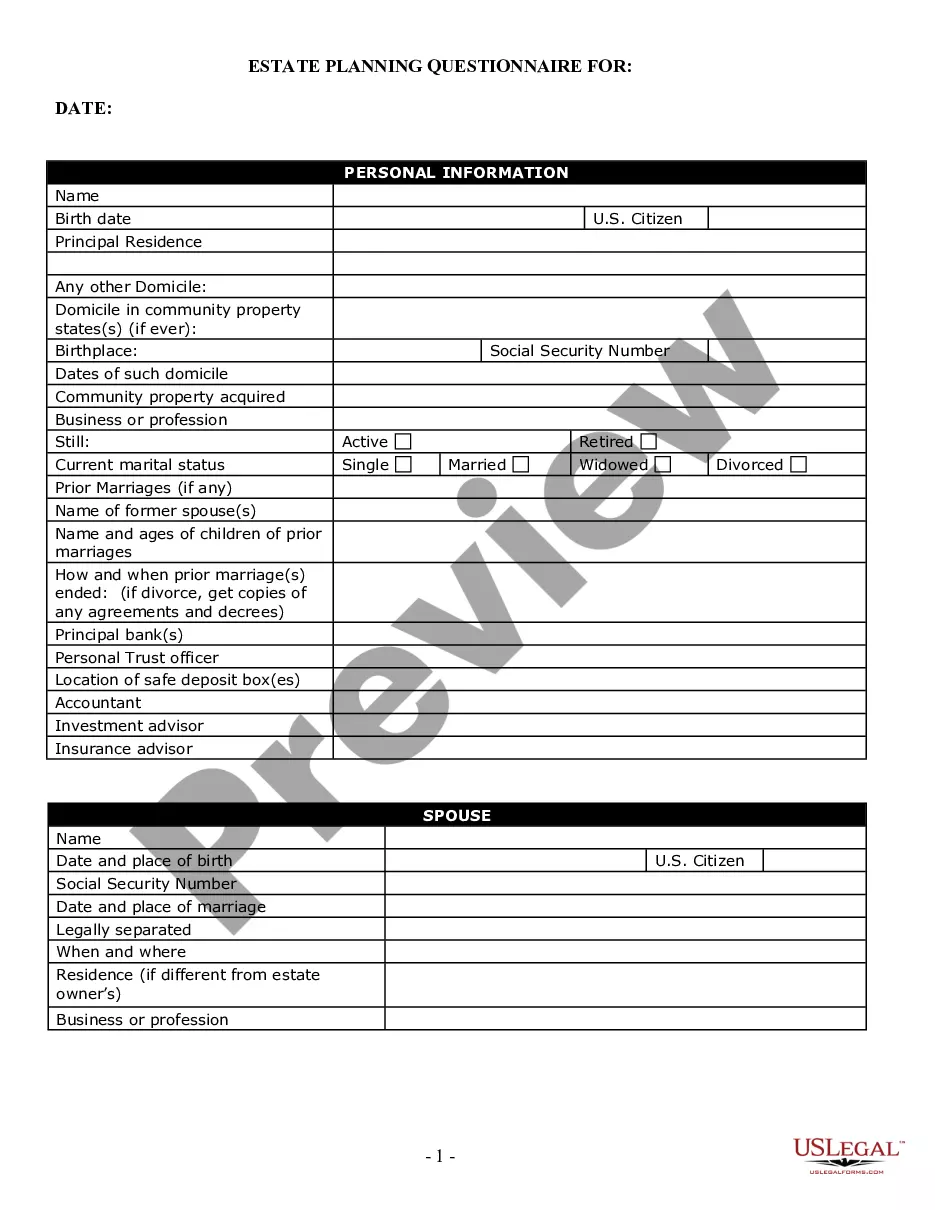

Wake North Carolina Estate Planning Questionnaire and Worksheets are comprehensive resources designed to assist individuals in creating a detailed estate plan tailored to their specific needs and requirements. These questionnaires and worksheets aim to gather crucial information and guide individuals through the estate planning process, ensuring a smooth and efficient planning experience. The Wake North Carolina Estate Planning Questionnaire and Worksheets cover various aspects of estate planning, including but not limited to: 1. Personal Information: These documents collect basic personal information like name, address, and contact details to establish the identity of the individual creating the estate plan. 2. Family Details: These questionnaires delve into the composition of the individual's family, including information about spouses, children, grandchildren, and other beneficiaries. It helps determine how the estate will be distributed among family members. 3. Asset Inventory: This section requires individuals to provide a detailed inventory of their assets, including real estate, investments, bank accounts, retirement accounts, insurance policies, and other valuables. This information is essential for proper estate distribution planning. 4. Health Care Preferences: These questionnaires cover health care directives and medical preferences, such as desired medical treatments, end-of-life care instructions, and appointment of a healthcare representative to make decisions on behalf of the individual. 5. Financial Matters: This section focuses on financial matters, such as the appointment of an executor or personal representative, guardianship designation for minor children, and instructions for the management and distribution of financial assets. 6. Special Instructions: Individuals can include specific instructions or requests regarding their estate plan, such as charitable donations, trusts, or any unique considerations. Some variations of the Wake North Carolina Estate Planning Questionnaire and Worksheets may include additional specialized sections addressing specific scenarios. These could include: — Business Succession Planning: This section is designed for individuals who own businesses and need to plan for the succession or transfer of their business interests to chosen beneficiaries or partners. — Trust Planning: For individuals interested in creating various types of trusts, such as revocable living trusts, irrevocable trusts, or special needs trusts, these questionnaires may include specific sections to gather relevant information. — Tax Planning: Some versions of the questionnaire may provide sections to gather information relevant to estate tax planning and strategies, ensuring the estate plan is optimized to minimize tax liabilities. Overall, the Wake North Carolina Estate Planning Questionnaire and Worksheets provide an organized framework for individuals to articulate their estate planning goals, wishes, and instructions. They serve as valuable tools to ensure that individuals can create robust estate plans that safeguard their assets, protect their loved ones, and fulfill their desired legacy.

Wake North Carolina Estate Planning Questionnaire and Worksheets

Description

How to fill out Wake North Carolina Estate Planning Questionnaire And Worksheets?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person without any legal education to create this sort of paperwork from scratch, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Wake North Carolina Estate Planning Questionnaire and Worksheets or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Wake North Carolina Estate Planning Questionnaire and Worksheets quickly employing our reliable platform. If you are already a subscriber, you can go ahead and log in to your account to download the appropriate form.

However, if you are new to our library, make sure to follow these steps before obtaining the Wake North Carolina Estate Planning Questionnaire and Worksheets:

- Ensure the form you have found is suitable for your location since the rules of one state or area do not work for another state or area.

- Review the document and go through a short outline (if provided) of cases the paper can be used for.

- If the one you picked doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Wake North Carolina Estate Planning Questionnaire and Worksheets once the payment is through.

You’re good to go! Now you can go ahead and print out the document or complete it online. Should you have any issues getting your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.