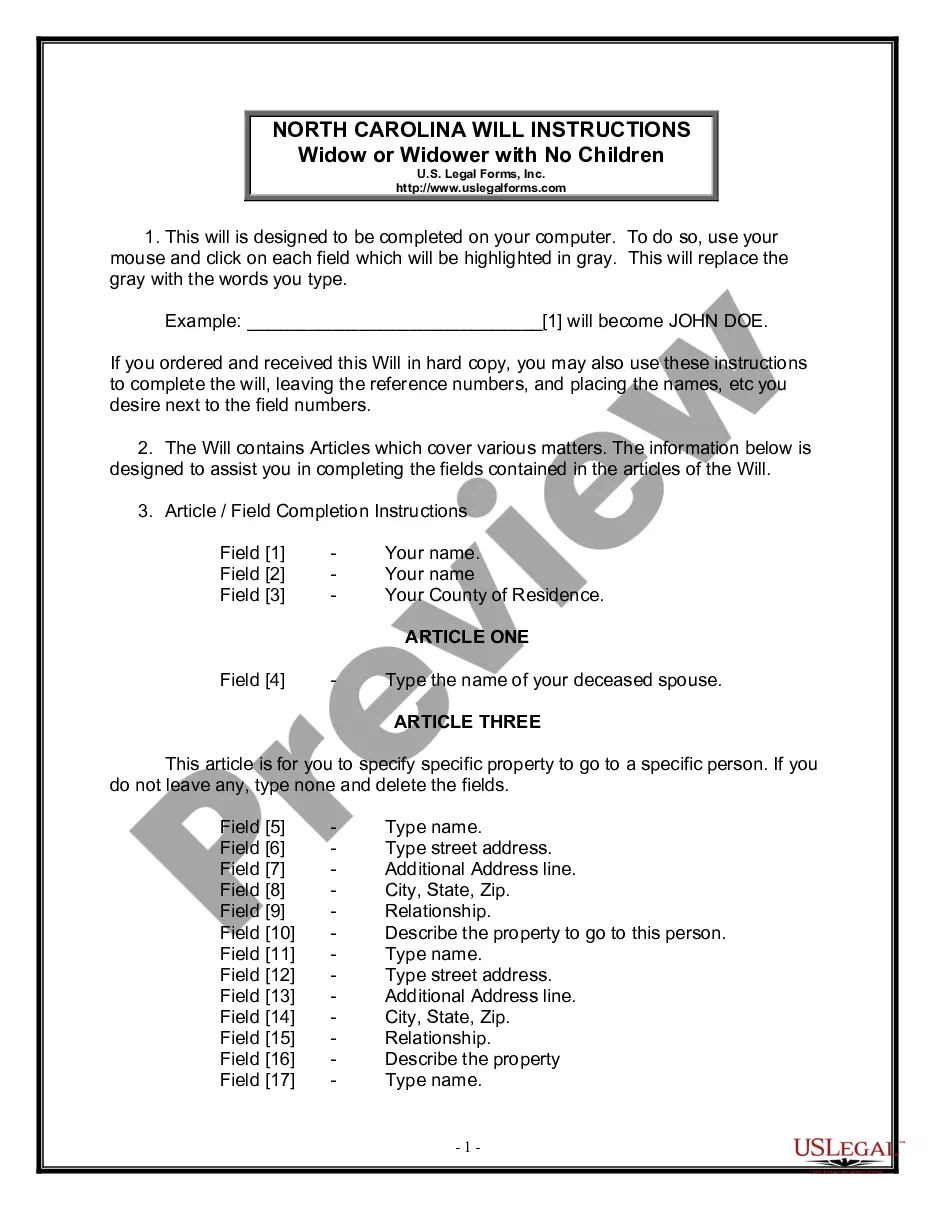

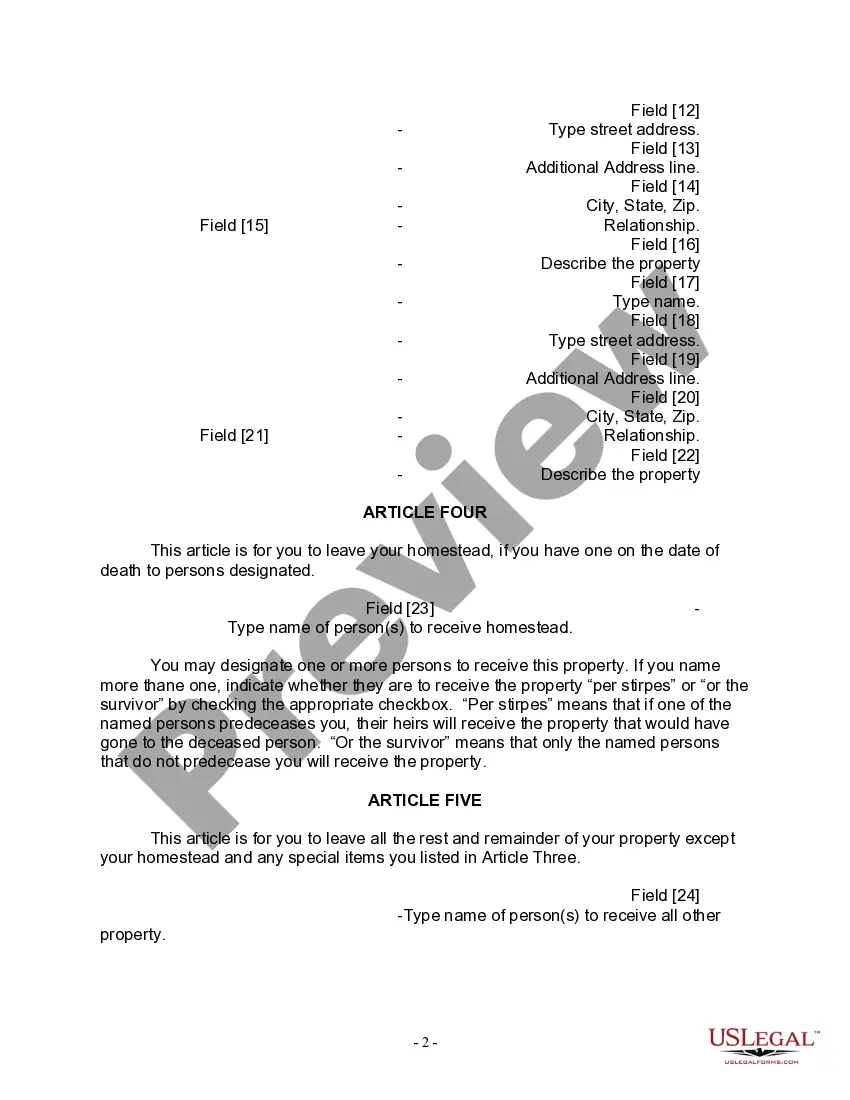

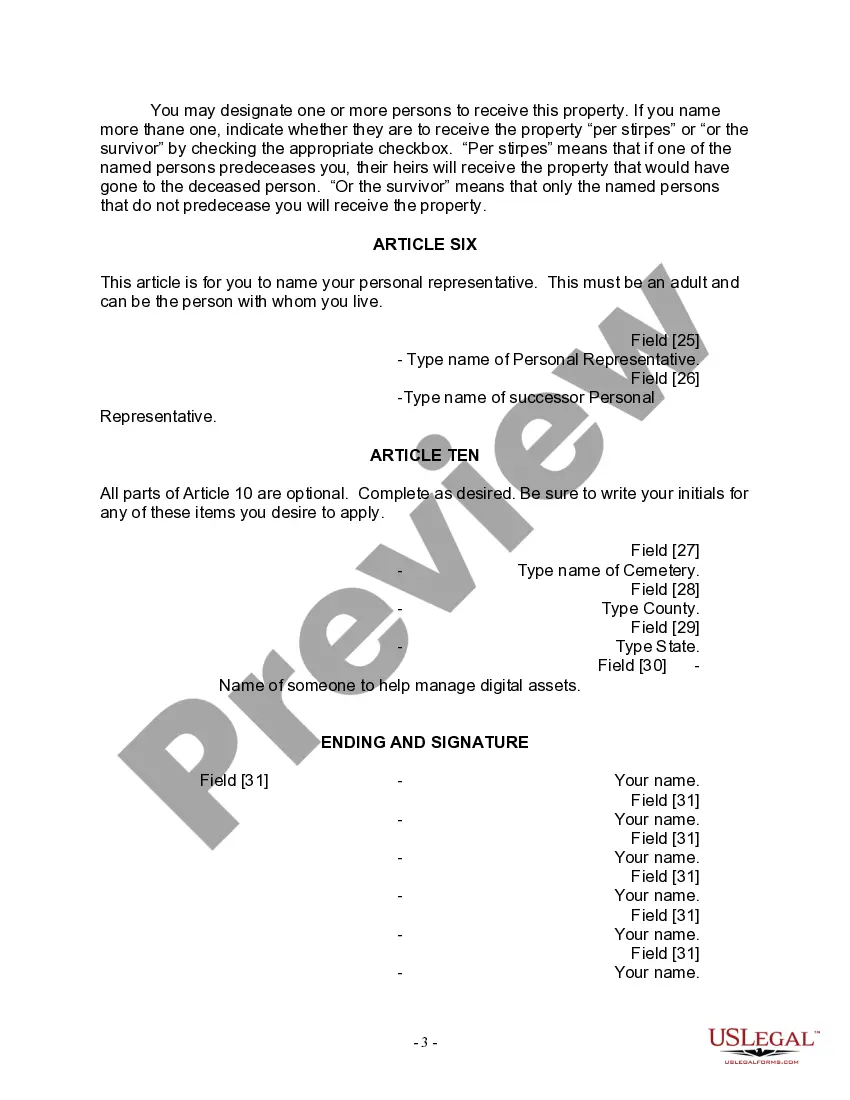

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Charlotte North Carolina Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals who are widowed and have no children to outline the distribution of their assets and properties after their death. This form ensures that the individual's final wishes are respected and carried out appropriately. This last will form is essential for individuals who want to have control over the distribution of their estate and avoid any potential disputes or confusion among their surviving loved ones. By creating a will, a widow or widower can provide clear instructions regarding their financial assets, real estate properties, personal belongings, and any other valuable possessions they may have at the time of their passing. Key elements of the Charlotte North Carolina Legal Last Will Form for a Widow or Widower with no Children typically include: 1. Identification: The will begins by providing the name, address, and other necessary identification details of the testator, i.e., the person creating the will. 2. Executor: The individual appoints an executor, often a trusted family member, friend, or professional, who will carry out the terms of the will and ensure that all assets are distributed as instructed. 3. Bequests: This section allows the widow or widower to specify any specific gifts or bequests they wish to make, such as giving a particular item or a set amount of money to a specific person or organization. 4. Beneficiaries: The testator identifies the beneficiaries who will inherit the remaining assets and properties. In the absence of children, typically, these beneficiaries can include other family members, close friends, or even charity organizations. 5. Alternate Beneficiaries: It is common to include a provision for alternate beneficiaries in case the primary beneficiaries are unable to receive their inheritances for any reason. 6. Residual Estate: The will outlines how any leftovers or residual estate should be distributed. This encompasses any assets not specifically mentioned in the bequests or beneficiaries section. 7. Guardianship: If the individual has any dependents, such as pets or minor children, they can appoint a guardian to ensure their care and well-being after the testator's death. 8. Funeral and Burial wishes: The will may also include instructions regarding funeral or cremation arrangements, as well as any specific details regarding the disposition of the testator's remains. It is important to note that while the general framework of the Charlotte North Carolina Legal Last Will Form for a Widow or Widower with no Children remains relatively consistent, there might be variations or additional clauses depending on the specific needs and preferences of the individual. Consulting with an attorney experienced in estate planning is highly advisable to ensure the will adheres to all relevant legal requirements and effectively reflects the testator's intentions.

The Charlotte North Carolina Legal Last Will Form for a Widow or Widower with no Children is a legal document that allows individuals who are widowed and have no children to outline the distribution of their assets and properties after their death. This form ensures that the individual's final wishes are respected and carried out appropriately. This last will form is essential for individuals who want to have control over the distribution of their estate and avoid any potential disputes or confusion among their surviving loved ones. By creating a will, a widow or widower can provide clear instructions regarding their financial assets, real estate properties, personal belongings, and any other valuable possessions they may have at the time of their passing. Key elements of the Charlotte North Carolina Legal Last Will Form for a Widow or Widower with no Children typically include: 1. Identification: The will begins by providing the name, address, and other necessary identification details of the testator, i.e., the person creating the will. 2. Executor: The individual appoints an executor, often a trusted family member, friend, or professional, who will carry out the terms of the will and ensure that all assets are distributed as instructed. 3. Bequests: This section allows the widow or widower to specify any specific gifts or bequests they wish to make, such as giving a particular item or a set amount of money to a specific person or organization. 4. Beneficiaries: The testator identifies the beneficiaries who will inherit the remaining assets and properties. In the absence of children, typically, these beneficiaries can include other family members, close friends, or even charity organizations. 5. Alternate Beneficiaries: It is common to include a provision for alternate beneficiaries in case the primary beneficiaries are unable to receive their inheritances for any reason. 6. Residual Estate: The will outlines how any leftovers or residual estate should be distributed. This encompasses any assets not specifically mentioned in the bequests or beneficiaries section. 7. Guardianship: If the individual has any dependents, such as pets or minor children, they can appoint a guardian to ensure their care and well-being after the testator's death. 8. Funeral and Burial wishes: The will may also include instructions regarding funeral or cremation arrangements, as well as any specific details regarding the disposition of the testator's remains. It is important to note that while the general framework of the Charlotte North Carolina Legal Last Will Form for a Widow or Widower with no Children remains relatively consistent, there might be variations or additional clauses depending on the specific needs and preferences of the individual. Consulting with an attorney experienced in estate planning is highly advisable to ensure the will adheres to all relevant legal requirements and effectively reflects the testator's intentions.