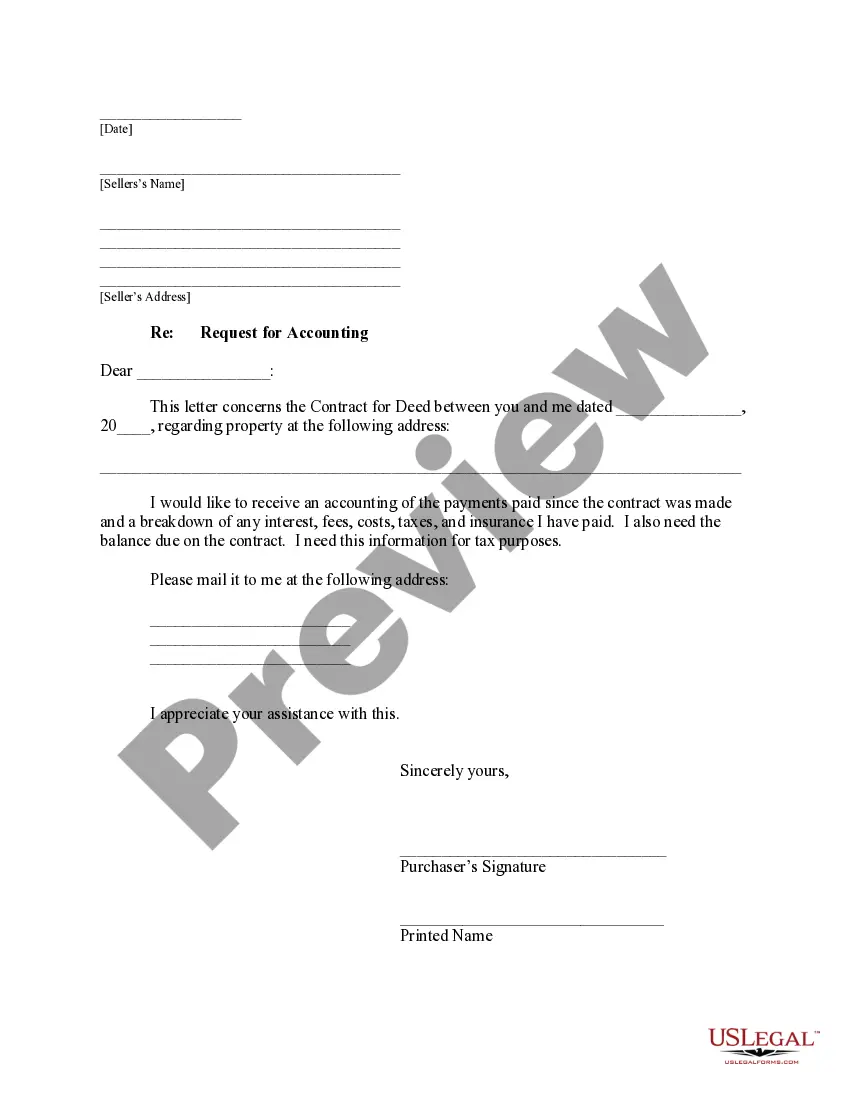

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Fargo North Dakota Buyer's Request for Accounting from Seller under Contract for Deed

Description

How to fill out North Dakota Buyer's Request For Accounting From Seller Under Contract For Deed?

We consistently aim to minimize or avert legal complications when managing intricate legal or monetary issues. In order to accomplish this, we seek out legal assistance that is often quite expensive. However, not every legal situation is that intricate. A majority of them can be addressed by us independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to manage your issues without resorting to a lawyer. We offer access to legal document templates that aren’t always readily available. Our templates are tailored to specific states and regions, greatly simplifying the search process.

Utilize US Legal Forms whenever you need to acquire and download the Fargo North Dakota Buyer's Request for Accounting from Seller under Contract for Deed or any other form quickly and securely. Simply Log In to your account and press the Get button adjacent to it. If you have misplaced the form, you can always retrieve it again from the My documents section.

The procedure is just as straightforward if you’re unfamiliar with the site! You can create your account within moments.

For over 24 years, we’ve aided millions by supplying ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Ensure that the Fargo North Dakota Buyer's Request for Accounting from Seller under Contract for Deed complies with the laws and regulations of your state and region.

- It’s essential to review the form’s description (if provided), and if you observe any inconsistencies with what you originally sought, look for an alternative form.

- After confirming that the Fargo North Dakota Buyer's Request for Accounting from Seller under Contract for Deed fits your needs, you can select the subscription choice and process your payment.

- You can then download the form in any available format.

Form popularity

FAQ

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

How do I write a Sales Agreement? Specify your location.Provide the buyer's and seller's information.Describe the goods and services.State the price and deposit details (if applicable)Outline payment details.Provide delivery terms.Include liability details.State if there's a warranty on the goods.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.

What is one advantage of a contract for deed? Gives the seller certain tax benefits.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.