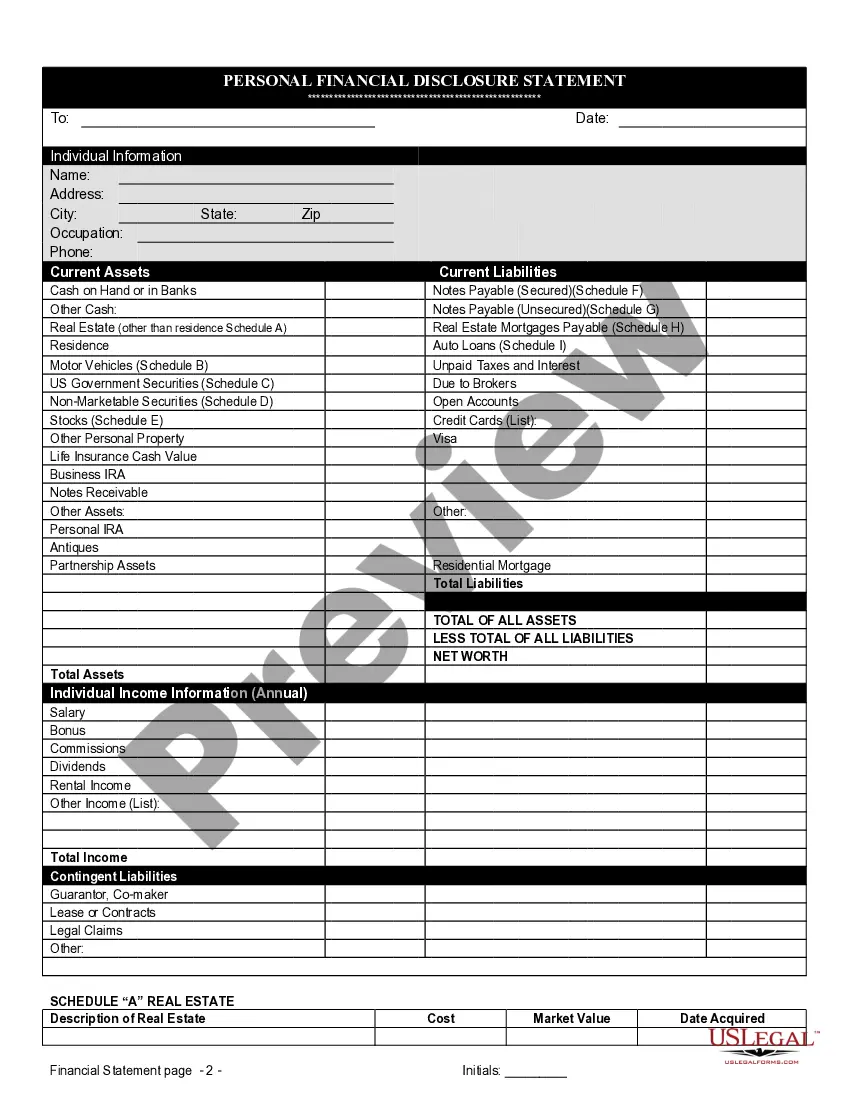

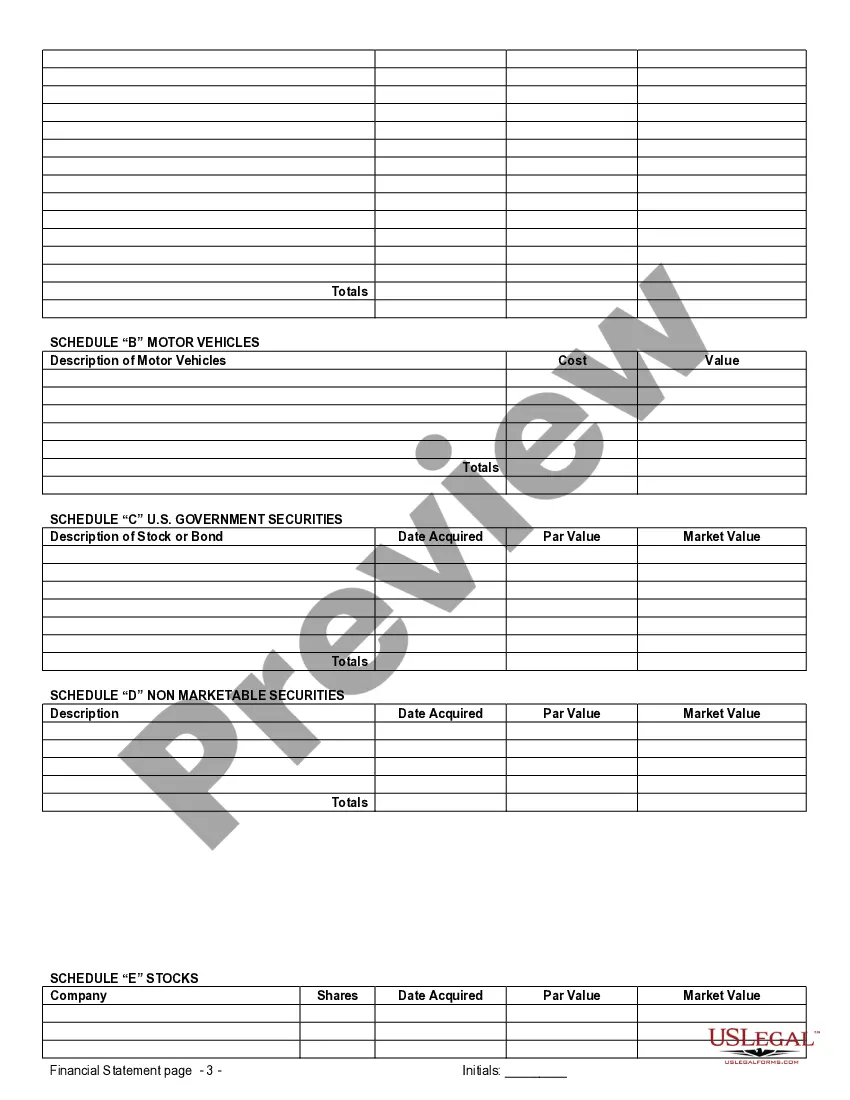

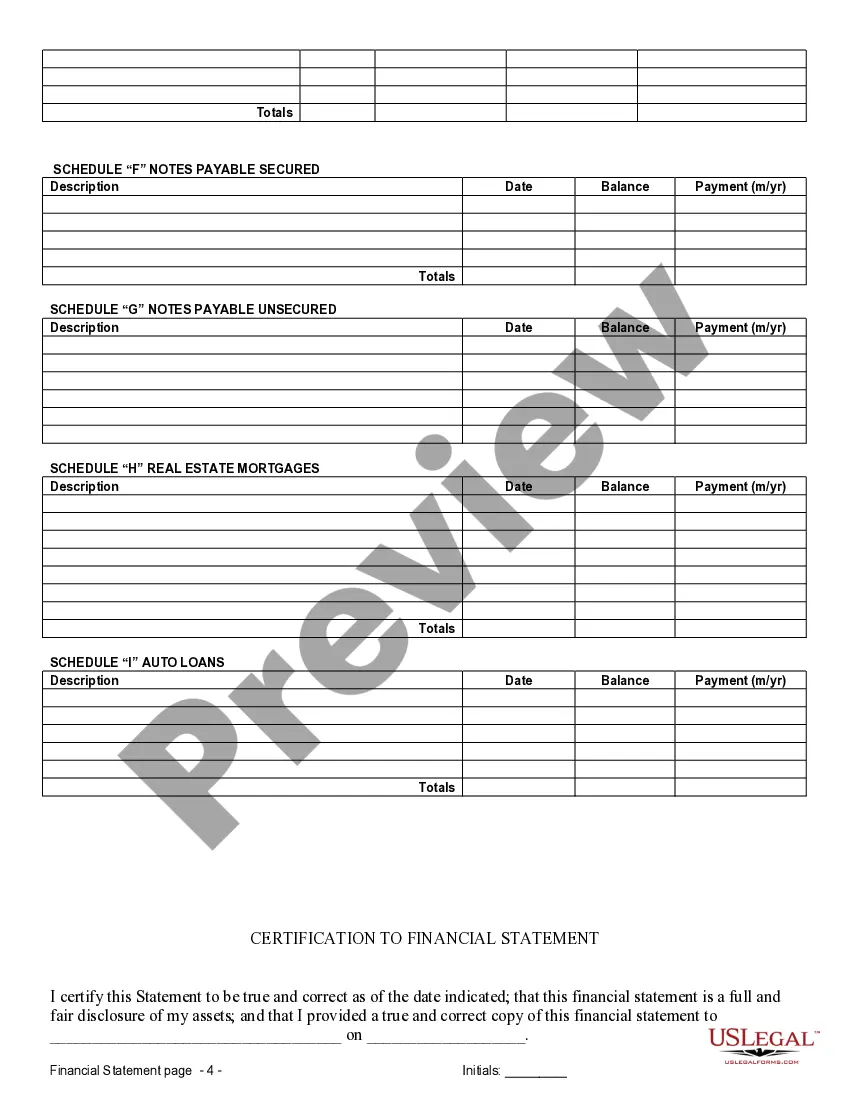

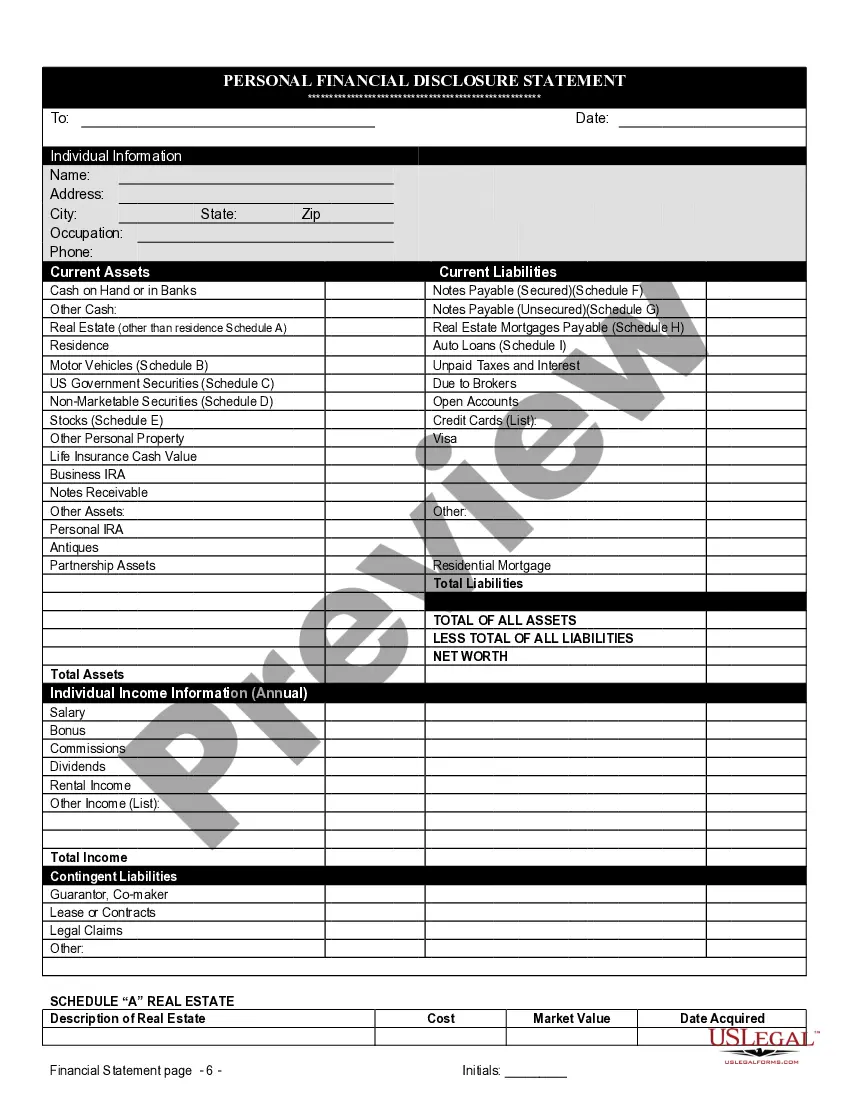

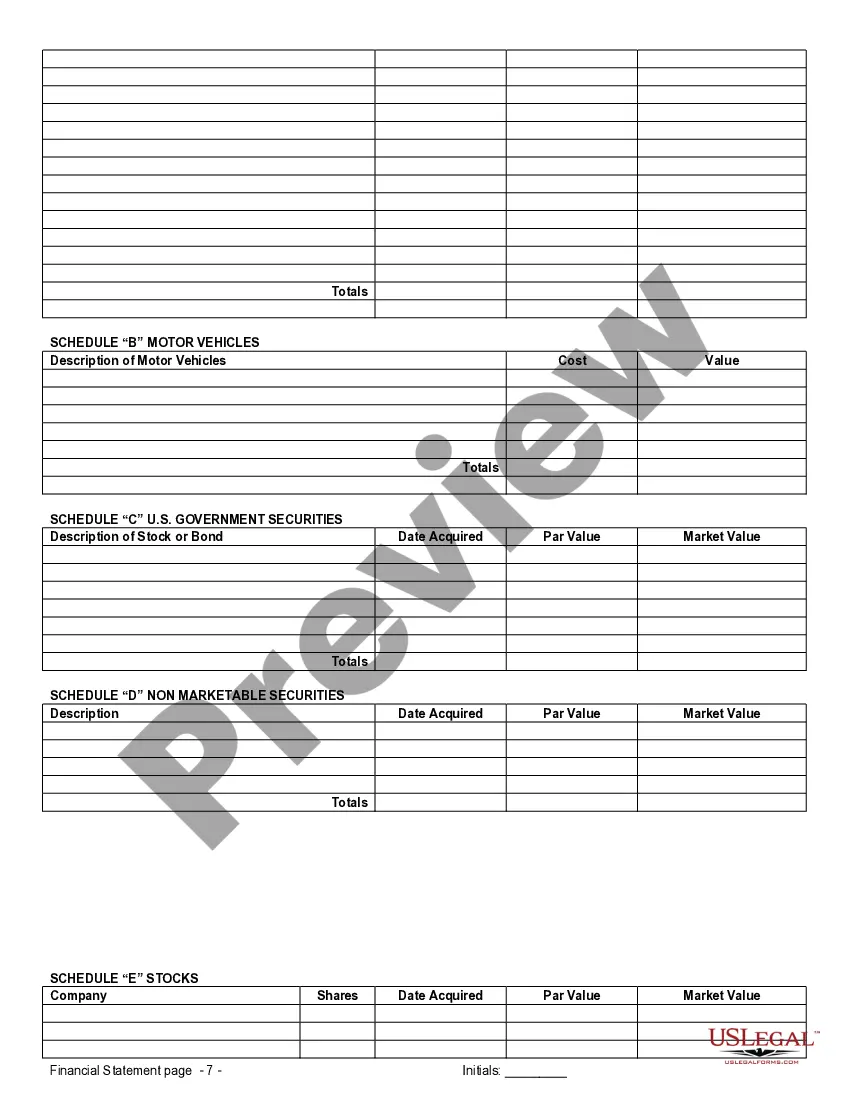

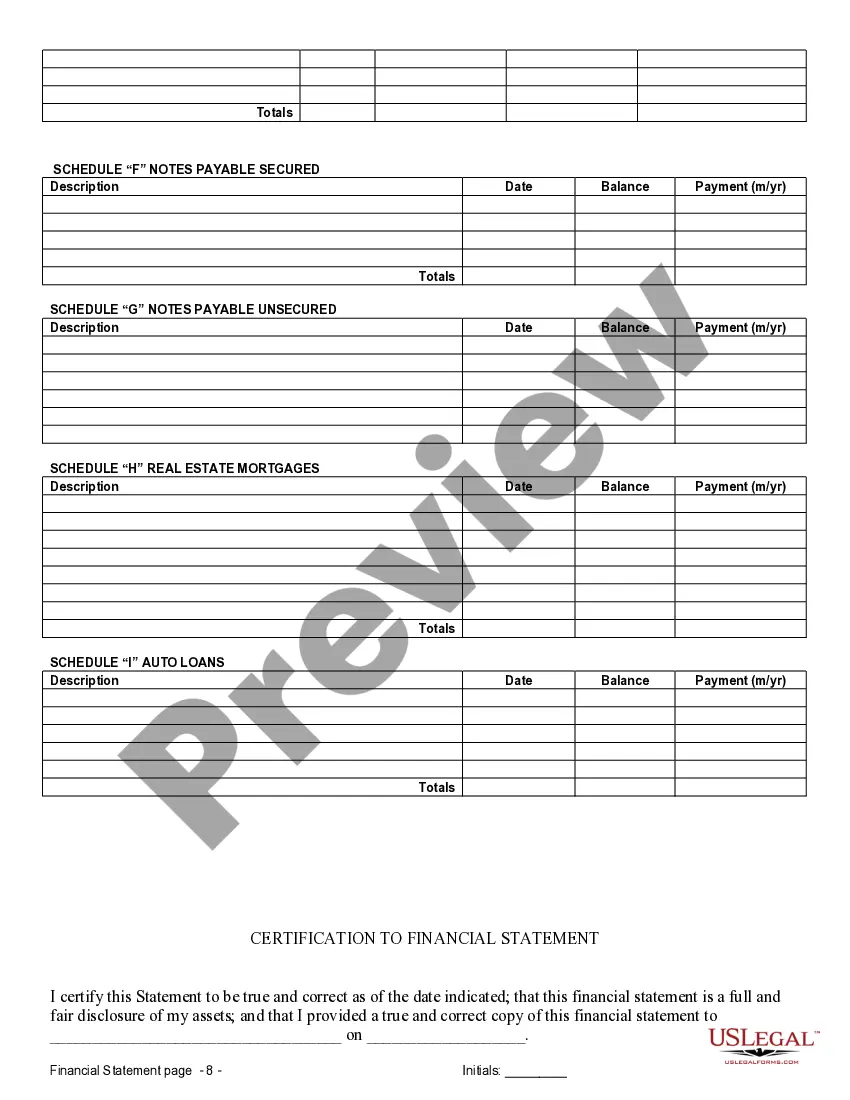

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out North Dakota Financial Statements Only In Connection With Prenuptial Premarital Agreement?

We consistently seek to minimize or avert legal complications when navigating intricate legal or financial matters.

To achieve this, we pursue legal solutions that are generally quite expensive.

However, not all legal situations are similarly complicated; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering a range from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you have misplaced the document, you can always redownload it in the My documents section. The process remains as straightforward for new users! You can create an account in just a few minutes. Ensure the Fargo North Dakota Financial Statements related to Prenuptial Premarital Agreement adheres to the regulations of your state and region. Additionally, it is crucial to review the form's description (if available), and if you observe any inconsistencies with your initial requirements, look for an alternative template. Once you have confirmed that the Fargo North Dakota Financial Statements related to Prenuptial Premarital Agreement is suitable for your needs, you can choose a subscription plan and make a payment. Afterwards, you can download the document in any preferred format. For over 24 years of our market presence, we have assisted millions by providing customizable and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your affairs without relying on legal advisors.

- We provide access to legal document templates that are not always accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- You can benefit from US Legal Forms whenever you need to obtain and download the Fargo North Dakota Financial Statements related to Prenuptial Premarital Agreements or any other document swiftly and securely.

Form popularity

FAQ

To write a prenuptial agreement, start by discussing your financial goals and concerns with your partner. Next, outline what you want included in the agreement, such as asset division, debt responsibilities, and any unique considerations. Utilizing resources like USLegalForms can simplify the process, providing templates specifically designed for creating Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement, ensuring your agreement meets legal standards.

While prenuptial agreements primarily protect assets owned before marriage, they can also stipulate how assets acquired during the marriage are managed. This flexibility allows both parties to negotiate terms that suit their financial situations. When drafting your Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement, ensure you cover both premarital and marital assets for comprehensive protection.

A prenuptial agreement typically does not cover child custody or child support issues. These matters are determined based on the best interests of the child at the time of divorce or separation. As you prepare your Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement, focus on the financial aspects while keeping in mind that some areas remain outside the scope of a prenup.

No, a prenuptial agreement can address both premarital assets and future earnings. It provides a framework for how to handle various financial matters during marriage, including any acquired assets. By incorporating Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement, both parties can clarify their expectations and financial responsibilities within the marriage.

Yes, you can include provisions in a prenuptial agreement regarding future inheritance. This ensures that any assets you inherit will remain separate and protected during and after marriage. Including this information in your Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement adds clarity and prevents disputes. It's advisable to consult a legal expert to ensure your prenup meets all necessary legal standards.

To ensure a prenuptial agreement is valid in Fargo, North Dakota, specific requirements must be met. Both parties should voluntarily sign the agreement, and it must be in writing. Additionally, full financial disclosure is necessary to uphold the integrity of the agreement. Utilizing a platform like USLegalForms can streamline this process and provide the necessary templates for your financial statements only in connection with a prenuptial premarital agreement.

Financial disclosure in a prenuptial agreement involves the sharing of each party's financial information. This process is crucial for ensuring both individuals fully understand their financial situation before marriage. In Fargo, North Dakota, financial statements only in connection with a prenuptial premarital agreement allow for informed decisions. This mutual understanding can help avoid disputes in the future.

Avoiding financial disclosure in a prenuptial agreement can be challenging, but it is feasible. In Fargo, North Dakota, both parties should understand their obligations to disclose financial statements. Transparency builds trust, but if you wish to minimize detailed disclosures, consider setting clear parameters in your agreement. You may benefit from legal guidance to navigate this process effectively.

A financial prenup is a prenuptial agreement that specifically addresses the financial arrangements between partners in the event of a divorce or separation. It outlines how assets, debts, and income will be handled, protecting both parties' financial interests. Having clear Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement enhances the effectiveness of a financial prenup. US Legal Forms can help you draft a polished financial prenup tailored to your needs.

A financial statement holds significant importance during a divorce as it provides a clear view of each party's financial situation. Courts rely on this information to make fair decisions regarding asset division and support payments. If you have prepared thorough Fargo North Dakota Financial Statements only in Connection with Prenuptial Premarital Agreement, you will find it easy to navigate the complexities of divorce. Consider using US Legal Forms to ensure your financial statement is accurate and comprehensive.