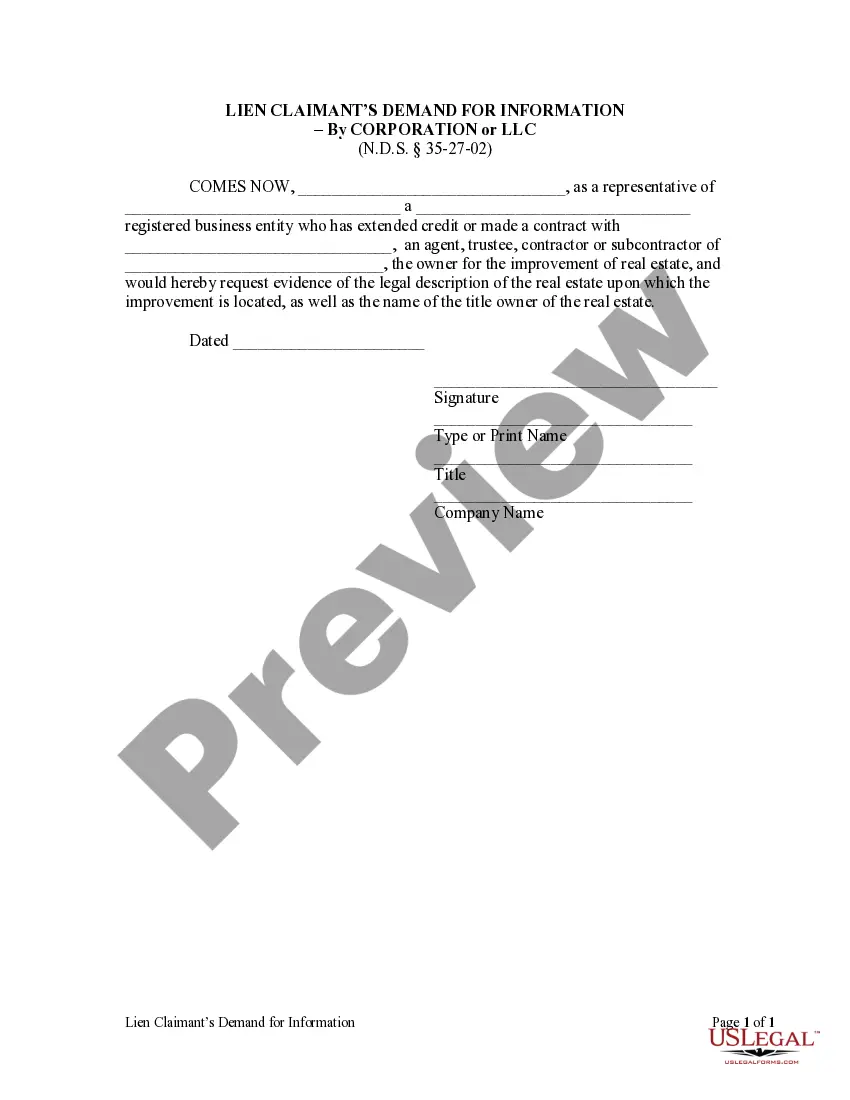

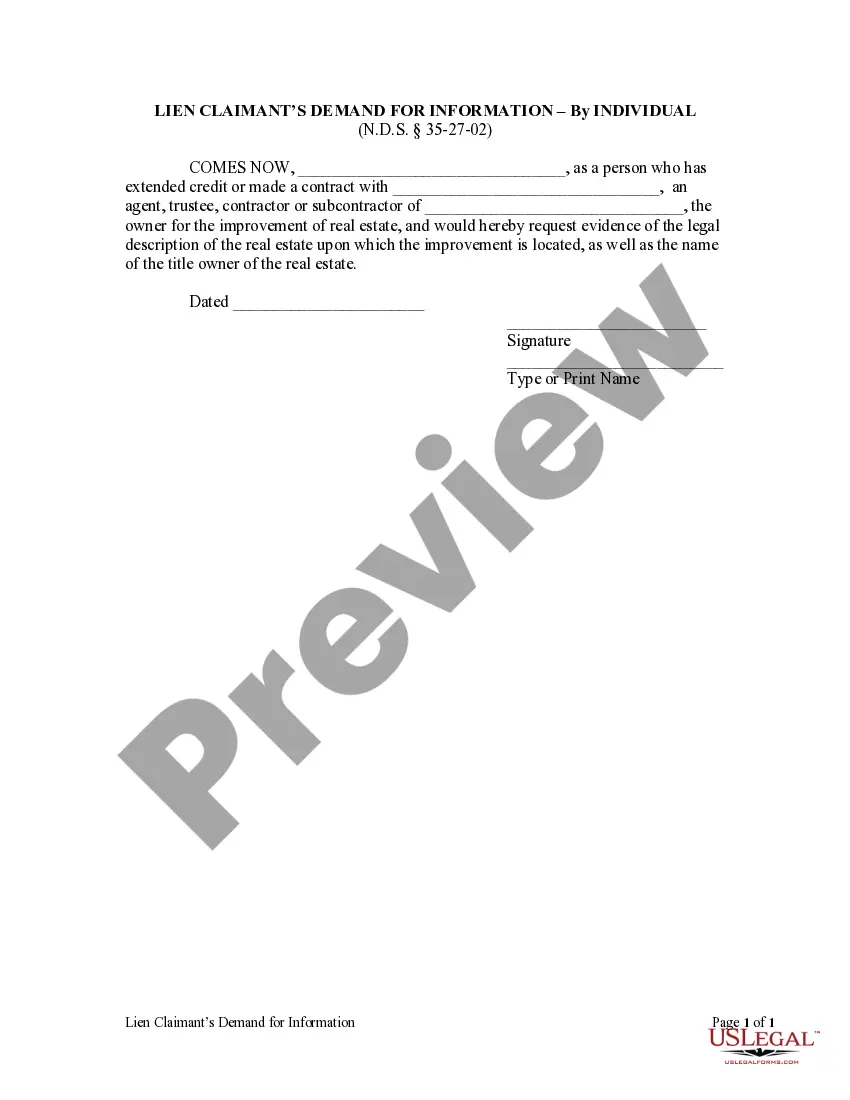

This Lien Claimant's Demand for Information form is for use by an individual who has extended credit or made a contract with an agent, trustee, contractor or subcontractor of the owner for the improvement of real estate, to request evidence of the legal description of the real estate upon which the improvement is located, as well as the name of the title owner of the real estate.

Fargo North Dakota Lien Claimant's Demand for Information - Individual

Description

How to fill out North Dakota Lien Claimant's Demand For Information - Individual?

Take advantage of the US Legal Forms and receive immediate access to any form template you need.

Our advantageous platform featuring thousands of documents simplifies the process of locating and acquiring nearly any document template you desire.

You can save, complete, and sign the Fargo North Dakota Lien Claimant's Demand for Information - Individual in just a few minutes instead of spending hours browsing the web for the correct template.

Utilizing our catalog is a superb approach to enhance the security of your document submission.

Locate the template you require. Verify that it is the form you were seeking: check its title and description, and utilize the Preview feature if it is available.

Initiate the download process. Click Buy Now and select the pricing option you prefer. After that, create an account and finalize your order using a credit card or PayPal.

- Our experienced attorneys routinely review all documents to ensure that the forms are suitable for a specific area and adhere to current laws and regulations.

- How can you acquire the Fargo North Dakota Lien Claimant's Demand for Information - Individual.

- If you have an account, simply Log In to your profile. The Download button will be active for all the samples you view.

- Moreover, you can access all previously saved documents in the My documents section.

- If you do not have an account yet, follow the steps below.

Form popularity

FAQ

File your lien with the register of deeds File your completed form with the register of deed's office in the South Dakota county where the property is located, and pay the recording fee.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

How to file a mechanics lien in South Dakota Prepare your South Dakota mechanics lien form.Serve a copy of the South Dakota mechanics lien on the owner.Record the South Dakota mechanics lien with the Register of Deeds.Enforce/release the South Dakota mechanics lien.

How to file a mechanics lien Complete a valid mechanics lien form. Each state has its own rules about the information and formatting required on the lien claim itself.Record the lien with the county.Serve notice to the property owner.

Now that you know if you can file a mechanics lien, let's dive into how to file your North Dakota mechanics lien. Step 1: Send a Notice of Intent to Lien.Step 2: Prepare your North Dakota lien form.Step 3: File your North Dakota mechanics lien.Enforce or release your mechanics lien.

File your lien with the register of deeds File your completed form with the register of deed's office in the South Dakota county where the property is located, and pay the recording fee.

As far as lien waivers, the vast majority of states don't require notarization. However, Texas is one of those states that require notarized lien waivers.

How to Fill Out an Unconditional Lien Waiver and Release on Progress Payment Form Name of Claimant. This term refers to the party that receives the payment who will also, eventually, sign the lien waiver document.Name of Customer.Job Location.Owner.Through Date.Amount.Exceptions.Claimant's Signature.

Once an unconditional lien waiver is signed, it is fully effective and enforceable. While using an unconditional lien waiver will certainly protect your property, it won't guarantee that the signor actually receives payment, since unconditional waivers are typically enforceable even if signor never gets paid.