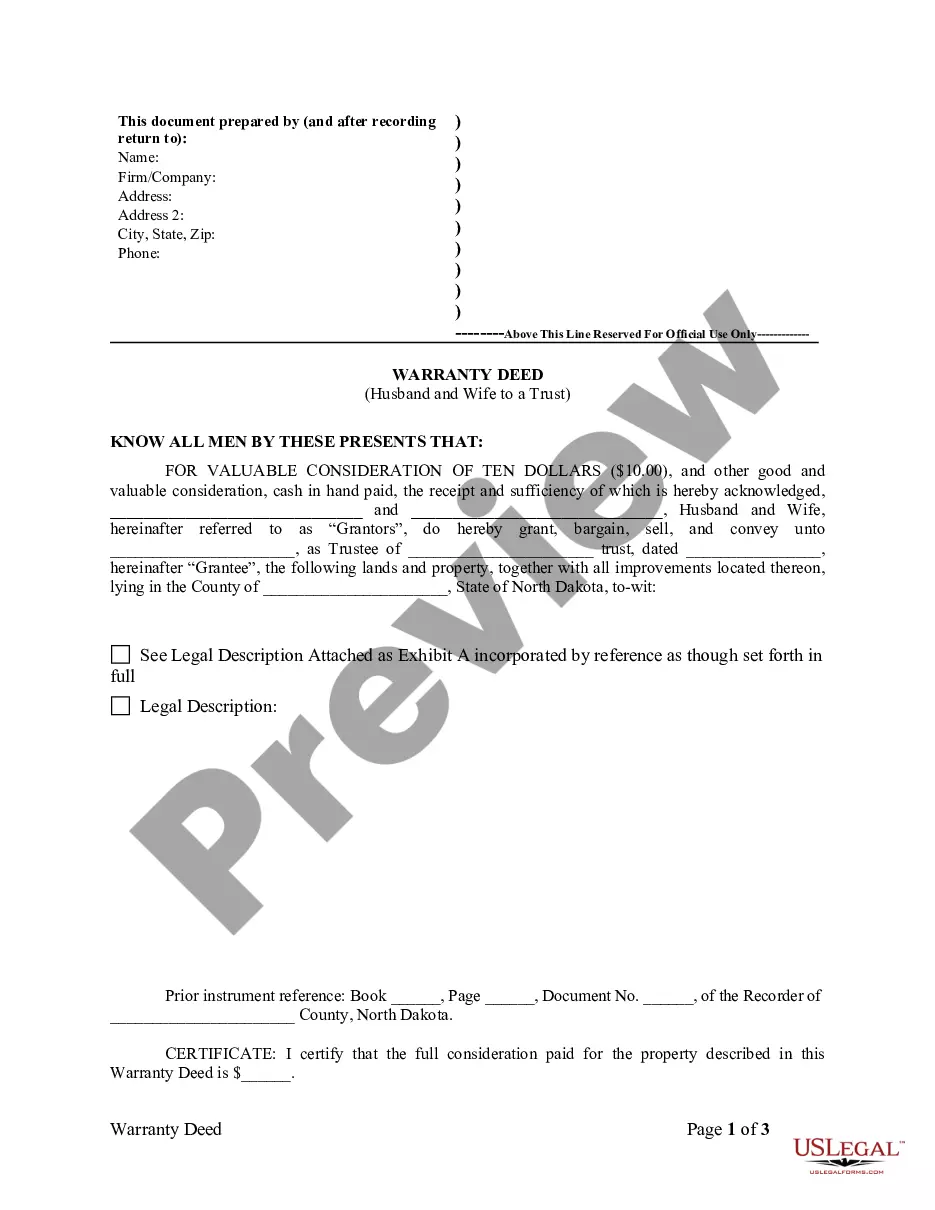

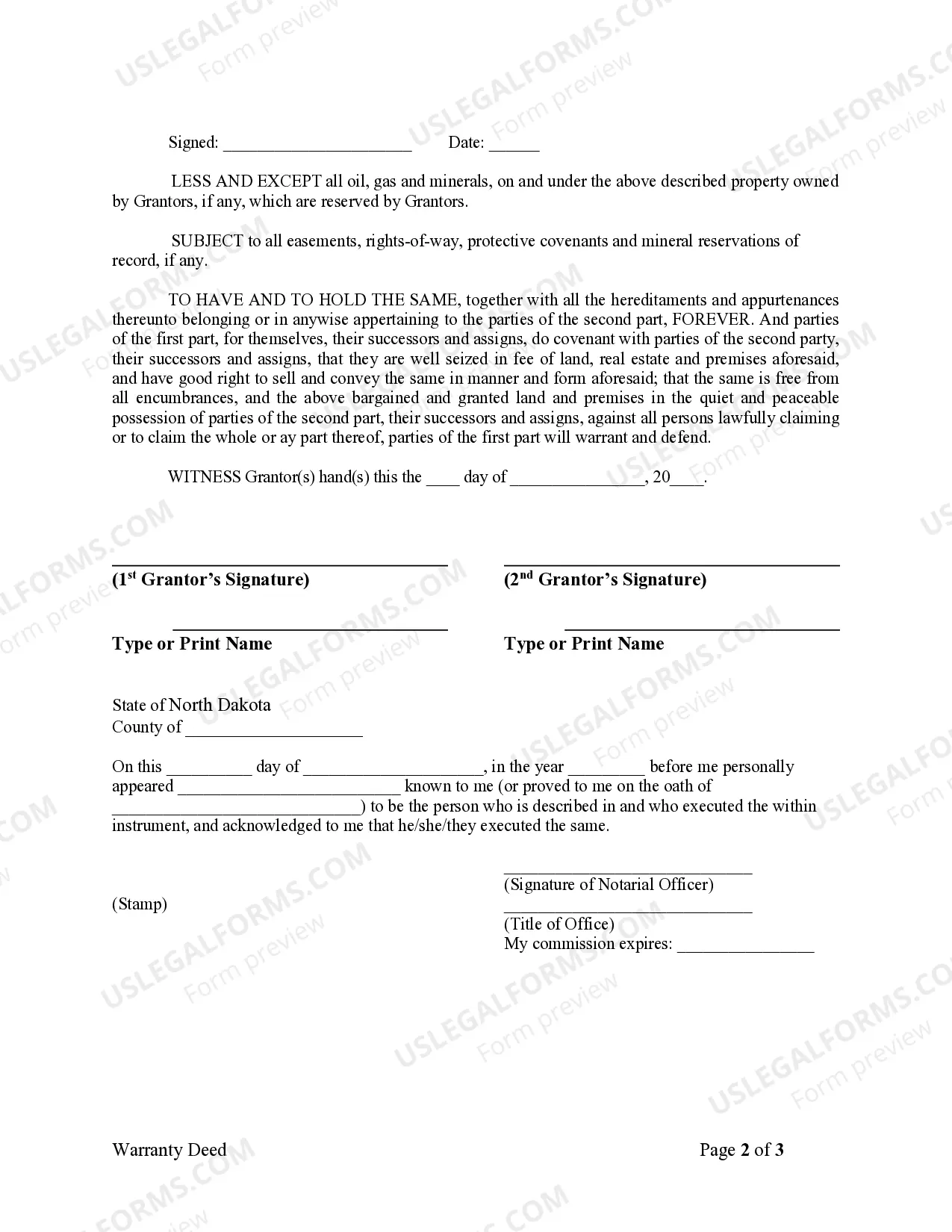

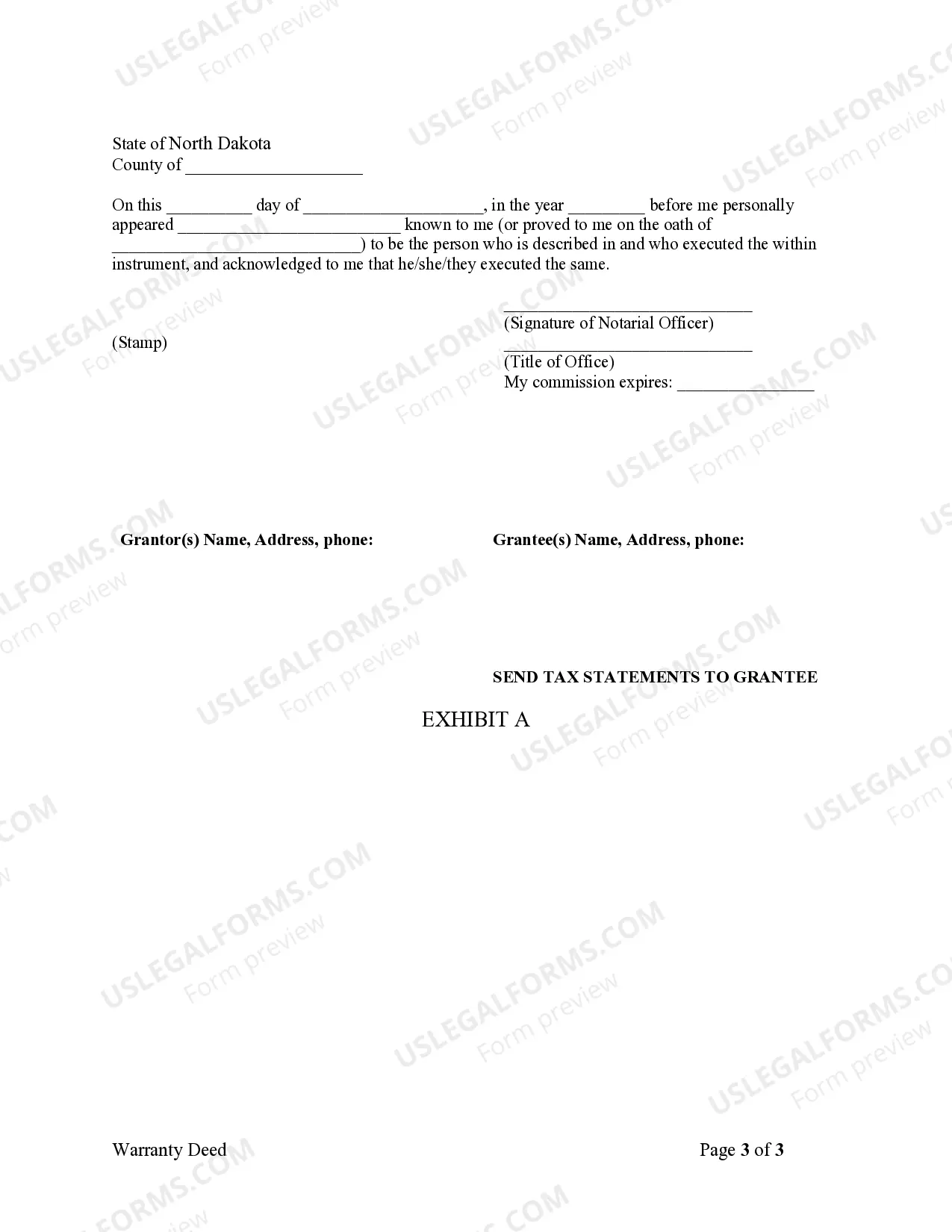

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Fargo North Dakota Warranty Deed from Husband and Wife to a Trust is a legal document that transfers ownership of real property from a married couple to a trust entity. This type of deed provides a guarantee, or warranty, that the property being transferred is free from any undisclosed liens or encumbrances, except for those specifically mentioned in the deed. The creation of a trust allows the married couple, referred to as granters, to transfer their property to a trustee who holds and manages the property on behalf of the trust's beneficiaries. The trustee has a legal obligation to follow the instructions outlined in the trust agreement while managing the property. In Fargo, North Dakota, there are different types of warranty deeds from husband and wife to a trust that can be used depending on specific circumstances and goals: 1. Revocable Living Trust Warranty Deed: This type of deed allows the granters to establish a living trust, which can be modified or revoked during their lifetime. The transfer of property to a revocable living trust does not change the granters' control over the property. 2. Irrevocable Trust Warranty Deed: In contrast to the revocable living trust, an irrevocable trust establishes a more permanent arrangement where the granters relinquish control over the property. Once transferred, the property cannot be taken back or modified without the consent of the beneficiaries. 3. Family Trust Warranty Deed: This refers to a trust established for the benefit of the granters' family members, such as children or grandchildren. The trust's purpose might include estate planning, asset protection, or avoiding probate. The specifics of the trust's beneficiaries can be tailored to the granters' preferences and needs. 4. Medicaid Trust Warranty Deed: Also known as a "Medicaid Asset Protection Trust," this type of deed is often utilized for long-term care planning. By transferring property into such a trust, individuals may potentially protect the asset from being spent down for Medicaid eligibility purposes in the event long-term care is required. The Fargo North Dakota Warranty Deed from Husband and Wife to a Trust serves as a crucial legal instrument for ensuring proper transfer of property rights while providing protection for both granters and beneficiaries. It is important to consult with legal professionals experienced in real estate and estate planning to determine which type of trust deed is most suitable for individual circumstances and goals.