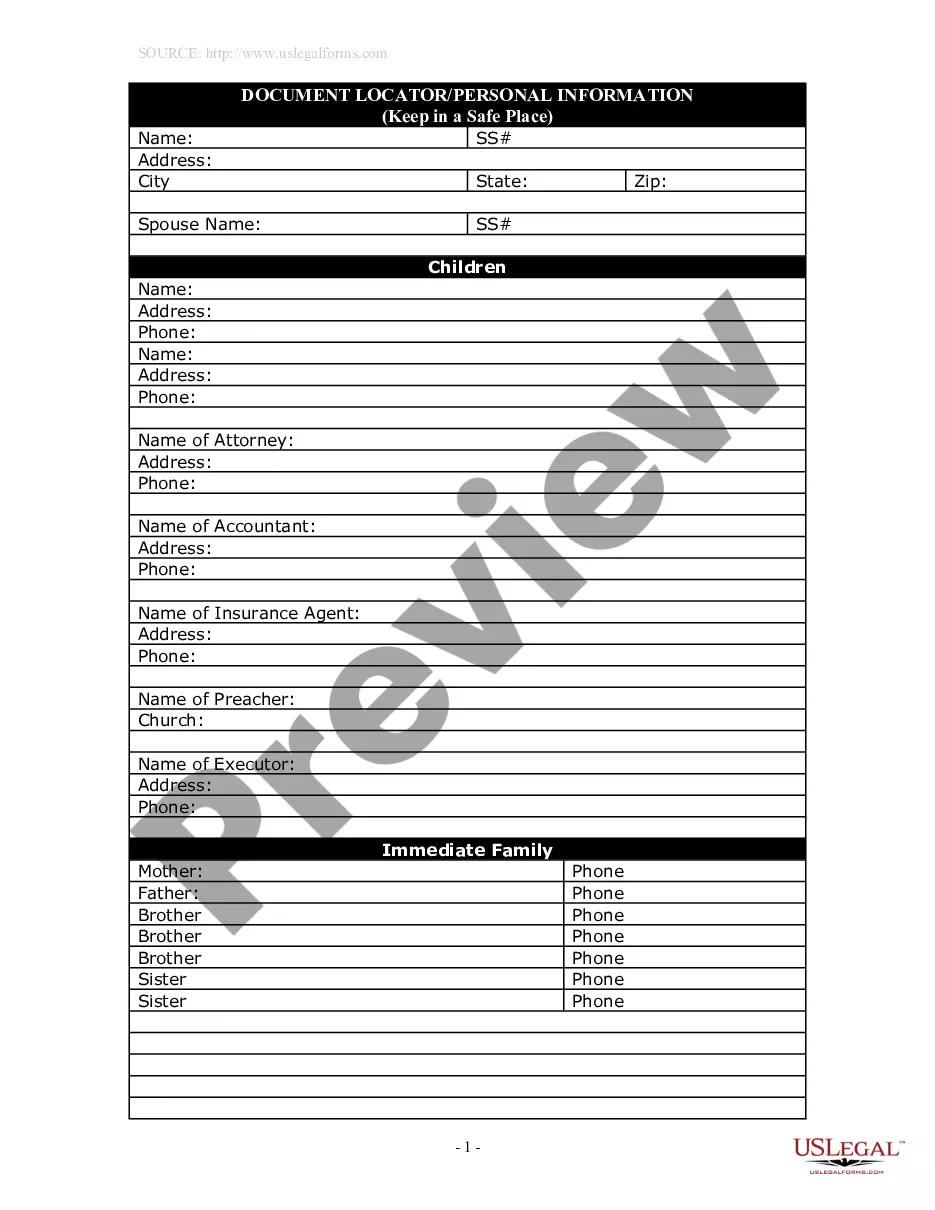

Raleigh North Carolina Document Locator and Personal Information Package including burial information form

Description

How to fill out North Carolina Document Locator And Personal Information Package Including Burial Information Form?

Regardless of social or professional standing, completing legal paperwork is an unfortunate requirement in today's business landscape.

Frequently, it becomes nearly impossible for an individual lacking legal experience to generate this type of documentation from scratch, primarily due to the intricate terminology and legal nuances involved.

This is precisely where US Legal Forms comes to provide assistance.

Ensure that the form you have located is tailored to your region, as regulations in one state or area are not applicable to another.

Review the document and examine a brief overview (if available) of the contexts in which the document can be applied.

- Our platform boasts an extensive repository with over 85,000 ready-to-use, state-specific documents suitable for virtually any legal matter.

- US Legal Forms also acts as an excellent resource for associates or legal advisors seeking to enhance their efficiency by using our DIY forms.

- Regardless of whether you need the Raleigh North Carolina Document Locator and Personal Information Package that includes a burial information form or any other document that will be acknowledged in your state or locality, US Legal Forms has everything available.

- Here’s how to swiftly acquire the Raleigh North Carolina Document Locator and Personal Information Package that encompasses a burial information form using our reliable platform.

- If you are an existing customer, proceed to Log In to your account to retrieve the necessary form.

- However, if you are new to our platform, ensure you follow these instructions before obtaining the Raleigh North Carolina Document Locator and Personal Information Package including burial information form.

Form popularity

FAQ

Where do I mail NC Form D-400? If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640.

For taxpayers filing using paper forms: If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001. If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640.

Mail this form with your check or money order in U.S. currency to: N.C. Department of Revenue, P.O. Box 25000, Raleigh, N.C. 27640-0630. Do not fold, tape, or staple this return or your check. Do not send cash.

Mail to: N.C. Department of Revenue P.O. Box 25000, Raleigh, N.C. 27640-0635 Fill in this circle if you were out of the country on the date that this application was due.

400 Individual Income Tax Return.

Attach copies of Income Forms W-2s, 1099s, and other income documents to the front of your Form 1040. You should send your Tax Return through the US Postal Service with a method for delivery tracking. This way, you will know when the IRS receives your Tax Return.

Important 2021 tax documents Forms W-2 from employer(s) Forms 1099 from banks, issuing agencies and other payers including unemployment compensation, dividends and distributions from a pension, annuity or retirement plan. Form 1099-K, 1099-Misc, W-2 or other income statement if they worked in the gig economy.

All individuals (including part-year residents and nonresidents) required to file a North Carolina individual income tax return must file Form D-400.

Your North Carolina income tax return (Form D-400).

400 Individual Income Tax Return.