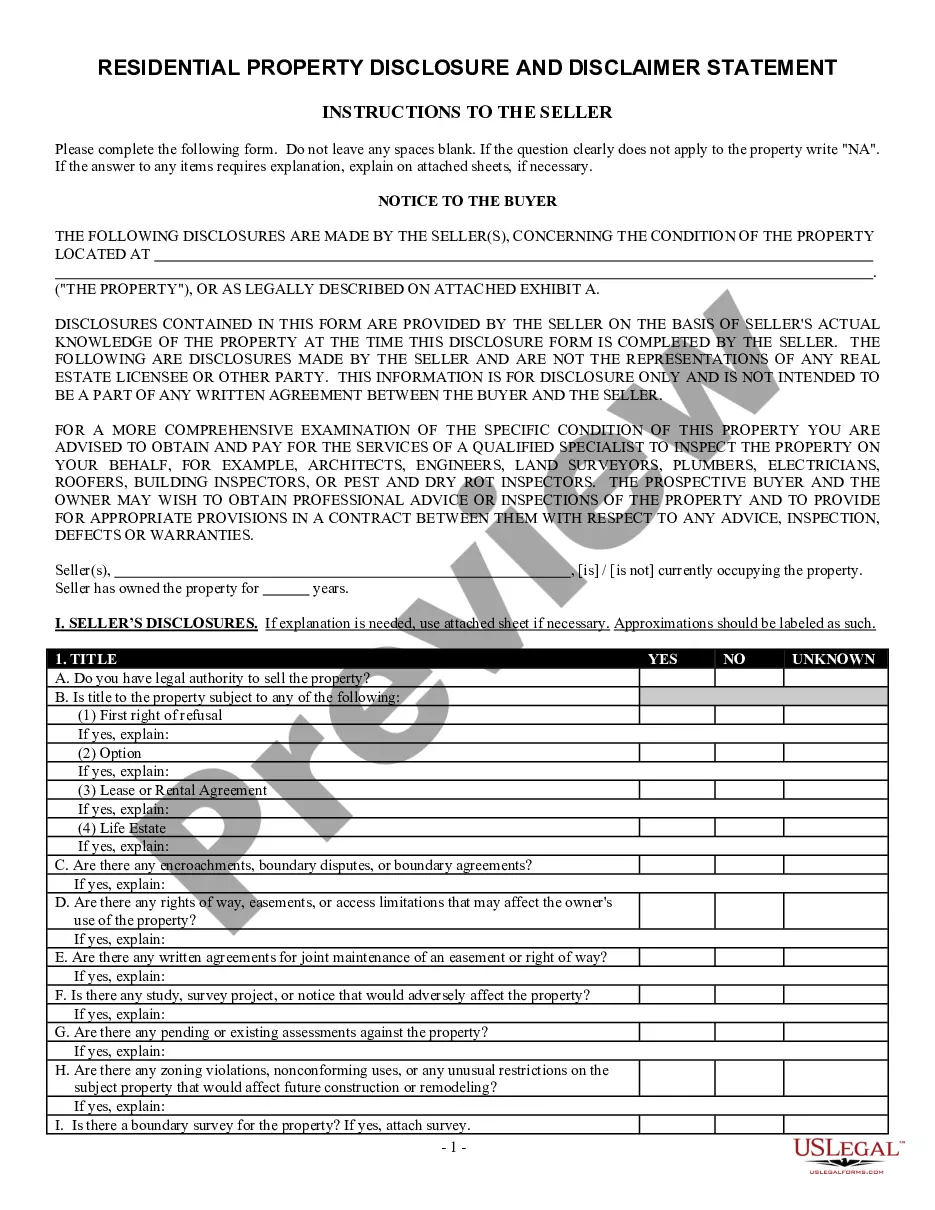

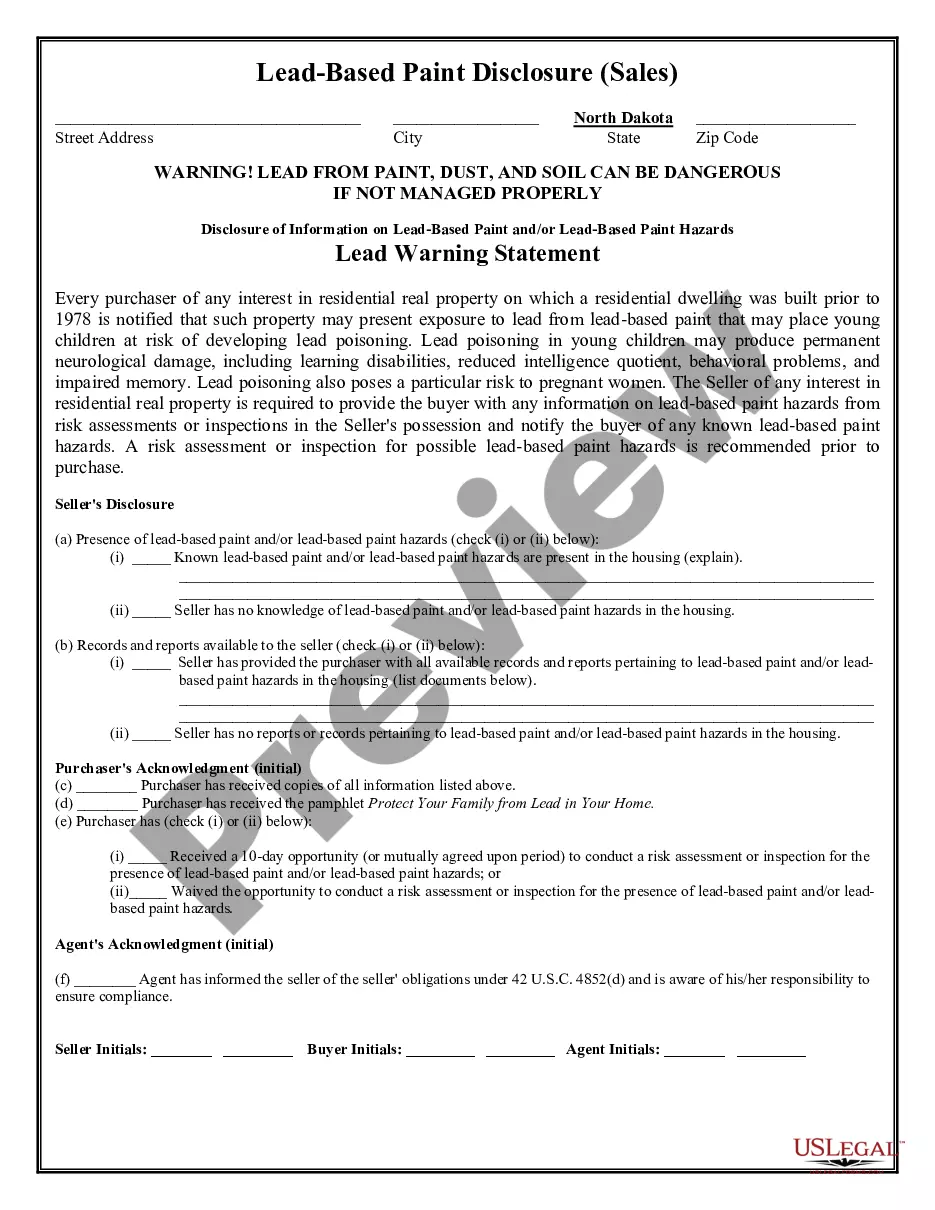

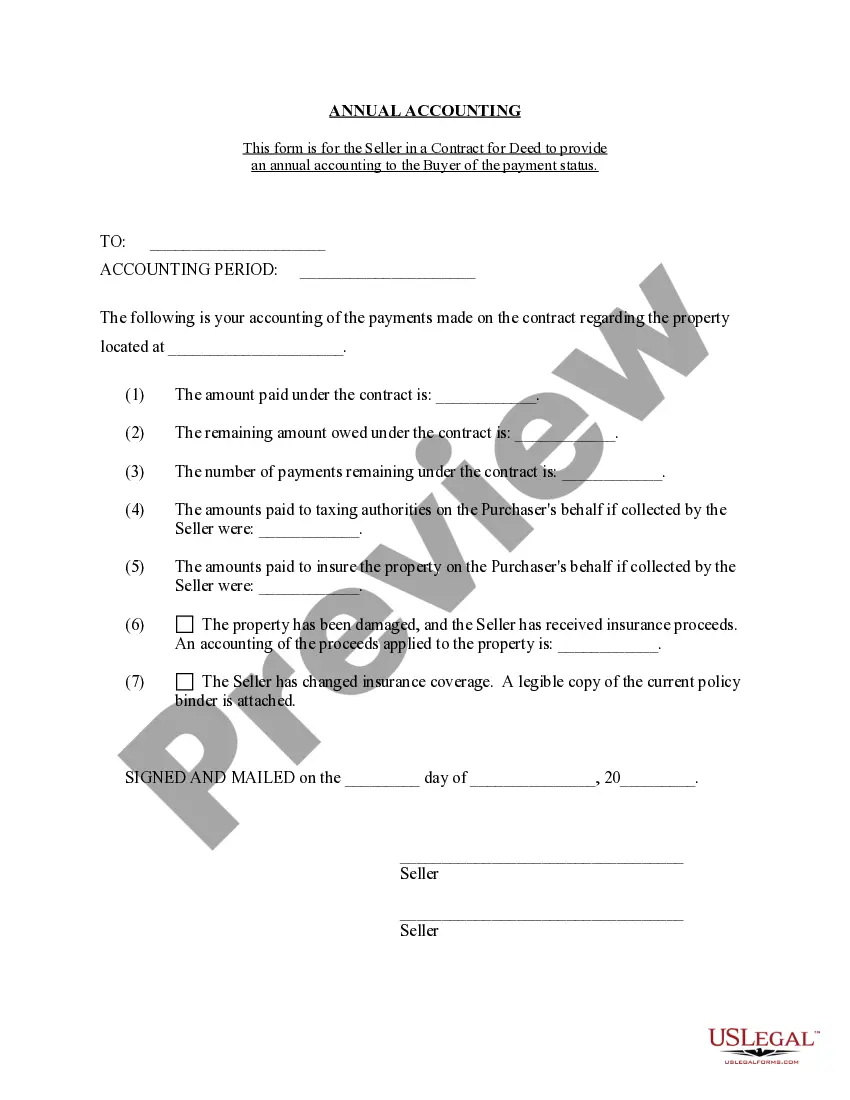

A Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement is a detailed financial document prepared by the seller of a property sold through a contract for deed in Fargo, North Dakota. This statement outlines the financial transactions and obligations related to the contract for deed for a given year. It provides a comprehensive overview of the financial activities and serves as an essential record for both the seller and the buyer. The Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement is essential for maintaining transparency and ensuring that both parties are aware of the financial status of the contract. It typically includes various details and key information such as: 1. Property Details: The statement starts with the identification of the property involved in the contract for deed, providing the legal description and any relevant identifiers. 2. Payment Summary: The seller's annual accounting statement details all the payments made by the buyer over the course of the year. It includes the date, amount, and method of payment (e.g., cash, check, online transfer). 3. Principal and Interest: This section outlines the allocation of payments between principal and interest. It states the remaining balance on the contract and calculates the interest accrued based on the agreed-upon terms. 4. Property Taxes: The statement includes an account of property taxes for the year, indicating the amount paid and any outstanding balances. It ensures that the property taxes are kept up to date as per the contract terms. 5. Insurance Payments: If the contract requires the buyer to maintain insurance coverage on the property, the accounting statement includes the insurance payments made by the buyer during the year. It may also specify the type of insurance coverage. 6. Maintenance and Repairs: This section provides a breakdown of any maintenance or repair expenses incurred by the seller during the year. It outlines the nature of the repairs, costs, and any reimbursements made by the buyer, if applicable. 7. Other Expenses: The Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement can also include other expenses related to the property. These may include utilities, homeowners association fees, or any other costs agreed upon in the contract. 8. Additional Terms: If there are any additional terms or clauses specific to the contract for deed, such as penalty provisions or buyout options, they may be included in this section. Different types of Fargo North Dakota Contract for Deed Seller's Annual Accounting Statements may exist depending on the specific terms agreed upon between the buyer and seller. For example, there may be variations in payment schedules, interest rates, or additional terms outlined in the statement. It is crucial for both parties to review the statement thoroughly and compare it with the original contract to ensure accuracy and address any discrepancies.

Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement

State:

North Dakota

City:

Fargo

Control #:

ND-00470-4

Format:

Word;

Rich Text

Instant download

Description

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

A Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement is a detailed financial document prepared by the seller of a property sold through a contract for deed in Fargo, North Dakota. This statement outlines the financial transactions and obligations related to the contract for deed for a given year. It provides a comprehensive overview of the financial activities and serves as an essential record for both the seller and the buyer. The Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement is essential for maintaining transparency and ensuring that both parties are aware of the financial status of the contract. It typically includes various details and key information such as: 1. Property Details: The statement starts with the identification of the property involved in the contract for deed, providing the legal description and any relevant identifiers. 2. Payment Summary: The seller's annual accounting statement details all the payments made by the buyer over the course of the year. It includes the date, amount, and method of payment (e.g., cash, check, online transfer). 3. Principal and Interest: This section outlines the allocation of payments between principal and interest. It states the remaining balance on the contract and calculates the interest accrued based on the agreed-upon terms. 4. Property Taxes: The statement includes an account of property taxes for the year, indicating the amount paid and any outstanding balances. It ensures that the property taxes are kept up to date as per the contract terms. 5. Insurance Payments: If the contract requires the buyer to maintain insurance coverage on the property, the accounting statement includes the insurance payments made by the buyer during the year. It may also specify the type of insurance coverage. 6. Maintenance and Repairs: This section provides a breakdown of any maintenance or repair expenses incurred by the seller during the year. It outlines the nature of the repairs, costs, and any reimbursements made by the buyer, if applicable. 7. Other Expenses: The Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement can also include other expenses related to the property. These may include utilities, homeowners association fees, or any other costs agreed upon in the contract. 8. Additional Terms: If there are any additional terms or clauses specific to the contract for deed, such as penalty provisions or buyout options, they may be included in this section. Different types of Fargo North Dakota Contract for Deed Seller's Annual Accounting Statements may exist depending on the specific terms agreed upon between the buyer and seller. For example, there may be variations in payment schedules, interest rates, or additional terms outlined in the statement. It is crucial for both parties to review the statement thoroughly and compare it with the original contract to ensure accuracy and address any discrepancies.

How to fill out Fargo North Dakota Contract For Deed Seller's Annual Accounting Statement?

If you’ve already utilized our service before, log in to your account and save the Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Fargo North Dakota Contract for Deed Seller's Annual Accounting Statement. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!