional options, such as the ability to disinherit certain individuals, specify funeral arrangements, or address charitable donations. To ensure that the will accurately reflects an individual's intentions and adheres to all legal requirements, it is advisable to seek professional legal assistance or consult an estate planning attorney familiar with Mecklenburg County laws. In summary, the Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children offers widows or widowers with children under 18 a vital means to safeguard their assets and provide for the well-being of their children. This legal document empowers individuals to designate guardians, determine asset distribution, and establish trusts or funds to protect the inheritance until the children reach a specified age or milestone.

The Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that enables widows or widowers residing in Mecklenburg County, North Carolina to create a comprehensive estate plan for the distribution of their assets and the care of their minor children after their demise. This particular legal form addresses the specific circumstances of widows or widowers who have children under the age of 18. It prioritizes the children's welfare, ensuring that they receive proper care and guardianship, and their inheritance is managed responsibly until they come of age. The Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children encompasses several vital elements to consider. Firstly, it allows individuals to designate an executor or personal representative who will oversee the administration of their estate. This executor will play a crucial role in ensuring that the deceased's wishes are carried out, debts are settled, and assets are distributed according to the provisions of the will. Furthermore, this legal form enables widows or widowers to appoint a guardian for their minor children. It gives them the ability to select a suitable person who will be responsible for the upbringing and wellbeing of their children in the event of their untimely passing. The form also allows the appointment of alternate guardians to ensure that contingency plans are in place. Additionally, the Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children allows parents to outline the specific provisions for their children's inheritance. This may include creating trusts or funds to manage and protect the assets until the children reach a predetermined age or milestone, such as turning 18 or completing their education. It is crucial to note that there may be variations or different versions of the Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children, depending on specific requirements or preferences. Some versions may provide additional options, such as the ability to disinherit certain individuals, specify funeral arrangements, or address charitable donations. To ensure that the will accurately reflects an individual's intentions and adheres to all legal requirements, it is advisable to seek professional legal assistance or consult an estate planning attorney familiar with Mecklenburg County laws. In summary, the Mecklenburg North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children offers widows or widowers with children under 18 a vital means to safeguard their assets and provide for the well-being of their children. This legal document empowers individuals to designate guardians, determine asset distribution, and establish trusts or funds to protect the inheritance until the children reach a specified age or milestone.