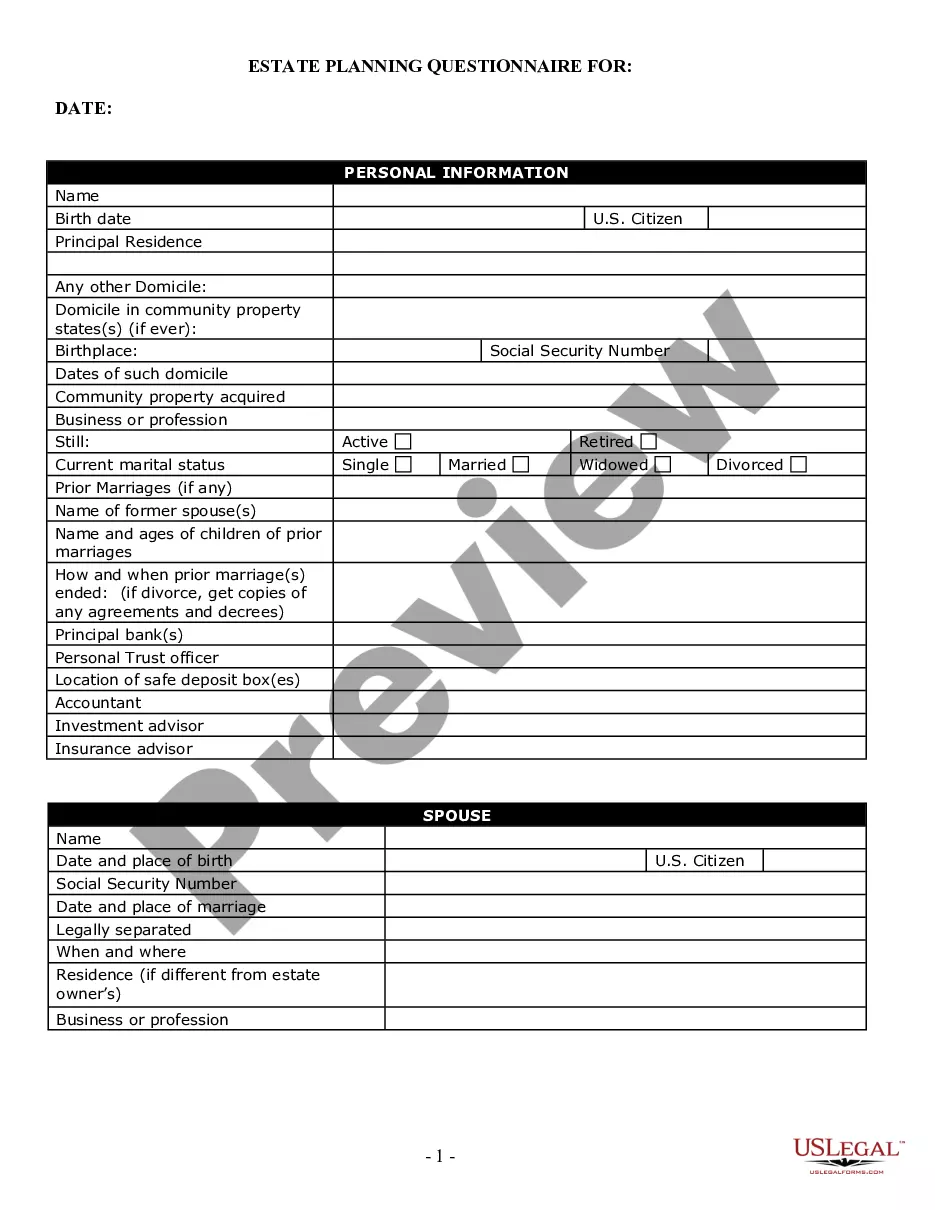

Fayetteville North Carolina Estate Planning Questionnaire and Worksheets refer to comprehensive and essential tools used in the estate planning process. These documents assist individuals in gathering crucial information and making important decisions in order to create a comprehensive estate plan tailored to their specific needs. The questionnaire and worksheets cover various legal, financial, and personal aspects, ensuring that all necessary details are considered. The Fayetteville North Carolina Estate Planning Questionnaire and Worksheets typically consist of several sections, including: 1. Personal Information: This section collects personal details of the estate owner, such as full legal name, contact information, social security number, and marital status. 2. Family and Beneficiary Information: Here, individuals provide information about their family members, including spouses, children, grandchildren, and other beneficiaries. This helps in determining how the estate should be distributed and ensuring the inclusion of specific bequests. 3. Assets and Liabilities: This section requires the estate owner to compile a comprehensive list of their assets, such as real estate properties, investment accounts, retirement funds, bank accounts, businesses, vehicles, and personal belongings. Additionally, they are asked to disclose any outstanding debts or liabilities. 4. Digital Assets and Online Accounts: With the increasing prominence of digital assets and online accounts, this section focuses on identifying and managing those assets, including digital files, online banking, email accounts, social media profiles, and cryptocurrency. 5. Healthcare and End-of-Life Preferences: A crucial part of estate planning involves making decisions about healthcare arrangements and end-of-life preferences. This section provides an opportunity for individuals to express their wishes regarding medical treatment, organ donation, life-sustaining measures, and appointment of healthcare proxies. 6. Guardianship and Minors: If the estate owner has minor children, this section addresses the appointment of guardians and their preferences regarding the care and upbringing of their children in case of unexpected incapacity or death. 7. Executor and Trustee Selection: Individuals can designate an executor, who will be responsible for managing and distributing the estate, as well as a trustee for any trust provisions. This section includes information about potential candidates and their contact details. 8. Charitable Giving: For those interested in leaving a legacy through charitable giving, this section allows individuals to specify any charitable organizations or causes they wish to support, along with details about the nature and amount of their desired contribution. Different types of Fayetteville North Carolina Estate Planning Questionnaire and Worksheets may vary based on the specific needs and goals of individuals or as per the preferences of legal firms or estate planning professionals. They may include additional sections or customized templates to address unique circumstances, such as complex family dynamics, asset protection strategies, or business succession planning. It is important to consult with an experienced estate planning attorney to ensure the right forms are utilized for each individual's specific situation.

Fayetteville North Carolina Estate Planning Questionnaire and Worksheets

Description

How to fill out Fayetteville North Carolina Estate Planning Questionnaire And Worksheets?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for attorney solutions that, usually, are very expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Fayetteville North Carolina Estate Planning Questionnaire and Worksheets or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Fayetteville North Carolina Estate Planning Questionnaire and Worksheets adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Fayetteville North Carolina Estate Planning Questionnaire and Worksheets is proper for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!