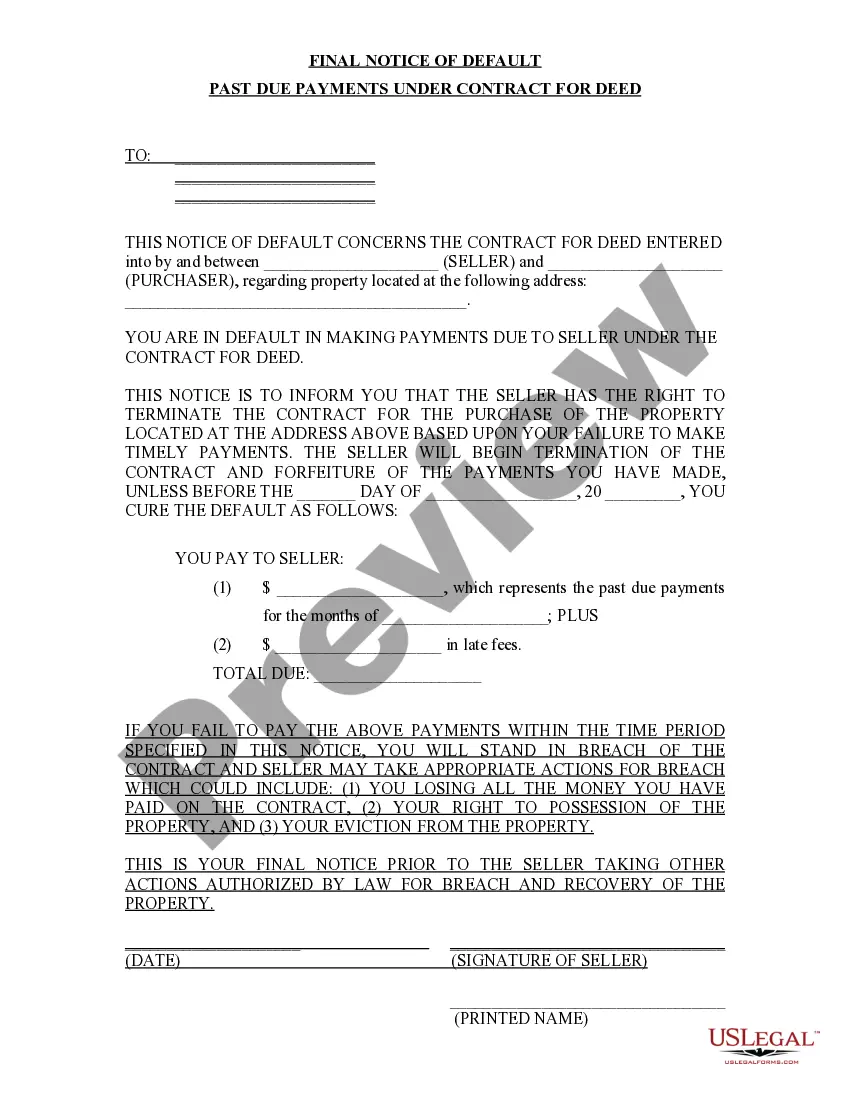

Keywords: Fargo North Dakota, Final Notice of Default, Past Due Payments, Contract for Deed Description: A Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document issued by the lender to inform the borrower that they have failed to make timely payments on a Contract for Deed agreement. This notice serves as a formal notification to the borrower that they are in breach of the terms stated in the contract and that immediate action must be taken to rectify the situation. There are different types of Final Notices of Default for Past Due Payments in connection with Contract for Deed that can be issued, depending on the severity and duration of the borrower's delinquency. These may include: 1. Initial Notice of Default: This is the first notice sent to the borrower when they fail to make their payments on time. It serves as a reminder and a warning that further action will be taken if the outstanding payments are not received promptly. 2. Second Notice of Default: If the borrower fails to respond or rectify the situation after receiving the initial notice, a second notice of default may be issued. This notice emphasizes the urgency of making the overdue payments and warns of potential legal consequences if the issue continues to be unresolved. 3. Final Notice of Default: If the borrower still fails to make the required payments after receiving the second notice, a final notice of default is issued. This notice marks the last opportunity for the borrower to address the outstanding payments before the lender proceeds with legal action, such as foreclosure or repossession of the property. It is important for the borrower to carefully read and understand the Final Notice of Default. It typically includes detailed information about the amount of the outstanding payment, the due date, any additional late fees or penalties, and the consequences that may occur if the debt remains unpaid. The notice also provides contact information for the lender or their representative, allowing the borrower to seek clarification, negotiate a payment plan, or resolve any disputes related to the default. Receiving a Final Notice of Default should be taken seriously, as it indicates a potential threat to the borrower's rights to the property. Acting promptly and seeking professional advice is crucial to avoid further legal complications and safeguard one's interests in the Contract for Deed agreement.

Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Fargo North Dakota Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

Filing a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed is a crucial step in the process. First, gather all relevant documents associated with your contract for deed, including payment records and communication history. Next, complete the notice form accurately, ensuring to include all necessary details, such as the debtor's information and the amount owed. Finally, file the notice with the appropriate county office and consider using a service like US Legal Forms to simplify this process and ensure compliance with local regulations.

In a contract for deed in North Dakota, the buyer generally assumes responsibility for property taxes. This obligation usually starts as soon as the buyer takes possession of the property. Properly managing these taxes is essential to preventing issues like a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed, which can complicate your financial situation.

The average interest rate on a contract for deed in North Dakota typically ranges between 5% to 10%. Factors such as the seller's terms, the buyer's creditworthiness, and market conditions can influence the exact rate. Understanding the interest component can help you avoid receiving a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed due to payment challenges.

A contract for deed is an agreement between a buyer and a seller where the buyer makes payments for a property directly to the seller. The seller retains the title until the buyer fulfills all payment obligations. If you are facing a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed, Understanding this agreement is crucial, as it outlines your rights and obligations. Always review your contract carefully and seek legal advice if needed.

Writing up a contract for deed involves detailing specific elements such as property description, payment schedule, interest rates, and any repairs required. It is also vital to stipulate the consequences of late payments, which may include a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed. Utilizing templates from uslegalforms can simplify this process, ensuring you cover all necessary legal aspects.

Two main disadvantages of a contract for deed are the risk of losing the property and the possibility of higher costs over time. If the buyer is unable to keep up with payments, they may receive a Fargo North Dakota Final Notice of Default for Past Due Payments in connection with Contract for Deed, resulting in potential eviction. Additionally, buyers often face limitations in their rights compared to traditional mortgage arrangements.